Del Monte’s Marine Trading Goes Unmentioned, Performance Undoubtedly Solid

Del Monte’s Marine Trading Goes Unmentioned,

Performance Undoubtedly Solid

When fruit giant Del Monte’s 2005 earnings were announced, no particular attention was paid to subsidiary Marine Trading Pacific, or the company’s share in the lucrative reefer trade. Chairman and CEO Mohammed Abu-Ghazaleh noted challenges “including higher costs for purchased fruit and vegetables, fuel, petroleum based products, packaging, and fertilizer.” Profit for 4Q04 dropped from $0.40 per share in the same quarter last year to a still solid $0.33 per share. However, it is possible that the reefer business played some part in the results being significantly higher than the $0.23 per share estimated by analysts polled by Thomson First Call.

When fruit giant Del Monte’s 2005 earnings were announced, no particular attention was paid to subsidiary Marine Trading Pacific, or the company’s share in the lucrative reefer trade. Chairman and CEO Mohammed Abu-Ghazaleh noted challenges “including higher costs for purchased fruit and vegetables, fuel, petroleum based products, packaging, and fertilizer.” Profit for 4Q04 dropped from $0.40 per share in the same quarter last year to a still solid $0.33 per share. However, it is possible that the reefer business played some part in the results being significantly higher than the $0.23 per share estimated by analysts polled by Thomson First Call.

Nordic American Files to Issue Another 3.2 million Shares

Nordic American Files to Issue Another

3.2 million Shares

Buy ships with debt and backfill the purchase through a secondary stock offering – that is the strategy being used by Nordic American Tanker Shipping (NATS), and so long as the equity market remains open, it’s a system that works for everyone, including the serial underwriters who are paid a 6% gross underwriting spread on the follow on deals.

In the most recent development, NATS announced on Wednesday yet another share offering pursuant to the company’s effective shelf registration statement. Repeat joint bookrunning managers Bear, Stearns & Co. Inc. and UBS Investment Bank, along with co-manager DnB NOR Markets, Inc., are selling an additional 3,500,000 common shares, with underwriters granted an option for an additional 525,000 shares to cover over-allotments. Proceeds are likely to amount to $200 million less fees. The new deal will substantially increase the 9.1 million shares currently outstanding.

The company’s plan is to use the proceeds of the offering in the financing of two double-hull suezmax tankers, to be delivered in March 2005, that Nordic American has already agreed to acquire for a purchase price of $149.3 million. Specifically, NATS plans to repay $5.0 million that it has borrowed under an existing credit facility led by DnB Nor for this purchase and to pay the remaining $130.3 million balance on the ships. According to the company, the any leftover funds will be used for general corporate purposes, including repayment of indebtedness and future vessel acquisitions.

Buy ships with debt and backfill the purchase through a secondary stock offering – that is the strategy being used by Nordic American Tanker Shipping (NATS), and so long as the equity market remains open, it’s a system that works for everyone, including the serial underwriters who are paid a 6% gross underwriting spread on the follow on deals.

In the most recent development, NATS announced on Wednesday yet another share offering pursuant to the company’s effective shelf registration statement. Repeat joint bookrunning managers Bear, Stearns & Co. Inc. and UBS Investment Bank, along with co-manager DnB NOR Markets, Inc., are selling an additional 3,500,000 common shares, with underwriters granted an option for an additional 525,000 shares to cover over-allotments. Proceeds are likely to amount to $200 million less fees. The new deal will substantially increase the 9.1 million shares currently outstanding.

The company’s plan is to use the proceeds of the offering in the financing of two double-hull suezmax tankers, to be delivered in March 2005, that Nordic American has already agreed to acquire for a purchase price of $149.3 million. Specifically, NATS plans to repay $5.0 million that it has borrowed under an existing credit facility led by DnB Nor for this purchase and to pay the remaining $130.3 million balance on the ships. According to the company, the any leftover funds will be used for general corporate purposes, including repayment of indebtedness and future vessel acquisitions.

Economou Puts IPO Funds to New Use in Accretive Purchases

Economou Puts IPO Funds to New Use in Accretive Purchases

George Economou has already begun to put the extra DryShips (NASDAQ: DRYS) proceeds to use in a flurry of transactions that one London broker said has actually pushed up the rates of secondhand bulk carriers by 10%. For example, market sources indicate that the newly listed company has purchased an additional charterfree capesize vessel this week for $85 million. Last week, the company acquired the 1995-built panamax bulker Linda Oldendorff for $40 million with a 14-month charter back to the sellers at $35,000 per day.

Based on these new deals, we thought it would be interesting to look at how the valuation of the vessels compares to the valuation of the company itself – to see if they are accretive or dilutive to shareholder value. The numbers are rough and dirty, but here goes:

We’ll look at the capesize first. DryShips bought the vessel charterfree for $85 million. Although capesize rates have been bouncing around a bit lately, Clarkson gives day rate guidance of $75,000 in the spot market which equates to $26 million in annual revenue. With management costs and dry docking accruals of about $5,400 per day, the total opex is $2 million per year. That means the vessel generates $24 million in EBITDA – or 3.5x the total purchase price. This multiple is actually low compared to the 4.1x EBITDA that DryShips was valued at in the IPO. For the purchase to have equaled the IPO valuation, DryShips would need to have paid $105 million for the ship. But now let’s imagine that charter rates trend down. This same deal would be dilutive to cashflow, at 5.15x, if day rates dropped to $50,000, which is substantially more than the $43,000 per day average for 3-year time charters, according to Clarkson. Now here’s where it gets really scary. If rates go to $18,000 per day, which is $4,000 per day more than the average one-year time charter rate in 2002 and $12,000 less than the average in 2003, the deal would have been struck at an incredible 17.6x EBITDA $18,000. Looking at the current Clarkson one-year rate for capesize bulkers of $65,000 per day, it would appear that DryShips acquired the vessel at precisely 4x 2005 EBITDA.

Now let’s turn to the panamax. According to market reports, Economou bought the ship for $40 million with a 14-month charter back at $35,000. Using a 365 day year and $5,000 per day opex, DryShips will generate EBITDA of $11 million on the vessel – and therefore paid approximately 3.6x 2005 EBITDA which is accretive to the company’s valuation.

When Public Companies Drive the Private Market

What we think is particularly interesting about this transaction is the idea that public companies can simply pay more for ships and still have the deals be accretive than other shipowners. In the table below, we present current price to 2005 projected cash flow multiples of some of the public tanker companies.

George Economou has already begun to put the extra DryShips (NASDAQ: DRYS) proceeds to use in a flurry of transactions that one London broker said has actually pushed up the rates of secondhand bulk carriers by 10%. For example, market sources indicate that the newly listed company has purchased an additional charterfree capesize vessel this week for $85 million. Last week, the company acquired the 1995-built panamax bulker Linda Oldendorff for $40 million with a 14-month charter back to the sellers at $35,000 per day.

Based on these new deals, we thought it would be interesting to look at how the valuation of the vessels compares to the valuation of the company itself – to see if they are accretive or dilutive to shareholder value. The numbers are rough and dirty, but here goes:

We’ll look at the capesize first. DryShips bought the vessel charterfree for $85 million. Although capesize rates have been bouncing around a bit lately, Clarkson gives day rate guidance of $75,000 in the spot market which equates to $26 million in annual revenue. With management costs and dry docking accruals of about $5,400 per day, the total opex is $2 million per year. That means the vessel generates $24 million in EBITDA – or 3.5x the total purchase price. This multiple is actually low compared to the 4.1x EBITDA that DryShips was valued at in the IPO. For the purchase to have equaled the IPO valuation, DryShips would need to have paid $105 million for the ship. But now let’s imagine that charter rates trend down. This same deal would be dilutive to cashflow, at 5.15x, if day rates dropped to $50,000, which is substantially more than the $43,000 per day average for 3-year time charters, according to Clarkson. Now here’s where it gets really scary. If rates go to $18,000 per day, which is $4,000 per day more than the average one-year time charter rate in 2002 and $12,000 less than the average in 2003, the deal would have been struck at an incredible 17.6x EBITDA $18,000. Looking at the current Clarkson one-year rate for capesize bulkers of $65,000 per day, it would appear that DryShips acquired the vessel at precisely 4x 2005 EBITDA.

Now let’s turn to the panamax. According to market reports, Economou bought the ship for $40 million with a 14-month charter back at $35,000. Using a 365 day year and $5,000 per day opex, DryShips will generate EBITDA of $11 million on the vessel – and therefore paid approximately 3.6x 2005 EBITDA which is accretive to the company’s valuation.

When Public Companies Drive the Private Market

What we think is particularly interesting about this transaction is the idea that public companies can simply pay more for ships and still have the deals be accretive than other shipowners. In the table below, we present current price to 2005 projected cash flow multiples of some of the public tanker companies.

Ship Finance Forum Germany Swelling in Size – Still Time to Sign Up

Ship Finance Forum Germany Swelling in Size – Still Time to Sign Up

We are absolutely delighted by the response we have received for our 4th Annual German Ship Finance Forum next Thursday in Hamburg. With record high asset prices, strong charter rates, a full orderbook, low margins on financing and capital markets that are wide open, the forum will discuss how this trend will continue and if it can continue. Distinguished speakers include the Heads of Shipping from the leading European and US banks and as well as the leading German ship-owners. We currently have 250 delegates signed up, making the event the largest ship finance forum in Europe. We would b pleased to share the delegate list with you, so just send an email to conferences@marinemoney.com. If you’d like to register, simply visit our web site at http://www.marinemoney.com/forums/

GER05/index.htm for the program and registration.

We are absolutely delighted by the response we have received for our 4th Annual German Ship Finance Forum next Thursday in Hamburg. With record high asset prices, strong charter rates, a full orderbook, low margins on financing and capital markets that are wide open, the forum will discuss how this trend will continue and if it can continue. Distinguished speakers include the Heads of Shipping from the leading European and US banks and as well as the leading German ship-owners. We currently have 250 delegates signed up, making the event the largest ship finance forum in Europe. We would b pleased to share the delegate list with you, so just send an email to conferences@marinemoney.com. If you’d like to register, simply visit our web site at http://www.marinemoney.com/forums/

GER05/index.htm for the program and registration.

Horizon Offshore Extends Maturities, Looks for New Lenders

Horizon Offshore Extends Maturities,

Looks for New Lenders

We understand that Horizon Offshore has repaid all amounts outstanding under its domestic revolving credit facility and has amended its EXIM guaranteed facility, agented by Southwest Bank of Texas, to further extend its maturity date to February 18, 2005. The company had previously extended the January 21, 2005 maturity date to February 11, 2005. According to documents filed by the company, Horizon continues to work with an as yet unnamed lender to refinance, through a term loan and revolving credit facility, the debt outstanding under its Southwest Bank EXIM guaranteed facility and The CIT Group/Equipment Finance, Inc. facilities. Future collections on foreign receivables will pay down the $12.1 million outstanding under the EXIM guaranteed facility. According to an industry source, “the company is also continuing to work with its subordinated note holders to complete this proposed refinancing and proceed with its previously announced equity recapitalization through equity offerings and/or consensual debt for equity exchanges with its subordinated note holders.”

We understand that Horizon Offshore has repaid all amounts outstanding under its domestic revolving credit facility and has amended its EXIM guaranteed facility, agented by Southwest Bank of Texas, to further extend its maturity date to February 18, 2005. The company had previously extended the January 21, 2005 maturity date to February 11, 2005. According to documents filed by the company, Horizon continues to work with an as yet unnamed lender to refinance, through a term loan and revolving credit facility, the debt outstanding under its Southwest Bank EXIM guaranteed facility and The CIT Group/Equipment Finance, Inc. facilities. Future collections on foreign receivables will pay down the $12.1 million outstanding under the EXIM guaranteed facility. According to an industry source, “the company is also continuing to work with its subordinated note holders to complete this proposed refinancing and proceed with its previously announced equity recapitalization through equity offerings and/or consensual debt for equity exchanges with its subordinated note holders.”

David Scott’s Nine Bear Points for Shipping

David Scott’s Nine Bear Points for Shipping

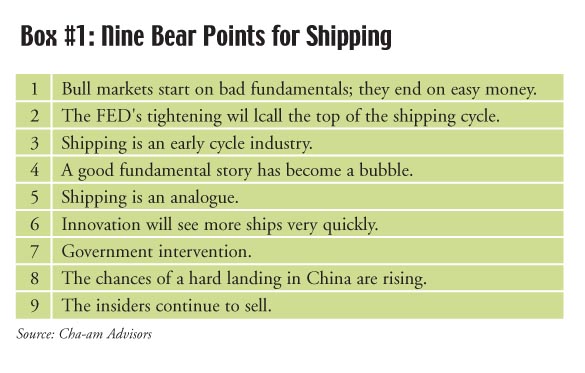

A scathingly bearish report on the prospects for the shipping industry was issued this week by David Scott of Thailand’s Cha-am Advisors. Cha-am Advisors, possibly named after the resort area on the Gulf of Thailand, appears to be something of a newcomer to shipping, with David Scott openly admitting “I know almost nothing about shipping.”

This has both its advantages and its drawbacks, with Mr. Scott able to recognize macroeconomic trends that may not strike many shippers as important, as well as being less subject to the psychological phenomenon of cognitive dissonance – something that subliminally moves people’s views to be more positive on an industry in which they have a vested interest. On the other hand, we found that support for those of Mr. Scott’s arguments that were shipping-specific to overall be thin.

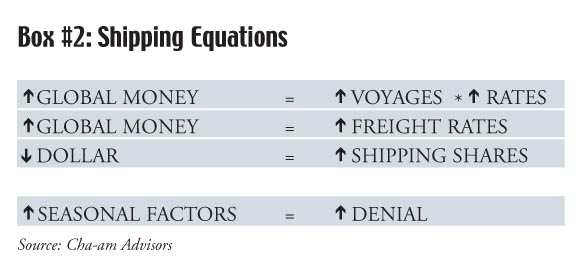

Exchange Rates, Gold Prices, and Freight Indices

David Scott’s argument centered around nine bearish points, as shown in Box 1, and revolved around the inherent inverse correlation between the strength of the dollar and shipping freight rates. He found that freight rates and the price of shipping company shares follow gold prices, with a one-year delay, as well as the Hang Seng index and the NASDAQ, while shipping freight rates reverse correlate with the US dollar. The Cha-am report argued that the dollar exchange rate “is a main driver of the monetary environment in a large and fast growing part of the world…(which) are huge sources of marginal demand for both commodities and for gold.” As a result, low US interest rates, a growing US current account deficit, and a weak dollar have “amplified the liquidity cycles across many markets but especially those markets for Physical Assets such as commodities and ships.” Mr. Scott used Irving Fisher’s equation Money * Velocity = Price * Output, then applied this principle more specifically to shipping with the equations shown in. Box 2.

The argument continues that the FED tightens monetary policy to combat inflationary pressure from rising import prices, as we have seen through the steady increase of the federal funds rate in the US throughout 2004. The effects of these actions then take about a year to hit the “early cycle” industries, or ones that perform better when the dollar is allowed to depreciate in response to deflationary pressure. As you may have guessed, shipping, along with a majority of commodities, is classified as an “early cycle” industry.

“Messed-up” Pricing Signals & Industry Distortion

At this point in his argument, Mr. Scott takes the time to acknowledge “we would have had a shipping bull market with or without the FED right now. The supply/demand situation was favorable with years of underinvestment and strong global growth.” Though it seems that this statement runs in some ways counter to his Bear Point #1 (see Box 1). Showing a graph in freight rates, which could well have been a graph of US-listed tanker stocks, he points to the unforeseen November jump and says that it is all about MONEY. A normal crest would have been more representative of good fundamentals rather than the ridiculously bull market.

The Cha-am report goes on to discuss a lending story that may sound eerily familiar to some, where a “messed-up pricing signal distorts the whole industry.” The bigger players sell older vessels and buy new ships while smaller players borrow more money to buy ships that would essentially be scrapping candidates in another market, only to run into a down market with massive loans where, particularly the owners of highly-priced older vessels “cannot afford to scrap them; cannot afford to run them; cannot afford them lying around doing nothing.” Mr. Scott does not have kind words for their lenders.

Will China Re-live Japan’s Shipping Experience from the turn of the 20th Century?

From this, Mr. Scott launches into a brief overview of why the supply side of the shipping market equations will rise much more rapidly then predicted, due largely to innovation that would lead to making VLCC building quicker and easier and largely on intervention by the Chinese government because “China’s strategic interest is in commodity deflation and by extension in low freight rates…To achieve deflationary result in the shipping business the most obvious lever to pull is build more ships.” Mr. Scott compared China to Japan at the turn of the twentieth century, who formed and heavily subsidized NYK Lines in order “to push transaction costs down and open up access to regional markets.”

Mr. Scott closes his article with two final points: that the chances of a hard landing in China are rising and that insiders continue to sell, largely in the form of raising money through IPOs.

All this essentially summarizes what we take to be the report’s cohesive argument. As you can see, he has taken advantage of his outsider perspective to identify some outside macroeconomic and historical factors that affect or may affect the trajectory of shipping freight rates. However, we are of the opinion that Mr. Scott, in trying to argue so many aspects of the story of an industry outside of his expertise, perhaps stretched himself a little too thinly.

For example, a comparison he makes between the shipping “bubble” and the tech “bubble” of 2000 misses the point that the internet created a whole new industry that people were only beginning to understand, while the shipping industry has existed for thousands of years and its greater exposure to the international capital markets was in many ways long overdue. He also takes the inverse correlation of freight rates and the US dollar to mean causation. While it suggests that the two are related, it does not necessarily follow that freight rates are doomed to fall ever lower for every penny the US dollar appreciates. Neither is the appreciation of the US dollar a given; Greenspan has stated he is not averse to monetary loosening, and a falling dollar, as a method to help alleviate affects of current austere federal budget proposals. Additionally, we do not dare to speculate on the effect of a floating yuan, but this too would surely impact the currency picture, for better or for worse.

More on the shipping front, the Cha-am report calls “the biggest signal of excess in this shipping bull market” the premium of secondhand vessel prices to newbuildings, commenting in particular that 5-year-old panamax prices were at a 20% premium to newbuildings. We checked with our sources to verify that the panamaxes in question were, indeed, bulkers, and as such have a longer life, as opposed to tankers, where 5-year-old vessels were being purchased at prices comparable to newbuildings. We feel that while dramatic, the statement was out of context as the newbuildings in question were ones not available for two or more years, while the used ships could immediately be put to work on contracts made in what was openly acknowledged to be a market high point guaranteeing a certain level of earnings to begin almost immediately.

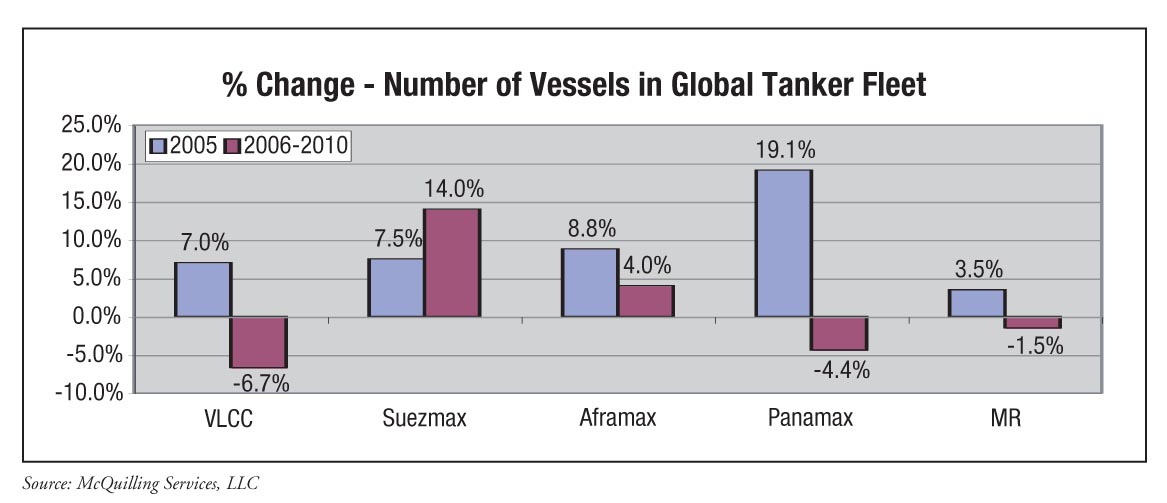

“A Bear Market for One is a Bear Market for All”

Mr. Scott asserted that shipping is an analogue, so that “a bear market for one is a bear market for all” (Box #1, Bear Point #6). He used this to counter an assertion that “containers will be the place to be because of supply/demand which look more favourable than other segments.” Undoubtedly this made him concerned that orderbooks in the container sector have reached 50% of the current fleet, causing him to conclude “if this has the best fundamentals I wonder what other segments look like!” Meanwhile, we understand from a public statement by Mark Harris at Pacific Basin that global orderbooks through 2008 for dry bulk handymax, panamax, and capesize carriers stand at a more modest 20%. McQuilling expects tanker growth to be even lower, with a net fall in the global VLCC fleet between 2006-2010.

Mr. Scott also claims that, due largely to its similarity to Japan at the turn of the 20th century, China will flood the shipbuilding market with “no-cost” producers. Now this certainly seems within the realm of possibility. However, to support his point, the analyst notes “I couldn’t find much about China’s plans for its shipping companies except that it planned t o consolidate the 6,000 existing players into bigger groups.” In the place of this information, he presents an article on the performance of China State Shipbuilding Corp. over the past year. The company has increased its output by a stunning 65% in the past year, but this does little to say whether or not it is representative of the broader Chinese shipping market, or that it is out of pace with Chinese growth in other industries. Finally, in Bear Point #8, Mr. Scott asserts that the chances of a hard landing in China are rising. He supports this point with the simply analogy of a VLCC, which is supposed to represent the Chinese economy, approaching Pusan at increasing speed that is unable to stop. This analogy could well be applicable. But we have read detailed reports to the contrary, and so are, strangely enough, not wholly convinced.

Short & Sweet: Telling an Important Side of the Story

One thing David Scott and his report certainly has that this article lacks is brevity. In attempting to judiciously present his views, this article has perhaps grown a bit verbose. Clearly we think the ideas that Mr. Scott presents are important, or we would not have dedicated so much time and space to them. The link between shipping and the currency markets is one we have not heard often discussed and bears more consideration. While it is only one factor in the bigger picture, it may very well be an important, oft-neglected one.

A scathingly bearish report on the prospects for the shipping industry was issued this week by David Scott of Thailand’s Cha-am Advisors. Cha-am Advisors, possibly named after the resort area on the Gulf of Thailand, appears to be something of a newcomer to shipping, with David Scott openly admitting “I know almost nothing about shipping.”

This has both its advantages and its drawbacks, with Mr. Scott able to recognize macroeconomic trends that may not strike many shippers as important, as well as being less subject to the psychological phenomenon of cognitive dissonance – something that subliminally moves people’s views to be more positive on an industry in which they have a vested interest. On the other hand, we found that support for those of Mr. Scott’s arguments that were shipping-specific to overall be thin.

Exchange Rates, Gold Prices, and Freight Indices

David Scott’s argument centered around nine bearish points, as shown in Box 1, and revolved around the inherent inverse correlation between the strength of the dollar and shipping freight rates. He found that freight rates and the price of shipping company shares follow gold prices, with a one-year delay, as well as the Hang Seng index and the NASDAQ, while shipping freight rates reverse correlate with the US dollar. The Cha-am report argued that the dollar exchange rate “is a main driver of the monetary environment in a large and fast growing part of the world…(which) are huge sources of marginal demand for both commodities and for gold.” As a result, low US interest rates, a growing US current account deficit, and a weak dollar have “amplified the liquidity cycles across many markets but especially those markets for Physical Assets such as commodities and ships.” Mr. Scott used Irving Fisher’s equation Money * Velocity = Price * Output, then applied this principle more specifically to shipping with the equations shown in. Box 2.

The argument continues that the FED tightens monetary policy to combat inflationary pressure from rising import prices, as we have seen through the steady increase of the federal funds rate in the US throughout 2004. The effects of these actions then take about a year to hit the “early cycle” industries, or ones that perform better when the dollar is allowed to depreciate in response to deflationary pressure. As you may have guessed, shipping, along with a majority of commodities, is classified as an “early cycle” industry.

“Messed-up” Pricing Signals & Industry Distortion

At this point in his argument, Mr. Scott takes the time to acknowledge “we would have had a shipping bull market with or without the FED right now. The supply/demand situation was favorable with years of underinvestment and strong global growth.” Though it seems that this statement runs in some ways counter to his Bear Point #1 (see Box 1). Showing a graph in freight rates, which could well have been a graph of US-listed tanker stocks, he points to the unforeseen November jump and says that it is all about MONEY. A normal crest would have been more representative of good fundamentals rather than the ridiculously bull market.

The Cha-am report goes on to discuss a lending story that may sound eerily familiar to some, where a “messed-up pricing signal distorts the whole industry.” The bigger players sell older vessels and buy new ships while smaller players borrow more money to buy ships that would essentially be scrapping candidates in another market, only to run into a down market with massive loans where, particularly the owners of highly-priced older vessels “cannot afford to scrap them; cannot afford to run them; cannot afford them lying around doing nothing.” Mr. Scott does not have kind words for their lenders.

Will China Re-live Japan’s Shipping Experience from the turn of the 20th Century?

From this, Mr. Scott launches into a brief overview of why the supply side of the shipping market equations will rise much more rapidly then predicted, due largely to innovation that would lead to making VLCC building quicker and easier and largely on intervention by the Chinese government because “China’s strategic interest is in commodity deflation and by extension in low freight rates…To achieve deflationary result in the shipping business the most obvious lever to pull is build more ships.” Mr. Scott compared China to Japan at the turn of the twentieth century, who formed and heavily subsidized NYK Lines in order “to push transaction costs down and open up access to regional markets.”

Mr. Scott closes his article with two final points: that the chances of a hard landing in China are rising and that insiders continue to sell, largely in the form of raising money through IPOs.

All this essentially summarizes what we take to be the report’s cohesive argument. As you can see, he has taken advantage of his outsider perspective to identify some outside macroeconomic and historical factors that affect or may affect the trajectory of shipping freight rates. However, we are of the opinion that Mr. Scott, in trying to argue so many aspects of the story of an industry outside of his expertise, perhaps stretched himself a little too thinly.

For example, a comparison he makes between the shipping “bubble” and the tech “bubble” of 2000 misses the point that the internet created a whole new industry that people were only beginning to understand, while the shipping industry has existed for thousands of years and its greater exposure to the international capital markets was in many ways long overdue. He also takes the inverse correlation of freight rates and the US dollar to mean causation. While it suggests that the two are related, it does not necessarily follow that freight rates are doomed to fall ever lower for every penny the US dollar appreciates. Neither is the appreciation of the US dollar a given; Greenspan has stated he is not averse to monetary loosening, and a falling dollar, as a method to help alleviate affects of current austere federal budget proposals. Additionally, we do not dare to speculate on the effect of a floating yuan, but this too would surely impact the currency picture, for better or for worse.

More on the shipping front, the Cha-am report calls “the biggest signal of excess in this shipping bull market” the premium of secondhand vessel prices to newbuildings, commenting in particular that 5-year-old panamax prices were at a 20% premium to newbuildings. We checked with our sources to verify that the panamaxes in question were, indeed, bulkers, and as such have a longer life, as opposed to tankers, where 5-year-old vessels were being purchased at prices comparable to newbuildings. We feel that while dramatic, the statement was out of context as the newbuildings in question were ones not available for two or more years, while the used ships could immediately be put to work on contracts made in what was openly acknowledged to be a market high point guaranteeing a certain level of earnings to begin almost immediately.

“A Bear Market for One is a Bear Market for All”

Mr. Scott asserted that shipping is an analogue, so that “a bear market for one is a bear market for all” (Box #1, Bear Point #6). He used this to counter an assertion that “containers will be the place to be because of supply/demand which look more favourable than other segments.” Undoubtedly this made him concerned that orderbooks in the container sector have reached 50% of the current fleet, causing him to conclude “if this has the best fundamentals I wonder what other segments look like!” Meanwhile, we understand from a public statement by Mark Harris at Pacific Basin that global orderbooks through 2008 for dry bulk handymax, panamax, and capesize carriers stand at a more modest 20%. McQuilling expects tanker growth to be even lower, with a net fall in the global VLCC fleet between 2006-2010.

Mr. Scott also claims that, due largely to its similarity to Japan at the turn of the 20th century, China will flood the shipbuilding market with “no-cost” producers. Now this certainly seems within the realm of possibility. However, to support his point, the analyst notes “I couldn’t find much about China’s plans for its shipping companies except that it planned t o consolidate the 6,000 existing players into bigger groups.” In the place of this information, he presents an article on the performance of China State Shipbuilding Corp. over the past year. The company has increased its output by a stunning 65% in the past year, but this does little to say whether or not it is representative of the broader Chinese shipping market, or that it is out of pace with Chinese growth in other industries. Finally, in Bear Point #8, Mr. Scott asserts that the chances of a hard landing in China are rising. He supports this point with the simply analogy of a VLCC, which is supposed to represent the Chinese economy, approaching Pusan at increasing speed that is unable to stop. This analogy could well be applicable. But we have read detailed reports to the contrary, and so are, strangely enough, not wholly convinced.

Short & Sweet: Telling an Important Side of the Story

One thing David Scott and his report certainly has that this article lacks is brevity. In attempting to judiciously present his views, this article has perhaps grown a bit verbose. Clearly we think the ideas that Mr. Scott presents are important, or we would not have dedicated so much time and space to them. The link between shipping and the currency markets is one we have not heard often discussed and bears more consideration. While it is only one factor in the bigger picture, it may very well be an important, oft-neglected one.

Year of the Rooster Rung in Cautiously by Citigroup in China

Year of the Rooster Rung in Cautiously by Citigroup in China

Citigroup’s China Economist Yiping Huang said recently “’There is widespread suspicion that official data underestimates China’s actual growth performance… indeed, versus the official industry-based GDP growth estimate of 9.5% for 4Q’04, our expenditure-based estimate suggests actual growth could be as high as 12% last year… which, if reliable, suggests growth in 2004 was pretty close to that achieved in 1992-94 when the economy overheated… and while consumption has improved steadily – retail sales increased, on our calculation, by 13.3% in 2004, compared to 7.8% in 2003 – our concern about economic risk lies not in the rate of aggregate growth but in the problem of overinvestment… for gross capital formation accounted for 42% GDP in 2003, likely increasing to 45% in 2004… unusually high, having reached above 40% only in 1959 and again in 1993… however, while the latest data points to renewed risks of overheating, we maintain our base case of a gradual soft landing’.”

Citigroup’s China Economist Yiping Huang said recently “’There is widespread suspicion that official data underestimates China’s actual growth performance… indeed, versus the official industry-based GDP growth estimate of 9.5% for 4Q’04, our expenditure-based estimate suggests actual growth could be as high as 12% last year… which, if reliable, suggests growth in 2004 was pretty close to that achieved in 1992-94 when the economy overheated… and while consumption has improved steadily – retail sales increased, on our calculation, by 13.3% in 2004, compared to 7.8% in 2003 – our concern about economic risk lies not in the rate of aggregate growth but in the problem of overinvestment… for gross capital formation accounted for 42% GDP in 2003, likely increasing to 45% in 2004… unusually high, having reached above 40% only in 1959 and again in 1993… however, while the latest data points to renewed risks of overheating, we maintain our base case of a gradual soft landing’.”

McQuilling: Global VLCC Fleet to Diminish from 2006 to 2010

McQuilling: Global VLCC Fleet to Diminish from 2006 to 2010

McQuilling Services, LLC issued a report looking at the 27,500 Dwt global tanker fleet by sector and gauging expected changes in supply. The current fleet as a whole has grown by 25.7% since 1991, translating into a compound growth rate per annum of 1.65%. In contrast to this, McQuilling calls for supply growth of 7.43% of the global fleet, or 8.59% in Dwt terms, in 2005 alone. This may sound like mediocre news for tanker operators, but from 2006-2010, as the majority of IMO regulations come into effect, the global fleet is projected to grow by a “token” 12 vessels, or 0.38%, from December 31, 2005 to the same day in 2010. In this time, McQuilling projects that the suezmax and aframax fleets will grow by 8.2 million tons and 6.3 million tons, respectively, while VLCC and panamax carrying capacity will actually fall, VLCCs by 3%. Predictions for newbuilding deliveries beyond 2007 are based on historical ordering patterns, so these numbers are not set in stone. However, they still make the rapid fleet growth set to occur in 2005 look less likely to cause a massive supply glut in the long term, as many fear.

McQuilling Services, LLC issued a report looking at the 27,500 Dwt global tanker fleet by sector and gauging expected changes in supply. The current fleet as a whole has grown by 25.7% since 1991, translating into a compound growth rate per annum of 1.65%. In contrast to this, McQuilling calls for supply growth of 7.43% of the global fleet, or 8.59% in Dwt terms, in 2005 alone. This may sound like mediocre news for tanker operators, but from 2006-2010, as the majority of IMO regulations come into effect, the global fleet is projected to grow by a “token” 12 vessels, or 0.38%, from December 31, 2005 to the same day in 2010. In this time, McQuilling projects that the suezmax and aframax fleets will grow by 8.2 million tons and 6.3 million tons, respectively, while VLCC and panamax carrying capacity will actually fall, VLCCs by 3%. Predictions for newbuilding deliveries beyond 2007 are based on historical ordering patterns, so these numbers are not set in stone. However, they still make the rapid fleet growth set to occur in 2005 look less likely to cause a massive supply glut in the long term, as many fear.

Tropical JP Morgan High Yield Conference Attracts Snowbirds

Tropical JP Morgan High Yield Conference Attracts Snowbirds

JP Morgan hosted a phenomenally well-attended high yield conference at the Lowe’s Hotel on sultry South Beach in Miami Florida last week. Among the 300 hundred companies that presented at the enormous event were faithful JP Morgan shipping clients NCL, Stena and General Maritime – the former two of which issued bonds in 2004. Although most shipowners have been selling equity due to where we are in the cycle, the high yield market remains incredibly receptive to new issuers and should not be overlooked.

JP Morgan hosted a phenomenally well-attended high yield conference at the Lowe’s Hotel on sultry South Beach in Miami Florida last week. Among the 300 hundred companies that presented at the enormous event were faithful JP Morgan shipping clients NCL, Stena and General Maritime – the former two of which issued bonds in 2004. Although most shipowners have been selling equity due to where we are in the cycle, the high yield market remains incredibly receptive to new issuers and should not be overlooked.