DVB Hires Thomas Falck

DVB Hires Thomas Falck

DVB Bank’s office in Bergen has hired Mr. Thomas Falck from ING Bank. Thomas had come from Singapore to Bergen this fall to become responsible for ING Bank’s clients in Scandinavia. ING Bank has since closed down their office in Norway and is instead strengthening its offices in London and Singapore. For DVB Bank, Thomas is a good catch with plenty of experience in ship finance and, as a bonus, he is also accustomed to the liquid weather conditions of his hometown Bergen. Mr. Pål Minne has left DVB for Nordea where he will work with non-shipping related industries.

DVB Bank’s office in Bergen has hired Mr. Thomas Falck from ING Bank. Thomas had come from Singapore to Bergen this fall to become responsible for ING Bank’s clients in Scandinavia. ING Bank has since closed down their office in Norway and is instead strengthening its offices in London and Singapore. For DVB Bank, Thomas is a good catch with plenty of experience in ship finance and, as a bonus, he is also accustomed to the liquid weather conditions of his hometown Bergen. Mr. Pål Minne has left DVB for Nordea where he will work with non-shipping related industries.

NAT De-listing from the OSE

NAT De-listing from the OSE

Nordic American Tanker Shipping announced that they will de-list from the Oslo Stock Exchange January 17 due to small trading volume and their European investor’s interest in trading the shares on the NYSE. The company will be saving cost and able to focus their investor relations efforts towards one market. Mr. Herbjørn Hansson has rightfully been criticizing the Norwegian government’s lack of effort in attracting foreign capital providers through making it more attractive to invest in Norwegian companies. The stock exchange has seen more blue water shipping companies de-list than new ones in the past two years. Meanwhile, NAT’s NY stock price is still going strong, with its P/NAV ratio at a striking 274% at market close on Wedneday.

Nordic American Tanker Shipping announced that they will de-list from the Oslo Stock Exchange January 17 due to small trading volume and their European investor’s interest in trading the shares on the NYSE. The company will be saving cost and able to focus their investor relations efforts towards one market. Mr. Herbjørn Hansson has rightfully been criticizing the Norwegian government’s lack of effort in attracting foreign capital providers through making it more attractive to invest in Norwegian companies. The stock exchange has seen more blue water shipping companies de-list than new ones in the past two years. Meanwhile, NAT’s NY stock price is still going strong, with its P/NAV ratio at a striking 274% at market close on Wedneday.

Ship Finance Launches New $1.2B Refinance Facility at 70 Points

Ship Finance Launches New $1.2B Refinance Facility at 70 Points

Ship Finance International launched its $1.2 billion refinancing facility last Thursday afternoon at a favorable 70 points over Libor. DnB NOR, which has been negotiating with the company since the summer, was mandated the facility agent. Calyon, Fortis Bank and Nordea are the lead arrangers and we expect the same banks in the original facility to take a piece of the new one that should close pretty soon given the interest in the deal.

Ship Finance International launched its $1.2 billion refinancing facility last Thursday afternoon at a favorable 70 points over Libor. DnB NOR, which has been negotiating with the company since the summer, was mandated the facility agent. Calyon, Fortis Bank and Nordea are the lead arrangers and we expect the same banks in the original facility to take a piece of the new one that should close pretty soon given the interest in the deal.

Box Market Heading for Bruising, Say Citigroup Analysts

Box Market Heading for Bruising, Say Citigroup Analysts

UK-based Citigroup Smith Barney analysts Simon Smith and Roger Elliott issued a bearish beginning of the year report on container shipping titled simply and ominously: “Hangover Starting.” The metaphor seems to be particularly apt and widely used in shipping these days, where even as they revel in phenomenal profits, everybody is aware that at some point the party is going to end and they are going to have to deal with Sunday morning…and worse yet, Monday. Smith and Elliott see that morning coming, and coming soon. In particular, they cite unfavorable early 2005 rate negotiations, no break from WTO-enforced removal of textile quotas, rising cost pressures and an increasingly unfavorable supply demand balance.

Asia-Europe trade lane agreements, traditionally a good indicator of the year’s price environment, yielded flat rates this year which, while not terrible in themselves, will not do much to help shippers faced with rising costs. Unit costs are expected to grow by 3-4%, partially due to a weak dollar but also attributable to a loss of positive carry which, according Citigroup Smith Barney analyst Charles de Trenck, is a natural occurrence when topline drivers, i.e. negotiated rates, slow but momentum on higher costs, i.e. past negotiated contracts for equipment, boxes, etc., continues. This is where the “hangover” can be directly traced back to the “party.”

Not only this, but if the Asia-Europe trade lane agreements yielded flat rates in the current environment, the future for container shippers grows increasingly bleak as supply looks set to outstrip demand by progressively larger amounts over the next two years, with capacity growth estimated by Citigroup Smith Barney at 12.4% and 15.4% for 2005 and 2006 respectively, while demand growth is forecast at 8% and 9% for the same years. These demand growth numbers are not feeble, but they are also not strong enough to stop the gap from growing, though the picture could be somewhat altered if differences between predicted and actual scrapping and utilization materialized.

Tariffs & Tidal Waves

An anticipated boost in demand when WTO members agreed to lift all quotas on textiles and apparel on December 31, 2004, however, has so far turned out to be what Smith and Elliott disparagingly call a “damp squib.” They attribute this to actions by authorities designed to mitigate the effects of the quota removal while complying with it in word. And as for the tsunami, it seems to have had a blessedly small impact on the industry as a whole, as minor damage sustained in some places is more or less balanced out by higher volume, which is expected to not yield particularly higher profits as many shippers will be contributing their much-needed services charitably.

High Risk: AP Moller and P&O

In the same report, Smith and Elliott categorized both P&O Nedlloyd and AP Moller as High Risk, rating PONL a reasonably optimistic HOLD with a target price of 39 euros and AP Moller a less positive SELL with a target price of DKr40,000. In the case of P&O Nedlloyd, the analysts believe that the group’s exceedingly low price to book and EV/EBITDA multiples give the group potential to close the gap with itself and the majority of the sector, thus keeping the stock price at least level even if the container sector as a whole were to fall to a lower center. On the contrary, they sees more downside risk for AP Moller, citing in particular “poor disclosure to public shareholders, which we believe puts them at a disadvantage.”

China: A Light in the Tunnel

In another Citigroup Smith Barney Report, analysts Yiping Huang and Lan Xue auspiciously predict that the long-awaited “landing” in China will be “soft.” They forecast that the government will move from administrative to monetary tightening, allowing interest rates to rise gradually and the exchange rate to become more flexible. And while they do expect the investment slowdown to have negative consequences for commodities markets, they look for more level growth in consumption. So whether or not there are bad times ahead for the container market, highly China-dependent markets and sectors such as dry bulk may have better things coming. And maybe even the participants in the container party will wake up to a soothing brunch with which to nurse their hangovers so that they can speedily recover.

UK-based Citigroup Smith Barney analysts Simon Smith and Roger Elliott issued a bearish beginning of the year report on container shipping titled simply and ominously: “Hangover Starting.” The metaphor seems to be particularly apt and widely used in shipping these days, where even as they revel in phenomenal profits, everybody is aware that at some point the party is going to end and they are going to have to deal with Sunday morning…and worse yet, Monday. Smith and Elliott see that morning coming, and coming soon. In particular, they cite unfavorable early 2005 rate negotiations, no break from WTO-enforced removal of textile quotas, rising cost pressures and an increasingly unfavorable supply demand balance.

Asia-Europe trade lane agreements, traditionally a good indicator of the year’s price environment, yielded flat rates this year which, while not terrible in themselves, will not do much to help shippers faced with rising costs. Unit costs are expected to grow by 3-4%, partially due to a weak dollar but also attributable to a loss of positive carry which, according Citigroup Smith Barney analyst Charles de Trenck, is a natural occurrence when topline drivers, i.e. negotiated rates, slow but momentum on higher costs, i.e. past negotiated contracts for equipment, boxes, etc., continues. This is where the “hangover” can be directly traced back to the “party.”

Not only this, but if the Asia-Europe trade lane agreements yielded flat rates in the current environment, the future for container shippers grows increasingly bleak as supply looks set to outstrip demand by progressively larger amounts over the next two years, with capacity growth estimated by Citigroup Smith Barney at 12.4% and 15.4% for 2005 and 2006 respectively, while demand growth is forecast at 8% and 9% for the same years. These demand growth numbers are not feeble, but they are also not strong enough to stop the gap from growing, though the picture could be somewhat altered if differences between predicted and actual scrapping and utilization materialized.

Tariffs & Tidal Waves

An anticipated boost in demand when WTO members agreed to lift all quotas on textiles and apparel on December 31, 2004, however, has so far turned out to be what Smith and Elliott disparagingly call a “damp squib.” They attribute this to actions by authorities designed to mitigate the effects of the quota removal while complying with it in word. And as for the tsunami, it seems to have had a blessedly small impact on the industry as a whole, as minor damage sustained in some places is more or less balanced out by higher volume, which is expected to not yield particularly higher profits as many shippers will be contributing their much-needed services charitably.

High Risk: AP Moller and P&O

In the same report, Smith and Elliott categorized both P&O Nedlloyd and AP Moller as High Risk, rating PONL a reasonably optimistic HOLD with a target price of 39 euros and AP Moller a less positive SELL with a target price of DKr40,000. In the case of P&O Nedlloyd, the analysts believe that the group’s exceedingly low price to book and EV/EBITDA multiples give the group potential to close the gap with itself and the majority of the sector, thus keeping the stock price at least level even if the container sector as a whole were to fall to a lower center. On the contrary, they sees more downside risk for AP Moller, citing in particular “poor disclosure to public shareholders, which we believe puts them at a disadvantage.”

China: A Light in the Tunnel

In another Citigroup Smith Barney report, analysts Yiping Huang and Lan Xue auspiciously predict that the long-awaited “landing” in China will be “soft.” They forecast that the government will move from administrative to monetary tightening, allowing interest rates to rise gradually and the exchange rate to become more flexible. And while they do expect the investment slowdown to have negative consequences for commodities markets, they look for more level growth in consumption. So whether or not there are bad times ahead for the container market, highly China-dependent markets and sectors such as dry bulk may have better things coming. And maybe even the participants in the container party will wake up to a soothing brunch with which to nurse their hangovers so that they can speedily recover.

Stolt Liquefies, Readies to Negotiate with Bondholders

Stolt Liquefies, Readies to Negotiate with Bondholders

This week marked another triumph in the restructuring of Stolt-Nielsen. Stolt-Nielsen SA announced this week plans to sell its 79,414,260 common shares, or entire 42% stake, in Stolt Offshore. The sale was executed through Fearnley, Lehman Brothers and Pareto Securities and will result in a liquidity event of $504 million at $6.35 per share, of which Stolt-Nielsen expects to book net profits of $360 million in 1Q05. One year ago Stolt had three business issues – Stolt Offshore, the fish farm and the Department of Justice investigation. Now it has just one.

Turning Three Problems into One

This transaction constitutes yet another step forward in the company’s multi-faceted restructuring process outlined in the accompanying table. This is, of course, a step forward in the particular process begun with the deconsolidation of the problematic Stolt Offshore group. Combined with the merging of much of Stolt Seafarm with Nutreco and its planned sale, this leaves the company, so badly tangled just one year ago, facing only the legal issues surrounding accusations of price fixing that have plagued its historically successful core business.

This deal is good news for both Stolt investors and lenders, many of whom have not given Stolt full credit for the value of its stake in Offshore. But the question is: what will Stolt do with the money? As readers may recall, Stolt gave bondholders a silent, or “hands off” lien over the stake in Offshore (along with a 1% bump up in interest rate) in exchange for waiving defaulted covenants. Under the terms of then negotiated deal, bondholders did not have to give consent for the sale, but Stolt is required to use a minimum of 70% of the proceeds to tender for the bonds at par. But here’s the rub: the Stolt bonds are now trading OVER par, which means holders will be very unlikely to tender in their bonds.

Capturing the Interest Arbitrage

So Stolt keeps the cash, buys T-bills and everything is fine, right? Right, unless Stolt wants to pay a dividend, engage in joint ventures or spend money on new business, although investment into existing core business is allowed. And lest anyone forget, it is the dividend paying shipping stocks that are commanding the highest valuation.

In order to be relieved of this liability, Stolt-Nielsen would have to call the bonds and pay its bondholders a make whole premium of about $20 million. This tends to imply that the company would have to be pretty well set on either wanting to pay dividends or invest in new business in order to pay the make whole. But there’s another variable: Stolt is looking at an annual extra cost of capital in the realm of 400 basis points if it does not buy back the existing bonds. So the company still has some important post-sale determinations to make about its financing. What will happen? The company and its bondholders have proven that they can negotiate with each other, so look for a deal that’s somewhere in between the make whole and par.

Another interesting aspect of the deal is speculating on the identity of the buyers. According to press releases, the shares were sold through Lehman, Fearnley and Pareto to qualified institutional investors. The sale, however, still echoes the company’s legal issues. It was not registered in the US, as is true of many international transactions, but it was also not registered in the UK, Sweden, or Norway, which leads us to conclude that the Stolt Offshore shares most likely have gone, somewhat appropriately, to offshore interests.

Stolt Stolt-Nielsen Proves itself to Oslo Analysts –

How about New York

Whatever the details of the deal, it seems that Stolt-Nielsen’s ability to overcome daunting obstacles and move forward for a solid year in its reconstruction has won the hearts and minds of a number of analysts. Norwegian analysts expect the company’s share price to rise rapidly, with Enskilda pointing out that the sale of Stolt Offshore shares increases the possibility of an extraordinary dividend (if they pay off bondholders). DnB NOR Markets expects a strong chemical tanker market going forward and believes both Stolt-Nielsen and Odfjell’s share prices will continue to rise, also commenting that the sale has the potential to release about $480 million in cash for Stolt-Nielsen and reduce its debt by 40%. Enskilda has maintained its target price of NOK 210 per share while DnB NOR predicts Stolt shares will hit NOK 250 in the next three months. The future looks rosier now for the long-suffering company, which has officially become a pure chemical tanker operator with promising markets ahead. All the company needs now is research coverage from New York.

This week marked another triumph in the restructuring of Stolt-Nielsen. Stolt-Nielsen SA announced this week plans to sell its 79,414,260 common shares, or entire 42% stake, in Stolt Offshore. The sale was executed through Fearnley, Lehman Brothers and Pareto Securities and will result in a liquidity event of $504 million at $6.35 per share, of which Stolt-Nielsen expects to book net profits of $360 million in 1Q05. One year ago Stolt had three business issues – Stolt Offshore, the fish farm and the Department of Justice investigation. Now it has just one.

Turning Three Problems into One

This transaction constitutes yet another step forward in the company’s multi-faceted restructuring process outlined in the accompanying table. This is, of course, a step forward in the particular process begun with the deconsolidation of the problematic Stolt Offshore group. Combined with the merging of much of Stolt Seafarm with Nutreco and its planned sale, this leaves the company, so badly tangled just one year ago, facing only the legal issues surrounding accusations of price fixing that have plagued its historically successful core business.

This deal is good news for both Stolt investors and lenders, many of whom have not given Stolt full credit for the value of its stake in Offshore. But the question is: what will Stolt do with the money? As readers may recall, Stolt gave bondholders a silent, or “hands off” lien over the stake in Offshore (along with a 1% bump up in interest rate) in exchange for waiving defaulted covenants. Under the terms of then negotiated deal, bondholders did not have to give consent for the sale, but Stolt is required to use a minimum of 70% of the proceeds to tender for the bonds at par. But here’s the rub: the Stolt bonds are now trading OVER par, which means holders will be very unlikely to tender in their bonds.

Capturing the Interest Arbitrage

So Stolt keeps the cash, buys T-bills and everything is fine, right? Right, unless Stolt wants to pay a dividend, engage in joint ventures or spend money on new business, although investment into existing core business is allowed. And lest anyone forget, it is the dividend paying shipping stocks that are commanding the highest valuation.

In order to be relieved of this liability, Stolt-Nielsen would have to call the bonds and pay its bondholders a make whole premium of about $20 million. This tends to imply that the company would have to be pretty well set on either wanting to pay dividends or invest in new business in order to pay the make whole. But there’s another variable: Stolt is looking at an annual extra cost of capital in the realm of 400 basis points if it does not buy back the existing bonds. So the company still has some important post-sale determinations to make about its financing. What will happen? The company and its bondholders have proven that they can negotiate with each other, so look for a deal that’s somewhere in between the make whole and par.

Another interesting aspect of the deal is speculating on the identity of the buyers. According to press releases, the shares were sold through Lehman, Fearnley and Pareto to qualified institutional investors. The sale, however, still echoes the company’s legal issues. It was not registered in the US, as is true of many international transactions, but it was also not registered in the UK, Sweden, or Norway, which leads us to conclude that the Stolt Offshore shares most likely have gone, somewhat appropriately, to offshore interests.

Stolt-Nielsen Proves itself to Oslo Analysts –

How about New York

Whatever the details of the deal, it seems that Stolt-Nielsen’s ability to overcome daunting obstacles and move forward for a solid year in its reconstruction has won the hearts and minds of a number of analysts. Norwegian analysts expect the company’s share price to rise rapidly, with Enskilda pointing out that the sale of Stolt Offshore shares increases the possibility of an extraordinary dividend (if they pay off bondholders). DnB NOR Markets expects a strong chemical tanker market going forward and believes both Stolt-Nielsen and Odfjell’s share prices will continue to rise, also commenting that the sale has the potential to release about $480 million in cash for Stolt-Nielsen and reduce its debt by 40%. Enskilda has maintained its target price of NOK 210 per share while DnB NOR predicts Stolt shares will hit NOK 250 in the next three months. The future looks rosier now for the long-suffering company, which has officially become a pure chemical tanker operator with promising markets ahead. All the company needs now is research coverage from New York.

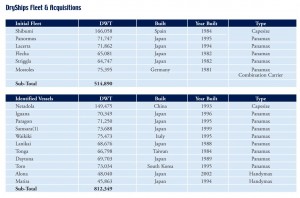

George Economou’s DryShips Files S-1: A Look Inside

George Economou’s DryShips Files S-1 ~

A Look Inside

George Economou’s dry bulk shipping IPO, to be called “DryShips”, filed a prospectus today to sell 7.1 million shares at $16-$18 each in an initial public offering with underwriters Cantor Fitzgerald & Co., Hibernia Southcoast Capital, Oppenheimer & Co., Dahlman Rose & Company, and HARRISdirect. A market report from CBS Marketwatch today reported that the price range is actually $14-$16. DryShips plans to pay a 5% dividend and will be listed on the Nasdaq under the ticker symbol “DRYS.”

As is our policy, we will refrain from presenting our valuation of the company intil the transaction is complete, so the following facts have been taken directly from the offering document.

Sources & Uses of IPO Funds

As the accompanying chart illustrates, at the time of the offering DryShips will own five panamax and one capesize vessel. The company also has 11 more dry bulk carriers on subjects for an aggregate cost of $322 million.

The the company states it will use the estimated $111.5 million net proceeds of the offering together with $145 million borrowed under a new $185 million credit facility from Commerzbank and HSH, 1.35 million shares and up to $30 million under another credit facility that it plans to put together to finance the purchase. The company will have $7.0 million in cash immediately prior to the closing of this offering.

According to the document, DryShips will acquire the capesize drybulk carrier Netadola and five panamax drybulk carriers – Paragon, Samsara, Waikiki, Toro, and Iguana – from companies beneficially owned by Mr. Economou’s sister for a total purchase price of $197.8 million with delivery by April 29, 2005. Netadola and the four Panamax drybulk carriers, Paragon, Samsara, Waikiki and Toro, will come in at the same purchase prices as those companies paid when they acquired the vessels from unaffiliated third parties ($164.3 million), and the panamax drybulk carrier Iguana will be acquired at its fair market value ($33.5 million). DryShips will buy the remaining five Identified Vessels directly from unaffiliated third parties at the aggregate purchase price of $119.0 million.

Of Dilution & Dividends

As the chart shows, new investors in DryShips will experience substantial dilution upon consummation of the offering. The reason for this is that, at October 31, 2004, as adjusted for subsequent events, DryShips had negative net tangible book value of $(4.7) million, or $(0.31) per share.

DryShips plans to issue a dividend to pre-offering shareholders of $69 million, comprised of $51.0 million of retained earnings as of October 31st and $18.0 million of earnings of the Initial Fleet for the period between November 1, 2004, and the date of this prospectus. The $69.0 million dividend has been accrued and reflected as a payable in the October 31, 2004 financial statements.

According to the prospectus, “After giving effect to the sale of 8,452,942 shares of common stock at a price of $17.00 per share, which is the mid-point of the expected range of $16.00 to $18.00 per share in this offering, and assuming that the underwriters’ over-allotment option is not exercised, the pro forma net tangible book value at October 31, 2004, would have been $130.1 million or $5.45 per share. This represents an immediate appreciation in net tangible book value of $5.76 per share to existing shareholders and an immediate dilution of net tangible book value of $11.55 per share to new investors.”

Strategy

DryShips intends to employ the vessels in the spot charter market, under period time charters and in drybulk carrier pools. The ships will be managed by Cardiff, which is under common control with DryShips. DryShips plans to grow its fleet through the acquisition of 10-20 year old capesize, panamax, handymax and handysize vessels.

George Economou‘s dry bulk shipping IPO, to be called “DryShips”, filed a prospectus today to sell 7.1 million shares at $16-$18 each in an initial public offering with underwriters Cantor Fitzgerald & Co., Hibernia Southcoast Capital, Oppenheimer & Co., Dahlman Rose & Company, and HARRISdirect. A market report from CBS Marketwatch today reported that the price range is actually $14-$16. DryShips plans to pay a 5% dividend and will be listed on the Nasdaq under the ticker symbol “DRYS.”

As is our policy, we will refrain from presenting our valuation of the company intil the transaction is complete, so the following facts have been taken directly from the offering document.

Sources & Uses of IPO Funds

As the accompanying chart illustrates, at the time of the offering DryShips will own five panamax and one capesize vessel. The company also has 11 more dry bulk carriers on subjects for an aggregate cost of $322 million.

The the company states it will use the estimated $111.5 million net proceeds of the offering together with $145 million borrowed under a new $185 million credit facility from Commerzbank and HSH, 1.35 million shares and up to $30 million under another credit facility that it plans to put together to finance the purchase. The company will have $7.0 million in cash immediately prior to the closing of this offering.

According to the document, DryShips will acquire the capesize drybulk carrier Netadola and five panamax drybulk carriers – Paragon, Samsara, Waikiki, Toro, and Iguana – from companies beneficially owned by Mr. Economou‘s sister for a total purchase price of $197.8 million with delivery by April 29, 2005. Netadola and the four Panamax drybulk carriers, Paragon, Samsara, Waikiki and Toro, will come in at the same purchase prices as those companies paid when they acquired the vessels from unaffiliated third parties ($164.3 million), and the panamax drybulk carrier Iguana will be acquired at its fair market value ($33.5 million). DryShips will buy the remaining five Identified Vessels directly from unaffiliated third parties at the aggregate purchase price of $119.0 million.

Of Dilution & Dividends

As the chart shows, new investors in DryShips will experience substantial dilution upon consummation of the offering. The reason for this is that, at October 31, 2004, as adjusted for subsequent events, DryShips had negative net tangible book value of $(4.7) million, or $(0.31) per share.

DryShips plans to issue a dividend to pre-offering shareholders of $69 million, comprised of $51.0 million of retained earnings as of October 31st and $18.0 million of earnings of the Initial Fleet for the period between November 1, 2004, and the date of this prospectus. The $69.0 million dividend has been accrued and reflected as a payable in the October 31, 2004 financial statements.

According to the prospectus, “After giving effect to the sale of 8,452,942 shares of common stock at a price of $17.00 per share, which is the mid-point of the expected range of $16.00 to $18.00 per share in this offering, and assuming that the underwriters’ over-allotment option is not exercised, the pro forma net tangible book value at October 31, 2004, would have been $130.1 million or $5.45 per share. This represents an immediate appreciation in net tangible book value of $5.76 per share to existing shareholders and an immediate dilution of net tangible book value of $11.55 per share to new investors.”

Strategy

DryShips intends to employ the vessels in the spot charter market, under period time charters and in drybulk carrier pools. The ships will be managed by Cardiff, which is under common control with DryShips. DryShips plans to grow its fleet through the acquisition of 10-20 year old capesize, panamax, handymax and handysize vessels.

Soc. Gen and KDB Get Mandate for Hanjin’s $200M Facility for Newbuildings

Soc. Gen and KDB Get Mandate for Hanjin’s $200M Facility for Newbuildings

FM learned that Hanjin Shipping mandated yesterday Soc. Gen and KDB (Korea Development Bank) to arrange a $200m facility for a newbuilding order. The company has ordered 3x 6,500TEU container vessels at a high price of $94.5M per vessel with delivery from Hyundai Heavy Industries in 2007. The facility has a 12-year term at 100 basis points with full repayment. The facility covers 70% of the total order price.

FM learned that Hanjin Shipping mandated yesterday Soc. Gen and KDB (Korea Development Bank) to arrange a $200m facility for a newbuilding order. The company has ordered 3x 6,500TEU container vessels at a high price of $94.5M per vessel with delivery from Hyundai Heavy Industries in 2007. The facility has a 12-year term at 100 basis points with full repayment. The facility covers 70% of the total order price.

Nordea Launches $312M Refinancing Facility for TFDS

Nordea Launches $312M Refinancing Facility for TFDS

Norwegian ferry operator Troms Fylkes Dampskibsselskap ASA (TFDS, owner of Hurtigruten) mandated on December 23, 2004 Nordea to lead arrange a NOK 1,950 million (US$312 million) credit facility for the purpose of refinancing a substantial portion of the company’s bank debt. The refinancing concludes a significant restructuring that the company successfully has concluded throughout 2004 which includes the issuance of equity, the issuance of convertible debt, the sale of its offshore activities, the sale of its share in Nor-Cargo and entering into a new 8-year contract with The Ministry of Transport and Communication for central government procurement of sea transport services worth approximately NOK 110 million each year.

The credit facility, which has a 7-year tenor, is priced at 0.95% for the first NOK 1,750 million and at 1.50% for the remaining NOK 200 million. The transaction will be presented at a bank meeting to take place on TFDS’s most modern cruise vessel when it visits Oslo on Thursday, January 13th. Nordea will syndicate the facility to both Norwegian and international banks.

Norwegian ferry operator Troms Fylkes Dampskibsselskap ASA (TFDS, owner of Hurtigruten) mandated on December 23, 2004 Nordea to lead arrange a NOK 1,950 million (US$312 million) credit facility for the purpose of refinancing a substantial portion of the company’s bank debt. The refinancing concludes a significant restructuring that the company successfully has concluded throughout 2004 which includes the issuance of equity, the issuance of convertible debt, the sale of its offshore activities, the sale of its share in Nor-Cargo and entering into a new 8-year contract with The Ministry of Transport and Communication for central government procurement of sea transport services worth approximately NOK 110 million each year.

The credit facility, which has a 7-year tenor, is priced at 0.95% for the first NOK 1,750 million and at 1.50% for the remaining NOK 200 million. The transaction will be presented at a bank meeting to take place on TFDS’s most modern cruise vessel when it visits Oslo on Thursday, January 13th. Nordea will syndicate the facility to both Norwegian and international banks.

Pareto Securities Arranges Convertible Bond for Sinvest

Pareto Securities Arranges Convertible Bond for Sinvest

Pareto Securities has very successfully arranged an unsecured convertible bond for Norwegian jack-up rig company Sinvest at $65m, but the company has decided to increase the bond to right under a $100m due to the strong investor appetite. The bond has an interest of 8.25% over 5 years and the option to repay the bond in 12 months at 130% over par. The bond can be converted at $4.6 per share. The share price today closed on the OSE at $3.26. The board will get the final approval for the increase January 24 at the extra ordinary meeting to take place. The bond is a refinancing of a secured existing bond of $28M. The company has 3 jack-up rigs under construction and with the new cash can exercise the options for two additional jack-up rigs.

Pareto Securities has very successfully arranged an unsecured convertible bond for Norwegian jack-up rig company Sinvest at $65m, but the company has decided to increase the bond to right under a $100m due to the strong investor appetite. The bond has an interest of 8.25% over 5 years and the option to repay the bond in 12 months at 130% over par. The bond can be converted at $4.6 per share. The share price today closed on the OSE at $3.26. The board will get the final approval for the increase January 24 at the extra ordinary meeting to take place. The bond is a refinancing of a secured existing bond of $28M. The company has 3 jack-up rigs under construction and with the new cash can exercise the options for two additional jack-up rigs.

Is the Sky Falling in on Tanker Equities?

Is the Sky Falling in on Tanker Equities?

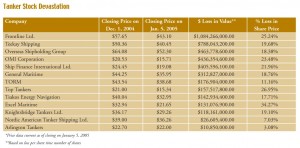

Is the sky falling in on the tanker market? That seems to be the question of the day. There are certainly those who would assert that it is, or is about to, as rapidly falling tanker stock prices and even more rapidly falling charter rates remind many of the barren shipping landscape of the 80s and parts of the 90s. Then there are those who would disagree and have drawn a very different conclusion based on their view of tanker market fundamentals. We thought it might be useful to take a look at these views and the opinions behind them as investors and operators recover from an ungraceful destruction of the tanker equities.

The Beginning of the End…?

Citigroup Smith Barney analyst John Kartsonas reports that dayrates for all classes of vessels have fallen by an average of more than 60% while Jefferies analyst Ray Wu reports that VLCC spot rates have fallen around 80% over the past eight weeks. JP Morgan analysts note that tanker stocks themselves have correspondingly fallen by 20-35%. An extrapolation of current trends would of course predict future devastation of the tanker industry, but fortunately these trends appear to be more of a temporary correction than an indicator of future rate and stock price falls.

Momentum vs. Value

In the first place, importantly, this sort of gargantuan drop was almost universally anticipated. No one thought the unprecedented rates and stock prices seen in November were sustainable. The question, rather, was when, how far, and how hard they would fall. OSG CEO Morten Arntzen exhibited this philosophy in his explanation to Bloomberg: “I never told anyone that the rates would stand at $200,000 a day. But I enjoyed it.” Savvy investors must have been able to identify with this sentiment in late autumn. JP Morgan analysts Jon Chappell, Gregory Burns and Hassan Malik noted that their 2005 projections, pre-the recent fall, had “already factored in seasonal declines, the impact of an OPEC production cut, and the belief that the November rate levels were not at all sustainable.” The difference between them and the more bearish Citigroup Smith Barney reports appears to have been more along the lines of how to prepare for and del with the dropping tanker market situation than over whether it would occur. So who were the investors that have moved suddenly and in droves to substantially more cautious tanker market positions?

The Chappell-Burns-Malik report argues that the recent massive drop in the tanker stocks represents “the exodus of a vast number of momentum investors,” to which the analysts attribute the tanker stocks’ “meteoric” rise and subsequent fall. Now that the stocks have come back down to earth, the JP Morgan analysts expect a return of the value investors. Indeed, Hibernia, who downgraded Top Tankers to a HOLD just as the stock tumble began in early December, has just upgraded the company back to a BUY, indicating they expected something of the recent fall and seem comfortable that the worst is over.

Citigroup and JP Morgan on Supply & Demand

The supply demand balance, is, naturally, also extremely important in determining the prospects for the tanker market’s health in 2005. The JP Morgan report looks for fleet expansion of 19.2 mdwt, or 5.9% capacity growth, in the coming year while Citigroup reports demonstrate comfort with a slightly higher growth number of around 21.5 mdwt, a growth rate of close to 7%. As the orderbook is a known number, discrepancies revolve more around scrapping expectations, largely involving how tanker companies will deal with the new IMO regulations set to come into effect in April of this year. In the demand arena, Citigroup’s Kartsonas expects growth of around 2% as compared to 7% this past year, with OPEC’s one mbpd production cut to reduce tanker demand by as much as 7-8 mdwt with a shift to less long-haul and more short-haul tonnage. OMI’s Robert Bugbee told Tradewinds that he expects demand to be stronger than this, pointing out factors such as China’s intent to build a strategic petroleum reserve that could easily raise demand by one mbpd. Also on the upside, the JP Morgan analysts used IEA forecasts to estimate tanker demand growth of 13.5 mdwt. This discrepancy seems to be largely geographic with respect to oil supply.

Material Gains

Yet another dispute revolves around whether shipping stocks are cheaply or expensively priced. Kartsonas notes their expense relative to historical levels while the JPM analysts note their cheapness relative to many other industries. You can look for yourself at their P/NAV ratings in the “Fair Value” table. As usual, the truth probably lies somewhere in the middle. While the extraordinary spot rates witnessed in the past few months may have dissipated, current rates are still comfortably above breakeven levels, which are estimated in the low $30Ks for a typical being above mid-cycle and even comparable to annual highs in more typical years as shown in “Rate Comparison” chart. Not only that, but this past boom has seen shipping companies increase transparency, modernize their accounting practices and begin to access whole new pools of capital, all of which contribute to lowering their cost of capital and increasing the opportunities for financing available to owners and operators.

The tanker companies are now seeing that not all their new supporters will stick around when the fad passes, but they have undoubtedly succeeded in raising their profile and increasing the breadth of their long-term support base. Just as importantly, the companies are continuing to demonstrate strong performance, in a far more sustainable fashion than before, and, as the JP Morgan trio pointed out, they offer the potential for share buybacks, dividend increases and consolidation.

Is the sky falling in on the tanker market? That seems to be the question of the day. There are certainly those who would assert that it is, or is about to, as rapidly falling tanker stock prices and even more rapidly falling charter rates remind many of the barren shipping landscape of the 80s and parts of the 90s. Then there are those who would disagree and have drawn a very different conclusion based on their view of tanker market fundamentals. We thought it might be useful to take a look at these views and the opinions behind them as investors and operators recover from an ungraceful destruction of the tanker equities.

The Beginning of the End…?

Citigroup Smith Barney analyst John Kartsonas reports that dayrates for all classes of vessels have fallen by an average of more than 60% while Jefferies analyst Ray Wu reports that VLCC spot rates have fallen around 80% over the past eight weeks. JP Morgan analysts note that tanker stocks themselves have correspondingly fallen by 20-35%. An extrapolation of current trends would of course predict future devastation of the tanker industry, but fortunately these trends appear to be more of a temporary correction than an indicator of future rate and stock price falls.

Momentum vs. Value

In the first place, importantly, this sort of gargantuan drop was almost universally anticipated. No one thought the unprecedented rates and stock prices seen in November were sustainable. The question, rather, was when, how far, and how hard they would fall. OSG CEO Morten Arntzen exhibited this philosophy in his explanation to Bloomberg: “I never told anyone that the rates would stand at $200,000 a day. But I enjoyed it.” Savvy investors must have been able to identify with this sentiment in late autumn. JP Morgan analysts Jon Chappell, Gregory Burns and Hassan Malik noted that their 2005 projections, pre-the recent fall, had “already factored in seasonal declines, the impact of an OPEC production cut, and the belief that the November rate levels were not at all sustainable.” The difference between them and the more bearish Citigroup Smith Barney reports appears to have been more along the lines of how to prepare for and del with the dropping tanker market situation than over whether it would occur. So who were the investors that have moved suddenly and in droves to substantially more cautious tanker market positions?

The Chappell-Burns-Malik report argues that the recent massive drop in the tanker stocks represents “the exodus of a vast number of momentum investors,” to which the analysts attribute the tanker stocks’ “meteoric” rise and subsequent fall. Now that the stocks have come back down to earth, the JP Morgan analysts expect a return of the value investors. Indeed, Hibernia, who downgraded Top Tankers to a HOLD just as the stock tumble began in early December, has just upgraded the company back to a BUY, indicating they expected something of the recent fall and seem comfortable that the worst is over.

Citigroup and JP Morgan on Supply & Demand

The supply demand balance, is, naturally, also extremely important in determining the prospects for the tanker market’s health in 2005. The JP Morgan report looks for fleet expansion of 19.2 mdwt, or 5.9% capacity growth, in the coming year while Citigroup reports demonstrate comfort with a slightly higher growth number of around 21.5 mdwt, a growth rate of close to 7%. As the orderbook is a known number, discrepancies revolve more around scrapping expectations, largely involving how tanker companies will deal with the new IMO regulations set to come into effect in April of this year. In the demand arena, Citigroup’s Kartsonas expects growth of around 2% as compared to 7% this past year, with OPEC’s one mbpd production cut to reduce tanker demand by as much as 7-8 mdwt with a shift to less long-haul and more short-haul tonnage. OMI’s Robert Bugbee told Tradewinds that he expects demand to be stronger than this, pointing out factors such as China’s intent to build a strategic petroleum reserve that could easily raise demand by one mbpd. Also on the upside, the JP Morgan analysts used IEA forecasts to estimate tanker demand growth of 13.5 mdwt. This discrepancy seems to be largely geographic with respect to oil supply.

Material Gains

Yet another dispute revolves around whether shipping stocks are cheaply or expensively priced. Kartsonas notes their expense relative to historical levels while the JPM analysts note their cheapness relative to many other industries. You can look for yourself at their P/NAV ratings in the “Fair Value” table. As usual, the truth probably lies somewhere in the middle. While the extraordinary spot rates witnessed in the past few months may have dissipated, current rates are still comfortably above breakeven levels, which are estimated in the low $30Ks for a typical being above mid-cycle and even comparable to annual highs in more typical years as shown in “Rate Comparison” chart. Not only that, but this past boom has seen shipping companies increase transparency, modernize their accounting practices and begin to access whole new pools of capital, all of which contribute to lowering their cost of capital and increasing the opportunities for financing available to owners and operators.

The tanker companies are now seeing that not all their new supporters will stick around when the fad passes, but they have undoubtedly succeeded in raising their profile and increasing the breadth of their long-term support base. Just as importantly, the companies are continuing to demonstrate strong performance, in a far more sustainable fashion than before, and, as the JP Morgan trio pointed out, they offer the potential for share buybacks, dividend increases and consolidation.