As I sit down to write this issue, surrounded by about 100 pages of Excel sheets containing details on hundreds of ship finance transactions, I am truly in awe of the scale and scope of the deals completed in the last 12 months. There were so many deals done that our analysis will comprise two issues. The year 2004 saw about $40 billion of debt deals, $20 billion of mergers & acquisitions, $8 billion of bonds and $6 billion of leases. All tolled, about $74 billion of capital was formed for shipping deals. Shipping financiers arranged $202 million every day during 2004, which equates to $8.4 million an hour or $140,000 per minute.

But more impressive than the pure scale of the deals, what really has me awestruck is the talent, energy, creativity, optimism, patience and analytical abilities of the community of financiers serving the shipping industry who have been solving, like a Rubik’s Cube, the complex riddle of how to concurrently make a deal so attractive to buyer, seller, investor and lender that they are not only willing but enthusiastic to conclude a transaction – and who have been conducting these high stakes acrobatics while traversing the peak in the shipping markets. Continue Reading

Categories:

Marine Money | February 1st, 2005 |

Add a Comment

Prasanth Prasannakumar Moves Back to CT, Joins Fortis’ Team

Freshly Minted understands that Prasanth Prasannakumar has left DVB’s New York office to join the swashbuckling Svein Engh-led team at Fortis USA. Prasanth brings with him all the key ingredients for success: time at sea, a Yale education and one year in the highly prestigious, and woefully grueling, Marine Money Training Academy. Based on the amount of capital markets and commercial deal flow coming out of Fortis’ Stamford, Connecticut offices these days, we expect Prasanth will be a busy boy.

Freshly Minted understands that Prasanth Prasannakumar has left DVB’s New York office to join the swashbuckling Svein Engh-led team at Fortis USA. Prasanth brings with him all the key ingredients for success: time at sea, a Yale education and one year in the highly prestigious, and woefully grueling, Marine Money Training Academy. Based on the amount of capital markets and commercial deal flow coming out of Fortis’ Stamford, Connecticut offices these days, we expect Prasanth will be a busy boy.

Merrill Hires Friedman, Breaks into Shipping

In yet another sign of how hot shipping is in the capital markets, Freshly Minted understands that Mark Friedman has left Goldman Sachs to start a global shipping practice at Merrill Lynch. While at Goldman, Mark called on North American clients like OMI, OSG and General Maritime, though we understand Merrill’s efforts will be global. Adding Merrill to the mix gives shipping companies more access to the retail investor market through their enormous network of retail stockbrokers, something we really haven’t seen fully developed in the past. Unlike many investment banks, Merrill is also a lender when need be. We wish Mark the best of luck in building the practice on what is without a doubt a mighty platform.

In yet another sign of how hot shipping is in the capital markets, Freshly Minted understands that Mark Friedman has left Goldman Sachs to start a global shipping practice at Merrill Lynch. While at Goldman, Mark called on North American clients like OMI, OSG and General Maritime, though we understand Merrill’s efforts will be global. Adding Merrill to the mix gives shipping companies more access to the retail investor market through their enormous network of retail stockbrokers, something we really haven’t seen fully developed in the past. Unlike many investment banks, Merrill is also a lender when need be. We wish Mark the best of luck in building the practice on what is without a doubt a mighty platform.

ACL to Issue $200 million in Bonds through UBS, Bank of America

Tugboat and river barge operator American Commercial Lines LLC has announced its intent to issue $200 million in 10-year, B3-rated bonds. The proceeds will be used to pay debt after the company emerged from bankruptcy protection on January 11. ACL is rated B2 by Moody’s and B+ by Standard & Poors, both with a stable outlook. The notes are set to price on February 8, with estimates in the range of 9%. UBS and Bank of America are managing the offering.

Tugboat and river barge operator American Commercial Lines LLC has announced its intent to issue $200 million in 10-year, B3-rated bonds. The proceeds will be used to pay debt after the company emerged from bankruptcy protection on January 11. ACL is rated B2 by Moody’s and B+ by Standard & Poors, both with a stable outlook. The notes are set to price on February 8, with estimates in the range of 9%. UBS and Bank of America are managing the offering.

Categories:

Bonds,

Freshly Minted | January 27th, 2005 |

Add a Comment

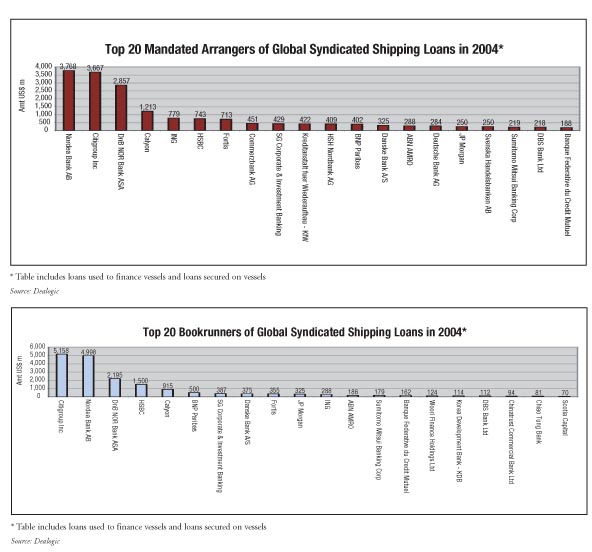

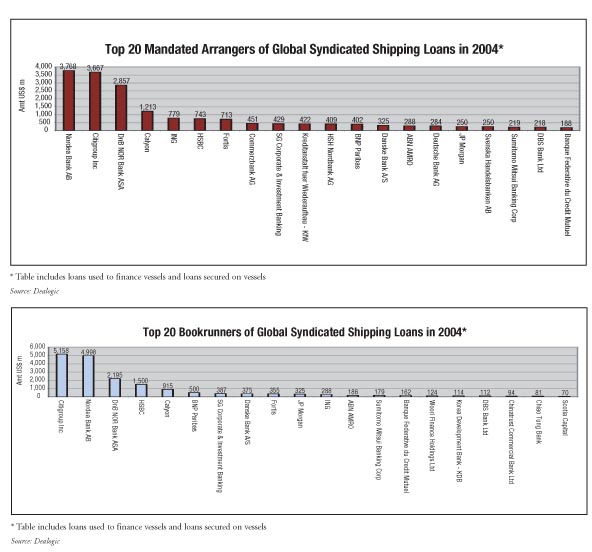

2004 Dealogic Global Shipping Tables

Below are global shipping bookrunner and mandated lead arranger graphs based on tables produced by Dealogic. These have been a matter of some debate this year, as Dealogic struggles to scientifically define an unscientific industry. You may have noticed a table in the January 13th Freshly Minted, which has since been revamped. The tables shown here are current and include only syndicated loans, which is different from some others in which bilaterals are also counted. Additionally, whereas in the past Dealogic has defined “shipping” loans as those that financed vessels or were otherwise noted as pertaining directly to shipping, the criteria in the below table has been broadened to also include loans that are secured by vessels. The rankings below, of course, show only relative performance based on particular criteria; we would like to congratulate all those who worked to make the absolute performance of the ship finance community this year so phenomenal.

Below are global shipping bookrunner and mandated lead arranger graphs based on tables produced by Dealogic. These have been a matter of some debate this year, as Dealogic struggles to scientifically define an unscientific industry. You may have noticed a table in the January 13th Freshly Minted, which has since been revamped. The tables shown here are current and include only syndicated loans, which is different from some others in which bilaterals are also counted. Additionally, whereas in the past Dealogic has defined “shipping” loans as those that financed vessels or were otherwise noted as pertaining directly to shipping, the criteria in the below table has been broadened to also include loans that are secured by vessels. The rankings below, of course, show only relative performance based on particular criteria; we would like to congratulate all those who worked to make the absolute performance of the ship finance community this year so phenomenal.

Categories:

Bank Debt,

Freshly Minted | January 27th, 2005 |

Add a Comment

DnB NOR Arranges $500m Cheap Unsecured Revolving Facility for OSG

Last week OSG filed an 8-K with the US SEC for a $500 million bilateral loan provided solely by DnB NOR. The deal was put together by Mr. Nicholai Nachamkin and his team in New York and provides a stunning 0.80% over Libor for the five first years and then 0.85% for the two remaining years of the term. For an unsecured loan and a one-bank deal, this price is extremely competitive. The unsecured loan will be used for refinancing some of Stelmar’s debt and will also go partly towards financing the OSG’s acquisition of the Stelmar shares.

Last week OSG filed an 8-K with the US SEC for a $500 million bilateral loan provided solely by DnB NOR. The deal was put together by Mr. Nicholai Nachamkin and his team in New York and provides a stunning 0.80% over Libor for the five first years and then 0.85% for the two remaining years of the term. For an unsecured loan and a one-bank deal, this price is extremely competitive. The unsecured loan will be used for refinancing some of Stelmar’s debt and will also go partly towards financing the OSG’s acquisition of the Stelmar shares.

Categories:

Bank Debt,

Freshly Minted | January 27th, 2005 |

Add a Comment

Seabulk Expands Offshore Fleet, Expands Presence in Brazil with Help of BNDES

Seabulk International announced this week that it had taken delivery of two newbuild vessels for its international offshore fleet. The first is the 236-foot UT-755L platform supply vessel Seabulk Agra built at the Promar shipyard outside Rio de Janeiro. The second is the multi-purpose offshore supply vessel Seabulk Advantage, which was purchased from Jaya Shipbuilding & Marine Pte. of Singapore.

The vessels were purchased at prices of $16.5 million and $8.5 million, respectively, according to forms filed by Seabulk with the SEC. The Seabulk Agra will join her sister vessel the Seabulk Brasil on a two-year time charter for Petrobras and will help Seabulk Offshore expand its relatively new presence in the Brazilian offshore market. Appropriately, financing for the vessel was provided by BNDES, the Brazilian National Development Bank.

The Seabulk Advantage will join five other Seabulk vessels currently employed in the Angolan offshore market. The vessel is on a five-year time charter for a major international oil company and was paid for in cash.

Seabulk International announced this week that it had taken delivery of two newbuild vessels for its international offshore fleet. The first is the 236-foot UT-755L platform supply vessel Seabulk Agra built at the Promar shipyard outside Rio de Janeiro. The second is the multi-purpose offshore supply vessel Seabulk Advantage, which was purchased from Jaya Shipbuilding & Marine Pte. of Singapore.

The vessels were purchased at prices of $16.5 million and $8.5 million, respectively, according to forms filed by Seabulk with the SEC. The Seabulk Agra will join her sister vessel the Seabulk Brasil on a two-year time charter for Petrobras and will help Seabulk Offshore expand its relatively new presence in the Brazilian offshore market. Appropriately, financing for the vessel was provided by BNDES, the Brazilian National Development Bank.

The Seabulk Advantage will join five other Seabulk vessels currently employed in the Angolan offshore market. The vessel is on a five-year time charter for a major international oil company and was paid for in cash.

Categories:

Bank Debt,

Freshly Minted | January 27th, 2005 |

Add a Comment

Euronav Looks to Nordea for $1.2 billion Refinancing

Following the company’s successful spin-off from CMB, Euronav is looking to refinance the entirety of is fleet debt with a new syndicated loan facility of up to $1.2 billion. Euronav typically pays in the range of 90-100 basis points, but could certainly hope to pay less if the strong market continues and banks are still in search of deal flow. Correspondingly, the company is trying particularly hard to execute the deal in a quick and efficient fashion. Euronav has turned to Nordea to for aid in its endeavor.

Following the company’s successful spin-off from CMB, Euronav is looking to refinance the entirety of is fleet debt with a new syndicated loan facility of up to $1.2 billion. Euronav typically pays in the range of 90-100 basis points, but could certainly hope to pay less if the strong market continues and banks are still in search of deal flow. Correspondingly, the company is trying particularly hard to execute the deal in a quick and efficient fashion. Euronav has turned to Nordea to for aid in its endeavor.

Categories:

Bank Debt,

Freshly Minted | January 27th, 2005 |

Add a Comment

NFC Closes First Deal with Islamic Finance Fund

Navigation Finance Corp, owned by Øivind Lorentzen III, Jan Næss and DVB Bank, has closed its first transaction through the newly established Islamic fund. The fund, Al Rubban NFC Shipping Fund IV, was formed with Northern Navigation, DVB and Kuwait Finance House in late 2004 and has $80 million for investments in shipping deals.

The deal was closed in Singapore this week and involves the purchase of a 1990-built product tanker and the subsequent charter for five years to the prominent Indonesian shipping company PT Arpeni Pratama Ocean Line. The fund reports that they have two more deals in the pipeline.

Navigation Finance Corp, owned by Øivind Lorentzen III, Jan Næss and DVB Bank, has closed its first transaction through the newly established Islamic fund. The fund, Al Rubban NFC Shipping Fund IV, was formed with Northern Navigation, DVB and Kuwait Finance House in late 2004 and has $80 million for investments in shipping deals.

The deal was closed in Singapore this week and involves the purchase of a 1990-built product tanker and the subsequent charter for five years to the prominent Indonesian shipping company PT Arpeni Pratama Ocean Line. The fund reports that they have two more deals in the pipeline.

Categories:

Equity,

Freshly Minted | January 27th, 2005 |

Add a Comment

Using Public Equity for Consolidation: Camillo Eitzen & Co. ASA

A good example of a company who has been using their shares for consolidation is Norwegian based Camillo Eitzen & Co. ASA, who went public last summer. After Tschudi & Eitzen split up the company, Mr. Axel Eitzen and his team have been extremely busy growing the company through M&A. The fast past of the development puts the company in the league of Frontline, Teekay and others when it comes to consolidation, and it is today one of the few Norwegian shipping companies with this aggressive entrepreneurial spirit. Looking at the table below you can see the impressive list of transactions that have taken place since their listing in Oslo.

A good example of a company who has been using their shares for consolidation is Norwegian based Camillo Eitzen & Co. ASA, who went public last summer. After Tschudi & Eitzen split up the company, Mr. Axel Eitzen and his team have been extremely busy growing the company through M&A. The fast past of the development puts the company in the league of Frontline, Teekay and others when it comes to consolidation, and it is today one of the few Norwegian shipping companies with this aggressive entrepreneurial spirit. Looking at the table below you can see the impressive list of transactions that have taken place since their listing in Oslo.

Categories:

Equity,

Freshly Minted | January 27th, 2005 |

Add a Comment