DVB HERDS CATS –

NSCSA ACQUIRES 30.3% OF PETREDEC

As any experienced shipping banker knows, bringing private equity into an existing operating company is generally a brutal experience. The main challenge usually revolves around valuation. Here’s how it works; what typically happens is that the financial advisor brings in one or two types of investors, each of who come with their own unique challenges.

First, there are the financial buyers. This group brings nothing to the party but money and maybe “a guy who used to work in the business”. Take that last part for what it’s worth. This “guy” generally knows only enough to be dangerous and slow down meetings. While sometimes these types of investors give the shipping company a “promote” of say, 10-15% of the equity, typically they assign zero value to anything that isn’t big and doesn’t float and can be re-leveraged by someone else. The typical reaction of the shipping company to this valuation technique, whose management have dedicated their lives to learning the industry, is “take a long walk off a short pier.”

They next group of potential investors are those strategic in nature, i.e. other shipping companies. We once had a cover of Marine Money entitled “Herding Cats” with a lovely illustration of a farmer trying to round-up wild cats, a good analogy for bringing together two shipping companies. What usually happens here is that each shipowner thinks the others ships, company, people, maintenance programs, ship management, chartering relationships, crew, banks, and maybe even food¸ are inferior to their own. And then there is the issue of rights conferred to minority interests. As any good shipping banker, and investor, knows full well, being a minority interest in a private company can really stink. These sorts of deals generally do not go far.

Creating Value

But every now and then a good financial advisor, one who really understands the personalities of the principals and knows the prospects for the business as well as the shipowner does, can achieve something really meaningful when bringing two companies together. Every now and then 1+1 can actually equal a lot more than 3; this happens when two companies have different, but complementary competencies and at the same time, share a vision for the market.

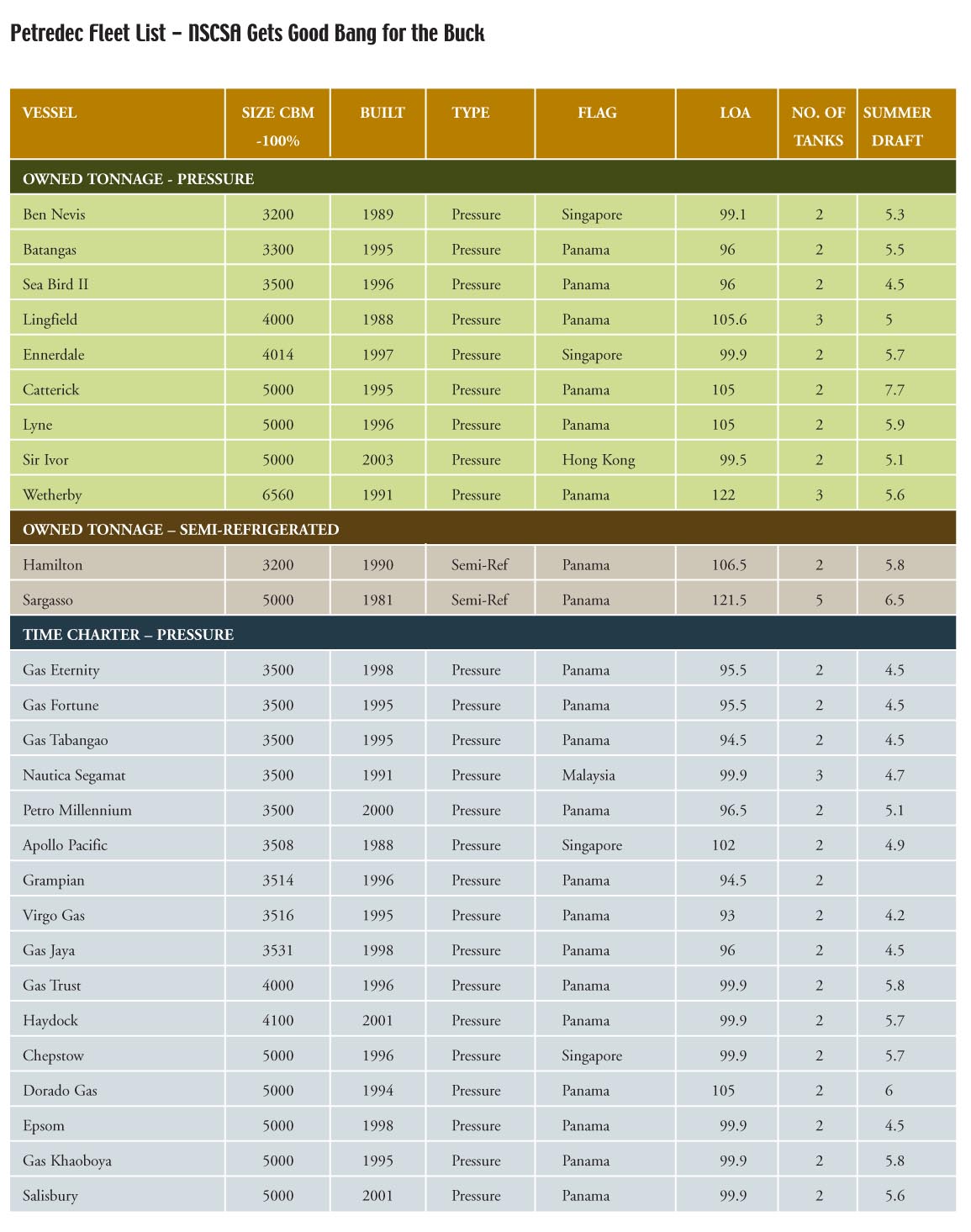

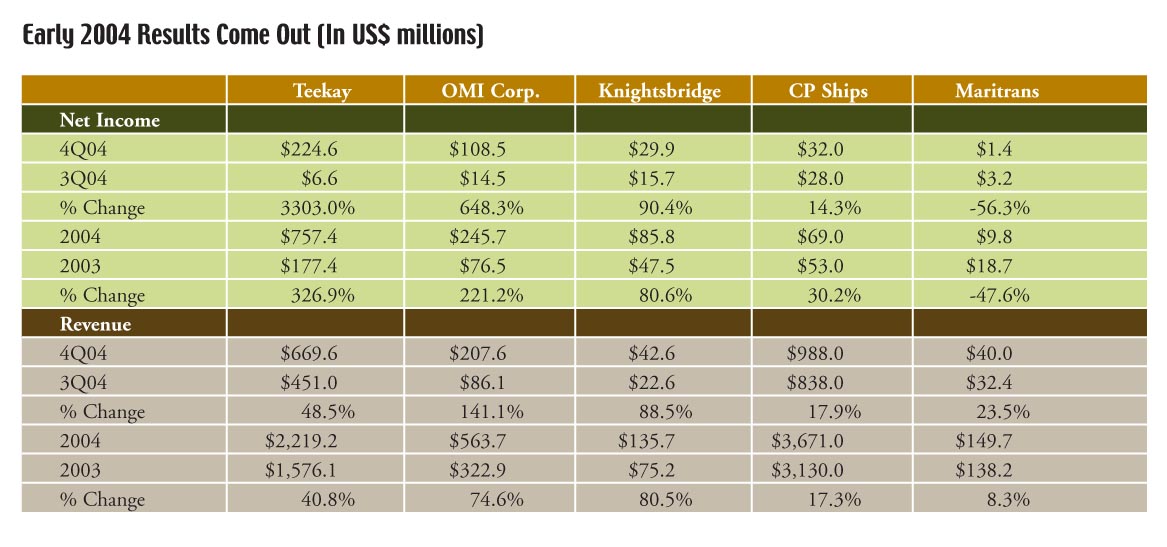

All this is a woefully long winded way telling you why we like the deal DVB announced this week whereby the National Shipping Company of Saudi Arabia (NSCSA) invested $50 million into LPG operator Petredec in exchange for a 30% stake in the company. This deal, at least the way we are looking at, is pure synergy and unlocks incredible potential for future growth with very little risk for both sides. For a paltry $50 million, the price of a single vessel, NSCSA gets 30% of Petredec, one of the leading players in the exciting and fast growing LPG market with a fleet of 53 vessels. Stevenson and Co., Glasgow, provided legal services on the deal for Petredec and NSCSA was advised by international lawyers Holman Fenwick & Willan and accountants Moore Stephens.

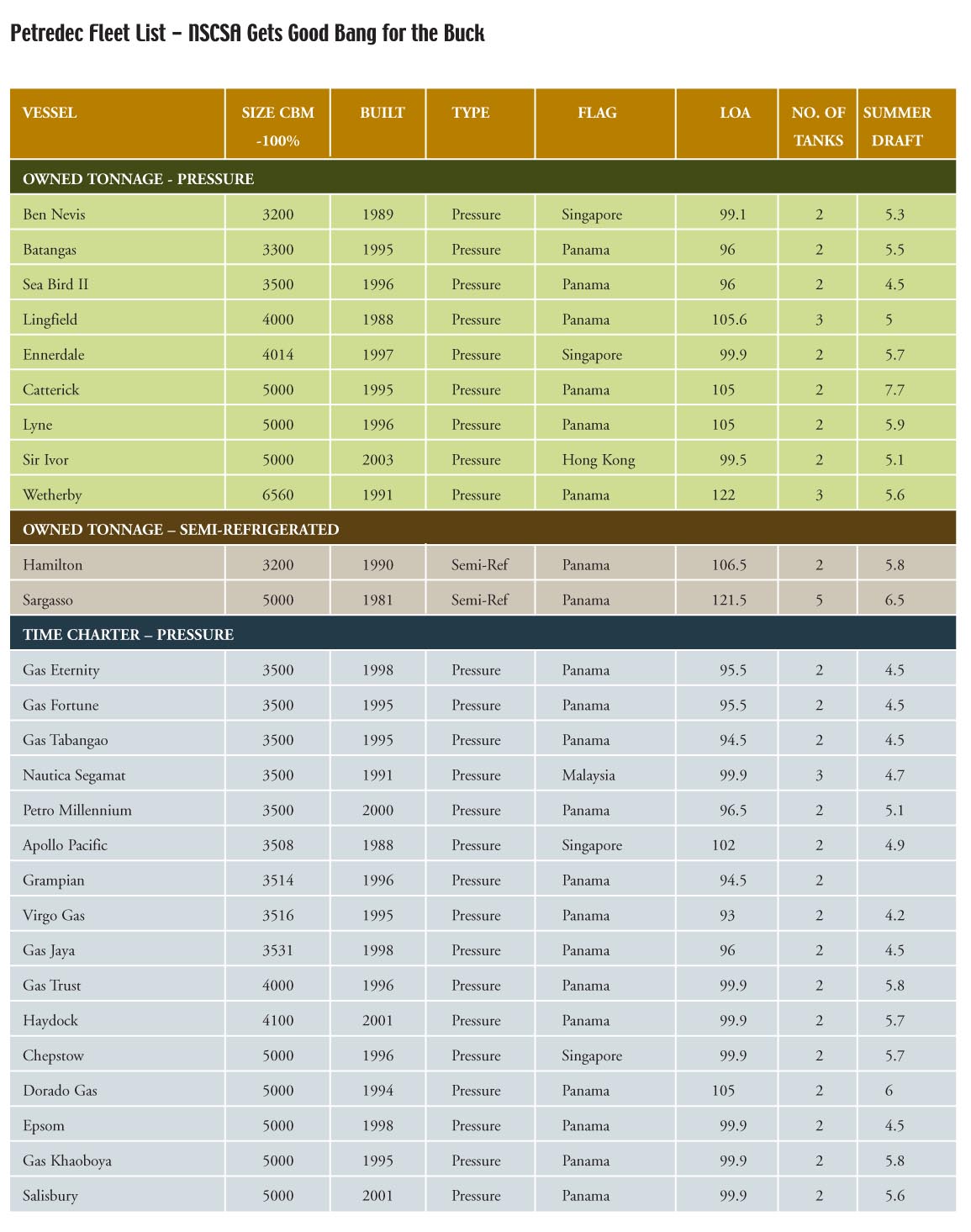

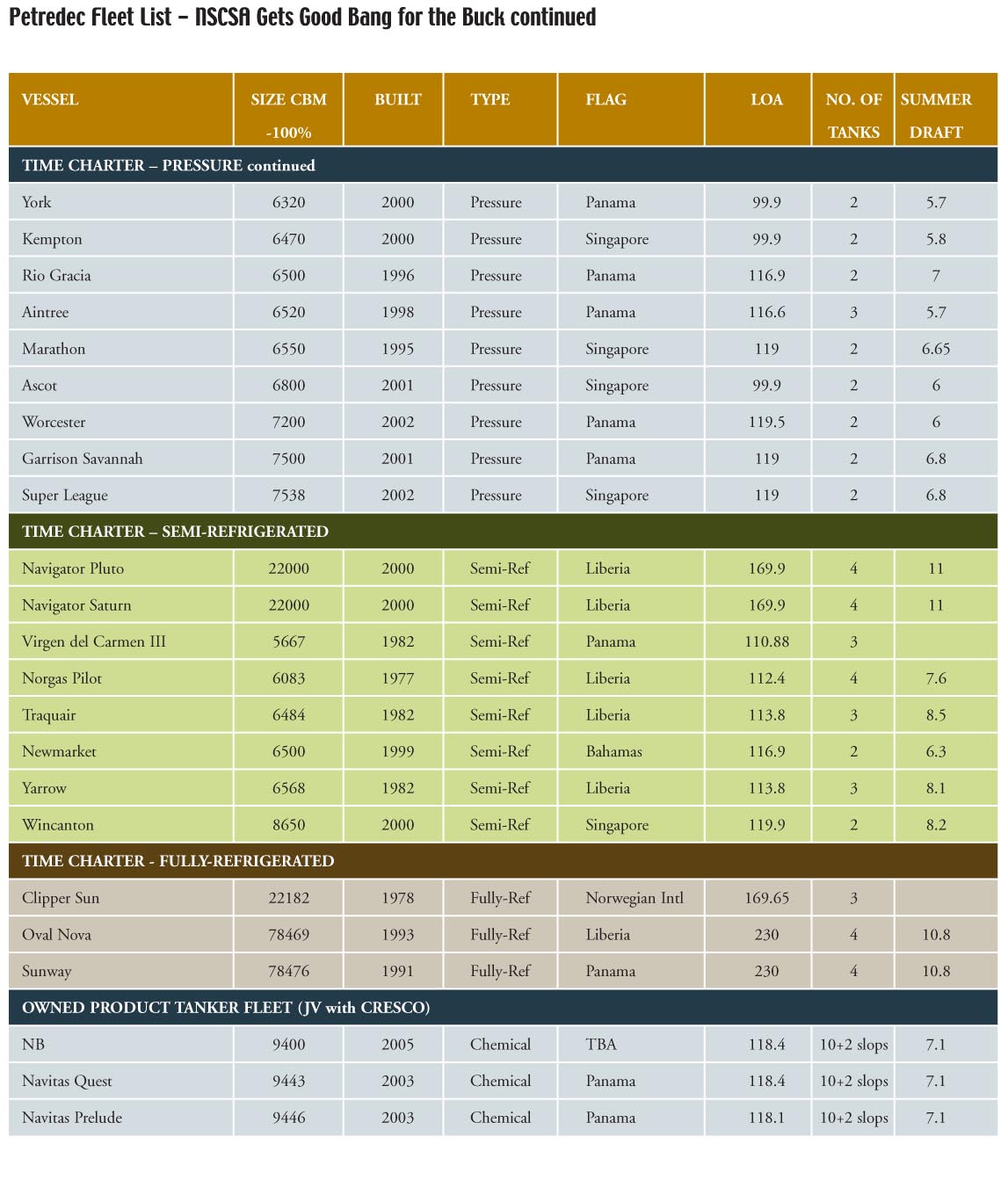

Petredec, for those of you who don’t know them, control a substantial fleet of owned and time chartered gas vessels operating worldwide outlined in the fleet list included with this article. And this isn’t a pure charter operation; eight new-building pressurised and semi-refrigerated vessels were delivered to Petredec during 1996-2000 ranging in size from 5000 to 8650 cbm and five further new-buildings, ranging in size from 4100 to 7500 cbm, joined the fleet during 2001 and 2002. The Petredec fleet, as well as being one of the youngest, is the largest fleet of gas tankers controlled by an independent trader making Petredec an interesting combination of trader and shipowner and put them alongside giants like Naftomar, Geogas and Dynergy.

Everyone’s a Winner

What we like about this deal is that both sides are getting a good deal. NSCSA has done a good deal and gotten a remarkable amount of market influence in the LPG market, a market they have been keen to enter, for the price of a single large LPG ship. Although the publicly traded tanker company is a minority shareholder in Petredec with 30%, we imagine the investor has at least one seat on the board and we also imagine there are some provisions built into the deal that will allow them to increase their ownership and influence in the future.

In a prepared statement, Mr. Abdullah S. Nojaidi, Chairman of NSCSA, communicated his motivation for the deal; “The gas trades out of the Gulf will grow significantly in the coming years. We consider our investment in Petredec to be the best route by which we can become a market leader in the shipping and trading of LPG in this region. This transaction represents a number of firsts for NSCSA, including our first share acquisition of an existing shipping company, our first venture into the gas trades, and our first major investment outside the GCC (Gulf Cooperation Council) region. This fulfils and fits perfectly with NSCSA’s long term strategy of strengthening international alliances and diversifying our portfolio, thus fulfilling the company’s growth ambitions. We are extremely pleased to be investing in and working with a company of Petredec’s calibre.”

For those who don’t know them, NSCSA is quoted on the Saudi stock exchange with a majority of shares owned privately, and with 28.2% owned by the government of the Kingdom of Saudi Arabia. In 2004, NSCSA consolidated revenue was SR1.66 billion ($442 million) and net income was SR431 million ($115 million). NSCSA directly and indirectly controls a fleet of 37 vessels delivered and on order, aggregating approximately 4.4 million dwt, including 11 VLCCs, 22 chemical /product carriers and 4 container/RoRos.

For Petredec, the transaction is also an amazing opportunity. The company is instantly able to order larger vessels, including two 82,000 m3 VLGCs very recently ordered at Hyundai Heavy Industries for delivery in 2008, to prepare for what they believe will be a good market for long haul LPG, rather than the smaller ships that they own currently.

Most remarkable is the access that their new partners will bring to the arrangement. Although Petredec has undoubtedly done business in Saudi, they are now tied together with a company that will provide them with a very special entrée into local market in a part of the world that is only increasing its exports of LPG, a bi-product of LNG and oil production that is used to make widely used butane and propane.

In a press release, Mr. Don Dunstan, Chairman of Petredec, said “We are extremely pleased to welcome NSCSA onboard as a shareholder in Petredec. We are aggressively growing our shipping and trading activities, and we expect to see a major part of this expansion take place in the Arabian Gulf. We are considering further development of our cooperation with NSCSA and we fully expect that our relationship will grow over time to our mutual benefit.”

Valuing Petredec

We are not privy to the valuation metric used in this transaction, so we will use some assumptions in trying to figure it out. Like all business that involved a combination of chartering and owning, we imagine the advisors at DVB came up with a cash flow valuation on the charter revenue and a net asset valuation based on the fleet and cash in the company. In the end, they undoubtedly used discounted cash flow analysis to arrive at number that made everyone happy – which we can tell you only half sarcastically was 130% of net asset value. Over the years, we have found that figure is the lowest premium at which shipowners agree to sell their businesses. So we know that Petredec sold 30.5% for $50 million, which values the company at $163 million.

As any experienced shipping banker knows, bringing private equity into an existing operating company is generally a brutal experience. The main challenge usually revolves around valuation. Here’s how it works; what typically happens is that the financial advisor brings in one or two types of investors, each of who come with their own unique challenges.

First, there are the financial buyers. This group brings nothing to the party but money and maybe “a guy who used to work in the business”. Take that last part for what it’s worth. This “guy” generally knows only enough to be dangerous and slow down meetings. While sometimes these types of investors give the shipping company a “promote” of say, 10-15% of the equity, typically they assign zero value to anything that isn’t big and doesn’t float and can be re-leveraged by someone else. The typical reaction of the shipping company to this valuation technique, whose management have dedicated their lives to learning the industry, is “take a long walk off a short pier.”

The next group of potential investors are those strategic in nature, i.e. other shipping companies. We once had a cover of Marine Money entitled “Herding Cats” with a lovely illustration of a farmer trying to round-up wild cats, a good analogy for bringing together two shipping companies. What usually happens here is that each shipowner thinks the others ships, company, people, maintenance programs, ship management, chartering relationships, crew, banks, and maybe even food¸ are inferior to their own. And then there is the issue of rights conferred to minority interests. As any good shipping banker, and investor, knows full well, being a minority interest in a private company can really stink. These sorts of deals generally do not go far.

Creating Value

But every now and then a good financial advisor, one who really understands the personalities of the principals and knows the prospects for the business as well as the shipowner does, can achieve something really meaningful when bringing two companies together. Every now and then 1+1 can actually equal a lot more than 3; this happens when two companies have different, but complementary competencies and at the same time, share a vision for the market.

All this is a woefully long winded way telling you why we like the deal DVB announced this week whereby the National Shipping Company of Saudi Arabia (NSCSA) invested $50 million into LPG operator Petredec in exchange for a 30% stake in the company. This deal, at least the way we are looking at, is pure synergy and unlocks incredible potential for future growth with very little risk for both sides. For a paltry $50 million, the price of a single vessel, NSCSA gets 30% of Petredec, one of the leading players in the exciting and fast growing LPG market with a fleet of 53 vessels. Stevenson and Co., Glasgow, provided legal services on the deal for Petredec and NSCSA was advised by international lawyers Holman Fenwick & Willan and accountants Moore Stephens.

Petredec, for those of you who don’t know them, control a substantial fleet of owned and time chartered gas vessels operating worldwide outlined in the fleet list included with this article. And this isn’t a pure charter operation; eight new-building pressurised and semi-refrigerated vessels were delivered to Petredec during 1996-2000 ranging in size from 5000 to 8650 cbm and five further new-buildings, ranging in size from 4100 to 7500 cbm, joined the fleet during 2001 and 2002. The Petredec fleet, as well as being one of the youngest, is the largest fleet of gas tankers controlled by an independent trader making Petredec an interesting combination of trader and shipowner and put them alongside giants like Naftomar, Geogas and Dynergy.

Everyone’s a Winner

What we like about this deal is that both sides are getting a good deal. NSCSA has done a good deal and gotten a remarkable amount of market influence in the LPG market, a market they have been keen to enter, for the price of a single large LPG ship. Although the publicly traded tanker company is a minority shareholder in Petredec with 30%, we imagine the investor has at least one seat on the board and we also imagine there are some provisions built into the deal that will allow them to increase their ownership and influence in the future.

In a prepared statement, Mr. Abdullah S. Nojaidi, Chairman of NSCSA, communicated his motivation for the deal; “The gas trades out of the Gulf will grow significantly in the coming years. We consider our investment in Petredec to be the best route by which we can become a market leader in the shipping and trading of LPG in this region. This transaction represents a number of firsts for NSCSA, including our first share acquisition of an existing shipping company, our first venture into the gas trades, and our first major investment outside the GCC (Gulf Cooperation Council) region. This fulfils and fits perfectly with NSCSA’s long term strategy of strengthening international alliances and diversifying our portfolio, thus fulfilling the company’s growth ambitions. We are extremely pleased to be investing in and working with a company of Petredec’s calibre.”

For those who don’t know them, NSCSA is quoted on the Saudi stock exchange with a majority of shares owned privately, and with 28.2% owned by the government of the Kingdom of Saudi Arabia. In 2004, NSCSA consolidated revenue was SR1.66 billion ($442 million) and net income was SR431 million ($115 million). NSCSA directly and indirectly controls a fleet of 37 vessels delivered and on order, aggregating approximately 4.4 million dwt, including 11 VLCCs, 22 chemical /product carriers and 4 container/RoRos.

For Petredec, the transaction is also an amazing opportunity. The company is instantly able to order larger vessels, including two 82,000 m3 VLGCs very recently ordered at Hyundai Heavy Industries for delivery in 2008, to prepare for what they believe will be a good market for long haul LPG, rather than the smaller ships that they own currently.

Most remarkable is the access that their new partners will bring to the arrangement. Although Petredec has undoubtedly done business in Saudi, they are now tied together with a company that will provide them with a very special entrée into local market in a part of the world that is only increasing its exports of LPG, a bi-product of LNG and oil production that is used to make widely used butane and propane.

In a press release, Mr. Don Dunstan, Chairman of Petredec, said “We are extremely pleased to welcome NSCSA onboard as a shareholder in Petredec. We are aggressively growing our shipping and trading activities, and we expect to see a major part of this expansion take place in the Arabian Gulf. We are considering further development of our cooperation with NSCSA and we fully expect that our relationship will grow over time to our mutual benefit.”

Valuing Petredec

We are not privy to the valuation metric used in this transaction, so we will use some assumptions in trying to figure it out. Like all business that involved a combination of chartering and owning, we imagine the advisors at DVB came up with a cash flow valuation on the charter revenue and a net asset valuation based on the fleet and cash in the company. In the end, they undoubtedly used discounted cash flow analysis to arrive at number that made everyone happy – which we can tell you only half sarcastically was 130% of net asset value. Over the years, we have found that figure is the lowest premium at which shipowners agree to sell their businesses. So we know that Petredec sold 30.5% for $50 million, which values the company at $163 million.

Categories:

Equity,

Freshly Minted | February 24th, 2005 |

Add a Comment

Torch Offshore – Up in Flames

It’s been a bad start to the year for Torch Offshore, Inc. (NASDAQ: TORC), the company established in 1978 to work on shallow water offshore pipeline installation and subsea construction for the oil and natural gas industry. In late December 2004, Torch announced that three of its vessels, the Midnight Express, Midnight Wrangler and Midnight Eagle, had been arrested by U.S. Marshals on behalf of creditors GE Capital, which declared an event of default and invoked a default interest rate of 18%.

Unable to cure the default, Torch filed for bankruptcy protection on January 12th and was de-listed from the NASDAQ a week later. Concurrent with the filing, Torch secured a new debtor in possession (DIP) financing of $6.9 million from Regions Bank and EDC, its two other lenders, that matures on April 1, 2005. In addition, the banks have agreed to provide a discretionary facility of up to $2.0 million for bonding and letters of credit. The interest rate on the DIP Facility is the prime rate plus 4.00% per annum.

At the time of the filing, Torch’s CEO Lyle Stockstill said, “The Company has been operating with a highly leveraged balance sheet for some time now, mostly due to the conversion efforts associated with the Midnight Express.” The Midnight Express was a conversion of a Smit vessel that was done in Quebec, which is why EDC was involved. In addition to the poor market, Torch’s conversion of the former 8,638-dwt Smit Express (built 1984) reportedly jumped to about $115 million from original budget estimates of about $90 million.

Torch’s filings with the SEC are a reminder to how unpleasant it can be working under bankruptcy. According to the documents, “the DIP Facility requires the Company to meet certain obligations, including the delivery of a weekly written report with respect to the cash flow forecast compared to actual results, quarterly and annual financial statements, and certificates of compliance on a quarterly and annual basis. The Company is also subject to limitations on paying indebtedness, creating liens against their property, and the weekly actual borrowing base test (as defined) cannot vary by more than 5% (in the negative) from the Company’s forecasted borrowing base test.

It’s been a bad start to the year for Torch Offshore, Inc. (NASDAQ: TORC), the company established in 1978 to work on shallow water offshore pipeline installation and subsea construction for the oil and natural gas industry. In late December 2004, Torch announced that three of its vessels, the Midnight Express, Midnight Wrangler and Midnight Eagle, had been arrested by U.S. Marshals on behalf of creditors GE Capital, which declared an event of default and invoked a default interest rate of 18%.

Unable to cure the default, Torch filed for bankruptcy protection on January 12th and was de-listed from the NASDAQ a week later. Concurrent with the filing, Torch secured a new debtor in possession (DIP) financing of $6.9 million from Regions Bank and EDC, its two other lenders, that matures on April 1, 2005. In addition, the banks have agreed to provide a discretionary facility of up to $2.0 million for bonding and letters of credit. The interest rate on the DIP Facility is the prime rate plus 4.00% per annum.

At the time of the filing, Torch’s CEO Lyle Stockstill said, “The Company has been operating with a highly leveraged balance sheet for some time now, mostly due to the conversion efforts associated with the Midnight Express.” The Midnight Express was a conversion of a Smit vessel that was done in Quebec, which is why EDC was involved. In addition to the poor market, Torch’s conversion of the former 8,638-dwt Smit Express (built 1984) reportedly jumped to about $115 million from original budget estimates of about $90 million.

Torch’s filings with the SEC are a reminder to how unpleasant it can be working under bankruptcy. According to the documents, “the DIP Facility requires the Company to meet certain obligations, including the delivery of a weekly written report with respect to the cash flow forecast compared to actual results, quarterly and annual financial statements, and certificates of compliance on a quarterly and annual basis. The Company is also subject to limitations on paying indebtedness, creating liens against their property, and the weekly actual borrowing base test (as defined) cannot vary by more than 5% (in the negative) from the Company’s forecasted borrowing base test.

Categories:

Equity,

Freshly Minted | February 23rd, 2005 |

Add a Comment

Shipowners Present at Deutsche Small Cap Equity Conference

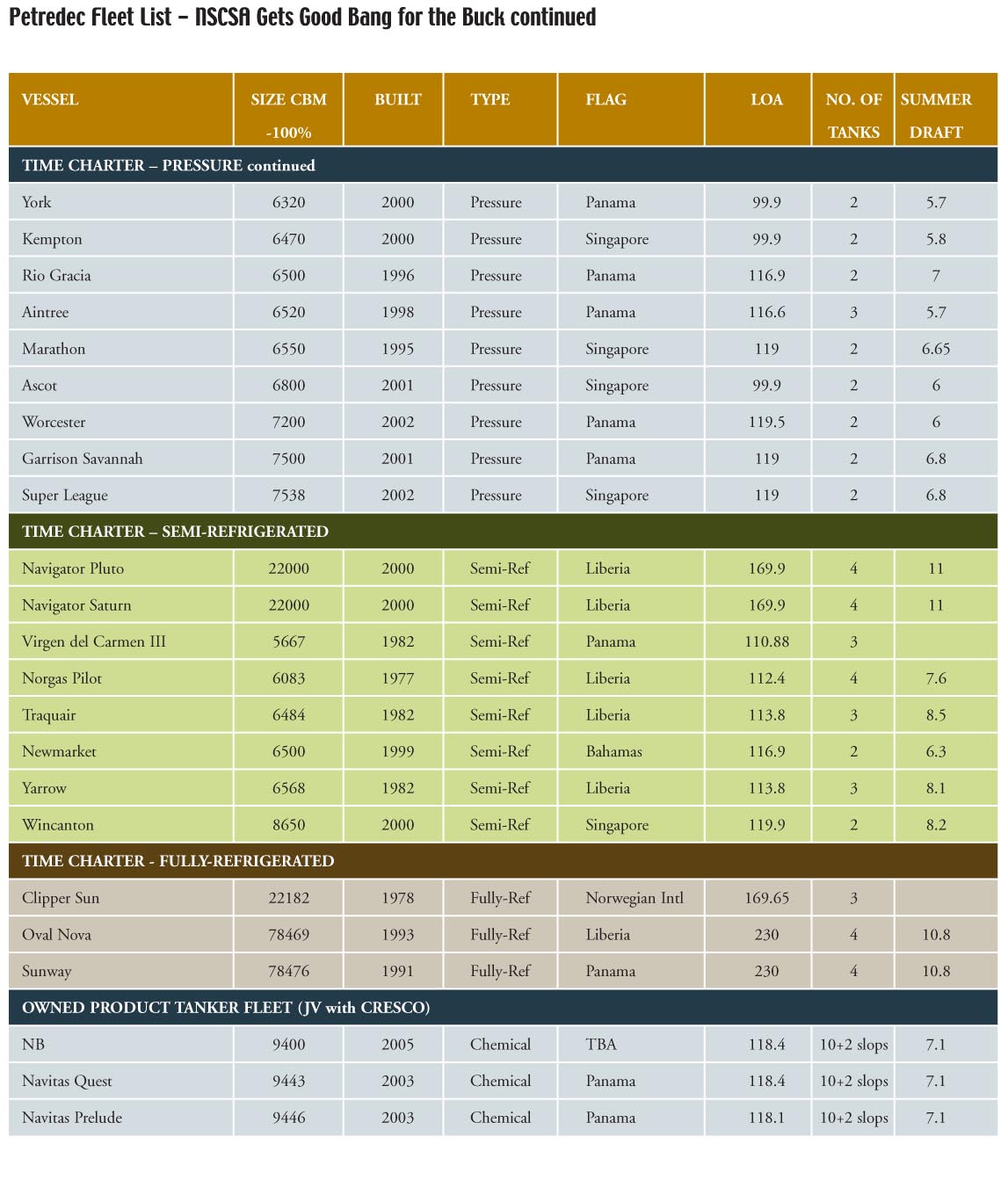

It’s no coincidence that investor conferences are being held in closer to the equator during these chilly months. This week, Deutsche Bank, which recently hired investment banker Craig Fuehrer from JP Morgan and veteran transportation analyst Jordan Alliger from Lazard (formerly with Goldman Sachs), held an event at the Ritz Carlton on the beach in Naples, Florida. Shipping companies that presented include: Kirby Corporation (NYSE: KEX), OMI (NYSE: OMM), General Maritime (NYSE: GMR), TEN (NYSE: TNP), Stolt Nielsen, S.A. (NASDAQ: SNSA) and Maritrans (NYSE: TUG). As you can see from the share price graphs for the last five days, with fundamentals as good as the shipping industry, it’s always a good idea for companies to get out on the road and tell their story to investors.

It’s no coincidence that investor conferences are being held in closer to the equator during these chilly months. This week, Deutsche Bank, which recently hired investment banker Craig Fuehrer from JP Morgan and veteran transportation analyst Jordan Alliger from Lazard (formerly with Goldman Sachs), held an event at the Ritz Carlton on the beach in Naples, Florida. Shipping companies that presented include: Kirby Corporation (NYSE: KEX), OMI (NYSE: OMM), General Maritime (NYSE: GMR), TEN (NYSE: TNP), Stolt Nielsen, S.A. (NASDAQ: SNSA) and Maritrans (NYSE: TUG). As you can see from the share price graphs for the last five days, with fundamentals as good as the shipping industry, it’s always a good idea for companies to get out on the road and tell their story to investors.

Categories:

Forums,

Freshly Minted | February 17th, 2005 |

Add a Comment

New York Conference Features Shipping Star Power

Last week’s Hellenic-/Norwegian-American Chambers of Commerce Joint Shipping Conference offered a plethora of luminaries from shipping’s universe. Between OSG’s Morten Arntzen, Teekay’s Sean Day, GenMar’s Peter Georgiopoulos, Tidewater’s Dean Taylor, NCL’s Colin Veitch, BP’s Bob Malone, Heidmar’s Per Heidenreich, Wilh. Wilhelmsen, Leif Hoegh, Navios’ Robert Shaw, Intrepid Shipping’s Richard du Moulin, Free Bulkers George Gourdomichalis, CR Weber’s Basil Mavroleon, Healy & Baillie’s Glen Oxton, and DNV’s Tor Svensen the bulk of the world’s tonnage was well represented.

The theme of the conference was “Shipping without Borders” which transcended from national identity to the impact of new technologies and landed squarely on the challenges of doing business in America. Or should we say the many challenges of doing business in the (50) States?

Per Heidenreich welcomed the assembled with the observation that “2004 was the most incredible shipping market in history, with Wall Street showing an alarming interest in shipping”. He reflected that the Norwegians are “awfully quiet” and urged them to learn what “makes the Greeks tick.”

The Greek contingent was happy to comply, with George Gourdomichalis offering the strengths of the Greek approach: Piraeus as a maritime cluster, a favorable tax climate, and the transition of Greek family-owned operations to corporations. As a counterpoint, Leif Hoegh underscored the decline in Norwegian shipping, both in the bulk and tanker trades as well as in the yard order book. He further advocated the Greek regard for shipping: “When you go to Piraeus, even the taxi drivers know about tankers. Piraeus is an exhilarating place!” When pressed as to whether the Leif Hoegh company would return to Norway, Mr. Hoegh’s one-word answer was a resounding “No”.

While acknowledging the decline of Norway’s shipping sector, Marianne Lie, Director General of the Norwegian Shipowners’ Association, presented the proposed tax and legislative changes within Norway designed to reinvigorate its maritime industry. The key word is “proposed”. Tor Svensen of DNV attempted to breach the gap by offering the concept of geographic co-location, while Anthony Argyropoulos, newly at Cantor Fitzgerald, adroitly attributed the Greek interest in the capital markets to their entrepreneurial spirit, without discouraging Norwegian interest.

After an overview of the freight futures market by Robert Shaw of Navios, technological advances in this field were covered by Basil Mavroleon of CR Weber, who helped transition the conference by eliminating borders entirely. In his call to action on FFA’s (Forward Freight Agreements), Basil reflected “If, as I believe it will, this market continues to strengthen, who, with underlying physical positions can continue to ignore participation in it – surely we must all find a way to engage with it, learn to utilize it to our benefit and play some part in the growth curve”. Implementation was discussed by Barry Bednar of J. Aron & Company and Tom Even Mortensen of IMAREX.

Wilhelm Wilhelmsen offered a global perspective as the conference’s luncheon keynote speaker. His answer to whether national identity has become irrelevant was a conditional “Yes”. Despite being Norway’s oldest and largest shipping enterprise, only 5% of the company’s employees have Norwegian as their mother tongue, and only a handful of ship calls handled by the company last year were in Norway. He feels that the shipping industry is “almost unwanted by the Norwegian authorities…many (companies) feel strongly that they are literally being kicked out.” Norway is the only major shipping nation that is in decline, with the government “destroying an industry which actually has everything required to ensure good and stable revenues for my country in the future.”

Turning the focus to doing business in the Americas, Sean Day of Teekay pointed to the industry’s image in the financial markets resulting in investor differentiation, and a greater scrutiny on quality of both fleets and management. Mr. Day declared Sarbanes-Oxley a “time sink” and expensive, while acknowledging that Teekay is a foreign filer that complies with US requirements.

Bob Malone of BP Shipping stated that his company’s strategy is to own ships in order to manage risk (against incidents). He felt the need to regain the public trust by managing the company, and pointed to the benefits gained through compliance with Sarbanes-Oxley.

Peter Georgiopoulos of GenMar struck a profoundly wistful note, reflecting that he used to think shipping connoted yachts, former US President’s wives and opera singers, but quickly learned that the world of shipping revolves around OPA, ISM and SARBOX. Regulation is making shipping increasingly expensive, and much less desirable.

OSG’s Morten Arntzen lifted everyone’s mood with his list of “Top Ten Challenges Facing Executives of American Shipping Companies Competing Internationally” (including finding an affordable Starbucks coffee in Europe, explaining why a suezmax built in the United States costs $240 million, and repeating “Foreign Corrupt Practices Act” 10 times). Mr. Arntzen demonstrated to the market doomsayers why the tanker industry of today is dramatically different from that of the early 70’s. He further went on to tout the merits of Sarbanes-Oxley as a significant management tool, and highlighted the benefits accruing to OSG from the recent Job Creation Act of 2004, with its attendant tonnage tax scheme for US-flag shipping.

Dean Taylor of Tidewater reiterated the challenges of doing business in the US amidst extensive and expensive regulation. Mr. Taylor’s remarks were surprisingly dour, considering the profitable condition of Tidewater and their enviable earnings multiple.

Norwegian Cruise Line’s Colin Veitch delivered an overview of how, and why, they decided to pursue a US-flag strategy despite the costs and challenges. Interestingly, it was Mr. Veitch who called upon industry to be proactive, rather than reactive, about regulation (such as environmental policies). With his extensive experience in the public sector, perhaps his suggestion to influence perception could inspire action leading to a positive image for shipping??

Last week’s Hellenic-/Norwegian-American Chambers of Commerce Joint Shipping Conference offered a plethora of luminaries from shipping’s universe. Between OSG’s Morten Arntzen, Teekay’s Sean Day, GenMar’s Peter Georgiopoulos, Tidewater’s Dean Taylor, NCL’s Colin Veitch, BP’s Bob Malone, Heidmar’s Per Heidenreich, Wilh. Wilhelmsen, Leif Hoegh, Navios’ Robert Shaw, Intrepid Shipping’s Richard du Moulin, Free Bulkers George Gourdomichalis, CR Weber’s Basil Mavroleon, Healy & Baillie’s Glen Oxton, and DNV’s Tor Svensen the bulk of the world’s tonnage was well represented.

The theme of the conference was “Shipping without Borders” which transcended from national identity to the impact of new technologies and landed squarely on the challenges of doing business in America. Or should we say the many challenges of doing business in the (50) States?

Per Heidenreich welcomed the assembled with the observation that “2004 was the most incredible shipping market in history, with Wall Street showing an alarming interest in shipping”. He reflected that the Norwegians are “awfully quiet” and urged them to learn what “makes the Greeks tick.”

The Greek contingent was happy to comply, with George Gourdomichalis offering the strengths of the Greek approach: Piraeus as a maritime cluster, a favorable tax climate, and the transition of Greek family-owned operations to corporations. As a counterpoint, Leif Hoegh underscored the decline in Norwegian shipping, both in the bulk and tanker trades as well as in the yard order book. He further advocated the Greek regard for shipping: “When you go to Piraeus, even the taxi drivers know about tankers. Piraeus is an exhilarating place!” When pressed as to whether the Leif Hoegh company would return to Norway, Mr. Hoegh’s one-word answer was a resounding “No”.

While acknowledging the decline of Norway’s shipping sector, Marianne Lie, Director General of the Norwegian Shipowners’ Association, presented the proposed tax and legislative changes within Norway designed to reinvigorate its maritime industry. The key word is “proposed”. Tor Svensen of DNV attempted to breach the gap by offering the concept of geographic co-location, while Anthony Argyropoulos, newly at Cantor Fitzgerald, adroitly attributed the Greek interest in the capital markets to their entrepreneurial spirit, without discouraging Norwegian interest.

After an overview of the freight futures market by Robert Shaw of Navios, technological advances in this field were covered by Basil Mavroleon of CR Weber, who helped transition the conference by eliminating borders entirely. In his call to action on FFA’s (Forward Freight Agreements), Basil reflected “If, as I believe it will, this market continues to strengthen, who, with underlying physical positions can continue to ignore participation in it – surely we must all find a way to engage with it, learn to utilize it to our benefit and play some part in the growth curve”. Implementation was discussed by Barry Bednar of J. Aron & Company and Tom Even Mortensen of IMAREX.

Wilhelm Wilhelmsen offered a global perspective as the conference’s luncheon keynote speaker. His answer to whether national identity has become irrelevant was a conditional “Yes”. Despite being Norway’s oldest and largest shipping enterprise, only 5% of the company’s employees have Norwegian as their mother tongue, and only a handful of ship calls handled by the company last year were in Norway. He feels that the shipping industry is “almost unwanted by the Norwegian authorities…many (companies) feel strongly that they are literally being kicked out.” Norway is the only major shipping nation that is in decline, with the government “destroying an industry which actually has everything required to ensure good and stable revenues for my country in the future.”

Turning the focus to doing business in the Americas, Sean Day of Teekay pointed to the industry’s image in the financial markets resulting in investor differentiation, and a greater scrutiny on quality of both fleets and management. Mr. Day declared Sarbanes-Oxley a “time sink” and expensive, while acknowledging that Teekay is a foreign filer that complies with US requirements.

Bob Malone of BP Shipping stated that his company’s strategy is to own ships in order to manage risk (against incidents). He felt the need to regain the public trust by managing the company, and pointed to the benefits gained through compliance with Sarbanes-Oxley.

Peter Georgiopoulos of GenMar struck a profoundly wistful note, reflecting that he used to think shipping connoted yachts, former US President’s wives and opera singers, but quickly learned that the world of shipping revolves around OPA, ISM and SARBOX. Regulation is making shipping increasingly expensive, and much less desirable.

OSG’s Morten Arntzen lifted everyone’s mood with his list of “Top Ten Challenges Facing Executives of American Shipping Companies Competing Internationally” (including finding an affordable Starbucks coffee in Europe, explaining why a suezmax built in the United States costs $240 million, and repeating “Foreign Corrupt Practices Act” 10 times). Mr. Arntzen demonstrated to the market doomsayers why the tanker industry of today is dramatically different from that of the early 70’s. He further went on to tout the merits of Sarbanes-Oxley as a significant management tool, and highlighted the benefits accruing to OSG from the recent Job Creation Act of 2004, with its attendant tonnage tax scheme for US-flag shipping.

Dean Taylor of Tidewater reiterated the challenges of doing business in the US amidst extensive and expensive regulation. Mr. Taylor’s remarks were surprisingly dour, considering the profitable condition of Tidewater and their enviable earnings multiple.

Norwegian Cruise Line’s Colin Veitch delivered an overview of how, and why, they decided to pursue a US-flag strategy despite the costs and challenges. Interestingly, it was Mr. Veitch who called upon industry to be proactive, rather than reactive, about regulation (such as environmental policies). With his extensive experience in the public sector, perhaps his suggestion to influence perception could inspire action leading to a positive image for shipping??

Categories:

Forums,

Freshly Minted | February 17th, 2005 |

Add a Comment

Fortis Reports on Offshore Sector,

Initiates Seacor and Hornbeck with BUY Rating

If you’ve ever wanted to know more about the offshore supply boat sector but didn’t know how to look, we highly recommend Fortis Bank’s newly issued reports, which give an overview of the sector and initiate coverage on Seacor Holdings and Hornbeck Offshore Services. Despite noting the sector’s history of being “plagued by over-capacity, low barriers to entry, and commoditized pricing,” analyst Dan Barrett is bullish on the short-term prospects for the sector, expecting to see a number of supply boat companies exceed consensus expectations over the next few quarters.

Mr. Barrett expects that supply will outstrip demand in the sector over the next 12-18 months, but is not shy about his belief that a rising tide will not lift all boats. He expects the market for new generation and deep-water capable boats to be quite strong, with utilization rates likely climbing from the 85-90% range to the mid 90s and day rates hitting record levels. Meanwhile, utilization rates for older boats with more limited capabilities will rise only along the margin.

In the Sector Note issued by Fortis, Mr. Barrett first discusses in detail the primary types of boats involved in the sector – Anchor Handling Towing Supply, Offshore Supply Vessels, Crew Boats and Standby/Rescue Vessels, among others – and the key global offshore basins – the Gulf of Mexico, the North Sea, West Africa, Asia – Pacific, the Middle East, Brazil, and the rest of Latin America. He gives an overview of the rate tendencies and contract types that prevail in the various vessel-types and regions that gives substance to his discussions of company strengths and weaknesses and supply/demand forecasts later in the report. Additionally, he notes that the Jones Act that protects the US market is, in the opinion of Fortis, not material to the industry due to the state of decline of oilfield activity in the Gulf of Mexico.

In the demand arena, Mr. Barrett identifies four key issues: the number of manned platforms/production facilities that need fuel, food, or drilling supplies (the floating vs. fixed factor is also important here), the number of active offshore drilling rigs, day rates for drilling rigs, and the level of offshore construction activity. Based on these, he anticipates a combined incremental increase in demand of 180 AHTS and OSVs in 2005 and 146 of these vessels in 2006. A t the same time, he expects delivery of only 155 AHTS and OSVs in 2005, which certainly indicates improving fundamentals, not even accounting for the scrapping variable.

A Rising Tide May Not Lift All Boats

Mr. Barrett, however, does not believe that this improving market will bring egalitarian benefit to all, but rather result in definite winners and losers. He looks for companies with a strong balance sheet, geographic diversity and, most importantly, large numbers and percentages of next generation and deep-water capable vessels in their fleets. As support for this stance, he points to the difference in utilization rates between Hornbeck’s largely new generation, deep-water capable Gulf of Mexico fleet and Trico Marine’s older less capable fleet in the same area from 1999 to 2004. Hornbeck’s vessels enjoyed utilization rates that were on average 34% higher than Trico’s and commanded dayrates that were more than $5,000 higher. Further emphasizing this statement is the report’s assertion that “each new boat built should win work at the expense of an older boat.” While these differences to vary based on location and particular employment, the overall message is pronounced.

So who will bear the brunt of the market upturn? Fortis Bank initiated coverage with a BUY rating on both Seacor Holdings and Hornbeck Offshore Services. Target prices are set at $71.00 for Seacor and $33.00 for Hornbeck, as against closing prices of $59.30 and $23.98, respectively, on February 16. Dan Barrett explained that Seacor merits its rating by being a leading supply boat company that is also growing its aviation and barge businesses while Hornbeck demonstrates superior margins, growth and returns. Nevertheless, both companies are currently valued well below the peer average. Mr. Barrett’s price target for both companies is based on 11.5x EV/EBITDA, still an 11% discount to drilling peers.

If you’ve ever wanted to know more about the offshore supply boat sector but didn’t know how to look, we highly recommend Fortis Bank’s newly issued reports, which give an overview of the sector and initiate coverage on Seacor Holdings and Hornbeck Offshore Services. Despite noting the sector’s history of being “plagued by over-capacity, low barriers to entry, and commoditized pricing,” analyst Dan Barrett is bullish on the short-term prospects for the sector, expecting to see a number of supply boat companies exceed consensus expectations over the next few quarters.

Mr. Barrett expects that supply will outstrip demand in the sector over the next 12-18 months, but is not shy about his belief that a rising tide will not lift all boats. He expects the market for new generation and deep-water capable boats to be quite strong, with utilization rates likely climbing from the 85-90% range to the mid 90s and day rates hitting record levels. Meanwhile, utilization rates for older boats with more limited capabilities will rise only along the margin.

In the Sector Note issued by Fortis, Mr. Barrett first discusses in detail the primary types of boats involved in the sector – Anchor Handling Towing Supply, Offshore Supply Vessels, Crew Boats and Standby/Rescue Vessels, among others – and the key global offshore basins – the Gulf of Mexico, the North Sea, West Africa, Asia – Pacific, the Middle East, Brazil, and the rest of Latin America. He gives an overview of the rate tendencies and contract types that prevail in the various vessel-types and regions that gives substance to his discussions of company strengths and weaknesses and supply/demand forecasts later in the report. Additionally, he notes that the Jones Act that protects the US market is, in the opinion of Fortis, not material to the industry due to the state of decline of oilfield activity in the Gulf of Mexico.

In the demand arena, Mr. Barrett identifies four key issues: the number of manned platforms/production facilities that need fuel, food, or drilling supplies (the floating vs. fixed factor is also important here), the number of active offshore drilling rigs, day rates for drilling rigs, and the level of offshore construction activity. Based on these, he anticipates a combined incremental increase in demand of 180 AHTS and OSVs in 2005 and 146 of these vessels in 2006. A t the same time, he expects delivery of only 155 AHTS and OSVs in 2005, which certainly indicates improving fundamentals, not even accounting for the scrapping variable.

A Rising Tide May Not Lift All Boats

Mr. Barrett, however, does not believe that this improving market will bring egalitarian benefit to all, but rather result in definite winners and losers. He looks for companies with a strong balance sheet, geographic diversity and, most importantly, large numbers and percentages of next generation and deep-water capable vessels in their fleets. As support for this stance, he points to the difference in utilization rates between Hornbeck’s largely new generation, deep-water capable Gulf of Mexico fleet and Trico Marine’s older less capable fleet in the same area from 1999 to 2004. Hornbeck’s vessels enjoyed utilization rates that were on average 34% higher than Trico’s and commanded dayrates that were more than $5,000 higher. Further emphasizing this statement is the report’s assertion that “each new boat built should win work at the expense of an older boat.” While these differences to vary based on location and particular employment, the overall message is pronounced.

So who will bear the brunt of the market upturn? Fortis Bank initiated coverage with a BUY rating on both Seacor Holdings and Hornbeck Offshore Services. Target prices are set at $71.00 for Seacor and $33.00 for Hornbeck, as against closing prices of $59.30 and $23.98, respectively, on February 16. Dan Barrett explained that Seacor merits its rating by being a leading supply boat company that is also growing its aviation and barge businesses while Hornbeck demonstrates superior margins, growth and returns. Nevertheless, both companies are currently valued well below the peer average. Mr. Barrett’s price target for both companies is based on 11.5x EV/EBITDA, still an 11% discount to drilling peers.

Morgan Stanley Downgrades Energy Shipping,

Remains Optimistic About Future

Morgan Stanley analysts Mark MacLean and Ole Slorer have been keeping a close watch on the US-listed tanker market lately. They caught a lot of people’s attention when they lowered their energy shipping Industry View from Attractive to In-line and lowered their recommendation on General Maritime from Overweight-V to Equal Weight. While Tradewinds notes that the analysts are concerned about factors like the decline in valuation for single-hull tankers, we understand that Mr. Slorer and Mr. MacLean believe that tanker stocks have only taken a run up in line with improving fundamentals in their market. The two recommend in their report that investors “lock in” the profits they can get off the latest run, as strong fourth quarter results are released, and look for a “better entry point in April-May.” Additionally, General Maritime, whose stock price was at $49.60 when the report was published, had reached within range of the $53.00 price target the Morgan Stanley analysts set when the company first announced its new dividend policy, so a re-rating to Equal Wight seems fairly natural.Morgan Stanley Downgrades Energy Shipping,

Remains Optimistic About Future

Morgan Stanley analysts Mark MacLean and Ole Slorer have been keeping a close watch on the US-listed tanker market lately. They caught a lot of people’s attention when they lowered their energy shipping Industry View from Attractive to In-line and lowered their recommendation on General Maritime from Overweight-V to Equal Weight. While Tradewinds notes that the analysts are concerned about factors like the decline in valuation for single-hull tankers, we understand that Mr. Slorer and Mr. MacLean believe that tanker stocks have only taken a run up in line with improving fundamentals in their market. The two recommend in their report that investors “lock in” the profits they can get off the latest run, as strong fourth quarter results are released, and look for a “better entry point in April-May.” Additionally, General Maritime, whose stock price was at $49.60 when the report was published, had reached within range of the $53.00 price target the Morgan Stanley analysts set when the company first announced its new dividend policy, so a re-rating to Equal Wight seems fairly natural.

Morgan Stanley analysts Mark MacLean and Ole Slorer have been keeping a close watch on the US-listed tanker market lately. They caught a lot of people’s attention when they lowered their energy shipping Industry View from Attractive to In-line and lowered their recommendation on General Maritime from Overweight-V to Equal Weight. While Tradewinds notes that the analysts are concerned about factors like the decline in valuation for single-hull tankers, we understand that Mr. Slorer and Mr. MacLean believe that tanker stocks have only taken a run up in line with improving fundamentals in their market. The two recommend in their report that investors “lock in” the profits they can get off the latest run, as strong fourth quarter results are released, and look for a “better entry point in April-May.” Additionally, General Maritime, whose stock price was at $49.60 when the report was published, had reached within range of the $53.00 price target the Morgan Stanley analysts set when the company first announced its new dividend policy, so a re-rating to Equal Wight seems fairly natural.

Odfjell Set to Raise up to NOK 600 million with

Inaugural Issue

On February 16, Odfjell launched its inaugural bond issue in the Norwegian market. The issue is to have a maximum amount of NOK 600 million (about $94.3m USD), with a first tranche of NOK 300 million. DnB NOR Markets is serving as sole lead manager for the issue, which has a tenor of three years and a coupon of 3-month NIBOR + 1.10%. Odfjell specializes in the transportation of chemicals and other specialty bulk liquids.

On February 16, Odfjell launched its inaugural bond issue in the Norwegian market. The issue is to have a maximum amount of NOK 600 million (about $94.3m USD), with a first tranche of NOK 300 million. DnB NOR Markets is serving as sole lead manager for the issue, which has a tenor of three years and a coupon of 3-month NIBOR + 1.10%. Odfjell specializes in the transportation of chemicals and other specialty bulk liquids.

Categories:

Bonds,

Freshly Minted | February 17th, 2005 |

Add a Comment

Two Holders, $18M, Tender Into Stolt-Nielsen Consent

Predictably, there was not an overwhelming response to Stolt-Nielsen S.A.’s offer to buy back bonds at 103. The reason we use the term “predictably” is because the tender price for the Notes was actually lower than the current trading price of the bonds. As we understand it, two holders comprising $18.2 million offered in their bonds, though we aren’t sure exactly why they would do it. As we’ve discussed in these pages before, we fully expect SNSA to offer the mandatory make-whole on their bonds and leases in order to loosen the restrictions imposed upon the company in consideration for restructuring the Notes in mid-2004.

Predictably, there was not an overwhelming response to Stolt-Nielsen S.A.’s offer to buy back bonds at 103. The reason we use the term “predictably” is because the tender price for the Notes was actually lower than the current trading price of the bonds. As we understand it, two holders comprising $18.2 million offered in their bonds, though we aren’t sure exactly why they would do it. As we’ve discussed in these pages before, we fully expect SNSA to offer the mandatory make-whole on their bonds and leases in order to loosen the restrictions imposed upon the company in consideration for restructuring the Notes in mid-2004.

Categories:

Bonds,

Freshly Minted | February 17th, 2005 |

Add a Comment

UBS Prices American Commercial Lines Bonds at 9.5%

As yet another startling example of the excessive amount of liquidity currently splashing around in the high yield bond market, formerly bankrupt American Commercial Lines (NASDAQ: AMCOV.PK) priced $200 million of bonds at 9.5% last Wednesday. Initial “price talk” for the deal was 9-5/8-9-7/8, but demand was so strong (6x oversubscribed) that the B3/B- rated transaction priced at 9.5%. Sole bookrunner on the deal was UBS (who also provided the company with its credit facility) and Bank of America served as co-manager.

Like the entire universe of marine-related high yield deals, ACL is already trading at 104, which brings the yield to worst down to 8.8%. The new bonds have a 10-year tenor and are non-callable for 5 years. Other extraordinary examples of successful shipping bond issuance and post transaction price tightening include CSFB’s deal for Ultrapetrol, Jefferies’ deal for Trailer Bridge, Jefferies/

Goldman Sachs deal for Hornbeck and UBS’ deal for Horizon Lines. Although the equity market has been receiving all of the headlines in recent months, largely due to where we are in the shipping cycle, the fact remains that high yield, especially when used to fund 100% acquisition cost, remains an incredibly cheap source of equity that, with today’s yield, is competitive compared to the German tax leasing market. Even deals with a CCC, or “triple hooks” rating, are getting done at phenomenally low rates.

What is particularly impressive about the deal is the valuation. Although ACL is leveraged 4x EBITDA, the fleet is comprised of barges that are toward the send of their useful lives. Therefore, the company will have to be very successful and aggressive in renewing their fleet or growing their business in order to meet the bullet refinancing that will occur in 10 years. The bonds are not the only instruments that are trading well. The company’s newly listed stock, which trades on the pink sheets, is trading at about $30, giving it a market capitalization of about $300 million.

As yet another startling example of the excessive amount of liquidity currently splashing around in the high yield bond market, formerly bankrupt American Commercial Lines (NASDAQ: AMCOV.PK) priced $200 million of bonds at 9.5% last Wednesday. Initial “price talk” for the deal was 9-5/8-9-7/8, but demand was so strong (6x oversubscribed) that the B3/B- rated transaction priced at 9.5%. Sole bookrunner on the deal was UBS (who also provided the company with its credit facility) and Bank of America served as co-manager.

Like the entire universe of marine-related high yield deals, ACL is already trading at 104, which brings the yield to worst down to 8.8%. The new bonds have a 10-year tenor and are non-callable for 5 years. Other extraordinary examples of successful shipping bond issuance and post transaction price tightening include CSFB’s deal for Ultrapetrol, Jefferies’ deal for Trailer Bridge, Jefferies/Goldman Sachs deal for Hornbeck and UBS’ deal for Horizon Lines. Although the equity market has been receiving all of the headlines in recent months, largely due to where we are in the shipping cycle, the fact remains that high yield, especially when used to fund 100% acquisition cost, remains an incredibly cheap source of equity that, with today’s yield, is competitive compared to the German tax leasing market. Even deals with a CCC, or “triple hooks” rating, are getting done at phenomenally low rates.

What is particularly impressive about the deal is the valuation. Although ACL is leveraged 4x EBITDA, the fleet is comprised of barges that are toward the send of their useful lives. Therefore, the company will have to be very successful and aggressive in renewing their fleet or growing their business in order to meet the bullet refinancing that will occur in 10 years. The bonds are not the only instruments that are trading well. The company’s newly listed stock, which trades on the pink sheets, is trading at about $30, giving it a market capitalization of about $300 million.

Categories:

Bonds,

Freshly Minted | February 17th, 2005 |

Add a Comment

2004 Earnings Begin to Roll In – Some Break Records,

Others See Mixed Results

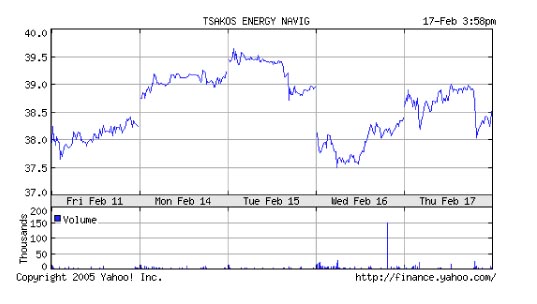

Public tanker companies OMI Corporation and Teekay Shipping both started the year off with a bang by announcing last year’s results, showing growth that was virtually off the charts. Tanker yield play Knightsbridge also brought exceedingly strong numbers, enough to prompt Jefferies analysts Magnus Fyhr and Douglas Mavrinac to commend the company for exceeding expectations, though not enough to lift the company any further than its HOLD rating. CP Ships enjoyed modest growth of both net income and revenue, even as the company recovers from its results restatement in 2003 and deals with the class action lawsuits that followed in its wake. Meanwhile, US-flag petroleum transporter Maritrans saw a rise in revenue paired with a drop in net income, though.

Public tanker companies OMI Corporation and Teekay Shipping both started the year off with a bang by announcing last year’s results, showing growth that was virtually off the charts. Tanker yield play Knightsbridge also brought exceedingly strong numbers, enough to prompt Jefferies analysts Magnus Fyhr and Douglas Mavrinac to commend the company for exceeding expectations, though not enough to lift the company any further than its HOLD rating. CP Ships enjoyed modest growth of both net income and revenue, even as the company recovers from its results restatement in 2003 and deals with the class action lawsuits that followed in its wake. Meanwhile, US-flag petroleum transporter Maritrans saw a rise in revenue paired with a drop in net income, though.

Categories:

Equity,

Freshly Minted | February 17th, 2005 |

Add a Comment