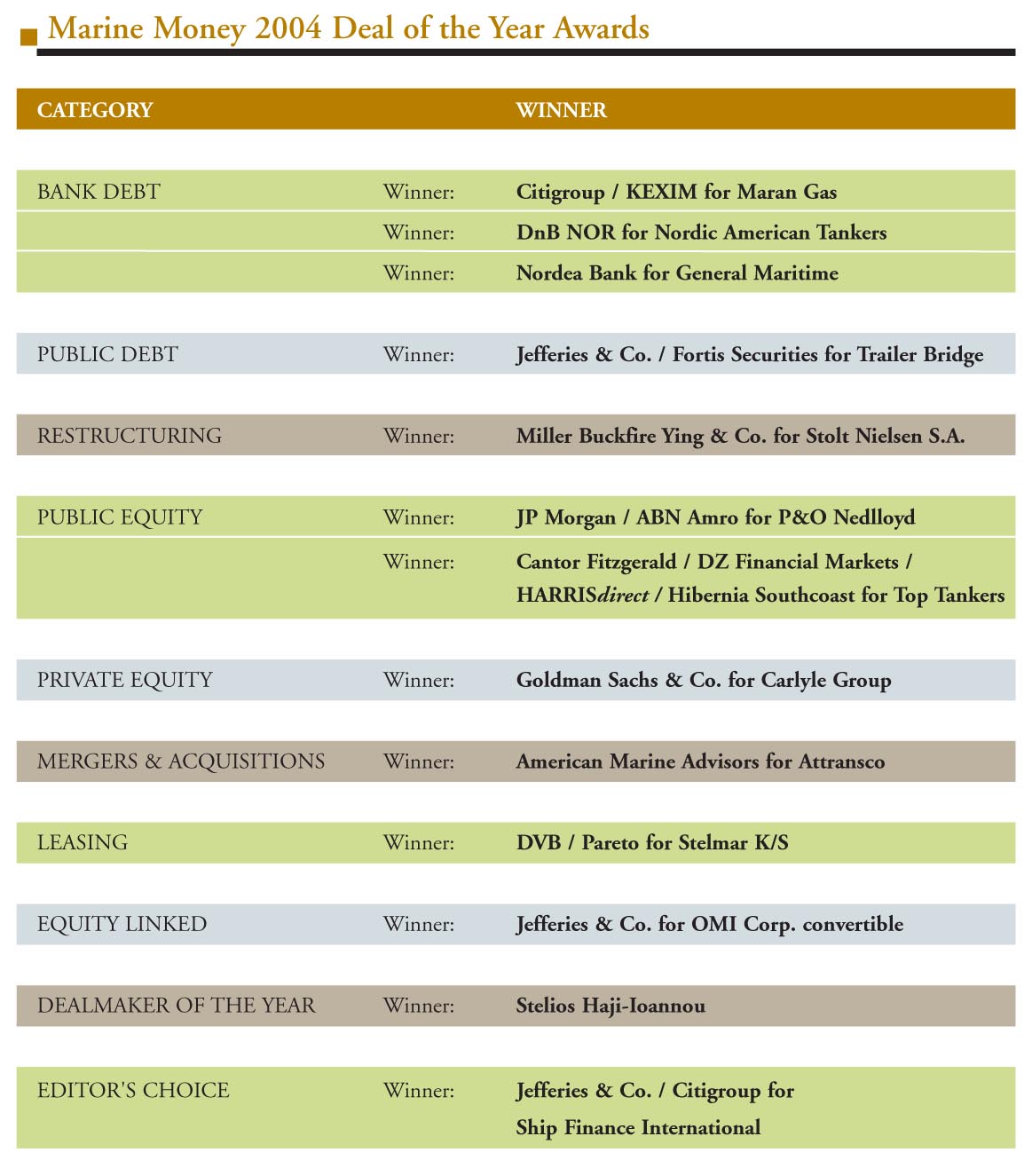

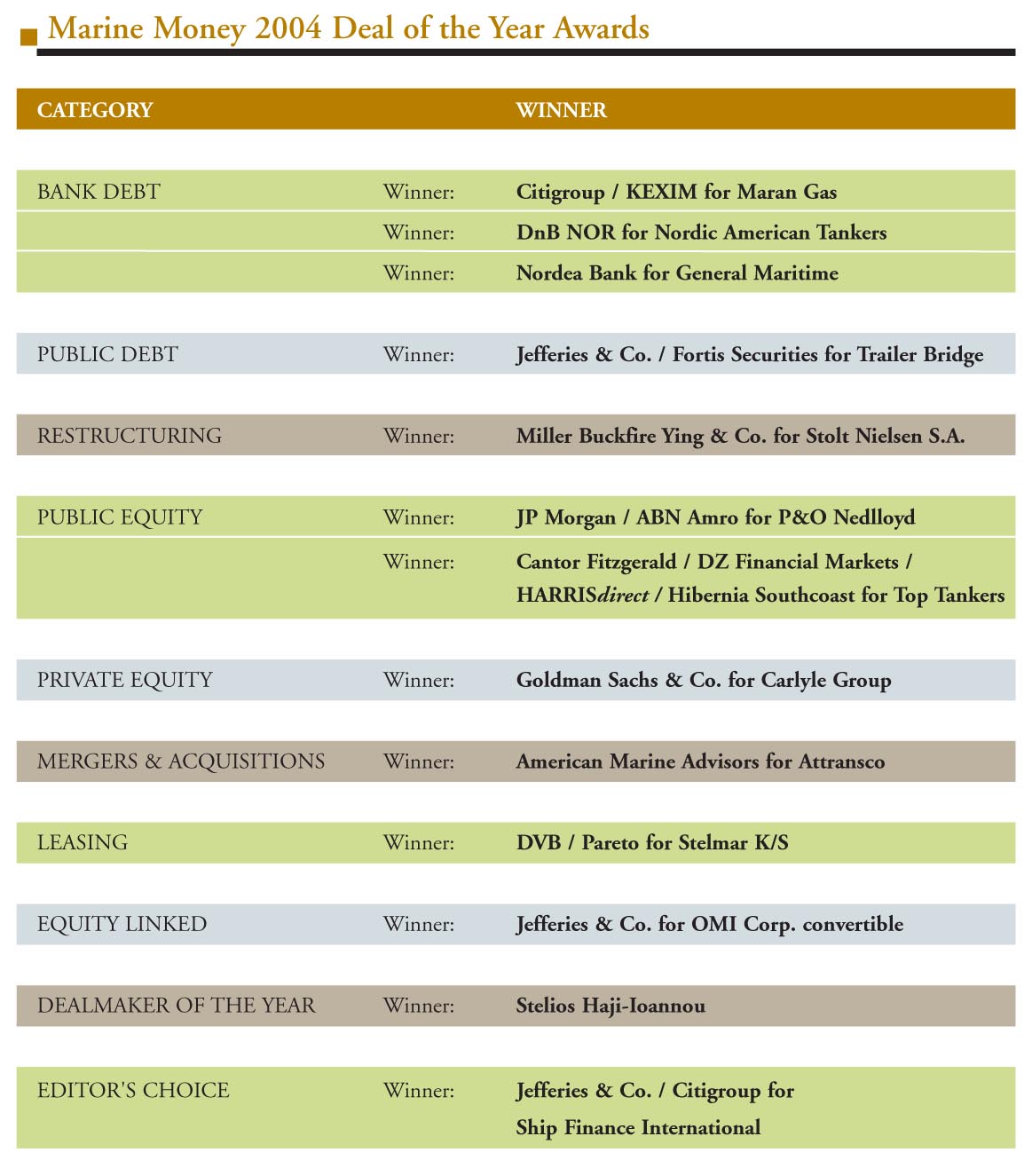

As we have said many times, 2004 was an incredible year in the shipping industry, and there the number of phenomenal deals done was unprecedented. Below are the deals in which we think that banks succeeded the most in bringing value to their clients. More details will be available in both our February and March issues, the former of which is now available on the web and should soon be arriving at your doorstep. Congratulations to all!!

Hudner Buys Modern Ships at 4.7x EBITDA

It is our understanding that B+H house bank Nordea and DVB are providing the debt on the deal, estimated to be about $75 million. According to a company press release, the new ships will more than double the EBITDA from $17.6 million in 2004 to $40 million in 2005. If we assume that the new ships will generate the $23 million of EBITDA difference, then B+H did the deal at 4.7x EBITDA, about where George Economou priced his DryShips deal last week. But not all cash flows are created equally. The major difference, of course, is that the DryShips vessels are trading on the spot market and could generate cashflows substantially higher or substantially lower than what is being forecast, while the B+H ships are on firm charters with possibly investment grade charterers. Moreover, since B+H is buying ships at less than 5x EBITDA on 5-year charterers, they will be close to full payout – a figure that is really remarkable in today’s market for ships this young.

Nordea, DVB Provide Debt – Who Will Provide Equity?

So where will the missing $35 million to fund the acquisition come from? There are a few options – re-leveraging the existing fleet, retained earnings, Hudner (who controls the majority of the stock) or outside investors. In the former case, the B+H ships have very little leverage, about $15 million, and the loan balances are declining rapidly. That said, the B+H fleet will be forced to come off the water in 2007, so they do not have much time to earn their way out of debt. Another option is for the company to attempt to access the public equity market through a PIPE or a secondary offering – and we have no doubt that a few of our investment banking friends have made the journey up to the bucolic and littoral offices of B+H. According to our calculation, B+H has about $15 per share in cash and steel, though the product tankers are coming off the water in 2007 due to regulations.

It is our understanding that B+H house bank Nordea and DVB are providing the debt on the deal, estimated to be about $75 million. According to a company press release, the new ships will more than double the EBITDA from $17.6 million in 2004 to $40 million in 2005. If we assume that the new ships will generate the $23 million of EBITDA difference, then B+H did the deal at 4.7x EBITDA, about where George Economou priced his DryShips deal last week. But not all cash flows are created equally. The major difference, of course, is that the DryShips vessels are trading on the spot market and could generate cashflows substantially higher or substantially lower than what is being forecast, while the B+H ships are on firm charters with possibly investment grade charterers. Moreover, since B+H is buying ships at less than 5x EBITDA on 5-year charterers, they will be close to full payout – a figure that is really remarkable in today’s market for ships this young.

Nordea, DVB Provide Debt – Who Will Provide Equity?

So where will the missing $35 million to fund the acquisition come from? There are a few options – re-leveraging the existing fleet, retained earnings, Hudner (who controls the majority of the stock) or outside investors. In the former case, the B+H ships have very little leverage, about $15 million, and the loan balances are declining rapidly. That said, the B+H fleet will be forced to come off the water in 2007, so they do not have much time to earn their way out of debt. Another option is for the company to attempt to access the public equity market through a PIPE or a secondary offering – and we have no doubt that a few of our investment banking friends have made the journey up to the bucolic and littoral offices of B+H. According to our calculation, B+H has about $15 per share in cash and steel, though the product tankers are coming off the water in 2007 due to regulations.

Categories:

Bank Debt,

Freshly Minted | February 10th, 2005 |

Add a Comment

B+H Gets Back in the Game

B+H Ocean Carriers (AMEX: BHO), the Rhode Island-based owner of vintage product tankers, has emerged from the shadows with a very interesting transaction this week. The company has purchased three mid-90’s-built double-hull OBOs from Christen Sveaas for $110.2 million, bringing their total OBO fleet up to 4 units. Upon the delivery of the vessels in March, they will go immediately onto five-year time charters to what we understand is a major energy company. This deal is somewhat reminiscent of the one that General Maritime did with Glencore on its OBOs last year. The appeal to the charterers is that the ships can carry “energy cargoes, both wet and dry, comprised principally of fuel oil, clean petroleum products and coal,” B+H said.

B+H Ocean Carriers (AMEX: BHO), the Rhode Island-based owner of vintage product tankers, has emerged from the shadows with a very interesting transaction this week. The company has purchased three mid-90’s-built double-hull OBOs from Christen Sveaas for $110.2 million, bringing their total OBO fleet up to 4 units. Upon the delivery of the vessels in March, they will go immediately onto five-year time charters to what we understand is a major energy company. This deal is somewhat reminiscent of the one that General Maritime did with Glencore on its OBOs last year. The appeal to the charterers is that the ships can carry “energy cargoes, both wet and dry, comprised principally of fuel oil, clean petroleum products and coal,” B+H said.

Categories:

Bank Debt,

Freshly Minted | February 10th, 2005 |

Add a Comment

UK Tightens Leasing Criteria

The United Kingdom Inland Revenue issued a clarification notice regarding the use of offshore-onshore structures for UK tax leases of vessels, according to Tom Kane of Global Capital Finance. Formerly, in the circumstance where there was a chain of leases, only one lessee had to satisfy the criteria set out to qualify them as a bona fide UK ship operator. With effect from February 3rd, all lessees must satisfy these criteria. Leases entered into before February 3, 2005 or within three months of this date providing that the terms had been agreed prior to it, will not be subject to the revised regulation, nor will time-charter arrangements or contracts of affreightment. Mr. Kane assures us that even after the change takes effect, the UK lease should remain “a highly effective and tax efficient method of financing vessels.”

The United Kingdom Inland Revenue issued a clarification notice regarding the use of offshore-onshore structures for UK tax leases of vessels, according to Tom Kane of Global Capital Finance. Formerly, in the circumstance where there was a chain of leases, only one lessee had to satisfy the criteria set out to qualify them as a bona fide UK ship operator. With effect from February 3rd, all lessees must satisfy these criteria. Leases entered into before February 3, 2005 or within three months of this date providing that the terms had been agreed prior to it, will not be subject to the revised regulation, nor will time-charter arrangements or contracts of affreightment. Mr. Kane assures us that even after the change takes effect, the UK lease should remain “a highly effective and tax efficient method of financing vessels.”

Categories:

Freshly Minted,

Leasing | February 10th, 2005 |

Add a Comment

Step Aside Fendi, Watch Out Gucci – Big John Brands

John Fredriksen has evolved into his own brand. What the tanker tycoon seems to have learned is that by taking a minority position in publicly traded shipping companies, he is able to create value when investors assume he is there to bid up the stock before taking the company over. With this week’s purchase of 5% of Jinhui, Big John Brands has a toehold in just about every sector of the shipping business. Since the shipping markets began to run in late 2002, Big John Brands has taken minority stakes in HMM, P&O Nedlloyd, NOL, Hanjin, Korea Line, General Maritime and probably a bunch more that we are forgetting.

At the same time, Fredriksen is reducing his stake in Frontline and affiliates. For example, this week Frontline decide to spin off almost half of Frontline’s remaining holding in Ship Finance Int. Ltd. The stake, equal to 25% of the total shares in Ship Finance, will represent a total dividend of approximately USD 400 million. Frontline shareholders will receive 1 share in Ship Finance for every 4 shares they have in Frontline Ltd. Ex date for the dividend is set to 3 February, record date 7 February while the shares will be distributed 18 February.

Fredriksen, who is also Frontline’s Chairman, said in a comment: “In line with our strategy we are pleased to announce that Frontline spins off further 25% of Ship Finance. The spin-off will hopefully lead to an increased liquidity, more independence, better coverage, higher interest and, hopefully, improved pricing of the Ship Finance shares. The difference in business strategy and dividend strategy makes the spin-off logical.”

John Fredriksen has evolved into his own brand. What the tanker tycoon seems to have learned is that by taking a minority position in publicly traded shipping companies, he is able to create value when investors assume he is there to bid up the stock before taking the company over. With this week’s purchase of 5% of Jinhui, Big John Brands has a toehold in just about every sector of the shipping business. Since the shipping markets began to run in late 2002, Big John Brands has taken minority stakes in HMM, P&O Nedlloyd, NOL, Hanjin, Korea Line, General Maritime and probably a bunch more that we are forgetting.

At the same time, Fredriksen is reducing his stake in Frontline and affiliates. For example, this week Frontline decide to spin off almost half of Frontline’s remaining holding in Ship Finance Int. Ltd. The stake, equal to 25% of the total shares in Ship Finance, will represent a total dividend of approximately USD 400 million. Frontline shareholders will receive 1 share in Ship Finance for every 4 shares they have in Frontline Ltd. Ex date for the dividend is set to 3 February, record date 7 February while the shares will be distributed 18 February.

Fredriksen, who is also Frontline’s Chairman, said in a comment: “In line with our strategy we are pleased to announce that Frontline spins off further 25% of Ship Finance. The spin-off will hopefully lead to an increased liquidity, more independence, better coverage, higher interest and, hopefully, improved pricing of the Ship Finance shares. The difference in business strategy and dividend strategy makes the spin-off logical.”

Categories:

Equity,

Freshly Minted | February 10th, 2005 |

Add a Comment

Is Hawaii the Next Puerto Rico?

As we have seen in the Puerto Rico market since the demise and withdrawal of Navieras, a little bit of extra capacity in a captive market can really pollute rates and destroy capital. Competition in the Hawaii market will be further exacerbated by the coming arrival a new Pasha-owned ro/ro working on the trade lane between Los Angeles and Hawaii. If there is a bright spot here, it is that the Hawaiian economy has been strengthening and might even be able to handle the added capacity.

Using Equity to Finance a Debt Deal

The debt financing of these vessels will be another interesting facet of the OceanBlue deal. We highly doubt that Caterpillar will be involved in ships that will compete against those in which they have already taken a considerable amount of risk. Moreover, with the vessels essentially operating in a “start up” business and with book values that make them totally uncompetitive in the international market should the startup not work, we think bank debt will be low. Therefore we would expect to see this deal financing with at least 50% equity and quite possibly more. This would give the lenders the ability to get out whole should they need to remarket the vessels on the international market.

Ocean Blue and the Need to Beef Up

One challenge associated with raising equity for OceanBlue will be the fact that the exit strategy is unclear unless DnB and Jefferies are able to make investors comfortable with the idea that OceanBlue will be able to beef up its business through newbuildings or acquisitions and then go public at a multiple of its book value. But where will they look to expand? With the supply demand balance of Jones Act markets extraordinarily tight, it will be both difficult and expensive to find good assets. If they are able to sell this story, though, then the IPO of Horizon Lines will come at a very good time by creating a comparable valuation that will get potential OceanBlue investors excited. The challenge therefore, is that OceanBlue is really a debt deal that needs equity – but at the end of the day, we have little doubt that the new Kvaerner ships will end up being consolidated into Matson or Horizon. There have been rumors that Alexander and Baldwin has been thinking of selling off Matson Navigation, though Horizon is the more logical choice in light of the age of their fleet and the fact that they are raising fresh equity. After all, Horizon Lines will need the ships at some point, and the economics of these ships is actually pretty reasonable. Moreover, Kvaerner might well shut down after the obligation to deliver these final vessels is fulfilled, which would make it very difficult for Horizon to find large ships at a comparable price.

As we have seen in the Puerto Rico market since the demise and withdrawal of Navieras, a little bit of extra capacity in a captive market can really pollute rates and destroy capital. Competition in the Hawaii market will be further exacerbated by the coming arrival a new Pasha-owned ro/ro working on the trade lane between Los Angeles and Hawaii. If there is a bright spot here, it is that the Hawaiian economy has been strengthening and might even be able to handle the added capacity.

Using Equity to Finance a Debt Deal

The debt financing of these vessels will be another interesting facet of the OceanBlue deal. We highly doubt that Caterpillar will be involved in ships that will compete against those in which they have already taken a considerable amount of risk. Moreover, with the vessels essentially operating in a “start up” business and with book values that make them totally uncompetitive in the international market should the startup not work, we think bank debt will be low. Therefore we would expect to see this deal financing with at least 50% equity and quite possibly more. This would give the lenders the ability to get out whole should they need to remarket the vessels on the international market.

Ocean Blue and the Need to Beef Up

One challenge associated with raising equity for OceanBlue will be the fact that the exit strategy is unclear unless DnB and Jefferies are able to make investors comfortable with the idea that OceanBlue will be able to beef up its business through newbuildings or acquisitions and then go public at a multiple of its book value. But where will they look to expand? With the supply demand balance of Jones Act markets extraordinarily tight, it will be both difficult and expensive to find good assets. If they are able to sell this story, though, then the IPO of Horizon Lines will come at a very good time by creating a comparable valuation that will get potential OceanBlue investors excited. The challenge therefore, is that OceanBlue is really a debt deal that needs equity – but at the end of the day, we have little doubt that the new Kvaerner ships will end up being consolidated into Matson or Horizon. There have been rumors that Alexander and Baldwin has been thinking of selling off Matson Navigation, though Horizon is the more logical choice in light of the age of their fleet and the fact that they are raising fresh equity. After all, Horizon Lines will need the ships at some point, and the economics of these ships is actually pretty reasonable. Moreover, Kvaerner might well shut down after the obligation to deliver these final vessels is fulfilled, which would make it very difficult for Horizon to find large ships at a comparable price.

Categories:

Equity,

Freshly Minted | February 10th, 2005 |

Add a Comment

Horizon & Ocean Blue –

Battle of the Equity Prospectuses

Concurrent with the preparations for Horizon’s public equity offer, a new competitor is in the marketplace with a private equity transaction that will compete against Horizon in the Puerto Rico market. Since the autumn of 2004, Kjell Inge Rokke’s Philadelphia Kvaerner shipyard decided to become a principal in the US flag market through the startup of “OceanBlue,” a liner service that will compete with Matson Navigation and Horizon Lines in the Hawaii market. The company has engaged DnB Nor and Jefferies to raise about half of the $288 million delivered cost (and working capital) – a price many believe will make them the lowest cost per slot in the market.

The OceanBlue situation must be a real disappointment for Castle Harlan, who probably purchased Horizon Lines under the assumption that competition and the supply of tonnage would remain tight. It will also be interesting to see how each of the companies describes the fundamentals for the market, the competition and the economics.

Nothing New Under the Sun

The genesis of the rather unusual situation is the fact that in exchange for about $400 million in state and Federal subsidies, Rokke’s Kvaerner’s Philadelphia shipyard agreed to build a minimum of four vessels. The first two ships, which were 2600 TEU containerships, went to Matson in 2002-2003 in deals construction financed by Caterpillar Finance, but no one has committed to buying the next two vessels and they are getting closer to being delivered.

Although this scenario may seem novel to many of us, the situation is very similar to one we saw in the early 1970s. During those years, Sun Oil’s Sun Shipyard built trailer ships, and when they were able to find a buyer, the yard put them in the Alaska Trade and operated the ships themselves – and later sold the business to the Saltchuk partners in Seattle who have been running the liner service under the brand “Tote.”

Like the Sun ships, the $120 million Kvaerner vessels are not competitive in the international market, so they need to be employed in the Jones Act. The only two Jones Act markets that can ostensibly support the economic requirements of ships with such specifications are Hawaii and Alaska – Rokke has chosen the former by planning a route from Oakland to Los Angeles to Honolulu and hired Brad Mulholland, the deposed king of Matson, to run the business along with John Graykowski, the former head of the Philadelphia Shipyard and the maritime commissioner under President Clinton.

In a very basic sense, we at Marine Money like the concept of shipyards owning vessels; such a structure would finally align the interests of shipyards with the market they pollute with overcapacity, but that really is beside the point. The majority of people we have spoken with think that the announcement from Rokke is simply a powerful marketing approach engineered to remind the management of Horizon and Matson that if they do not work with the new ships, they will be working against the new ships.

Concurrent with the preparations for Horizon’s public equity offer, a new competitor is in the marketplace with a private equity transaction that will compete against Horizon in the Puerto Rico market. Since the autumn of 2004, Kjell Inge Rokke’s Philadelphia Kvaerner shipyard decided to become a principal in the US flag market through the startup of “OceanBlue,” a liner service that will compete with Matson Navigation and Horizon Lines in the Hawaii market. The company has engaged DnB Nor and Jefferies to raise about half of the $288 million delivered cost (and working capital) – a price many believe will make them the lowest cost per slot in the market.

The OceanBlue situation must be a real disappointment for Castle Harlan, who probably purchased Horizon Lines under the assumption that competition and the supply of tonnage would remain tight. It will also be interesting to see how each of the companies describes the fundamentals for the market, the competition and the economics.

Nothing New Under the Sun

The genesis of the rather unusual situation is the fact that in exchange for about $400 million in state and Federal subsidies, Rokke’s Kvaerner’s Philadelphia shipyard agreed to build a minimum of four vessels. The first two ships, which were 2600 TEU containerships, went to Matson in 2002-2003 in deals construction financed by Caterpillar Finance, but no one has committed to buying the next two vessels and they are getting closer to being delivered.

Although this scenario may seem novel to many of us, the situation is very similar to one we saw in the early 1970s. During those years, Sun Oil’s Sun Shipyard built trailer ships, and when they were able to find a buyer, the yard put them in the Alaska Trade and operated the ships themselves – and later sold the business to the Saltchuk partners in Seattle who have been running the liner service under the brand “Tote.”

Like the Sun ships, the $120 million Kvaerner vessels are not competitive in the international market, so they need to be employed in the Jones Act. The only two Jones Act markets that can ostensibly support the economic requirements of ships with such specifications are Hawaii and Alaska – Rokke has chosen the former by planning a route from Oakland to Los Angeles to Honolulu and hired Brad Mulholland, the deposed king of Matson, to run the business along with John Graykowski, the former head of the Philadelphia Shipyard and the maritime commissioner under President Clinton.

In a very basic sense, we at Marine Money like the concept of shipyards owning vessels; such a structure would finally align the interests of shipyards with the market they pollute with overcapacity, but that really is beside the point. The majority of people we have spoken with think that the announcement from Rokke is simply a powerful marketing approach engineered to remind the management of Horizon and Matson that if they do not work with the new ships, they will be working against the new ships.

Categories:

Equity,

Freshly Minted | February 10th, 2005 |

Add a Comment

Horizon Kicks Off IPO Process

We understand from market sources that Horizon has chosen its IPO underwriting team and kicked off the public offering process. We believe that Goldman Sachs and UBS are leads on the deal and Bear Stearns, JP Morgan and Deutsche Bank will serve as co managers. Depending on how the underwriters are able to value the company, we believe that Castle Harlan will sell a minority position for somewhere in the neighborhood of $200-$250 million. Look for the deal to come to market in the late spring/early summer.

We understand from market sources that Horizon has chosen its IPO underwriting team and kicked off the public offering process. We believe that Goldman Sachs and UBS are leads on the deal and Bear Stearns, JP Morgan and Deutsche Bank will serve as co managers. Depending on how the underwriters are able to value the company, we believe that Castle Harlan will sell a minority position for somewhere in the neighborhood of $200-$250 million. Look for the deal to come to market in the late spring/early summer.

Categories:

Equity,

Freshly Minted | February 10th, 2005 |

Add a Comment

With Trøim at Carnivale in Rio, Shipping Deals Slow Down

Navios Selling, Selling Navios

There’s been a lot of buzz in the ship finance world this week about Lazard’s auction of Connecticut-based Navios Corporation. For those that missed it, Navios major shareholders, which are comprised of the company’s management, the Leventis Group of Greece and Saltchuk of Seattle, together hired investment bank Lazard Freres to sell the asset-light dry bulk owner operator a few months ago, and as bids came in late last week the market was aflutter with speculation and excitement.

Many of the shipping investment banks were representing bidders on the deal, which saw valuations range from $450 million to over $550 million. The deal also piqued the interest of many of the dominant consolidators and traders like OMI, Restis and Fredriksen, along with Goldman Sachs and George Economou‘s recent, oversubscribed and cash-laden DryShips. As we go to press tonight, blank check company International Shipping Enterprises announced that, “following a competitive bidding process, it executed an agreement providing for an exclusive period to negotiate definitive documentation to acquire all of the shares of Navios.”

For those who don’t know the company, Navios was founded 50 years ago as the shipping subsidiary of United States Steel Corporation, and today the fleet is comprised of 28 panamax and handymax vessels. We don’t have the offering memo on this deal, so we won’t even play around with a valuation because it’s impossible to do with any accuracy. Here’s why: of the company’s 28 vessels, the 6 ultra handymaxes are owned, and of the 22 long-term time chartered vessels, 15 are currently in operation and the remaining seven are scheduled for delivery at various times over the next two years. Moreover, Navios has options to acquire 13 of the time-chartered vessels. Further, we suspect that the owned vessels have a substantial net asset value and historically the vessels controlled under the largely Japanese charters-in have low daily rates and cheap purchase options. If that weren’t enough of a rat’s nest for valuation, Navios generates loads of money trading ships and FFAs and owns and operates a bulk terminal in Uruguay to boot. That’s why we won’t touch it.

We will say, however, that we always find it fascinating when asset-light shipping companies, whether they are traders or non-owning pools, solicit a valuation for their businesses. We say fascinating because historically shipping companies have had a hard time proving worth beyond steel irrespective of the talents of their management or sophistication of their software. That said, there have been some success stories, the best of which is Noble Group, which has a $3 billion market capitalization on the Singapore Stock Exchange. PacBasin also got some credit for its management. Noble, like Navios, owns few ships but instead make their money trading commodities.

Until we have more information, all we will say is this: if any asset-light shipping company could break ground in gaining a high valuation, it is Navios and it is now. The company has an incredibly good reputation and has developed what we understand to be highly efficient freight forecasting models – which begs another question: why are they selling?

Navios Selling, Selling Navios

There’s been a lot of buzz in the ship finance world this week about Lazard’s auction of Connecticut-based Navios Corporation. For those that missed it, Navios major shareholders, which are comprised of the company’s management, the Leventis Group of Greece and Saltchuk of Seattle, together hired investment bank Lazard Freres to sell the asset-light dry bulk owner operator a few months ago, and as bids came in late last week the market was aflutter with speculation and excitement.

Many of the shipping investment banks were representing bidders on the deal, which saw valuations range from $450 million to over $550 million. The deal also piqued the interest of many of the dominant consolidators and traders like OMI, Restis and Fredriksen, along with Goldman Sachs and George Economou‘s recent, oversubscribed and cash-laden DryShips. As we go to press tonight, blank check company International Shipping Enterprises announced that, “following a competitive bidding process, it executed an agreement providing for an exclusive period to negotiate definitive documentation to acquire all of the shares of Navios.”

For those who don’t know the company, Navios was founded 50 years ago as the shipping subsidiary of United States Steel Corporation, and today the fleet is comprised of 28 panamax and handymax vessels. We don’t have the offering memo on this deal, so we won’t even play around with a valuation because it’s impossible to do with any accuracy. Here’s why: of the company’s 28 vessels, the 6 ultra handymaxes are owned, and of the 22 long-term time chartered vessels, 15 are currently in operation and the remaining seven are scheduled for delivery at various times over the next two years. Moreover, Navios has options to acquire 13 of the time-chartered vessels. Further, we suspect that the owned vessels have a substantial net asset value and historically the vessels controlled under the largely Japanese charters-in have low daily rates and cheap purchase options. If that weren’t enough of a rat’s nest for valuation, Navios generates loads of money trading ships and FFAs and owns and operates a bulk terminal in Uruguay to boot. That’s why we won’t touch it.

We will say, however, that we always find it fascinating when asset-light shipping companies, whether they are traders or non-owning pools, solicit a valuation for their businesses. We say fascinating because historically shipping companies have had a hard time proving worth beyond steel irrespective of the talents of their management or sophistication of their software. That said, there have been some success stories, the best of which is Noble Group, which has a $3 billion market capitalization on the Singapore Stock Exchange. PacBasin also got some credit for its management. Noble, like Navios, owns few ships but instead make their money trading commodities.

Until we have more information, all we will say is this: if any asset-light shipping company could break ground in gaining a high valuation, it is Navios and it is now. The company has an incredibly good reputation and has developed what we understand to be highly efficient freight forecasting models – which begs another question: why are they selling?

Arabian Nights. Desert Sands.

Phenomenal Opportunities.

What a great time we had in Dubai. And the conference went well too!!!

Seriously, our First Annual Marine Money Ship Finance Conference held in the magnificent Grand Hyatt hotel in Dubai on 2nd February was a great success. Over 167 shipowners, shipping bankers and shipping service executives spent the day with us. All the major players from Dubai and the region were represented, as well as local and international financiers. In terms of figures, over 60 representatives of shipping groups were there, 12 local and regional banks or financial institutions and over 15 foreign lenders.

We were honoured with keynote addresses by Mr. Sultan Ahmed bin Sulayem, Executive Chairman of Ports Customs and Free Zone Corporation, and Mr. Yusr Sultan, Board Member of GEM and CEO of Terminals, Shipping and LPG, Emirates National Oil Company. The words that come to mind from both addresses are optimism, opportunity, pride, potential and quality. Dubai is going places, and the government and major private players in shipping have plans for greater things to come. An internationally recognized state flag for the UAE is on the agenda. The amount of local investment into shipping such a move could bring is astounding.

We heard from local and regional shipping companies who had taken a chance, used great initiative and then reaped the rewards – these included Emarat Maritime LLC and Emirates Ship Investment Co. We were privileged to hear an enlightening presentation by IRISL (IR Iran Shipping Lines), a company with 87 vessels, more being built and expansion plans for another 40 vessels by 2007. IRISL cannot always get foreign finance because of the lack of a national credit rating by the international agencies. To get around this, IRISL has set up a company in Germany that will own vessels, fly acceptable flags and be able to attract the type of investment and banking interest the company requires -forward thinking indeed.

Dubai Maritime City gave us an update on their plans to create a unique shipping service environment on land currently being reclaimed from the sea. The area will house a shipyard and repair yard, commercial space for all shipping activities, a maritime academy, a marina and state of the art office space for shipping companies to operate. It is planned to be ready by 2007!

Banks are interested in the shipping potential in the region. National Bank of Fujairah and DVB Bank AG held an intriguing discussion about their different approaches to lending in the region. Both have a great deal to offer, and the point was emphasized that there is every opportunity for local and international banks to link up and complement each other’s strengths, thereby giving optimal service to the region’s shipowners.

And our final session, entitled alternative finance, included a discussion by our anchor sponsor, Tufton Oceanic, about Islamic Finance, a new and huge potential source of finance to our industry, and a talk by CAT Finance baiting the audience with talk about building ships in the region and getting suitable finance.

The entire event was truly a great success emphasizing the opportunities that exist in the amazing locale of Dubai. You have to visit it to realise the enormous development and potential here. And shipping and shipping finance is part of that development. Marine Money will be back next year for the Second Marine Money Gulf Ship Finance Conference. Try to come. It is a great place to do business….and more!!

What a great time we had in Dubai. And the conference went well too!!!

Seriously, our First Annual Marine Money Ship Finance Conference held in the magnificent Grand Hyatt hotel in Dubai on 2nd February was a great success. Over 167 shipowners, shipping bankers and shipping service executives spent the day with us. All the major players from Dubai and the region were represented, as well as local and international financiers. In terms of figures, over 60 representatives of shipping groups were there, 12 local and regional banks or financial institutions and over 15 foreign lenders.

We were honoured with keynote addresses by Mr. Sultan Ahmed bin Sulayem, Executive Chairman of Ports Customs and Free Zone Corporation, and Mr. Yusr Sultan, Board Member of GEM and CEO of Terminals, Shipping and LPG, Emirates National Oil Company. The words that come to mind from both addresses are optimism, opportunity, pride, potential and quality. Dubai is going places, and the government and major private players in shipping have plans for greater things to come. An internationally recognized state flag for the UAE is on the agenda. The amount of local investment into shipping such a move could bring is astounding.

We heard from local and regional shipping companies who had taken a chance, used great initiative and then reaped the rewards – these included Emarat Maritime LLC and Emirates Ship Investment Co. We were privileged to hear an enlightening presentation by IRISL (IR Iran Shipping Lines), a company with 87 vessels, more being built and expansion plans for another 40 vessels by 2007. IRISL cannot always get foreign finance because of the lack of a national credit rating by the international agencies. To get around this, IRISL has set up a company in Germany that will own vessels, fly acceptable flags and be able to attract the type of investment and banking interest the company requires -forward thinking indeed.

Dubai Maritime City gave us an update on their plans to create a unique shipping service environment on land currently being reclaimed from the sea. The area will house a shipyard and repair yard, commercial space for all shipping activities, a maritime academy, a marina and state of the art office space for shipping companies to operate. It is planned to be ready by 2007!

Banks are interested in the shipping potential in the region. National Bank of Fujairah and DVB Bank AG held an intriguing discussion about their different approaches to lending in the region. Both have a great deal to offer, and the point was emphasized that there is every opportunity for local and international banks to link up and complement each other’s strengths, thereby giving optimal service to the region’s shipowners.

And our final session, entitled alternative finance, included a discussion by our anchor sponsor, Tufton Oceanic, about Islamic Finance, a new and huge potential source of finance to our industry, and a talk by CAT Finance baiting the audience with talk about building ships in the region and getting suitable finance.

The entire event was truly a great success emphasizing the opportunities that exist in the amazing locale of Dubai. You have to visit it to realise the enormous development and potential here. And shipping and shipping finance is part of that development. Marine Money will be back next year for the Second Marine Money Gulf Ship Finance Conference. Try to come. It is a great place to do business….and more!!