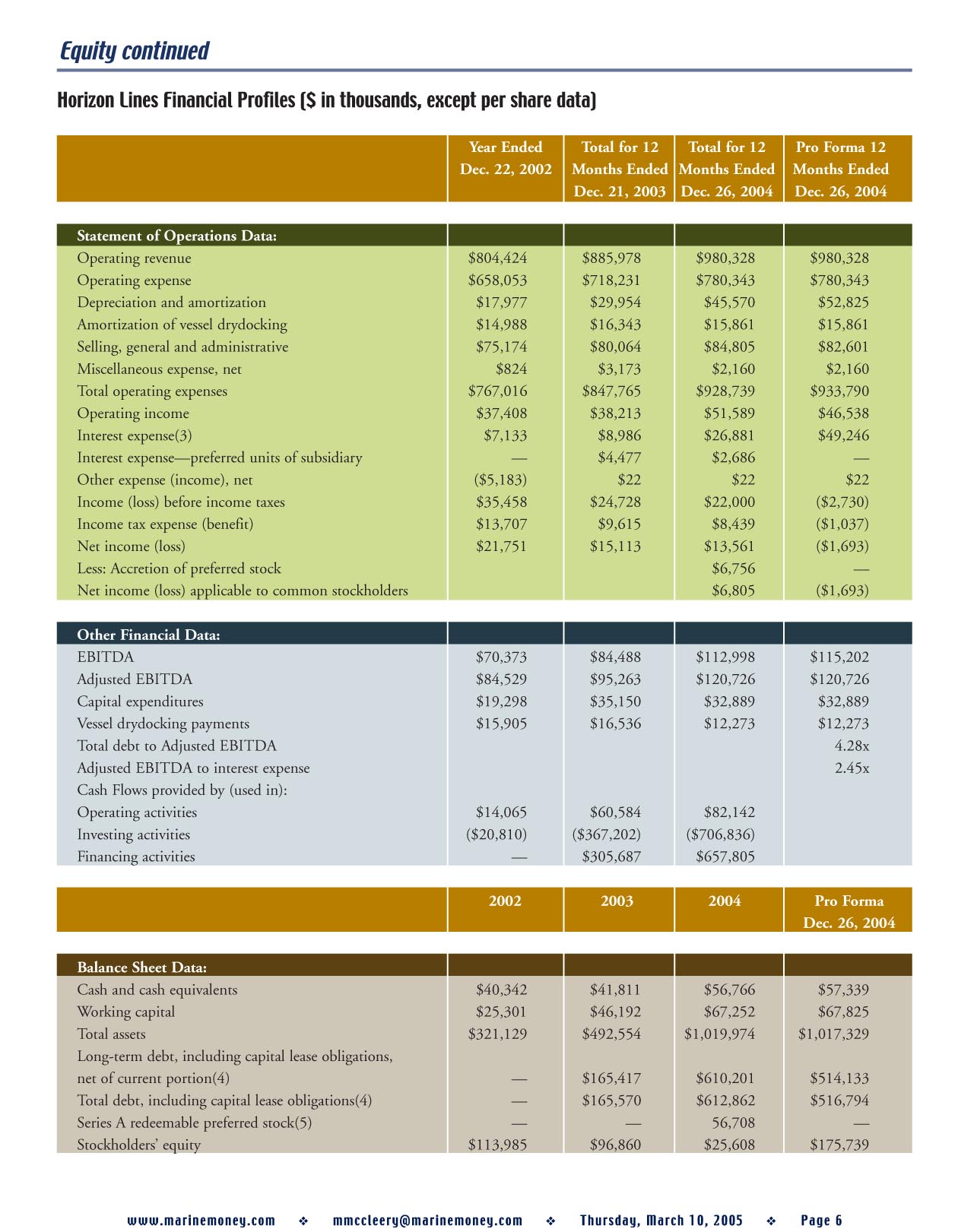

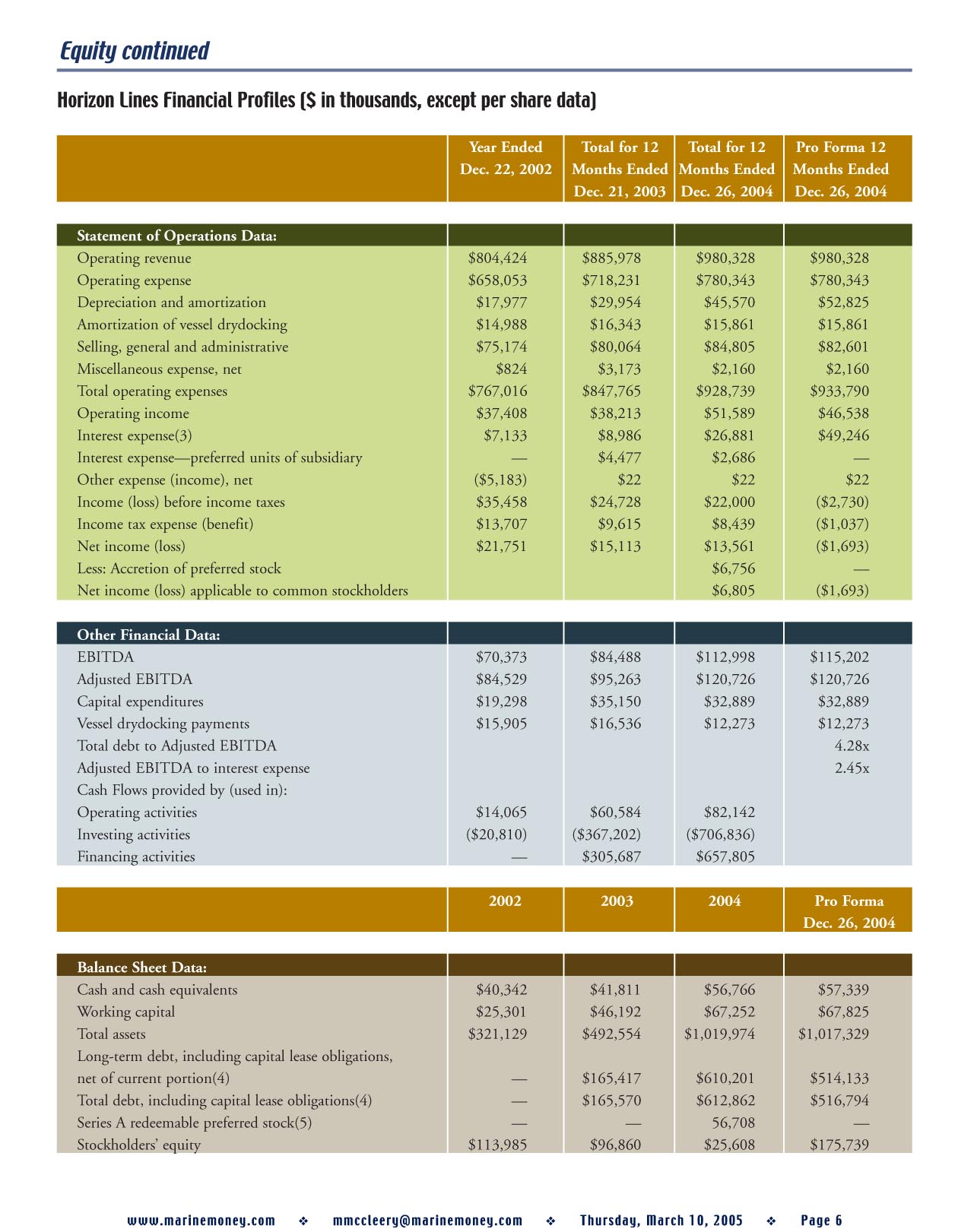

It appears as if the equity in Horizon Lines will be turned over yet again – for the third time in as many years. Leading Jones Act container shipping and logistics company Horizon Lines has filed an S-1 with the U.S. SEC in its bid to raise up to $287.5 million through its initial public offering. The company is looking to be listed on the NYSE under the symbol HRZ. Joint bookrunning lead managers on the deal are Goldman, Sachs & Co. and UBS Investment Bank, while co-managers are Bear, Stearns & Co., Deutsche Bank Securities and JP Morgan. The deal comes as private equity firm Castle Harlan, which purchased Horizon Lines in July 2004, seeks to cash out on some of its massive $663.3 million investment while maintaining a controlling stake in the company, which is well-positioned strategically in all three of the non-contiguous U.S. Jones Act markets as well as Guam. Castle Harlan extracted about $80 million of its original investment in the company through the issuance of a zero coupon bond in late 2004, and this deal will likely represent a total return of invested equity.

A Little Something for Everyone

By way of review, the Carlyle Group of Washington, D.C. had bought Horizon from CSX Lines for around $375 million in 2002 before selling the company to Castle Harlan for over $650 million in 2004. While the trade press reported that Carlyle nearly double its money, that statistic refers to the enterprise value of the company and assumes the firm used its own money. In actual fact, assuming Carlyle put up 20% of the equity on the original deal, then the private equity firm would have turned its $75 million initial investment into $350 million, or a return of about 460% on its equity.

On the surface, the deal looked reasonably priced even from Castle Harlan’s perspective at 7.3x. However, significant deductions for drydocking expenditures brought the multiple to 11-13x, placing the purchase at the upper end of the reasonable range, but still not shocking considering how sacrosanct the Jones Act is. But then, using the metrics behind the $140 million price Kvaerner Philadelphia newbuildings fetched from Matson with a 40-year amortization period, Horizon Lines’ vessels can be valued at about $35 million each, reasonably closer to what Castle Harlan paid for them before even considering the steady stream of earnings the vessels bring. Less than a year later, Castle Harlan has already extracted $80 million from Horizon through a bond offering and stands ready to issue almost $290 million worth of shares.

Horizon –a Cash Cow for Goldman Sachs

But when you look at risk adjusted returns, the sure winner is the investment bank that has been involved every step of the way, Goldman Sachs. Horizon has been a true cash-cow for the firm as they bought the company for Carlyle, then sold the company to Castle, then did two bond offerings for the company for Castle and are now bookrunner on the equity offering.

What’s Left?

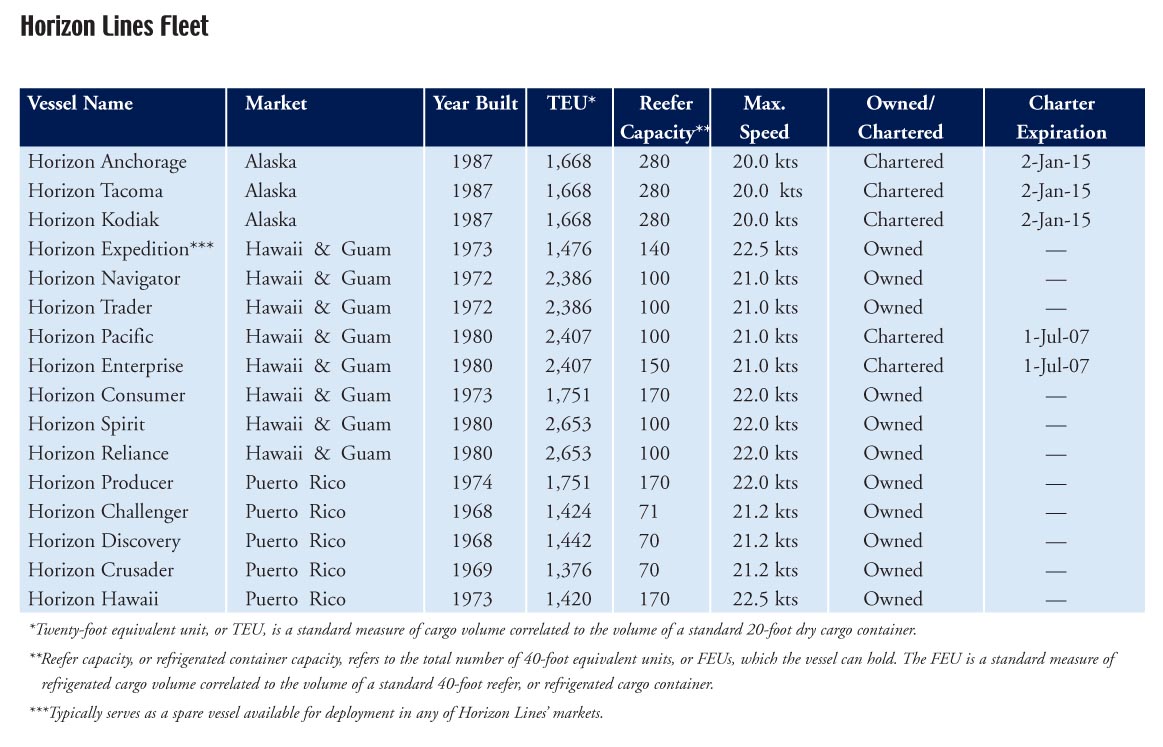

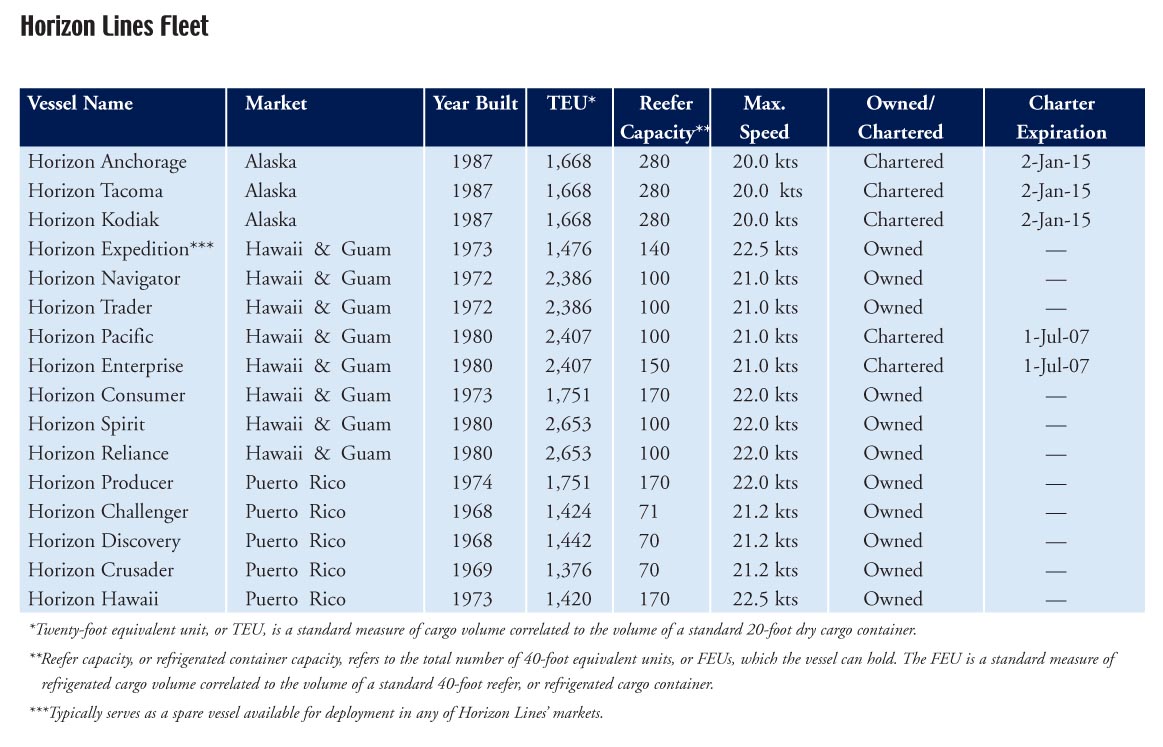

Like most deals, there are “pros and cons” to the Horizon transaction. The “pros” are that the company has a privileged position in a U.S. Jones Act trade, which limits competition to companies that have U.S. built ships that are owned at least 75% by Americans, fly the U.S. flag and have U.S. crews. Horizon is one of only two providers of its services in the Hawaii and Guam markets and the largest such provider in Guam – two stable and growing, albeit slowly, markets.

And then there are the “cons”, Horizon has been bounced between two private equity firms who have extracted a lot of equity over the last three years and have not replaced any of the company’s 28-year-old vessels. The proceeds of this deal will pay back the founders and reduce debt, which will theoretically create buying power assuming they can arrange like kind debt facilities, but at some point there will be some major capital expenditures to be made even though the company states that each of its ships has a 45-year useful life.

The story is not exciting, but it is solid. So long as the sacrosanct U.S. Jones Act is not altered and the maintenance and replacement of the company’s fleet does not prove to be a problem. And it certainly makes sense for Castle Harlan, who has no particular need to maintain much more than a controlling stake in the company, and who also can hardly hope to follow in the footsteps of Carlyle and watch the company double in value once again over the next two years.

Categories:

Equity,

Freshly Minted | March 10th, 2005 |

Add a Comment

As we go to press, we understand that Danish tanker and bulk shipping company TORM has agreed to purchase a modern fleet of five product tankers and one panamax tanker from LGR Navigazione. The vessels range from just over 17,000 mdwt up to 72,000 mdwt and have an average age in the range of five years; only the panamax tanker was built before 2000. Purchase price is said to be around $290 million, and the ships had previously been a part of the TORM pool.

The purchase falls right in line with TORM’s stated policy of continued fleet renewal. It also comes after TORM’s January purchase of 5.5 product tankers from Malaysia Bulk Carriers Group and Wah Kwong Shipping Holdings Limited for $250 million.

Concurrent with the purchase, Jefferies analysts Magnus Fyhr and Douglas Mavrinac issued a report downgrading TORM from a Buy to a Hold. This should probably not be taken too bearishly, however, as they are maintaining their former price target of $55.00. TORM has crossed this threshold in the past week, but at $51.18 is trading a few dollars below it at presstime. The analysts cite valuation as the reason for the downgrade, noting that TORM trades at a significant premium to its tanker comparables at 8.2 times 2005E EPS and over 130% of NAV. It doesn’t help that Jefferies has reduced 2005 EPS estimates for the company from $7.49 to $6.30. However, the analysts maintain that both the product tanker and dry bulk markets have attractive outlooks.

Diana Shipping –

Sailing Toward a Successful IPO

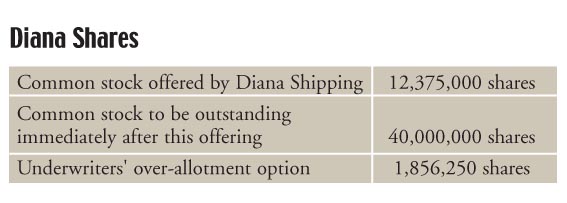

Simeon Palios and Fortis-owned Diana Shipping began its roadshow in London this week to raise $241 million through the sale of 14.2 million shares of common stock, which will trade on the New York Stock Exchange under the ticker “DSX”. Bear Stearns is sole bookrunner on the deal, and co-managers include Jefferies & Company, UBS Investment Bank and Fortis Securities, which immediately prior to the offering will own 25% of Diana through its private equity fund Maas Capital Investments.

A Dry Bulk Version of Nordic American Shipping

We see absolutely no reason why this offering will not be wildly successful. As we’ve seen in the last 12 months, every new shipping deal that comes to market brings with it a slightly different structure, fleet and philosophy that suits both the selling shareholders and, ideally, investors – and Diana is no exception.

For example, proceeds from the Diana IPO will be used to reduce the net debt on the company’s post-IPO fleet of 10 bulk carriers to zero while the company has pledged to pay out all of its free cash. Sound familiar? It should; this technique is reminiscent of Nordic American Tankers, which not coincidentally is the brainchild of underwriter Bear Stearns – NATS enjoys the strongest valuation in its peer group.

According to our own 2004 pro forma of the company’s financial performance (and assuming no reserve), Diana would have been able to pay a dividend of $1.94, which equates to a whopping 11% yield based on the anticipated offering price, although this is before whatever amount the management feels it should keep on hand for working capital and growth. When the opportunities arise, the unleveraged Diana will simply borrow against its unpledged assets and go shopping. The prospectus notes that “in times when we have debt outstanding, we intend to limit our dividends per share to the amount that we would have been able to pay if we were financed entirely with equity.”

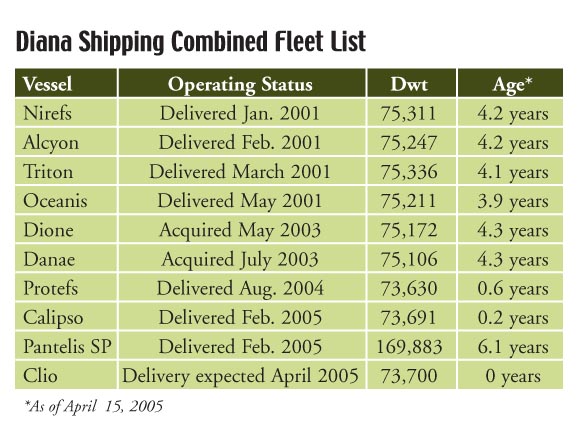

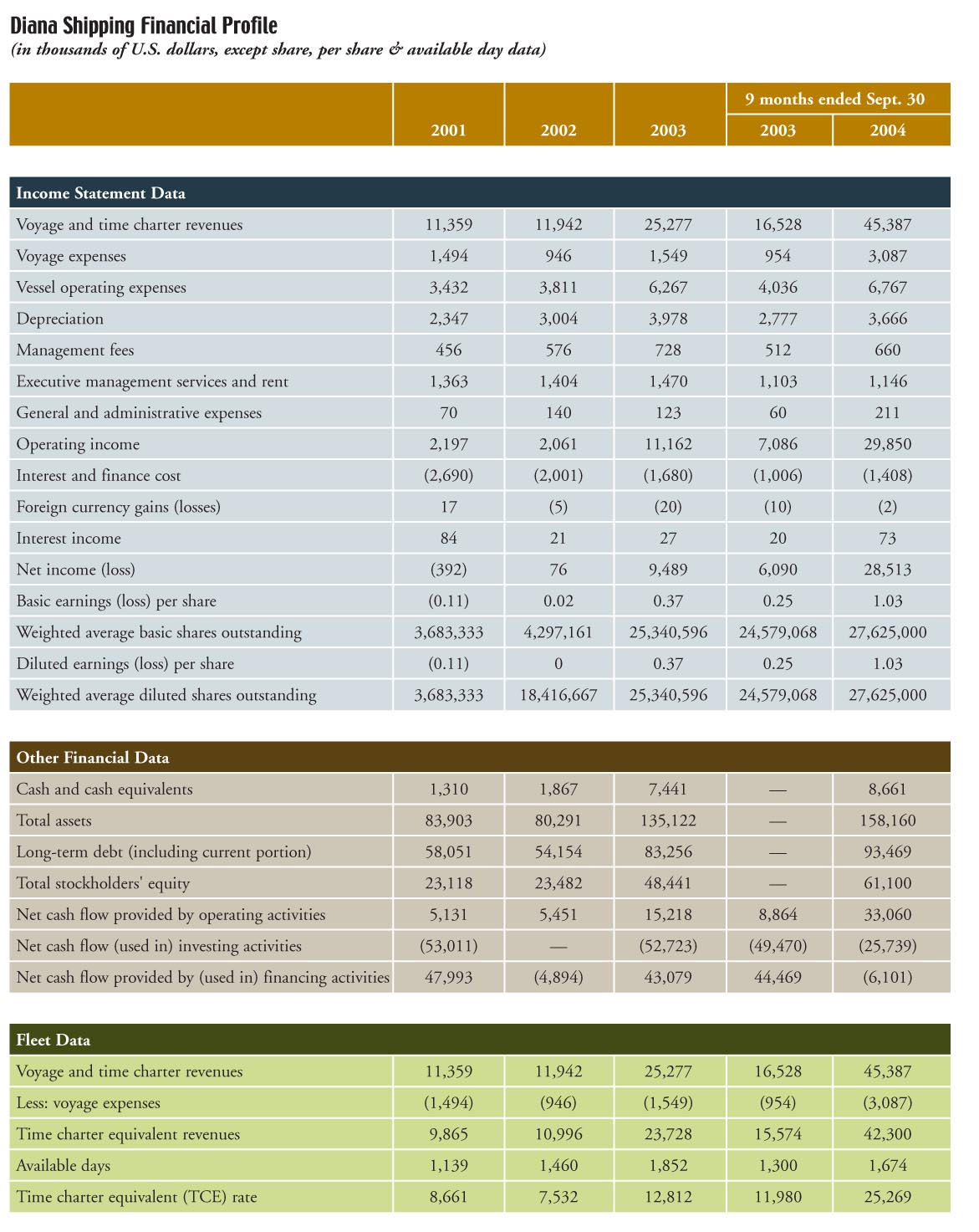

As the fleet list indicates, Diana owns a fleet of seven modern panamax vessels with an average age of just 3.1 years, which should make the fleet very attractive to investors so long as the price can be justified. As the fleet is indeed focused, it is not diversified, meaning investors will be exposed to one of the most volatile segments of the dry bulk business. According to the Form F-1 filed with the SEC, during the nine month period ended September 30, 2004, the company’s vessels achieved daily time charter equivalent rates of $25,269. To give you a sense of just how volatile this business is, the company also said that “during 2001, 2002 and 2003 and the nine months ended September 30, 2004, we recorded net income (loss) of ($0.4) million, $0.1 million, $9.5 million and $28.5 million, respectively.”

Diana’s plan is to grow the business with modern units, and the company recently entered into newbuilding contracts with a Chinese shipyard for the construction of two additional 73,000dwt panamaxes. The company also signed an MOA with Louis Dreyfus Armateurs to purchase a secondhand capesize vessel. All of the new ships should be in the fleet and earning money by the first half of 2005.

Use of Proceeds

As mentioned above, one of the novel features of the Diana transaction is the fact that the company will use the proceeds of the offering to eliminate debt. Of the $182 million proceeds, after fees and expenses, the company will use $15.0 million to fund the final installment due on the new panamax dry bulk carrier that it expects to be delivered to the company in April 2005 and the remaining $166.4 million to repay all of seven of its outstanding credit facilities that mature between June 2013 and November 2015 and bear interest at LIBOR plus 1.125% to LIBOR plus 1.3%.

Although the company’s ships are managed by an affiliate, another interesting feature of this deal is the fact that Diana has agreed to buy the ship management company, Diana Shipping Services (DSS), in the future. According to the filing, “We have entered into an agreement with the stockholders of DSS pursuant to which the DSS stockholders may sell all, but not less than all, of their outstanding shares of DSS to us during the 12 month period following the consummation of this offering for $20.0 million in cash. Under the terms of the agreement, if the DSS stockholders do not sell their outstanding shares to us prior to the one-year anniversary of this offering, we may purchase the DSS shares from them for the same consideration at any time prior to the second anniversary of this offering. We expect the DSS stockholders to sell their outstanding shares of DSS to us during the 12 months following the offering and intend to exercise our option if they do not do so. We intend to finance our expected acquisition of our fleet manager with borrowings under our new credit facility and to refinance the acquisition related debt with the net proceeds of future equity issuances. Upon our acquisition of DSS, DSS will become our wholly-owned subsidiary and we will conduct the strategic, commercial and technical management of our fleet in-house.”

According to the filing, DSS charges Diana $15,000 per month to manage its soon to be 10 ships – giving DSS revenue of $1.8 million. DSS also charges Diana a 2% commission on all revenue generated by the company’s ships. Using the figure of $25,000 per day, each of the 10 vessels will generate $9.1 million, or $91 million on a fleet basis. Using the 2% commission structure, DSS will earn another $1.8 million on the revenue, lifting DSS’ gross revenue, from Diana alone, to $3.6 million. Although we have no idea what sort of overhead the company will have, we would estimate that running 10 ships from Greece would cost in the order of $1 million – leaving net income of $2.6 million. Therefore, according to the purchase price to be paid by the public company, DSS will fetch 13x earnings.

Dilution

Any shipping deal that comes to market with assets on its balance sheet that are less than current market values plus the premium to NAV currently assigned to shipping companies will result in dilution to the new shareholders – and Diana is no exception. Moreover, as we saw in the case of DryShips, this dilution is increased when the selling shareholders extract cash from retained earnings from the balance sheet prior to the offering. In this case, here is how it works: “As of November 30, 2004, on an adjusted basis giving effect to the payment of a $34.0 million cash dividend in December 2004, the declaration of a $14.0 million dividend in February 2005 (payable in April 2005 to stockholders of record in February 2005) and a $19.5 million preferential deemed dividend (representing the portion of the consideration to purchase our fleet manager that exceeds the carrying value of our fleet manager’s net assets as of September 30, 2004) that we expect to record in connection with our acquisition of our fleet manager, we had net tangible book value of $20.7 million, or $0.75 per share. After giving effect to the sale of 12,375,000 shares of common stock at an assumed initial public offering price of $16.00 per share (representing the midpoint of the price range shown on the cover of this prospectus), our pro forma adjusted net tangible book value as of November 30, 2004, would have been $202.8 million, or $5.07 per share. This represents an immediate appreciation in adjusted net tangible book value of $4.32 per share to existing stockholders and an immediate dilution in adjusted net tangible book value of $10.93 per share to new investors.”

Based on the ready comparison between DryShips and Diana, it is very difficult to imagine that investors will not love this deal. Although we are certainly closer to the top of the shipping cycle than the bottom, the reality is that modern ships with minimal leverage will survive even the nastiest of market corrections and be around for the next turn of the cycle. In our view, this transaction is proof that underwriters, investors and shipping companies have learned from the unfortunate high yield bonds issued in the late 1990s and have created structures that capture all of the value that shipping has to offer.

Simeon Palios and Fortis-owned Diana Shipping began its roadshow in London this week to raise $241 million through the sale of 14.2 million shares of common stock, which will trade on the New York Stock Exchange under the ticker “DSX”. Bear Stearns is sole bookrunner on the deal, and co-managers include Jefferies & Company, UBS Investment Bank and Fortis Securities, which immediately prior to the offering will own 25% of Diana through its private equity fund Maas Capital Investments.

A Dry Bulk Version of Nordic American Shipping

We see absolutely no reason why this offering will not be wildly successful. As we’ve seen in the last 12 months, every new shipping deal that comes to market brings with it a slightly different structure, fleet and philosophy that suits both the selling shareholders and, ideally, investors – and Diana is no exception.

For example, proceeds from the Diana IPO will be used to reduce the net debt on the company’s post-IPO fleet of 10 bulk carriers to zero while the company has pledged to pay out all of its free cash. Sound familiar? It should; this technique is reminiscent of Nordic American Tankers, which not coincidentally is the brainchild of underwriter Bear Stearns – NATS enjoys the strongest valuation in its peer group.

According to our own 2004 pro forma of the company’s financial performance (and assuming no reserve), Diana would have been able to pay a dividend of $1.94, which equates to a whopping 11% yield based on the anticipated offering price, although this is before whatever amount the management feels it should keep on hand for working capital and growth. When the opportunities arise, the unleveraged Diana will simply borrow against its unpledged assets and go shopping. The prospectus notes that “in times when we have debt outstanding, we intend to limit our dividends per share to the amount that we would have been able to pay if we were financed entirely with equity.”

As the fleet list indicates, Diana owns a fleet of seven modern panamax vessels with an average age of just 3.1 years, which should make the fleet very attractive to investors so long as the price can be justified. As the fleet is indeed focused, it is not diversified, meaning investors will be exposed to one of the most volatile segments of the dry bulk business. According to the Form F-1 filed with the SEC, during the nine month period ended September 30, 2004, the company’s vessels achieved daily time charter equivalent rates of $25,269. To give you a sense of just how volatile this business is, the company also said that “during 2001, 2002 and 2003 and the nine months ended September 30, 2004, we recorded net income (loss) of ($0.4) million, $0.1 million, $9.5 million and $28.5 million, respectively.”

Diana’s plan is to grow the business with modern units, and the company recently entered into newbuilding contracts with a Chinese shipyard for the construction of two additional 73,000dwt panamaxes. The company also signed an MOA with Louis Dreyfus Armateurs to purchase a secondhand capesize vessel. All of the new ships should be in the fleet and earning money by the first half of 2005.

Use of Proceeds

As mentioned above, one of the novel features of the Diana transaction is the fact that the company will use the proceeds of the offering to eliminate debt. Of the $182 million proceeds, after fees and expenses, the company will use $15.0 million to fund the final installment due on the new panamax dry bulk carrier that it expects to be delivered to the company in April 2005 and the remaining $166.4 million to repay all of seven of its outstanding credit facilities that mature between June 2013 and November 2015 and bear interest at LIBOR plus 1.125% to LIBOR plus 1.3%.

Although the company’s ships are managed by an affiliate, another interesting feature of this deal is the fact that Diana has agreed to buy the ship management company, Diana Shipping Services (DSS), in the future. According to the filing, “We have entered into an agreement with the stockholders of DSS pursuant to which the DSS stockholders may sell all, but not less than all, of their outstanding shares of DSS to us during the 12 month period following the consummation of this offering for $20.0 million in cash. Under the terms of the agreement, if the DSS stockholders do not sell their outstanding shares to us prior to the one-year anniversary of this offering, we may purchase the DSS shares from them for the same consideration at any time prior to the second anniversary of this offering. We expect the DSS stockholders to sell their outstanding shares of DSS to us during the 12 months following the offering and intend to exercise our option if they do not do so. We intend to finance our expected acquisition of our fleet manager with borrowings under our new credit facility and to refinance the acquisition related debt with the net proceeds of future equity issuances. Upon our acquisition of DSS, DSS will become our wholly-owned subsidiary and we will conduct the strategic, commercial and technical management of our fleet in-house.”

According to the filing, DSS charges Diana $15,000 per month to manage its soon to be 10 ships – giving DSS revenue of $1.8 million. DSS also charges Diana a 2% commission on all revenue generated by the company’s ships. Using the figure of $25,000 per day, each of the 10 vessels will generate $9.1 million, or $91 million on a fleet basis. Using the 2% commission structure, DSS will earn another $1.8 million on the revenue, lifting DSS’ gross revenue, from Diana alone, to $3.6 million. Although we have no idea what sort of overhead the company will have, we would estimate that running 10 ships from Greece would cost in the order of $1 million – leaving net income of $2.6 million. Therefore, according to the purchase price to be paid by the public company, DSS will fetch 13x earnings.

Dilution

Any shipping deal that comes to market with assets on its balance sheet that are less than current market values plus the premium to NAV currently assigned to shipping companies will result in dilution to the new shareholders – and Diana is no exception. Moreover, as we saw in the case of DryShips, this dilution is increased when the selling shareholders extract cash from retained earnings from the balance sheet prior to the offering. In this case, here is how it works: “As of November 30, 2004, on an adjusted basis giving effect to the payment of a $34.0 million cash dividend in December 2004, the declaration of a $14.0 million dividend in February 2005 (payable in April 2005 to stockholders of record in February 2005) and a $19.5 million preferential deemed dividend (representing the portion of the consideration to purchase our fleet manager that exceeds the carrying value of our fleet manager’s net assets as of September 30, 2004) that we expect to record in connection with our acquisition of our fleet manager, we had net tangible book value of $20.7 million, or $0.75 per share. After giving effect to the sale of 12,375,000 shares of common stock at an assumed initial public offering price of $16.00 per share (representing the midpoint of the price range shown on the cover of this prospectus), our pro forma adjusted net tangible book value as of November 30, 2004, would have been $202.8 million, or $5.07 per share. This represents an immediate appreciation in adjusted net tangible book value of $4.32 per share to existing stockholders and an immediate dilution in adjusted net tangible book value of $10.93 per share to new investors.”

Based on the ready comparison between DryShips and Diana, it is very difficult to imagine that investors will not love this deal. Although we are certainly closer to the top of the shipping cycle than the bottom, the reality is that modern ships with minimal leverage will survive even the nastiest of market corrections and be around for the next turn of the cycle. In our view, this transaction is proof that underwriters, investors and shipping companies have learned from the unfortunate high yield bonds issued in the late 1990s and have created structures that capture all of the value that shipping has to offer.

Categories:

Equity,

Freshly Minted | March 3rd, 2005 |

Add a Comment

Be Bullish – Titan Tapping Bond Market for

Tanker Investments

You know a public company is truly bullish when they use bonds to raise capital instead of equity at this point in the cycle, despite solid stock market valuations. Although the difference may seem like a subtle one, it’s not – companies that issue bonds are basically saying that they do not want to give up any of the upside and are not particularly worried about the potential downside of correcting markets. Not surprisingly, we have not seen tons of bond issuance here in New York, despite the fact that yields are tighter (lower) than they have been for many years.

But leave it to tanker owner Titan Petrochemicals, listed on the Hong Kong Stock Exchange, to be bullish! Freshly Minted understands that oil tanker owner and oil trading group, who will join us as a panelist at Marine Money Week June 15-16, is planning to raise $400 million through a bond issue in Hong Kong. The company will use the proceeds of the offering to grow and renew its fleet of 30 single hull tankers, nine of which are VLCCs, and lower the 17-year average age of the ships. Morgan Stanley will be the sole bookrunner and lead manager for the senior unsecured bond issue, which has been rated B-/B1 by S&P and Moodys.

You know a public company is truly bullish when they use bonds to raise capital instead of equity at this point in the cycle, despite solid stock market valuations. Although the difference may seem like a subtle one, it’s not – companies that issue bonds are basically saying that they do not want to give up any of the upside and are not particularly worried about the potential downside of correcting markets. Not surprisingly, we have not seen tons of bond issuance here in New York, despite the fact that yields are tighter (lower) than they have been for many years.

But leave it to tanker owner Titan Petrochemicals, listed on the Hong Kong Stock Exchange, to be bullish! Freshly Minted understands that oil tanker owner and oil trading group, who will join us as a panelist at Marine Money Week June 15-16, is planning to raise $400 million through a bond issue in Hong Kong. The company will use the proceeds of the offering to grow and renew its fleet of 30 single hull tankers, nine of which are VLCCs, and lower the 17-year average age of the ships. Morgan Stanley will be the sole bookrunner and lead manager for the senior unsecured bond issue, which has been rated B-/B1 by S&P and Moodys.

Categories:

Bonds,

Freshly Minted | March 3rd, 2005 |

Add a Comment

Economou Deal Skewered By Investment Bank Weeden

In this past week’s welling@weeden newsletter, Kathryn Welling wrote a no-holds-barred critique of George Economou, his DryShips deal and, most importantly, the investors who participated. Really, the only thing the piece respected was Mr. Economou’s ruthless intelligence.

“He knows well, too, that institutional memory in the investment world, other than in a few “relics” like himself, these days has a lifespan rivaling that of a fruit fly. Still, he’d thought, the red herring was so outrageous, the deal’s timing so brazenly on the heels, practically, of its principal’s last disastrous (for the public) foray into the public markets, that sparks would just have to fly when this fellow dared show his face in New York.”

Ms. Welling has harsh words for “the sea of speculative sap flowing around anything even remotely connected to the energy sector,” and quotes an attendee at the DryShips lunch as describing “a room full of portfolio managers being led like lambs to slaughter.” The unnamed source also noted that no one even questioned what had happened with the massive Alpha Shipping Plc loan default that occurred only in 1998. And Ms. Welling doesn’t stop there. She then runs through red flags in the prospectus, ranging from the close family connections that are rife throughout DryShips and its several affiliates to the immediate and substantial dilution incurred by purchasers of DryShips shares and the $69 million dividend received by the company’s original shareholders. She also quoted one shipping analyst that was “stunned that Economou made so little” in the strong freight markets of the past two years. If the dry bulk market remains strong, Ms. Welling’s review makes for an entertaining history. If it collapses, it is a damning critique of Wall Street.

In this past week’s welling@weeden newsletter, Kathryn Welling wrote a no-holds-barred critique of George Economou, his DryShips deal and, most importantly, the investors who participated. Really, the only thing the piece respected was Mr. Economou’s ruthless intelligence.

“He knows well, too, that institutional memory in the investment world, other than in a few “relics” like himself, these days has a lifespan rivaling that of a fruit fly. Still, he’d thought, the red herring was so outrageous, the deal’s timing so brazenly on the heels, practically, of its principal’s last disastrous (for the public) foray into the public markets, that sparks would just have to fly when this fellow dared show his face in New York.”

Ms. Welling has harsh words for “the sea of speculative sap flowing around anything even remotely connected to the energy sector,” and quotes an attendee at the DryShips lunch as describing “a room full of portfolio managers being led like lambs to slaughter.” The unnamed source also noted that no one even questioned what had happened with the massive Alpha Shipping Plc loan default that occurred only in 1998. And Ms. Welling doesn’t stop there. She then runs through red flags in the prospectus, ranging from the close family connections that are rife throughout DryShips and its several affiliates to the immediate and substantial dilution incurred by purchasers of DryShips shares and the $69 million dividend received by the company’s original shareholders. She also quoted one shipping analyst that was “stunned that Economou made so little” in the strong freight markets of the past two years. If the dry bulk market remains strong, Ms. Welling’s review makes for an entertaining history. If it collapses, it is a damning critique of Wall Street.

Navigation Finance Closes 8-year Deal on

Rio Tinto Panamax

Details are very sketchy, but we understand from market sources that NFC’s Al Rubban Fund has closed an 8-year bareboat on the 1996-built panamax bulker Endeavour owned by Pratap Shirke’s PanOceanic Bulk Carriers. Close watchers of the high yield fiasco of the late 1990s will recall that the ship was part of the PanOceanic fleet, which issued bonds through Chase in 1997 and were the first to restructure with a $0.75 settlement. As we understand this deal, NFC purchased the ship from Shirke and bareboated it back to him, after which time Shirke then bareboated the vessel to mining giant Rio Tinto, which then hired Shirke to perform technical management. Debt on the deal, which we assume was at least 90% of the purchase price thanks to an 8-year deal with a credit like Rio Tinto, was provided by Bank of Ireland.

Details are very sketchy, but we understand from market sources that NFC’s Al Rubban Fund has closed an 8-year bareboat on the 1996-built panamax bulker Endeavour owned by Pratap Shirke’s PanOceanic Bulk Carriers. Close watchers of the high yield fiasco of the late 1990s will recall that the ship was part of the PanOceanic fleet, which issued bonds through Chase in 1997 and were the first to restructure with a $0.75 settlement. As we understand this deal, NFC purchased the ship from Shirke and bareboated it back to him, after which time Shirke then bareboated the vessel to mining giant Rio Tinto, which then hired Shirke to perform technical management. Debt on the deal, which we assume was at least 90% of the purchase price thanks to an 8-year deal with a credit like Rio Tinto, was provided by Bank of Ireland.

Categories:

Freshly Minted,

Leasing | March 3rd, 2005 |

Add a Comment

MC Shipping In Sale/Leaseback on Bergesen LPG Ships

The progress that CEO Tony Crawford has made at MC Shipping over the last few months has been nothing short of remarkable. In that time, the once dormant Amex-listed company has shown a burst of energy and ambition with the sale of its older container ships, the recapitalization of its balance sheet, the streamlining of its shareholding structure, the buy back of its bonds, the expansion of its banking relationship and a sharp focus on the white-hot LPG sector. Not surprisingly, MC’s share price has soared 167%, from $3 to $8, over the course of the restructuring.

In the company’s latest move, MC announced late last week that it had acquired two very large LPG vessels from Bergesen. MC paid $83 million for the 75,000 cubic Berge Flanders (1991) and 77,000 cubic Berge Kobe (1987) and leased the ships back to Bergesen for five years. Although this deal is largely an equity financing (the success of which will hinge on residual values when the ships are redelivered) and could have been done in the KS market, it demonstrates MC’s ambition to be a leading player in one of the hottest sectors of shipping. Including the new ships, MC Shipping owns a fleet of nine LPG vessels, including three VLGC’s and six smaller vessels ranging from 3,000 to 77,000 cubic meters in capacity. MC also retains an investment in four container ships as well as two small sea-river vessels.

The progress that CEO Tony Crawford has made at MC Shipping over the last few months has been nothing short of remarkable. In that time, the once dormant Amex-listed company has shown a burst of energy and ambition with the sale of its older container ships, the recapitalization of its balance sheet, the streamlining of its shareholding structure, the buy back of its bonds, the expansion of its banking relationship and a sharp focus on the white-hot LPG sector. Not surprisingly, MC’s share price has soared 167%, from $3 to $8, over the course of the restructuring.

In the company’s latest move, MC announced late last week that it had acquired two very large LPG vessels from Bergesen. MC paid $83 million for the 75,000 cubic Berge Flanders (1991) and 77,000 cubic Berge Kobe (1987) and leased the ships back to Bergesen for five years. Although this deal is largely an equity financing (the success of which will hinge on residual values when the ships are redelivered) and could have been done in the KS market, it demonstrates MC’s ambition to be a leading player in one of the hottest sectors of shipping. Including the new ships, MC Shipping owns a fleet of nine LPG vessels, including three VLGC’s and six smaller vessels ranging from 3,000 to 77,000 cubic meters in capacity. MC also retains an investment in four container ships as well as two small sea-river vessels.

Categories:

Freshly Minted,

Leasing | March 3rd, 2005 |

Add a Comment

Nordic American Raises $173 million,

JP Morgan Bearish

Nordic American Tanker Shipping priced it’s 3.5 million share follow-on offering today at $49.50 per share, raising $173 million not counting 545,000 shares reserved for over-allotments. Bear, Stearns & Co. and UBS investment Bank are acting as joint bookrunning managers on the deal while DnB NOR Markets is serving as co-manager. The proceeds from the deal are to be used to repay any amounts borrowed under the company’s senior secured credit facility and to go towards the price of two suezmax tankers that NAT had previously agreed to purchase.

Early in the morning of the day the offering priced, JP Morgan issued research reports initiating both Nordic American and fellow tanker yield-play Knightsbridge as Underweight.

Nordic American Tanker Shipping priced its 3.5 million share follow-on offering today at $49.50 per share, raising $173 million not counting 545,000 shares reserved for over-allotments. Bear, Stearns & Co. and UBS Investment Bank are acting as joint bookrunning managers on the deal while DnB NOR Markets is serving as co-manager. The proceeds from the deal are to be used to repay any amounts borrowed under the company’s senior secured credit facility and to go towards the price of two suezmax tankers that NAT had previously agreed to purchase.

Early in the morning of the day the offering priced, JP Morgan issued research reports initiating both Nordic American and fellow tanker yield-play Knightsbridge as Underweight.

Categories:

Equity,

Freshly Minted | March 3rd, 2005 |

Add a Comment

Euronav Snaps up Six Metrostar VLCCs,

Ghandoor Takes Two

In a transaction that eliminates one company as a candidate for an IPO but adds another, Theodore Angelopoulos’ Metrostar is rumored to have netted around $200 million in profit in a massive sale of eight VLCCs at an average price in the range of $127 million. Two of the ships went to Lebanese-owned, Greek-based VLCC-player Ghandoor, which has another four newbuild VLCCs on order with Daewoo for delivery in 2006-2007. The other six tankers went to recently-listed, tanker-focused Euronav – a key member of the Tankers International pool.

The purchase price of the six vessels that Mark Savarese’s company picked up is said to be a whopping $776 million for ships ranging from a 1993-built to a vessel to be delivered this May. Euronav’s previous fleet consisted of four 50%-owned V-plus vessels (in a JV with OSG), three 30-50%-owned VLCCs and eight wholly owned VLCCs. If the details of this sale are correct, that means this could truly be a transformational acquisition for the company. And from both Euronav and Ghandoor, it is a vote of confidence in the tanker market going forward, though whether it is warranted only time can tell.

In a transaction that eliminates one company as a candidate for an IPO but adds another, Theodore Angelopoulos’ Metrostar is rumored to have netted around $200 million in profit in a massive sale of eight VLCCs at an average price in the range of $127 million. Two of the ships went to Lebanese-owned, Greek-based VLCC-player Ghandoor, which has another four newbuild VLCCs on order with Daewoo for delivery in 2006-2007. The other six tankers went to recently-listed, tanker-focused Euronav – a key member of the Tankers International pool.

The purchase price of the six vessels that Mark Savarese’s company picked up is said to be a whopping $776 million for ships ranging from a 1993-built to a vessel to be delivered this May. Euronav’s previous fleet consisted of four 50%-owned V-plus vessels (in a JV with OSG), three 30-50%-owned VLCCs and eight wholly owned VLCCs. If the details of this sale are correct, that means this could truly be a transformational acquisition for the company. And from both Euronav and Ghandoor, it is a vote of confidence in the tanker market going forward, though whether it is warranted only time can tell.

Categories:

Equity,

Freshly Minted | March 3rd, 2005 |

Add a Comment

DnB Nor, Jefferies Score Huge Success for

Kvaerner Philadelphia

When DnB NOR and Jefferies were mandated to raise $75 million in equity so that Kvaerner could place its two orphaned US flag newbuildings OceanBlue, a Kvaerner sponsored enterprise, to compete with Matson, we held our breath. And then we wrote an article entitled: “Will Hawaii Become the Next Puerto Rico?” referring to the fact that a price war might erupt with the addition of another player in what is already a fragile market. Although we understand that DnB NOR and Jefferies have been having success in placing the equity, we were very pleased to learn recently that Kvaerner has in fact entered into contracts to sell the vessels to Matson, who had bought the first two vessels, for $290 million. The new ships are expected to be delivered to Matson and placed into the company’s Guam service in July 2005 and June 2006. “The contract with Matson confirms that Kvaerner Philadelphia has made a successful transition to become a highly efficient Jones Act shipbuilder,” said Dave Meehan, President at the yard, which we now imagine has set its sights on building 10 highly sought-after US flag product tankers.

When DnB NOR and Jefferies were mandated to raise $75 million in equity so that Kvaerner could place its two orphaned US flag newbuildings OceanBlue, a Kvaerner sponsored enterprise, to compete with Matson, we held our breath. And then we wrote an article entitled: “Will Hawaii Become the Next Puerto Rico?” referring to the fact that a price war might erupt with the addition of another player in what is already a fragile market. Although we understand that DnB NOR and Jefferies have been having success in placing the equity, we were very pleased to learn recently that Kvaerner has in fact entered into contracts to sell the vessels to Matson, who had bought the first two vessels, for $290 million. The new ships are expected to be delivered to Matson and placed into the company’s Guam service in July 2005 and June 2006. “The contract with Matson confirms that Kvaerner Philadelphia has made a successful transition to become a highly efficient Jones Act shipbuilder,” said Dave Meehan, President at the yard, which we now imagine has set its sights on building 10 highly sought-after US flag product tankers.

Categories:

Equity,

Freshly Minted | March 3rd, 2005 |

Add a Comment