Why Bankers, Investors Should Look to Chemicals

It has often been said that the chemical tanker market is a lagging indicator of economic expansion, and that theory appears to hold true for the shipping companies that serve the business. If that is the case, the chemical tanker sector, comprised of companies such as Stolt Nielsen, Odfjell and Berlian Laju Tankers, may be the next place for both equity investors and lenders to put capital to work at this point in the cycle. Although we have said it before, we will say it again: we would very much like to see Odfjell and BLT come to the U.S. markets and, along with recently renewed Stolt Nielsen, create some critical mass and institutional awareness of the sector. Hopefully, we will all be able to discuss this at Marine Money Week.

In a very encouraging pre-announcement made this week, Odfjell said that gross revenue reached USD 1 billion and daily timecharter earnings in fourth quarter 2004 were 24% higher than fourth quarter 2003. Although EBIT in 2004 was up 36% over last year, the company’s net result was lower in the fourth quarter due to higher bunker prices, bonuses and “antitrust expenses.” Odfjell’s consolidated net result after tax was USD 86 million in 2004, compared to USD 22 million in 2003. EBITDA for 2004 was $194 million, up from $170 million last year. Odfjell’s return on equity was 15.5% and return on total assets was 6.6%. Return on capital employed (ROCE) was 8.0% in 2004. “As per 31 December 2004, the Price/Earnings ratio (P/E) was 17.8 and the Price/Cash flow ratio was 8.3. Based on book value, the Enterprise Value (EV)/EBITDA multiple is 7.0 while, based upon market value as per 31 December 2004, the EV/EBITDA multiple is 11.9. Interest coverage ratio (EBITDA/Net interest expenses) stays high in 2004 at 7.4, compared to 7.5 last year.

Stolt Nielsen Can’t Wait to Celebrate

Hard-earned Success

It’s remarkable what happens when momentum shifts. This week Stolt Nielsen released certain unaudited financial information regarding its anticipated results for the fourth quarter and full year ended November 30, 2004. SNSA expects to report income before tax provision and minority interest for the fourth quarter of $48 million to $54 million. For the full year, SNSA expects to report income before tax provision and minority interest of $83 million to $89 million, about $60 million of which comes in from the transportation group which includes the parcel tankers. The outlook for 2005 also looks good with contracts of affreightment being renewed at “significantly higher rates.”

Moreover, the tank container division (which Jefferies was mandated to sell but was subsequently taken off the market when Stolt realized it would not need the cash) saw further improvements in margins as the business is benefiting from a strong market.

Here are a few highlights of Stolt’s major presence on the Oslo Stock Exchange:

• SNSA is the 3rd largest non-Norwegian company (as measured by market cap) listed on the OSE after RCCL and Frontline, and just ahead of SOSA.

• SNSA had the best return of all of the companies in 2004 in the OBX (172%)

• SNSA was number 14 of all companies in terms of trading volume.

It has often been said that the chemical tanker market is a lagging indicator of economic expansion, and that theory appears to hold true for the shipping companies that serve the business. If that is the case, the chemical tanker sector, comprised of companies such as Stolt Nielsen, Odfjell and Berlian Laju Tankers, may be the next place for both equity investors and lenders to put capital to work at this point in the cycle. Although we have said it before, we will say it again: we would very much like to see Odfjell and BLT come to the U.S. markets and, along with recently renewed Stolt Nielsen, create some critical mass and institutional awareness of the sector. Hopefully, we will all be able to discuss this at Marine Money Week.

In a very encouraging pre-announcement made this week, Odfjell said that gross revenue reached USD 1 billion and daily timecharter earnings in fourth quarter 2004 were 24% higher than fourth quarter 2003. Although EBIT in 2004 was up 36% over last year, the company’s net result was lower in the fourth quarter due to higher bunker prices, bonuses and “antitrust expenses.” Odfjell’s consolidated net result after tax was USD 86 million in 2004, compared to USD 22 million in 2003. EBITDA for 2004 was $194 million, up from $170 million last year. Odfjell’s return on equity was 15.5% and return on total assets was 6.6%. Return on capital employed (ROCE) was 8.0% in 2004. “As per 31 December 2004, the Price/Earnings ratio (P/E) was 17.8 and the Price/Cash flow ratio was 8.3. Based on book value, the Enterprise Value (EV)/EBITDA multiple is 7.0 while, based upon market value as per 31 December 2004, the EV/EBITDA multiple is 11.9. Interest coverage ratio (EBITDA/Net interest expenses) stays high in 2004 at 7.4, compared to 7.5 last year.

Categories:

Equity,

Freshly Minted | February 3rd, 2005 |

Add a Comment

Shipping Rides Along With “New Global Resources

Super Cycle”

The Australian team at Citigroup put out a research piece this week that described a ‘resources super cycle’ that bodes very, very well for shipowners. According to the report, the super cycle ‘constitutes a sustained period of trend increases in real commodity prices; driven by higher trend demand growth as major economies industrialize and urbanize; in which supply increases but not sufficiently to offset demand… previous super cycles occurred in the late 1800′s/early 1900′s driven by the urbanisation and industrialization of the USA, again in the 1940′s and 1950′s with the post war reconstruction of Europe, and most recently in the 1960′s and early 1970′s driven by Japan’s economic renaissance… we believe China is the catalyst for a similar super cycle that commenced in 2002… driving sustained earnings growth that will outweigh conventional sell signals in a more conventional maturing cycle… as a result, we have increased our long-term commodity price and exchange rate forecasts… while anticipating that increased cash flow will be allocated to capex, acquisitions and capital management programs… our commodity preference is for the bulks (iron ore, coking coal and alumina), aluminium, zinc and gold.”

The Australian team at Citigroup put out a research piece this week that described a ‘resources super cycle’ that bodes very, very well for shipowners. According to the report, the super cycle ‘constitutes a sustained period of trend increases in real commodity prices; driven by higher trend demand growth as major economies industrialize and urbanize; in which supply increases but not sufficiently to offset demand… previous super cycles occurred in the late 1800′s/early 1900′s driven by the urbanisation and industrialization of the USA, again in the 1940′s and 1950′s with the post war reconstruction of Europe, and most recently in the 1960′s and early 1970′s driven by Japan’s economic renaissance… we believe China is the catalyst for a similar super cycle that commenced in 2002… driving sustained earnings growth that will outweigh conventional sell signals in a more conventional maturing cycle… as a result, we have increased our long-term commodity price and exchange rate forecasts… while anticipating that increased cash flow will be allocated to capex, acquisitions and capital management programs… our commodity preference is for the bulks (iron ore, coking coal and alumina), aluminium, zinc and gold.”

Categories:

Equity,

Freshly Minted | February 3rd, 2005 |

Add a Comment

Morgan Stanley Upgrades Tanker Sector

Just four days after upgrading General Maritime Corporation to Overweight-V on the announcement of its new dividend policy, Morgan Stanley analysts Mark MacLean and Ole Slorer issued a report revamping their formerly bearish view on the tanker market and raising their industry view to Attractive. This, of course, is good news for tanker companies and their shareholders, but we thought we would take a closer look at what is behind their change of heart.

OPEC Passes on Production Cut, Demand

Forecasts Improve

We looked back just as far as Mr. MacLean’s much more cautious forecast for the tanker market in 2005 published in the January issue of Marine Money, and we were reminded yet again of just how volatile the tanker industry really is. In both the earlier report and the more recent one, near-term fundamentals were classified as strong and concerns about OPEC production cuts were iterated. Since December, a 1.0 mbpd OPEC production cut effective as of January 1, 2005 did not have any particularly deleterious effects, while an OPEC meeting held on January 30 confirmed that OPEC did not feel it was necessary to cut production again at this time. Both these factors improved the outlook for the demand side of the equation.

Also in Mr. MacLean’s earlier forecast, an expansion of supply in the realm of 2.0 mdwt was predicted, to be met by an expansion of demand of 1.5 mbpd. In their more recent report, however, the two Morgan Stanley analysts raised their demand forecast to 1.7 mbpd after this week’s OPEC meeting, noting that at 2.0 mbpd the markets would be balanced and an increase to 2.6 mbpd, as seen last year, would see the market “positively booming.” These numbers do leave room for some notable upside potential in freight rates, which helps explain the 15-20% composite upside potential in the General Maritime, OMI, OSG, and Teekay stocks the analysts cover.

Beyond Supply & Demand: Stronger Asset Values,

Hopes for More Dividends

However, it does not appear to be just the numbers that underlie the analysts’ new bullish view. Whereas the earlier analysis focused primarily on the supply-demand balance, the newer one is broader in focus, considering fundamental changes in the tanker companies covered and in the tanker industry. While this sort of qualitative analysis is, to a certain extent, less scientific, it has the advantage that it is less affected by relatively minor differences (i.e. scrapping estimates, oil demand estimates) and so has the potential to be somewhat more consistent in the face of changing forecasts for supply and demand.

In their most recent report, Mr. Slorer and Mr. MacLean note the increased support for net asset values lent by increases in both newbuilding and secondhand prices and by strong balance sheets that are only being further strengthened by record 4Q04 earnings. As cash becomes slightly less dear to companies, they are willing to spend more on investments for the future, pushing up asset prices and even the monetary value of their own companies.

Perhaps more interesting is the temporary positive externality General Maritime seems to have created with the announcement of its new dividend policy. Far from boosting its own stock price at the expense of the other tanker companies, it has actually moved the Morgan Stanley analysts to become more bullish on General Maritime’s competitors, because they expect the change in policy will put pressure on the other U.S.-listed tanker companies to follow suit as the “valuation bifurcation of high yielding stocks” is brought into relief.

Just four days after upgrading General Maritime Corporation to Overweight-V on the announcement of its new dividend policy, Morgan Stanley analysts Mark MacLean and Ole Slorer issued a report revamping their formerly bearish view on the tanker market and raising their industry view to Attractive. This, of course, is good news for tanker companies and their shareholders, but we thought we would take a closer look at what is behind their change of heart.

OPEC Passes on Production Cut, Demand Forecasts Improve

We looked back just as far as Mr. MacLean’s much more cautious forecast for the tanker market in 2005 published in the January issue of Marine Money, and we were reminded yet again of just how volatile the tanker industry really is. In both the earlier report and the more recent one, near-term fundamentals were classified as strong and concerns about OPEC production cuts were iterated. Since December, a 1.0 mbpd OPEC production cut effective as of January 1, 2005 did not have any particularly deleterious effects, while an OPEC meeting held on January 30 confirmed that OPEC did not feel it was necessary to cut production again at this time. Both these factors improved the outlook for the demand side of the equation.

Also in Mr. MacLean’s earlier forecast, an expansion of supply in the realm of 2.0 mdwt was predicted, to be met by an expansion of demand of 1.5 mbpd. In their more recent report, however, the two Morgan Stanley analysts raised their demand forecast to 1.7 mbpd after this week’s OPEC meeting, noting that at 2.0 mbpd the markets would be balanced and an increase to 2.6 mbpd, as seen last year, would see the market “positively booming.” These numbers do leave room for some notable upside potential in freight rates, which helps explain the 15-20% composite upside potential in the General Maritime, OMI, OSG, and Teekay stocks the analysts cover.

Beyond Supply & Demand: Stronger Asset Values, Hopes for More Dividends

However, it does not appear to be just the numbers that underlie the analysts’ new bullish view. Whereas the earlier analysis focused primarily on the supply-demand balance, the newer one is broader in focus, considering fundamental changes in the tanker companies covered and in the tanker industry. While this sort of qualitative analysis is, to a certain extent, less scientific, it has the advantage that it is less affected by relatively minor differences (i.e. scrapping estimates, oil demand estimates) and so has the potential to be somewhat more consistent in the face of changing forecasts for supply and demand.

In their most recent report, Mr. Slorer and Mr. MacLean note the increased support for net asset values lent by increases in both newbuilding and secondhand prices and by strong balance sheets that are only being further strengthened by record 4Q04 earnings. As cash becomes slightly less dear to companies, they are willing to spend more on investments for the future, pushing up asset prices and even the monetary value of their own companies.

Perhaps more interesting is the temporary positive externality General Maritime seems to have created with the announcement of its new dividend policy. Far from boosting its own stock price at the expense of the other tanker companies, it has actually moved the Morgan Stanley analysts to become more bullish on General Maritime’s competitors, because they expect the change in policy will put pressure on the other U.S.-listed tanker companies to follow suit as the “valuation bifurcation of high yielding stocks” is brought into relief.

Categories:

Equity,

Freshly Minted | February 3rd, 2005 |

Add a Comment

He’s Back!

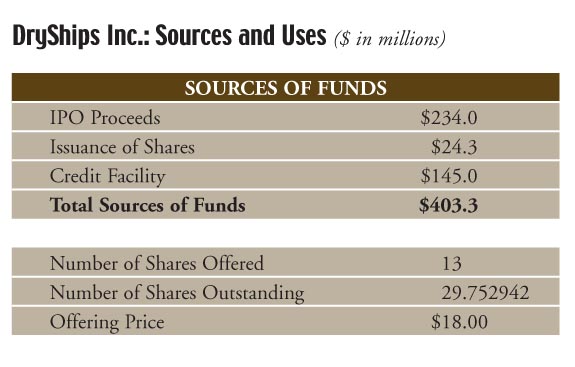

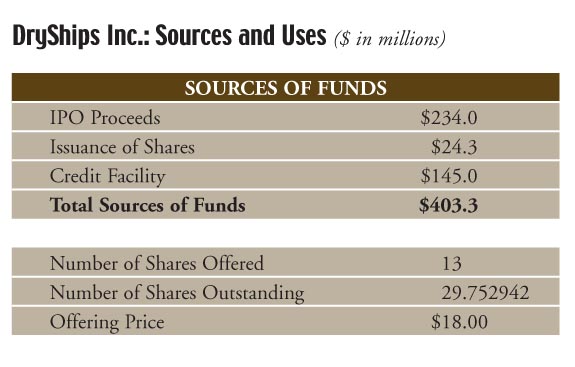

With Wednesday’s extraordinarily successful DryShips Inc. floatation, George Economou has stunned the ship finance community and silenced even his harshest critics. The final deal nearly doubled from its original size, going from 7.1 million shares in the initial prospectus to an astonishing 13.0 million shares (before underwriters’ over-allotments). The $18.00 price per share compared favorably with the red herring price of $17.00 but was significantly higher than the $14.00-$16.00 range initially put out by the company. In total, DryShips raised a gross $234 million (again before the shoe and underwriters’ commissions) against an initial target of $120.7 million (same basis). Market sources tell us the deal was 9x oversubscribed, and as we go to press, the stock is up 10% in heavy trading. This transaction was a huge success for George, Mark Blazer, Anthony Argyropoulos and Cantor Fitzgerald, which is proving to be a formidable force in shipping finance.

Let’s take a quick look at the deal from both sides of the ball. First, when John Sinders of Jefferies told more than 100 shipowners, in attendance at the Marine Money/Jefferies seminar at the Piraeus Yacht Club two weeks ago, that the pool of U.S. investment capital available for shipping equities was unlimited, the owners hooted – but Sinders was absolutely spot on. As we have said in these pages for more than two years, U.S. investors are clamoring to invest in dry cargo shipping deals, and DryShips has been the first to come to market with scale. Although we have not seen the roadshow slides yet, we suspect that the word “China” in six-inch red letters was superimposed on the background of each one. Sometimes as shipping professionals, we tend to over think and complicate things. Conversely, investors in this space look to simplify (perhaps oversimplify) things.

With Wednesday’s extraordinarily successful DryShips Inc. floatation, George Economou has stunned the ship finance community and silenced even his harshest critics. The final deal nearly doubled from its original size, going from 7.1 million shares in the initial prospectus to an astonishing 13.0 million shares (before underwriters’ over-allotments). The $18.00 price per share compared favorably with the red herring price of $17.00 but was significantly higher than the $14.00-$16.00 range initially put out by the company. In total, DryShips raised a gross $234 million (again before the shoe and underwriters’ commissions) against an initial target of $120.7 million (same basis). Market sources tell us the deal was 9x oversubscribed, and as we go to press, the stock is up 10% in heavy trading. This transaction was a huge success for George, Mark Blazer, Anthony Argyropoulos and Cantor Fitzgerald, which is proving to be a formidable force in shipping finance.

Let’s take a quick look at the deal from both sides of the ball. First, when John Sinders of Jefferies told more than 100 shipowners, in attendance at the Marine Money/Jefferies seminar at the Piraeus Yacht Club two weeks ago, that the pool of U.S. investment capital available for shipping equities was unlimited, the owners hooted – but Sinders was absolutely spot on. As we have said in these pages for more than two years, U.S. investors are clamoring to invest in dry cargo shipping deals, and DryShips has been the first to come to market with scale. Although we have not seen the roadshow slides yet, we suspect that the word “China” in six-inch red letters was superimposed on the background of each one. Sometimes as shipping professionals, we tend to over think and complicate things. Conversely, investors in this space look to simplify (perhaps oversimplify) things.

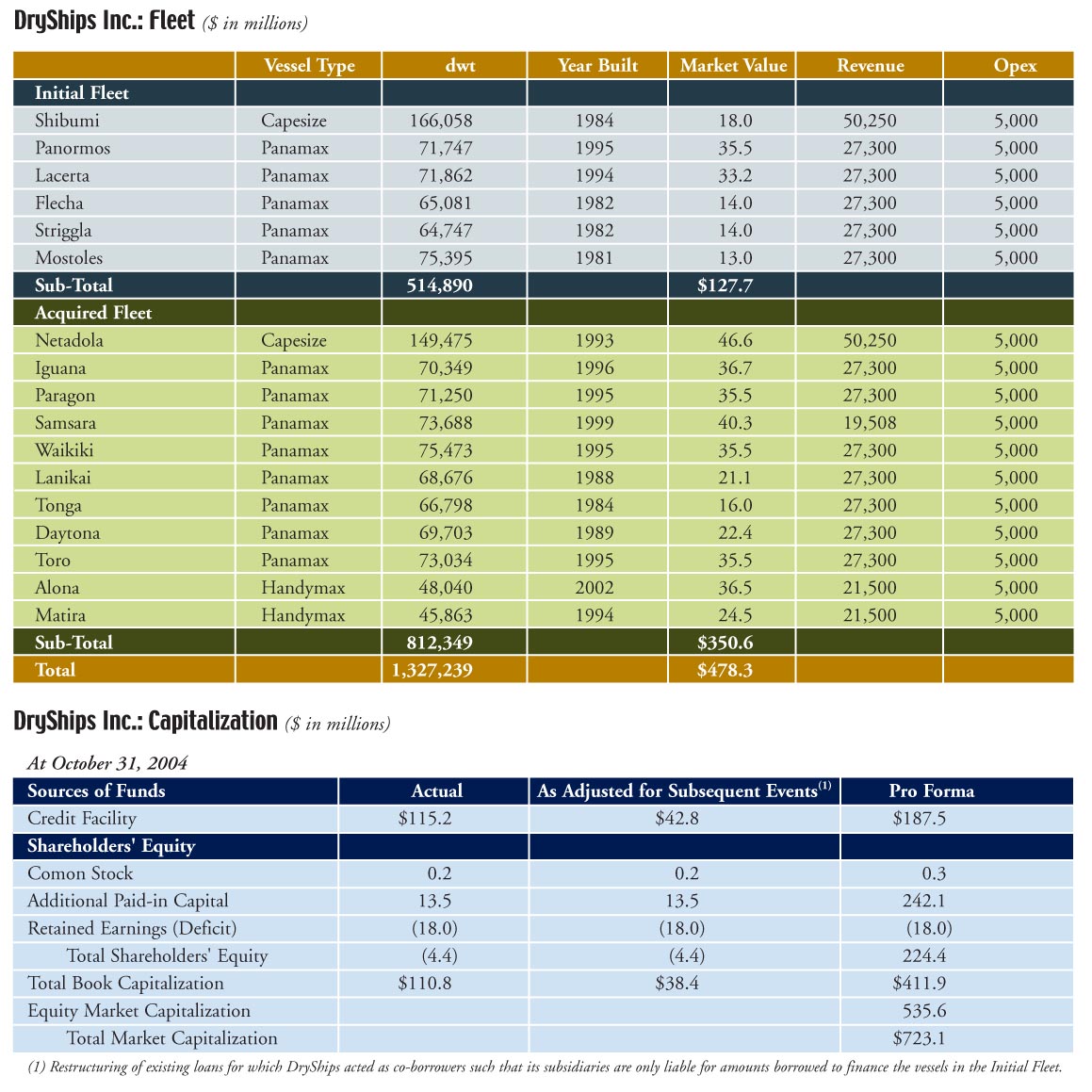

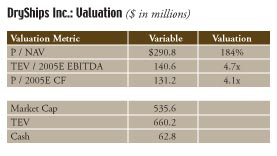

The Valuation: 1.8x NAV; 4.1x EBITDA

The key to making an IPO attractive to both issuers and investors is valuation. The company needs to feel as though it is getting an attractive enough valuation on its assets to make it worth selling, and investors need to feel that there is still some upside in the future. It is always a delicate balance, but this deal, thanks to the composition of the fleet and the outlook for the markets, has done just that. Here’s what we mean:

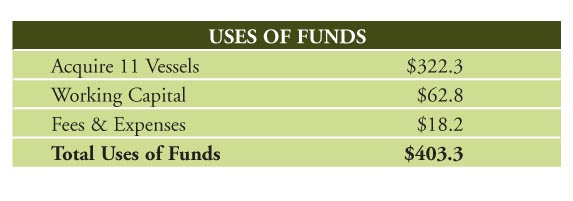

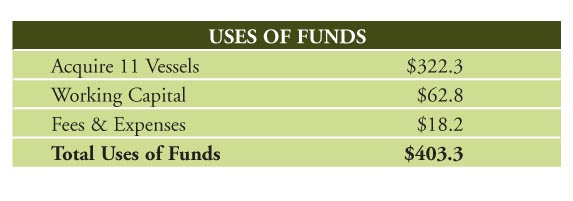

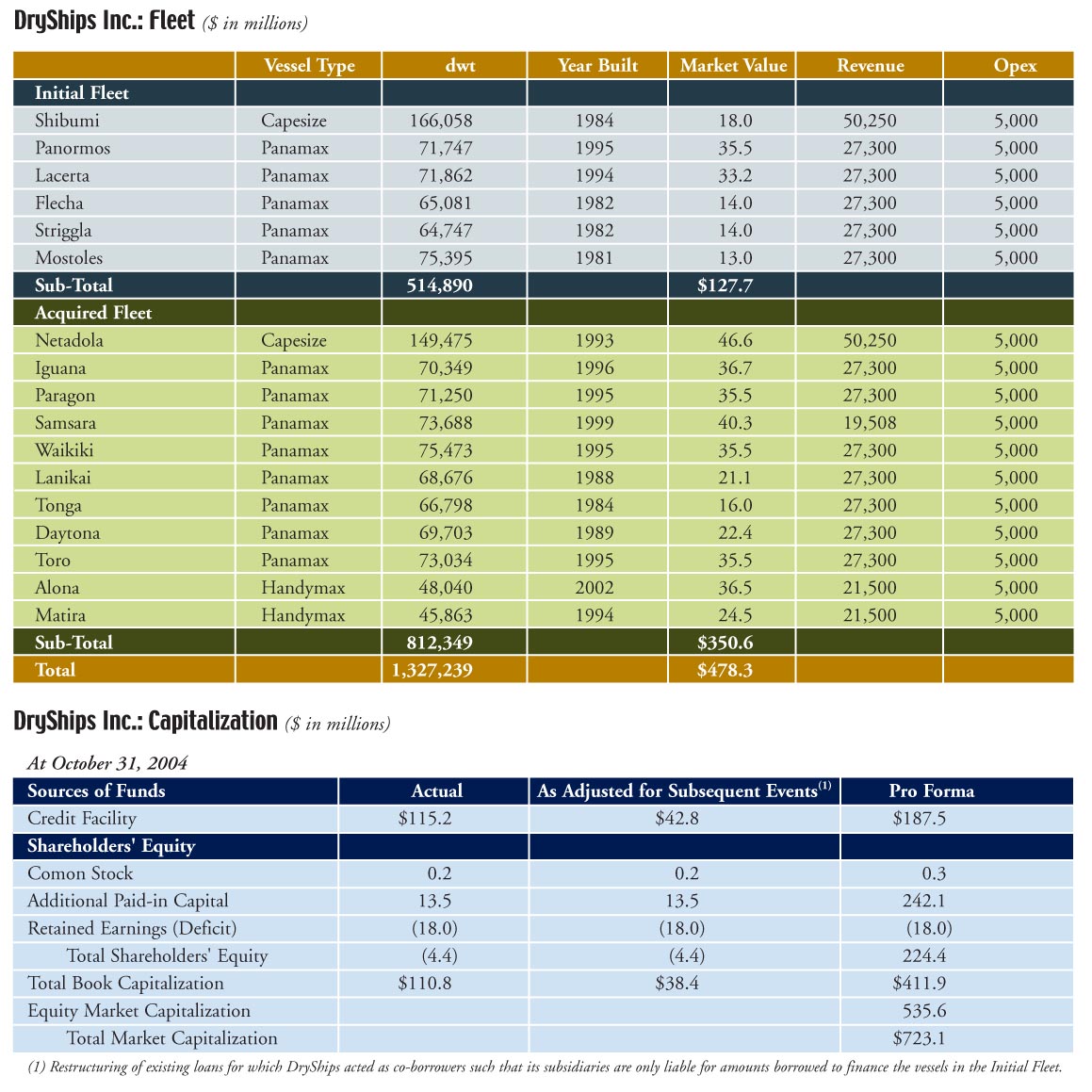

As you can see from the charts that accompany this analysis, DryShips was valued at about 1.8x net asset value. This was clearly attractive to George, especially in light of where asset values currently are when looked at in an historical perspective and the fact that many of the ships are coming into the company from the open market. The net asset valuation is pretty much in line with comparables in both the tanker and dry bulk industries (Excel), if not a bit higher.

What is interesting, though, is to look at the company’s value from a cashflow, or EBITDA, standpoint. As the charts illustrate, the DryShips deal was priced at about 4.1x 2005 cash flow. We arrived at these figures using 2005 estimates for capesize, panamax and handysize vessels that comprise the fleet. While this figure may appear low in absolute terms, it is important to recognize that the vessels in the DryShips fleet have an average age of 10 years – 10 years less cashflow generation power than a newbuilding, which would clearly have a high EBITDA multiple because new ships cost more than their marginal earning ability. In addition, the DryShips fleet will trade mostly on the spot market, so the EBITDA multiple will not be a static number – for better or for worse.

For companies thinking of entering the U.S. capital markets during this extraordinary moment in time, the DryShips deal should provide encouragement. The deal was done on very favorable terms for a company that restructured a bond after making just one coupon payment and a fleet that consists of spot trading vessels that are of middle age.

Categories:

Equity,

Freshly Minted | February 3rd, 2005 |

Add a Comment

After a two-month blip, the various shipping markets appear to be returning to their state of excitement and optimism. The stellar success of George Economou’s DryShips IPO is one indicator of market health, while reports issued by analysts from both Morgan Stanley and Citigroup, traditionally among the more bearish banks on shipping, suggest that not just the present but also the future is bright. Not to say that they will necessarily outshine the past year – be sure to keep your eyes open for our Deal of the Year Awards announcement in next week’s Freshly Minted.

Categories:

Equity,

Freshly Minted | February 3rd, 2005 |

Add a Comment

The Dealmaker of the Year award, our most subjective, is also one of our most important. The purpose of this category is to recognize that financial professional who, whether working for a shipping company or a financial institution, challenged the established limits of the ship finance community to make the industry better for shareholders going forward.

Last year, the first in which we introduced this award category, the winner was Tor Olav Trøim, for his tireless work with Frontline, Golar and Ship Finance International. This year, in what is undoubtedly a proxy for the remarkable times we are living in, we received far more nominations for the Dealmaker of the Year award than we did last year.

The serially nominated include Peter Evensen, John Sinders, Ronny Bjørnadal, Harald Hanssen, Evangelos Pistiolis, Michael Parker, Carl Steen, Herbjørn Hansson, Trøim, Garup Meidell, Peter Georgiopoulos, John Fredriksen, Hans Petter Aas, Angeliki Frangou, Fred Cheng, KEXIM generally, Svein Engh, Anthony Argyropoulos, Robert Bugbee, Michael Borch, Titan, Kevin Wong, Simon Smith, Graham Porter, Axel Eitzen, Victor Restis, George Economou and Jacob Stolt Nielsen. Continue Reading

Categories:

Marine Money | February 1st, 2005 |

Add a Comment

In words of American writer John McPhee, author of the ubiquitous tale about U.S. merchant mariners Looking for a Ship, “there is always someone, somewhere getting it.”

So it also goes with restructuring in the shipping industry; no matter how superb the market conditions may appear, there are always a group of companies paying mightily – generally for sins committed in an earlier time. This year, the blood in the water belonged to, among others, Stolt Nielsen, Stolt Offshore, Oglebay Norton, Northern Offshore, Ocean Rig, Trico Marine, Royal Olympic Cruise Lines, and American Commercial Lines.

And as we always see in a sharply rising freight market, the companies that get caught short get squeezed. It used to be through timecharters, being long cargo at predetermined rates but short the ships to carry it, but with the increasing acceptance of freight forward agreements, the number of companies driven into financial distress through paper has also grown. Take for example China Aviation Oil, which lost $550 million by being caught short oil in a market that kept on rising. Continue Reading

Categories:

Marine Money | February 1st, 2005 |

Add a Comment

Spreading Risk, Doubling Down he chart below says it all: 2004 was a record year for mergers and acquisitions in the shipping industry – cash was abundant, earnings were strong, the capital markets were open and interest rates were low. In other words, the market conditions were ideal for making deals, although we won’t know the real impact on shareholders for some time.

There were three distinct motivations that drove the explosive M&A deal volume of 2004. First off, there was an incredible amount of liquidity available. Both private and public companies have been generating huge amounts of cash from operations since the market began its upward climb in late 2002, and many have been keen on using that cash to grow or renew their fleets. In addition to internally generated funds, the debt and equity markets were wide open for shipping issuers all year long, with the exception of a brief blip in the bond market in May. The fact that asset values were at historical highs didn’t stop buyers from taking a punt. Ships were still generating enough cash that vessel acquisitions were accretive to earnings, and therefore took public company share prices higher. For the private companies, strong cash flows, with or without short-medium term charter cover, were enough to amortize debt quickly and bring loan balances down to reasonable, even attractive, levels. Add to that the fact that shipyards are ostensibly “full” and the fundamental outlook in most markets, other than large container ships, is pretty good, and it follows naturally that ship shoppers were not in short supply. Continue Reading

Categories:

Marine Money | February 1st, 2005 |

Add a Comment

There was good news and bad news for vessel leasing in 2004.

The good news was that there were loads of yield hungry investors interested in putting up the equity portion of leveraged leases. The bad news for lease arrangers was that this made competition for deals keener than we have ever seen it, with some shipping companies simultaneously requesting bids from multiple providers in the KG market, K/S market and private sources such as First Ship Lease and Navigation Finance.

From a structural standpoint, the challenge was that the long-term cash flows available in the market place did not reflect the enormously high vessel prices – driven by the spot market. The result was that lease arrangers had a harder time finding “projects” where the cash flows from a strong credit charter could amortize enough debt based on the very high asset purchase prices.

But there were also some enormous positives. First off, there were loads of newbuildings delivering, many of which had already been sold into the leasing markets upon delivery, and this provided a baseline amount of business. Secondly, the high asset prices encouraged tanker companies in particular to sell older units and lease them back. This type of transaction allowed them to book a gain to earnings, which was further enhanced by the high P/E multiples at which the stocks have been trading, and lower the age profile of their owned fleet – a statistic appreciated by investors. In a rising freight market, owners also liked the idea of selling ships and taking them back on charter at a fixed rate in order to keep commercial and operational control of assets they know well. Continue Reading

Categories:

Marine Money | February 1st, 2005 |

Add a Comment

The volume of bank debt transactions in the shipping market this year has been phenomenal. To help our readers get their minds around the data, however, we have included a substantial number of tables, which require some explanation.

The first two you will see are global shipping bookrunner and mandated lead arranger graphs based on tables produced by Dealogic. These have been a matter of some debate this year, as Dealogic struggles to scientifically define an unscientific industry. The tables shown here include only syndicated loans, which is different from some others in which bilaterals are also counted. Additionally, whereas in the past Dealogic defined “shipping” loans as those that financed vessels or were otherwise noted as pertaining directly to shipping, this year the criteria has been broadened to also include loans that are secured by vessels.

To support the Dealogic data, we have also included either complete or representative lists of deals done some of by the year’s top-performing banks. This is intended to allow our readers to look past the sort of minor differences in definition that inevitably affect league tables so as to get a better flavor of what sort of business the busiest banks did in 2004, in their own words. Continue Reading

Categories:

Marine Money | February 1st, 2005 |

Add a Comment