General Maritime Announces Dividend Policy, Picks up Premium

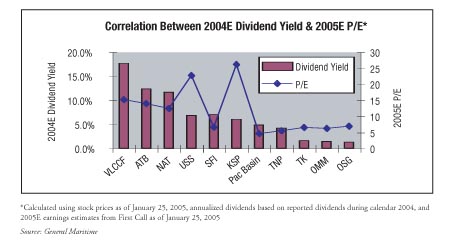

In what we can only assume is an effort to drive up the General Maritime share price in advance of Frontline’s potentially hostile take over, General Maritime has adopted a dividend policy. The play here is that dividend yield paying stocks like Knightsbridge and NAT are being valued on a multiple of dividends, which is significantly higher than the tanker companies that pay small dividends (less than 5 percent) or no dividends at all. The chart on page 2 illustrates this phenomenon

GMR Shares a BUY, with Potential to Reach $53, $62…or Even $76

Based on an NAV of $41.83/share, as estimated by Jefferies, General Maritime would be worth over $76 if it was valued the same way as NAT, and even if it was valued like the more modest yield play Knightsbridge, the share price would still go up over $62. Analysts were quick to match General Maritime’s shift in strategy to a shift in target valuation. Even before the dividend policy announcement, Dahlman Rose & Co. analyst Harvey Stober had initiated coverage on General Maritime with a BUY on January 19, noting that: “With cash accumulating quickly, GMR has the wherewithal to institute a significant dividend or major share repurchase program.” Not long after, General Maritime announced just such a plan. Morgan Stanley quickly moved its target P/NAV for GMR up to 150%, upgrading the company to Overweight V with a target share price of $53. The more bullish Jefferies & Company set a target price at $62, close to what GMR would be at VLCCF’s valuation. What we did not see in the reports, however, was a mention of Frontline.

A Future with FRO? Depends on the Price

Peter Georgiopoulos and Jeff Pribor spoke confidently of making accretive acquisitions and growing the company in their conference call, and for the most part questions from listeners revolved around the details of their plans. Only Natasha Boyden of Cantor Fitzgerald ventured to directly ask about the situation with Frontline and whether this action would have an impact. To this there was a pause, followed by a cautious “I don’t know” before the more confident answer that this strategy change was the result of a long study and careful consideration of company strategy. But then just yesterday Bloomberg TV reported that General Maritime would be interested in a merger with Frontline, saying that Peter Georgiopoulos commented that the rival oil tanker operator would have to pay heavily in cash if he wished to purchase the company.

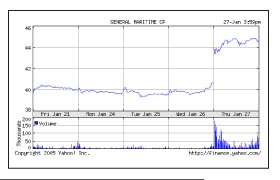

Whether or not this is in the cards, Mr. Georgiopoulos and Mr. Pribor have already succeeded in having their company reevaluated by leading analysts – Magnus Fyhr and Douglas Mavrinac at Jefferies and Mark MacLean and Ole Slorer at Morgan Stanley – and have watched their stock price shoot up an astonishing 9.81% to $44.65 in just one day. Not only that, but the terms of the dividend policy specify the Board of Director’s intent to establish reserves for maintenance and capital expenditures probably equating to around $100 million in 2005. So while they immediately picked up the premium in share price, the company should have a grace period before it actually has to pay out any cash.

In what we can only assume is an effort to drive up the General Maritime share price in advance of Frontline‘s potentially hostile take over, General Maritime has adopted a dividend policy. The play here is that dividend yield paying stocks like Knightsbridge and NAT are being valued on a multiple of dividends, which is significantly higher than the tanker companies that pay small dividends (less than 5 percent) or no dividends at all. The chart on page 2 illustrates this phenomenon

GMR Shares a BUY, with Potential to Reach $53, $62…or Even $76

Based on an NAV of $41.83/share, as estimated by Jefferies, General Maritime would be worth over $76 if it was valued the same way as NAT, and even if it was valued like the more modest yield play Knightsbridge, the share price would still go up over $62. Analysts were quick to match General Maritime’s shift in strategy to a shift in target valuation. Even before the dividend policy announcement, Dahlman Rose & Co. analyst Harvey Stober had initiated coverage on General Maritime with a BUY on January 19, noting that: “With cash accumulating quickly, GMR has the wherewithal to institute a significant dividend or major share repurchase program.” Not long after, General Maritime announced just such a plan. Morgan Stanley quickly moved its target P/NAV for GMR up to 150%, upgrading the company to Overweight V with a target share price of $53. The more bullish Jefferies & Company set a target price at $62, close to what GMR would be at VLCCF’s valuation. What we did not see in the reports, however, was a mention of Frontline.

A Future with FRO? Depends on the Price

Peter Georgiopoulos and Jeff Pribor spoke confidently of making accretive acquisitions and growing the company in their conference call, and for the most part questions from listeners revolved around the details of their plans. Only Natasha Boyden of Cantor Fitzgerald ventured to directly ask about the situation with Frontline and whether this action would have an impact. To this there was a pause, followed by a cautious “I don’t know” before the more confident answer that this strategy change was the result of a long study and careful consideration of company strategy. But then just yesterday Bloomberg TV reported that General Maritime would be interested in a merger with Frontline, saying that Peter Georgiopoulos commented that the rival oil tanker operator would have to pay heavily in cash if he wished to purchase the company.

Whether or not this is in the cards, Mr. Georgiopoulos and Mr. Pribor have already succeeded in having their company reevaluated by leading analysts – Magnus Fyhr and Douglas Mavrinac at Jefferies and Mark MacLean and Ole Slorer at Morgan Stanley – and have watched their stock price shoot up an astonishing 9.81% to $44.65 in just one day. Not only that, but the terms of the dividend policy specify the Board of Director’s intent to establish reserves for maintenance and capital expenditures probably equating to around $100 million in 2005. So while they immediately picked up the premium in share price, the company should have a grace period before it actually has to pay out any cash.

Categories:

Equity,

Freshly Minted | January 27th, 2005 |

Add a Comment

SMBC Builds up Shipping Group

Japanese Sumitomo Mitsui Banking Corp. is expanding their ship finance activities outside Japan and has employed Mr. Stanislas Roger as head of shipping finance, responsible for all their activities outside Japan. The bank, with a shipping portfolio of close to $4.5 billion, has been very active in the Japanese market and is now the first Japanese bank to setup a designated team for shipping finance outside the country. As many of you know, Mr. Roger came from Credit Lyonnais, where he was head of shipping until the bank merged with Credit Agricole to become Calyon last year. SMBC shipping group is now represented in London and Paris.

Japanese Sumitomo Mitsui Banking Corp. is expanding their ship finance activities outside Japan and has employed Mr. Stanislas Roger as head of shipping finance, responsible for all their activities outside Japan. The bank, with a shipping portfolio of close to $4.5 billion, has been very active in the Japanese market and is now the first Japanese bank to setup a designated team for shipping finance outside the country. As many of you know, Mr. Roger came from Credit Lyonnais, where he was head of shipping until the bank merged with Credit Agricole to become Calyon last year. SMBC shipping group is now represented in London and Paris.

Categories:

Debt,

Freshly Minted | January 20th, 2005 |

Add a Comment

Jefferies & Marine Money Bring a Little Bit of US Markets to Greece

Jefferies and Company and Marine Money hosted a very well attended private seminar for about 100 shipowners in Piraeus last night. The cocktail party and presentation were held at the Piraeus Yacht Club and were intended to give owners an update on conditions in US equity markets and guidance on where their shipping companies will be valued if they go public. John Sinders and Matt McCleery participated in a very lively Q+A session after the presentation. In many ways, structures such as Arlington are ideal for Greek owners, including those who have older vessels that are generating strong cash flows dovetailing with newbuilding deliveries in the coming years. There are about one dozen Greek companies in various stages of IPO preparation and we expect a sizable universe of publicly traded dry bulk shipping companies to form through the balance of 2005.

Jefferies and Company and Marine Money hosted a very well attended private seminar for about 100 shipowners in Piraeus last night. The cocktail party and presentation were held at the Piraeus Yacht Club and were intended to give owners an update on conditions in US equity markets and guidance on where their shipping companies will be valued if they go public. John Sinders and Matt McCleery participated in a very lively Q+A session after the presentation. In many ways, structures such as Arlington are ideal for Greek owners, including those who have older vessels that are generating strong cash flows dovetailing with newbuilding deliveries in the coming years. There are about one dozen Greek companies in various stages of IPO preparation and we expect a sizable universe of publicly traded dry bulk shipping companies to form through the balance of 2005.

Categories:

Debt,

Freshly Minted | January 20th, 2005 |

Add a Comment

Life is Good in Hong Kong

Or so says the CEO of still-recently public company Pacific Basin. He sees plenty of room for growth within the Pacific area serving commodity companies, once there are reasonably priced acquisitions to be made, of course. He is also quick to point out that it is too easy to fall into the belief that the recent market strength was due to just China. This is somewhat easier for Mr. Harris to say, however, as the small size of his ships is conducive to the transport of a wide variety of commodities, and as such his company is less dependent on coal and iron ore than CMB. The size of his ships is also ideal for the multitude of new ports developing along China’s coast, as well as for making deliveries in Japan, where land transportation of goods is more difficult

However it may be, it is beginning to look like the landing in China may indeed by soft, and the dry bulk market is substantially less threatened by new deliveries in the next couple years than the container market. Even now, many shipyards would prefer not to build new dry bulk ships, as they provide substantially less room to add value than LPG, LNG or even container ships and become a drag on earnings with steel prices still near their peak. Investors should certainly take note, as the dry bulk market opens up a whole new way to play the shipping markets that might be slightly less trendy than tanker stocks and does not face the downside risk of an oncoming supply glut. U.S.-listed Excel Maritime has certainly been among one of the greatest beneficiaries this year, watching its stock price go from $4.84 at the close of last year to $23.75 at the close of this one, while DryShips hopes it, too, can profit from current interest and the under-saturation of US markets with dry bulk companies.

Or so says the CEO of still-recently public company Pacific Basin. He sees plenty of room for growth within the Pacific area serving commodity companies, once there are reasonably priced acquisitions to be made, of course. He is also quick to point out that it is too easy to fall into the belief that the recent market strength was due to just China. This is somewhat easier for Mr. Harris to say, however, as the small size of his ships is conducive to the transport of a wide variety of commodities, and as such his company is less dependent on coal and iron ore than CMB. The size of his ships is also ideal for the multitude of new ports developing along China’s coast, as well as for making deliveries in Japan, where land transportation of goods is more difficult

However it may be, it is beginning to look like the landing in China may indeed by soft, and the dry bulk market is substantially less threatened by new deliveries in the next couple years than the container market. Even now, many shipyards would prefer not to build new dry bulk ships, as they provide substantially less room to add value than LPG, LNG or even container ships and become a drag on earnings with steel prices still near their peak. Investors should certainly take note, as the dry bulk market opens up a whole new way to play the shipping markets that might be slightly less trendy than tanker stocks and does not face the downside risk of an oncoming supply glut. U.S.-listed Excel Maritime has certainly been among one of the greatest beneficiaries this year, watching its stock price go from $4.84 at the close of last year to $23.75 at the close of this one, while DryShips hopes it, too, can profit from current interest and the under-saturation of US markets with dry bulk companies.

Categories:

Equity,

Freshly Minted | January 20th, 2005 |

Add a Comment

Good Morning, Good Afternoon and Good Evening

In line with the rest of the shipping market, the dry bulk sector has surely been in quite good health this past year, but the real concern at present is what is in store for next year. In an international conference call hosted by Jean-Louis Morisot of Goldman Sachs, Pacific Basin CEO Mark Harris and Compagnie Maritime Belge (CMB) Director Ludwig Criel took the time to differentiate between expectations for the different sectors of the dry bulk market while Goldman Sachs analyst Paul Gray grounded their views by offering his expectations of the performance of the commodities that dry bulkers transport.

An Exceptional Year

The three seemed to be in agreement that 2004 was an exceptional year and that this exceptionality can be substantially attributed to the growth of demand for shipping finally having caught up to supply. While China’s growth has played a key role in the development of the 2004 market, Mr. Harris pointed out that China’s growth was really nothing new, and had been going on in a similar fashion for a good decade. He also commented on how shipbuilding and other “old economy” industries had fallen out of fashion during the 1990s, allowing for the unique synchronization of exceptional markets across the shipping sectors.

What about the Scrap Market?

As to the longevity of the current market, Mr. Harris and Mr. Criel discussed the global orderbooks through 2008 for the handysize, panamax and capesize fleets, all of which stand at a modest 20%. At the same time, roughly 25% of the global panamax fleet and 13% of the capesize fleet are over twenty years, while the global handysize fleet has an average age of 17 – 2/3 is over 15 and 1/4 over 25. This means there should be sufficient room for ship retirement to allow for a comfortable entrance for the ships on order. And when asked about the scrap market, the reply came from Mr. Harris that there isn’t any, as anyone whose got “two band-aids and a paperclip to rub together” will keep a ship going in this market.

Commodities and the China Factor

Mr. Criel’s thoughts about the future support the advice of Lorentzen & Stemoco analyst Nicolai Hansteen who stated in this month’s Marine Money that “whether you believe China will be able to keep up the pace of its growth or you fear that the steam has run out should decide your investment positions.” And Mr. Gray gave reason to take optimism from this advice, forecasting an acceleration in crude steel production of 3.2% p.a. and an even greater acceleration in pig iron production at 3.7% p.a., both driven by China. While Mr. Gray also thinks that both steel and iron markets are near peak, he explained his belief that he does not expect prices or demand for these commodities to “fall off a cliff,” but rather looks for gravitation to a level that is significantly higher than those to which we may historically have become accustomed. This is reasonably good news for Mr. Criel’s capesize and panamax fleet, which focuses primarily on transporting iron ore and coal aside from some involvement in grain.

In line with the rest of the shipping market, the dry bulk sector has surely been in quite good health this past year, but the real concern at present is what is in store for next year. In an international conference call hosted by Jean-Louis Morisot of Goldman Sachs, Pacific Basin CEO Mark Harris and Compagnie Maritime Belge (CMB) Director Ludwig Criel took the time to differentiate between expectations for the different sectors of the dry bulk market while Goldman Sachs analyst Paul Gray grounded their views by offering his expectations of the performance of the commodities that dry bulkers transport.

An Exceptional Year

The three seemed to be in agreement that 2004 was an exceptional year and that this exceptionality can be substantially attributed to the growth of demand for shipping finally having caught up to supply. While China’s growth has played a key role in the development of the 2004 market, Mr. Harris pointed out that China’s growth was really nothing new, and had been going on in a similar fashion for a good decade. He also commented on how shipbuilding and other “old economy” industries had fallen out of fashion during the 1990s, allowing for the unique synchronization of exceptional markets across the shipping sectors.

What about the Scrap Market?

As to the longevity of the current market, Mr. Harris and Mr. Criel discussed the global orderbooks through 2008 for the handysize, panamax and capesize fleets, all of which stand at a modest 20%. At the same time, roughly 25% of the global panamax fleet and 13% of the capesize fleet are over twenty years, while the global handysize fleet has an average age of 17 – 2/3 is over 15 and 1/4 over 25. This means there should be sufficient room for ship retirement to allow for a comfortable entrance for the ships on order. And when asked about the scrap market, the reply came from Mr. Harris that there isn’t any, as anyone whose got “two band-aids and a paperclip to rub together” will keep a ship going in this market.

Commodities and the China Factor

Mr. Criel’s thoughts about the future support the advice of Lorentzen & Stemoco analyst Nicolai Hansteen who stated in this month’s Marine Money that “whether you believe China will be able to keep up the pace of its growth or you fear that the steam has run out should decide your investment positions.” And Mr. Gray gave reason to take optimism from this advice, forecasting an acceleration in crude steel production of 3.2% p.a. and an even greater acceleration in pig iron production at 3.7% p.a., both driven by China. While Mr. Gray also thinks that both steel and iron markets are near peak, he explained his belief that he does not expect prices or demand for these commodities to “fall off a cliff,” but rather looks for gravitation to a level that is significantly higher than those to which we may historically have become accustomed. This is reasonably good news for Mr. Criel’s capesize and panamax fleet, which focuses primarily on transporting iron ore and coal aside from some involvement in grain.

Categories:

Equity,

Freshly Minted | January 20th, 2005 |

Add a Comment

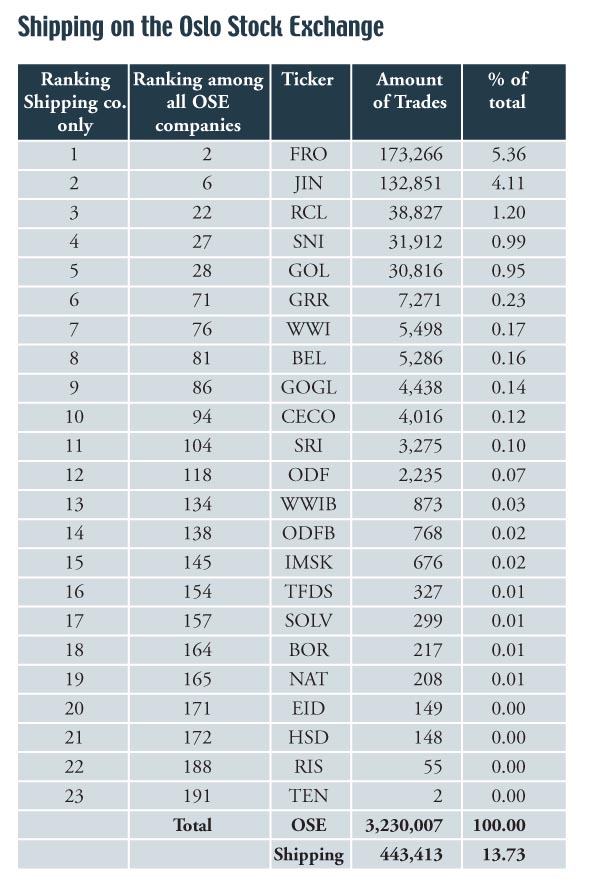

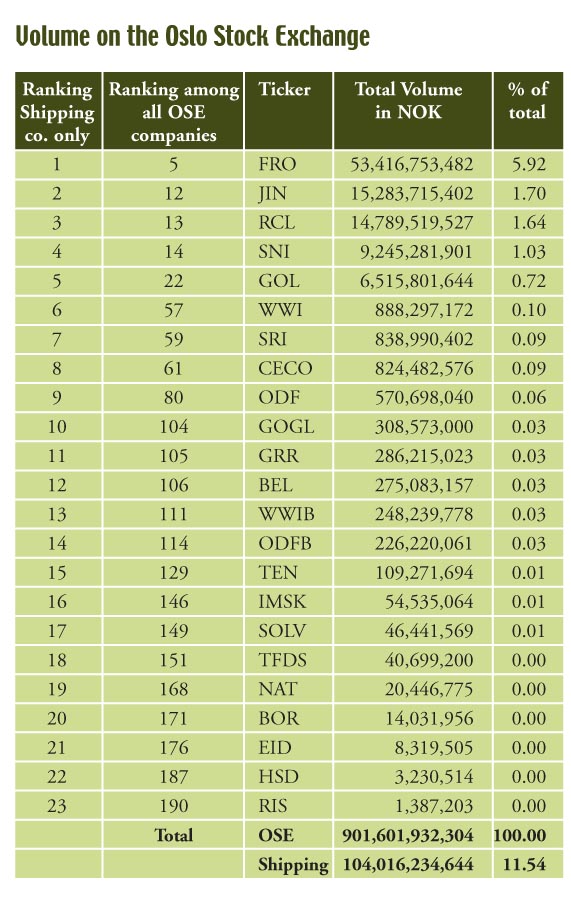

Frontline and Jinhui: the Most Liquid Shares on the OSE in 2004

Looking at trading volume on the Oslo Stock Exchange in 2004, we are not surprised to see Frontline on top as the second most traded stock of all companies listed on the exchange last year, with over 173,000 trades, or about 5% of the total for all companies listed on the OSE. In volume, the company ranks 5th of all listed companies, with over NOK 53.4 billion, which is about 6% of total volume on the exchange. This is illustrated in the charts on page 2 & 3.

What we where surprised to see was that Jinhui was the 2nd most traded shipping company and 2nd largest in volume among the shipping companies. This company has been the favorite share for the day traders in Oslo, and the fact that is the 6th most traded stock of all listed companies is a testament to this. The company is way ahead of such large companies as RCL, Wilhelmsen and Stolt-Nielsen. As seen from the table below, the company had close to 134,000 trades with a volume of NOK 15.2 billion. This demonstrates that the OSE can still be an attractive exchange for shipping companies, boasting what is perhaps the most experienced shipping investment community, with the advantage of being able to take a long term perspective.

Looking at trading volume on the Oslo Stock Exchange in 2004, we are not surprised to see Frontline on top as the second most traded stock of all companies listed on the exchange last year, with over 173,000 trades, or about 5% of the total for all companies listed on the OSE. In volume, the company ranks 5th of all listed companies, with over NOK 53.4 billion, which is about 6% of total volume on the exchange. This is illustrated in the charts on page 2 & 3.

What we where surprised to see was that Jinhui was the 2nd most traded shipping company and 2nd largest in volume among the shipping companies. This company has been the favorite share for the day traders in Oslo, and the fact that is the 6th most traded stock of all listed companies is a testament to this. The company is way ahead of such large companies as RCL, Wilhelmsen and Stolt-Nielsen. As seen from the table below, the company had close to 134,000 trades with a volume of NOK 15.2 billion. This demonstrates that the OSE can still be an attractive exchange for shipping companies, boasting what is perhaps the most experienced shipping investment community, with the advantage of being able to take a long term perspective.

Categories:

Equity,

Freshly Minted | January 20th, 2005 |

Add a Comment

DryShips Takes to the Road

We are hearing good things about the DryShips roadshow currently underway on the West Coast. There is vigorous demand for dry bulk deals from the US investor community, and we expect the successful execution of this transaction to spawn more deals throughout 2005. As for pricing, look for a valuation multiple of 4-5x EBITDA – about where PacBasin is trading. Interestingly, we have not heard much talk of net asset value with this deal, but clearly there will be a premium. Unlike tankers, dry bulkers are driven more off cash flow because their ships have longer lives that generally extend beyond their book value depreciation schedule.

We are hearing good things about the DryShips roadshow currently underway on the West Coast. There is vigorous demand for dry bulk deals from the US investor community, and we expect the successful execution of this transaction to spawn more deals throughout 2005. As for pricing, look for a valuation multiple of 4-5x EBITDA – about where PacBasin is trading. Interestingly, we have not heard much talk of net asset value with this deal, but clearly there will be a premium. Unlike tankers, dry bulkers are driven more off cash flow because their ships have longer lives that generally extend beyond their book value depreciation schedule.

Categories:

Equity,

Freshly Minted | January 20th, 2005 |

Add a Comment

Horizon Lines IPO

Freshly Minted understands that that US liner company Horizon Lines is interviewing prospective underwriters for an upcoming IPO. Horizon Lines, formerly CSX Lines, was purchased by Carlyle Group in late 2002 for $375 million and sold just over a year later to private equity fund Castle Harlan for $675 million – thanks to a hungry LBO market, lower interest rates and improved EBITDA. Castle Harlan took about $100 million out of the company through a zero coupon bond last month and is set to extract its remaining equity (and a phenomenal return) through the IPO while likely maintaining a large stake in the business. Look for the coterie of Horizon Line service providers such as Goldman Sachs, UBS and ABN on the deal along with Jefferies, who has the most powerful research franchise in the business.

Freshly Minted understands that that US liner company Horizon Lines is interviewing prospective underwriters for an upcoming IPO. Horizon Lines, formerly CSX Lines, was purchased by Carlyle Group in late 2002 for $375 million and sold just over a year later to private equity fund Castle Harlan for $675 million – thanks to a hungry LBO market, lower interest rates and improved EBITDA. Castle Harlan took about $100 million out of the company through a zero coupon bond last month and is set to extract its remaining equity (and a phenomenal return) through the IPO while likely maintaining a large stake in the business. Look for the coterie of Horizon Line service providers such as Goldman Sachs, UBS and ABN on the deal along with Jefferies, who has the most powerful research franchise in the business.

Categories:

Equity,

Freshly Minted | January 20th, 2005 |

Add a Comment

Correction

In the last week’s Freshly Minted, we incorrectly characterized Tsakos Shipping & Trading as a private company controlled by TEN.

We have been contacted by TEN representatives, who clarified that Tsakos Shipping & Trading is a completely private independent organization which manages TEN’s vessels but is totally separate from TEN. Tsakos family interests control TST and own less than a quarter of TEN’s shares. Apart from common managers, there is absolutely no relationship between TEN and the vessel Athos I and, correspondingly, no liability for damage on the part of TEN.

In the last week’s Freshly Minted, we incorrectly characterized Tsakos Shipping & Trading as a private company controlled by TEN.

We have been contacted by TEN representatives, who clarified that Tsakos Shipping & Trading is a completely private independent organization which manages TEN’s vessels but is totally separate from TEN. Tsakos family interests control TST and own less than a quarter of TEN’s shares. Apart from common managers, there is absolutely no relationship between TEN and the vessel Athos I and, correspondingly, no liability for damage on the part of TEN.

Citigroup Promotes Simon Booth

Citigroup has promoted Mr. Simon Booth to Managing Director with responsibilities for Northern Europe. Simon is starting to close in on the veterans in ship finance, having been involved in the industry for almost 20 years. Congratulations to Simon.

Citigroup has promoted Mr. Simon Booth to Managing Director with responsibilities for Northern Europe. Simon is starting to close in on the veterans in ship finance, having been involved in the industry for almost 20 years. Congratulations to Simon.