TBS Offers Investors Blend of Dry Bulk and Liner

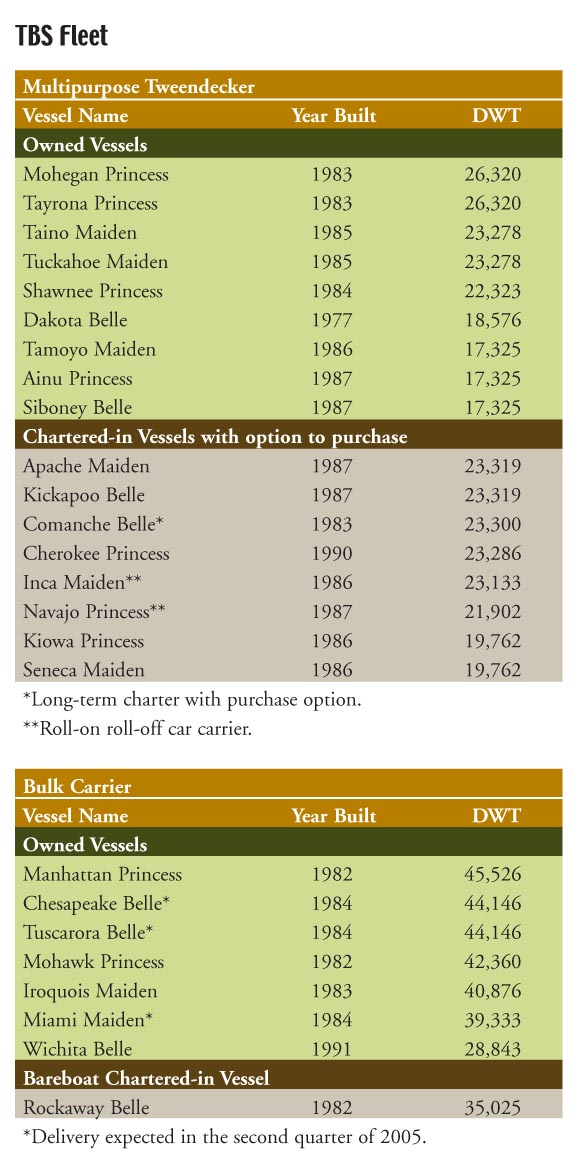

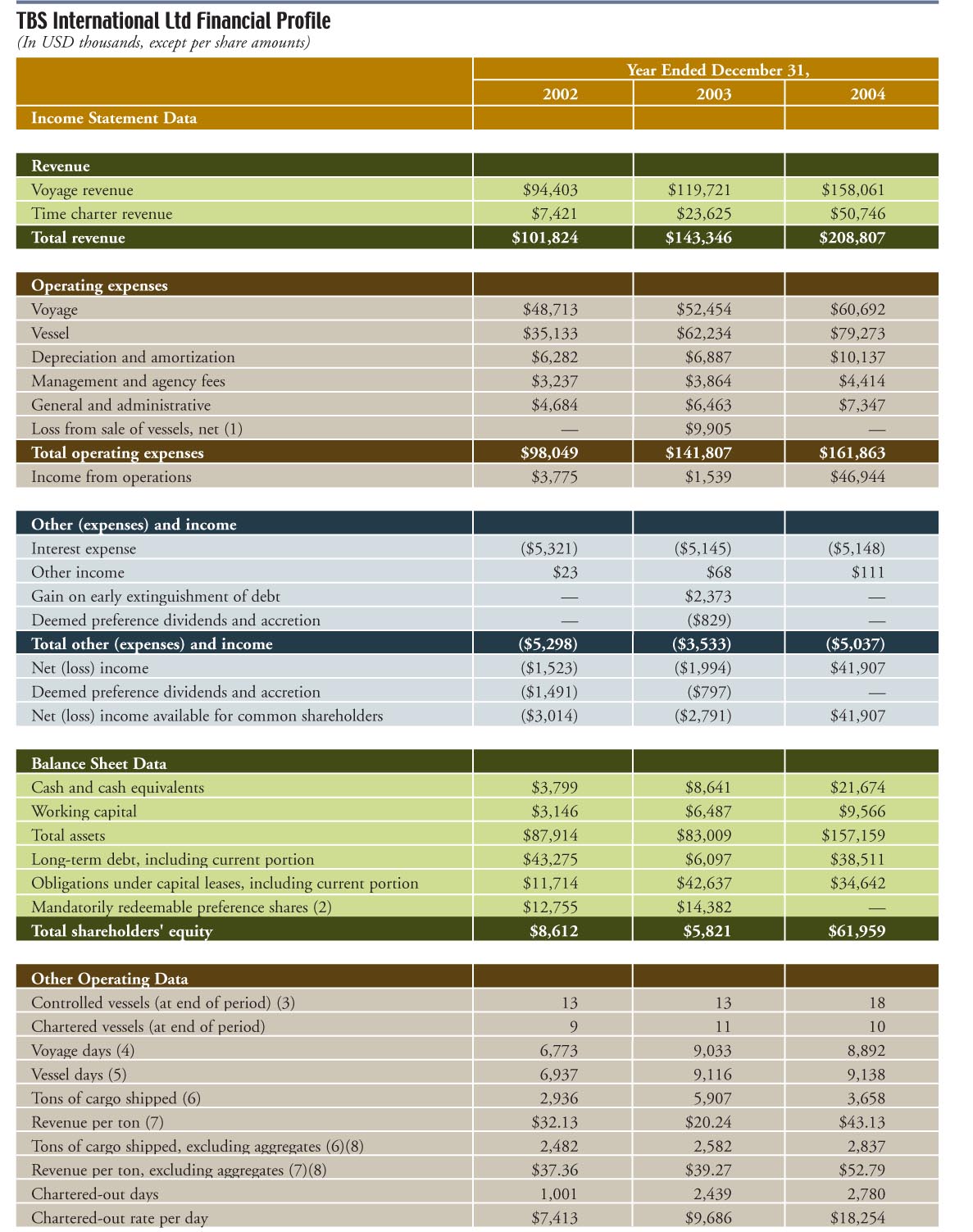

Last week we were delighted to see that TBS International Limited filed an S-1 with the U.S. SEC for an initial public offering on the NYSE under the ticker symbol TSI. The company seeks to raise up to $125 million through underwriters Merrill Lynch & Co. (who recently financed some of their ships and brought ex-Goldman Banker Mark Friedman on board in February to build a shipping practice) and Jefferies & Company. For those of you who aren’t familiar with the company, TBS is based in Yonkers, New York and provides liner, parcel, bulk and vessel chartering services on a select group of international routes, particularly between Latin America and China and Japan and South Korea. The company currently operates a fleet of 30 vessels, 13 of which are owned, nine of which are under charters with purchase options, and eight of which are under charters without such options.

TBS International’s strategy is and has been to stay away from the vagaries of the tramp market and instead target niche markets, where the necessity of local knowledge and strong customer relationships creates high barriers to entry. The company considers it important to tailor its scheduling to customers like Honeywell in hard-to-reach ports and with unusual carrying needs. Smaller vessels with flexible capabilities allow the vessels access to a variety of smaller ports that the more popular and economical larger vessels cannot reach. Proceeds from the offering are to allow the company to focus on increasing its market share in key routes while developing new trade routes through selected fleet expansion. As far as make-up, TBS intends to maintain its combination dry bulk and multipurpose tweendeckers focus. If suitable vessels are not available to purchase, then proceeds in the meantime will be used to repay debt and for working capital. Memoranda of agreement have, however, been completed for the purchase of three additional dry bulk vessels, as can be seen in the fleet list.

In the “Risk Factors” section, TBS International cites the extent to which its fate is linked with both the Chinese and global economies. The company notes that it has a history of losses – namely five loss-making years since 1997 – and that it filed for bankruptcy in 2000. A large part of this misfortune can be attributed, the company attests, to the sharp decline in the South American and Asian economies from which TBS derives much of its business. Unlike U.S.-flag Horizon Lines, TBS is fully subject to the volatility associated with international shipping; the hope, of course, is that this will also allow investors greater access to upside potential.

The B&H EBITDA Machine

B+H Ocean Carriers announced on Wednesday that it has now taken delivery of all three mid-1990s, double hull combination carriers that it had agreed to acquire for $110.2 million. Each of these vessels was simultaneously delivered to Sempra Energy or Glencore, the major oil companies with which they have 5-year time charters. Here’s where it gets interesting; B+H specified in the press release EBITDA for the next 12 months at the level of $48-50 million. The depreciation cost is set to be $13.1 million over this period and interest expense to be approximately $3.4 million. These expenses subtracted from $49 million, the midpoint of the expected EBITDA range, yield earnings of 32.5 million over the next 12 months. This boils down to roughly $8.00 per share, implying that B+H is selling at a price to earnings multiple around 3x, about 35-40% over the industry average. Although many of the company’s tankers will be phased out in the coming years, the important thing is that their earnings are virtually guaranteed, with 98% of the fleet’s vessel days fixed through March 2006. For investors who believe the company can continue to do good accretive deals that lower the age of fleet, this company is a good bet.

Deep Sea Supply Signs Letter of Intent to Buy 6 AHTS from Tidewater

The latest company to evolve this month is Norwegian Deep Sea Supply put together by project brokers S&T Energy (based in London, Oslo and Moscow) and Mr. Odd Breivik. The new company has agreed to acquire six AHTS vessels from Tidewater for a price of $202 million, pending financing. If the deal goes through, Tidewater will make a healthy financial gain of $80 million. The vessels are KMAR 404 class and were built at Kværner Kleven in 1998-99.

The company has secured, pending other financing, a $100 million facility from Fortis Bank, and it plans to launch a convertible bond of between $17 and $60 million, as well as a private placement to investors of between $64 and $123 million. Norwegian investment banks ABG Sundal Collier and First Securities, who are running the show, are in London this week for the roadshow, which is to close on March 18. The company aims to list on the OSE following the completed financing and has a growth strategy that involves the acquisition of more vessels.

Oslo Likes Offshore

The Norwegian investors like offshore. With Norwegian interests responsible for half of the 21 jack-ups ordered over the past six months, and four semi submersibles on spec, it can’t get any hotter than this. Mr. John Fredriksen is investing some of his excess cash into the rig market, and we see new companies being formed to benefit from the expected growth. To accommodate this, it follows that there are also new supply ship companies being formed out of Norway.

Seacor Finds Value in Seabulk

After being in play for more than a year, Seacor Holdings Inc. announced on Wednesday night that they had signed a definitive agreement to acquire tanker/offshore services company Seabulk International, and the transaction has been unanimously approved by the board of directors at each of the companies. According to the agreement, holders of Seabulk stock will for each share receive approximately 0.2694 shares of Seacor common stock and $4.00 in cash. This represents a premium of approximately 29% to where the shares of the companies were trading at market close on March 16; CKH closed at $65.28 while SBLK closed at $16.73. As of press time, Seabulk’s stock has jumped to $21.01, while Seacor’s has fallen marginally to $64.15, which is a typical market reaction to an acquisition.

Private equity funds Carlyle/Riverstone Global Energy and Power Fund I, LP and CSFB-affiliated DLJ Merchant Banking Partners III, LP own approximately 75% of Seabulk’s common shares. Unlike hedge fund Wexford, which sold stock into the open market for many months, Carlyle and CSFB have been patiently waiting to sell for more than a year.. The transaction itself will be worth a total of approximately $1.003 billion, comprised of $532 million in aggregate equity value and $471 million in net debt obligations, comprised of Title XI bonds on the tankers, a high yield bond and a revolving credit facility from Fortis.

When Riverstone bought Seabulk, the investment thesis was that they paid for the company’s modern double hull U.S. flag product tankers and got the offshore business for free. We suspect Seacor’s rationale is probably very similar. Seacor is hardly a stranger to Seabulk as the former bought many of the latter’s more modern assets when Seabulk when into financial distress in 1999.

The last time we valued Seabulk, we arrived at about $14/share, so advisor Jefferies must be feeling very good about the valuation it achieved. UBS Securities acted as financial advisor to Seacor on the transaction. Credit Suisse First Boston advised on behalf of its DLJ Merchant Banking fund. The merger is expected to close by the end of the second quarter of 2005, subject to approval by shareholders of Seacor and Seabulk.

Seacor Chairman and CEO Charles Fabrikant commented in a press release that: “The merger of Seacor and Seabulk fits the goal of diversification we have outlined for several years in annual letters to shareholders. Both Seacor and Seabulk have achieved leadership positions in different asset-based transportation service businesses. The combination will create a balanced portfolio of assets, focused on five different business niches. Seabulk’s position in the U.S. tanker business, with its business template of multi-year contracts, and the harbor tug business are a good balance to the offshore vessel sector, the helicopter business, and the inland river barge business.”

Seabulk’s Chairman and CEO Gerhard Kurz expressed similar sentiments, and it the new company will certainly go to a privileged position as one of only two companies providing complete global service in their specific industry. It will be interesting to see how this affects the valuation, though we do suspect there may be further shake-up to come after the transaction is finalized. OSG had in the past expressed interest in Seabulk’s tanker fleet, and with tanker values at a substantial premium to historical prices, it would not be too surprising to see Seacor opt to cash out on the value of Seabulk’s fleet rather than getting involved in a whole new industry that would not add much value to its other operations.

Diana Roadshow Attracting Lots of Investor Interest

Diana Roadshow Attracting Lots of Investor Interest

That’s what we hear. And why not: as the Nordic American Tankers of the dry bulk industry, we’re sure this deal will be snapped up by investors. The company began its investor presentations in London last week before coming over to the States.

Mergers & Acquisitions to Dominate 2005 Dealflow

Mergers & Acquisitions to Dominate

2005 Dealflow

It’s really no surprise, at least to us, that merger and acquisition activity has been very brisk so far in 2005. With companies flush with cash, credit abundant, the outlook for the markets positive into the foreseeable future and public markets assigning premium valuations to shipping companies, growth is the name of the game – and many of the public companies have gotten so large that single ship acquisitions are no longer meaningful.

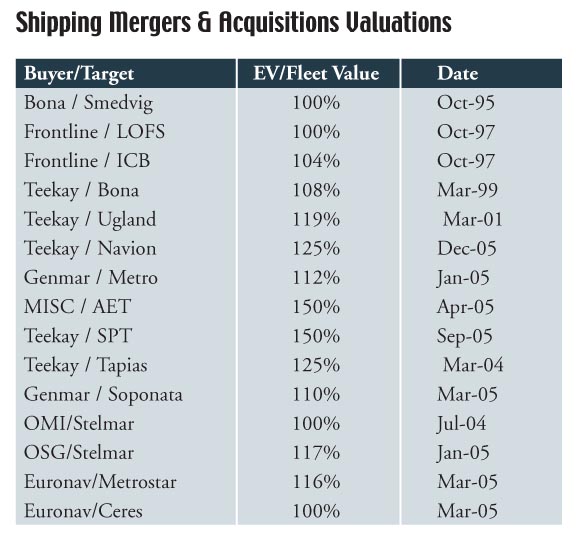

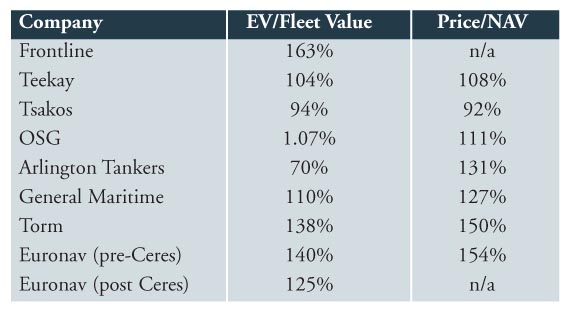

As the valuation table that accompanies this article shows, public shipping companies have been willing and able to pay premium prices for en bloc purchases, even when their own shares are priced at such a discount to the prices that they are paying that the transactions are effectively dilutive by some metrics. Due to the nature of shipping, most of these deals have involved hard assets only, and not employees, real estate, intellectual property, etc, and as a result, investment bankers have been supplanted by shipbrokers as advisors – and in many cases the shipowners have simply done the deals direct with no advisors at all.

Dominating the action in the last week has been the recently de-merged Euronav whose CEO Paddy Rogers has had one a heck of a busy start to the month of March. In the last 10 days, the company has announced acquistions of 16 ships totaling about $1.5 billion. For those who aren’t familiar with the company, Euronav is key driver behind the Tankers International pool and currently has whole or partial interest in a fleet of 28 VLCCs and ULCCs – 25 of which trade in the TI pool and represent more than half the total fleet of that marketing alliance.

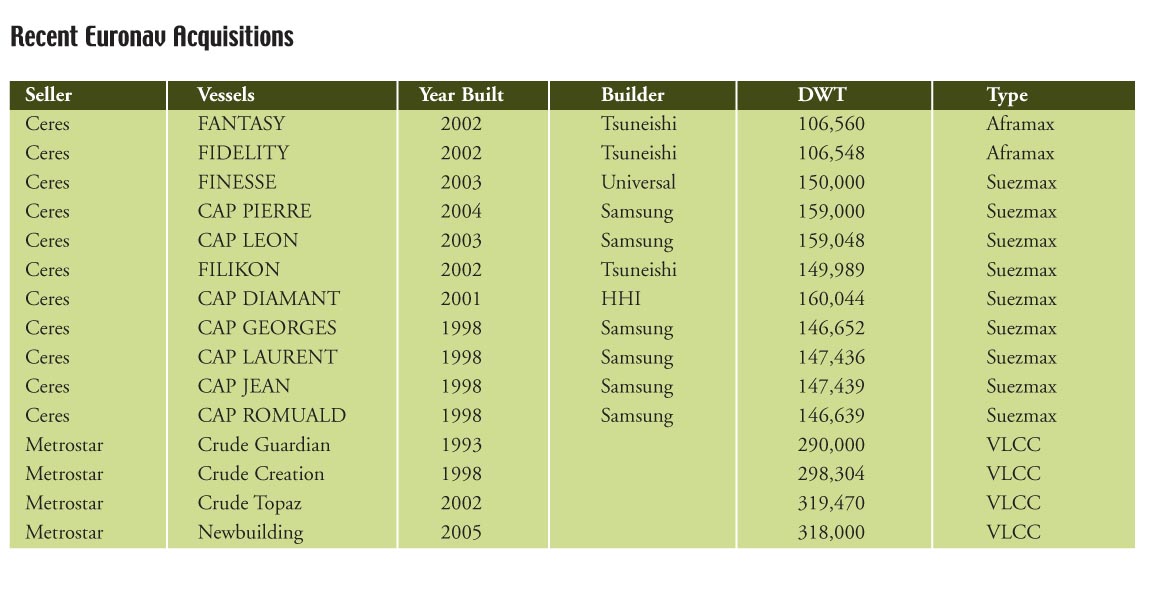

The first deal that the company announced, on March 3rd, was consistent with the Euronav’s existing business. The transaction involved the acquisition of four VLCCs from Metrostar; the Crude Guardian (1993 – 290,927 dwt), the Crude Creation (1998 – 298,304 dwt), the Crude Topaz (2002 – 319,470 dwt) and a newbuilding (± 318,000 dwt) to be delivered in May 2005 for a total purchase price of $477.5 million – or $120 million each. At the time of the announcement, Euronav said that the new vessels would be entered into the TI pool. “Given the market outlook, the Executive Committee is confident that the addition of the 4 vessels will be accretive to both growth and earnings of the company.” A big move, a full price. Fine.

And then just five days later Euronav filed a public statement saying that it had successfully concluded negotiations to acquire a controlling position in Tanklog, the suezmax/aframax operation owned and managed by Livanos-controlled Ceres Hellenic, for $1.07 billion. Now this was an interesting one. In addition to the sheer size of the deal, this transaction was a shocker because it marked the VLCC-focused company’s move into two new sectors. Tanklog’s fleet consists of 14 Suezmax tankers, of which five will deliver from Samsung in 2006 and 2007. The fleet also has two modern double hull aframax tankers.

Euronav will use a combination of stock, cash and assumption of debt to fund the purchase with some of the considering likely coming from the recent $1.2 billion unsecured loan that the company is presently marketing through Nordea at LIBOR + 80 basis points. Euronav will pay $410 million in cash at the closing and will issue to Ceres 10.5 million primary shares lifting the total shares outstanding to 52.5 million and giving the Livanos a 20% stake in the entire enterprise, compared to the 45% controlled by members of the Saverys family. Euronav will also assume $300 million in debt on the suezmax tankers under construction. Euronav could certainly be a player in the US capital markets, but to date the company has shown little interest in being exposed to vagaries of regulatory requirements such as Sarbanes Oxley.

According to our calculations, Euronav paid a full price for the spot trading VLCCs and got good value for the suezmaxes. That said, although the valuation of the Ceres suezmax fleet appears low compared to the VLCC acquisition and other M&A deals, it is important to bear in mind that most the ships are on long term charter to Valero and Sun, many for as long as 10 years, and are therefore not commanding the $70,000 per day rates that spot suezmaxes are presently getting. All in all, the Ceres transaction was a clean and drama free deal, more likely done over the dinner table than the boardroom table, in which two partners in the Coeclerici dry bulk pool found that their objectives were perfectly aligned.

It’s really no surprise, at least to us, that merger and acquisition activity has been very brisk so far in 2005. With companies flush with cash, credit abundant, the outlook for the markets positive into the foreseeable future and public markets assigning premium valuations to shipping companies, growth is the name of the game – and many of the public companies have gotten so large that single ship acquisitions are no longer meaningful.

As the valuation table that accompanies this article shows, public shipping companies have been willing and able to pay premium prices for en bloc purchases, even when their own shares are priced at such a discount to the prices that they are paying that the transactions are effectively dilutive by some metrics. Due to the nature of shipping, most of these deals have involved hard assets only, and not employees, real estate, intellectual property, etc, and as a result, investment bankers have been supplanted by shipbrokers as advisors – and in many cases the shipowners have simply done the deals direct with no advisors at all.

Dominating the action in the last week has been the recently de-merged Euronav whose CEO Paddy Rogers has had one a heck of a busy start to the month of March. In the last 10 days, the company has announced acquistions of 16 ships totaling about $1.5 billion. For those who aren’t familiar with the company, Euronav is key driver behind the Tankers International pool and currently has whole or partial interest in a fleet of 28 VLCCs and ULCCs – 25 of which trade in the TI pool and represent more than half the total fleet of that marketing alliance.

The first deal that the company announced, on March 3rd, was consistent with the Euronav’s existing business. The transaction involved the acquisition of four VLCCs from Metrostar; the Crude Guardian (1993 – 290,927 dwt), the Crude Creation (1998 – 298,304 dwt), the Crude Topaz (2002 – 319,470 dwt) and a newbuilding (± 318,000 dwt) to be delivered in May 2005 for a total purchase price of $477.5 million – or $120 million each. At the time of the announcement, Euronav said that the new vessels would be entered into the TI pool. “Given the market outlook, the Executive Committee is confident that the addition of the 4 vessels will be accretive to both growth and earnings of the company.” A big move, a full price. Fine.

And then just five days later Euronav filed a public statement saying that it had successfully concluded negotiations to acquire a controlling position in Tanklog, the suezmax/aframax operation owned and managed by Livanos-controlled Ceres Hellenic, for $1.07 billion. Now this was an interesting one. In addition to the sheer size of the deal, this transaction was a shocker because it marked the VLCC-focused company’s move into two new sectors. Tanklog’s fleet consists of 14 Suezmax tankers, of which five will deliver from Samsung in 2006 and 2007. The fleet also has two modern double hull aframax tankers.

Euronav will use a combination of stock, cash and assumption of debt to fund the purchase with some of the considering likely coming from the recent $1.2 billion unsecured loan that the company is presently marketing through Nordea at LIBOR + 80 basis points. Euronav will pay $410 million in cash at the closing and will issue to Ceres 10.5 million primary shares lifting the total shares outstanding to 52.5 million and giving the Livanos a 20% stake in the entire enterprise, compared to the 45% controlled by members of the Saverys family. Euronav will also assume $300 million in debt on the suezmax tankers under construction. Euronav could certainly be a player in the US capital markets, but to date the company has shown little interest in being exposed to vagaries of regulatory requirements such as Sarbanes Oxley.

According to our calculations, Euronav paid a full price for the spot trading VLCCs and got good value for the suezmaxes. That said, although the valuation of the Ceres suezmax fleet appears low compared to the VLCC acquisition and other M&A deals, it is important to bear in mind that most the ships are on long term charter to Valero and Sun, many for as long as 10 years, and are therefore not commanding the $70,000 per day rates that spot suezmaxes are presently getting. All in all, the Ceres transaction was a clean and drama free deal, more likely done over the dinner table than the boardroom table, in which two partners in the Coeclerici dry bulk pool found that their objectives were perfectly aligned.

TORM Picks Up Six Tankers from LGR Navigazione

As we go to press, we understand that Danish tanker and bulk shipping company TORM has agreed to purchase a modern fleet of five product tankers and one panamax tanker from LGR Navigazione. The vessels range from just over 17,000 mdwt up to 72,000 mdwt and have an average age in the range of five years; only the panamax tanker was built before 2000. Purchase price is said to be around $290 million, and the ships had previously been a part of the TORM pool.

The purchase falls right in line with TORM’s stated policy of continued fleet renewal. It also comes after TORM’s January purchase of 5.5 product tankers from Malaysia Bulk Carriers Group and Wah Kwong Shipping Holdings Limited for $250 million.

Concurrent with the purchase, Jefferies analysts Magnus Fyhr and Douglas Mavrinac issued a report downgrading TORM from a Buy to a Hold. This should probably not be taken too bearishly, however, as they are maintaining their former price target of $55.00. TORM has crossed this threshold in the past week, but at $51.18 is trading a few dollars below it at presstime. The analysts cite valuation as the reason for the downgrade, noting that TORM trades at a significant premium to its tanker comparables at 8.2 times 2005E EPS and over 130% of NAV. It doesn’t help that Jefferies has reduced 2005 EPS estimates for the company from $7.49 to $6.30. However, the analysts maintain that both the product tanker and dry bulk markets have attractive outlooks.

DryShips Gets a BUY

Although they were not even an underwriter on the deal, Jefferies has become the first to publish research on DryShips. It seems like we have featured an article on DryShips every week since 2005 began. Both massive and controversial, this deal seems to have some of the key ingredients to maintaining the market spotlight, and everyone has an opinion. Last week we got a brief synopsis of Kathryn Welling’s strongly negative opinion of the deal, a viewpoint that emphasized George Economou’s dubious history in the U.S. capital markets and the lack of historical research done by investors.

This week, Jefferies analysts Magnus Fyhr and Douglas Mavrinac have published a much brighter view. The pair rates DryShips a Buy, with a target price of no less than $30 per share. Their report begins with a focus on the apparently magical factors that whisked DryShips’ IPO performance above all expectations: growth in China and energy demand. The outlook on these fronts has yet to change. Mr. Fyhr and Mr. Mavrinac also look for increased global industrial activity and believe that strong growth in India and the U.S. will buttress the more widely discussed growth in China. Further into the future, they note that increasing competition for shipyard capacity should serve to limit fleet growth beyond 2008. And yard owners seeking to maximize margins will often turn away from the lower-value added dry bulk vessels if they are forced to choose.

But dry bulk market prospects have been reported to be strong for some time, and the niche has long been under-represented in the U.S. capital markets. While there are always those who caution against the shipping industry’s cyclicality, much of the criticism surrounding the DryShips deal, like that of Ms. Welling, revolved around specifics of the company, its principal, and the particular deal. That is why the more interesting part of the Jefferies report is its support for DryShips specifically, as a particularly well-situated player in the dry bulk industry.

Asset Prices, Consolidation and Valuations

Mr. Fyhr and Mr. Mavrinac believe that DryShips is “poised to become a consolidator in the dry bulk market.” The company’s acquisition of 19 vessels in the short period since its IPO and its current stance as the world’s second largest panamax dry bulk operator lend credibility to this statement. And while many have commented that vessel prices are too high for DryShips’ pace of acquisition, in the event of a serious market downturn the company will be greatly helped by the fact that its purchases have been funded in such large proportion by equity, rather than debt that needs to be serviced.

The Jefferies report also cites DryShips as being an “attractive dividend yield with potential for extraordinary dividends.” The company is reasonably valued at 2.9x price to book, though it is expensive at a price to net asset value ratio of 170%, especially considering the premium at which asset values currently stand. However, at price to cashflow ratios for 2005E and 2006E of 3.3x and 3.1x, respectively, DryShips trades at a substantial discount to tanker comparables.

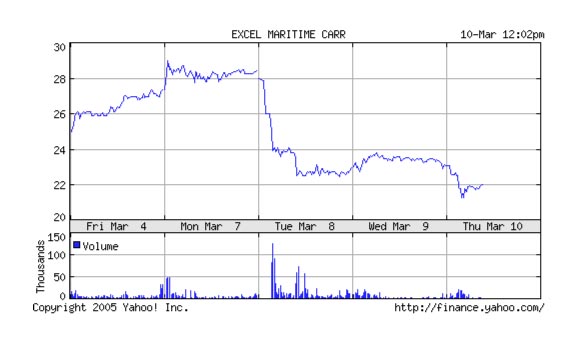

Excel Goes Back to Equity Markets

Investors in the US are hungry for dry bulk shares and Excel Maritime is serving up another round, just as Diana Shipping moves its roadshow from London to America. Having raised $52 million through a share sale to institutional investors in late 2004, sold at a steep discount to the then-current trading price, Excel Maritime is bravely heading back to the equity markets for another round. Investors took the stock down sharply when the company announced its intention to issue another 5,899,000 shares through sales agents Cantor Fitzgerald & Co. and Hibernia Southcoast Capital. The company hopes to raise up to $32.1 million with this offering.

The proceeds are primarily to be used to pay for identified vessels, for which Memoranda of Agreement have already been signed. Proceeds may also be made available for the purchase of additional vessels or, to a lesser extent, general corporate purposes. Excel further reiterated its desire to continue its fleet expansion when on Wednesday the company agreed to acquire the MV IDC 2, to be renamed the MV Attractive, for a price of $15.5 million. The handymax bulk carrier was built in 1985, which contrasts with the company’s stated objective of reducing the age of its fleet, by Mitsubishi Engineering & Shipbuilding Co. and has a capacity of 41,500 dwt.

Then on Thursday Excel announced that the company had agreed to acquire the handymax bulk carrier MV Fiona Bulker, to be renamed the MV Princess I, for a price of $25.6 million. The 38,800 dwt vessel was built in 1994 by Ishikawajima-Harima Heavy Industries.

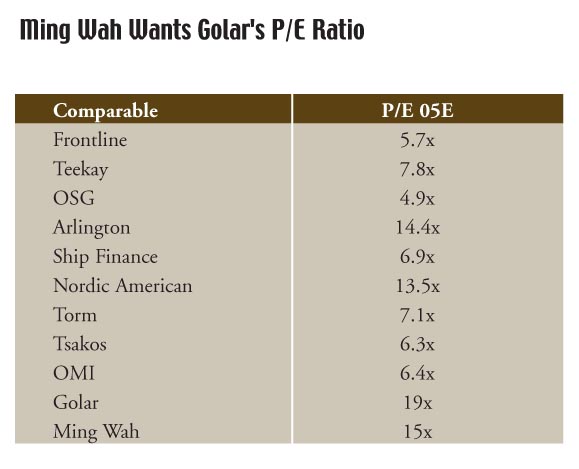

China Merchants Group Aims to Take Ming Wah to Market for $600 million

On a slightly less immediate front than the steady stream of shipping IPOs coming to the U.S. capital markets, China Merchants Group has announced its intention to list its oil tanker business, Ming Wah, in the A-share market in China. The group is hoping to raise up to US$600 million through the offering, and Chairman Qin Xiao has his sights set on a price to earnings ratio in the 12-15x range. The listing is expected to come to market in June or July.