Noble Prices $700 million Bonds at T+225 – JP Morgan Sole Books

In yet another stunning example of the liquidity that exists in the global bond markets and the investor appetite for anything having to do with commodities, Noble Group priced $700 million bonds last week through sole bookrunner JP Morgan with a spread over Treasuries of 225 basis points. The unsecured notes have a 10-year term and are non-callable for the first five years.

As for use of proceeds, $364 million of the net proceeds will be used to repay debt (with an average cost of 3.8%), and the balance of $315 million will be used for general corporate purposes, which we assume could include strategic acquisitions. The net result of the deal is that the company will term out its debt, eliminate all short-term principal maturities and gain a massive hunting license, which, in conjunction with the extraordinary amount of free cash the company is generating, will create a meaningful amount of buying power.

Like many companies involved in the trading and transportation of resources and energy, Noble has enjoyed phenomenal growth in recent years. EBITDA jumped from $46 million in 2002 to $85 million in 2003 to a whopping $348 million in 2004. In 2004, EBITDA/Interest expense was 7.8x and total debt to EBITDA was 2.6x. Despite the incredible growth and lightly leveraged balance sheet, Noble still trades at a significant discount to DryShips on a cash flow basis.

So what will Noble buy? Probably not ships, judging from the fact that the company’s references to shipping are kept to a minimum in the offering document. In fact, Noble seems more interested in providing financing to shipowners willing to buy vessels and charter them to Noble than it does buying ships for its own account, and it is possible that some of the balance sheet power will be used for this purpose.

In stark contrast to the recent shipping IPOs, here is how Noble describes itself: “We are a leading global diversified natural resources merchant. We source, market, transport and deliver a wide selection of industrial raw materials, agricultural products and energy products. We believe we provide a value-added service in the commodities supply chain by efficiently linking producers and consumers on a global basis, integrating each step of the supply chain from sourcing to delivery. Our role as a merchant, coupled with our expertise in logistics services, gives us the flexibility to operate at any level of the supply chain based on our clients’ needs. We focus on specific geographical regions, products and services where we perceive we are able to add value by more efficiently managing the linkages of supply and demand. We have also developed complementary ancillary services which, combined with our hedging, insurance and financing capabilities, allow us to arrange turnkey solutions for our clients.”

Excel Maritime Raises $124 million,Watches Share Price Sink

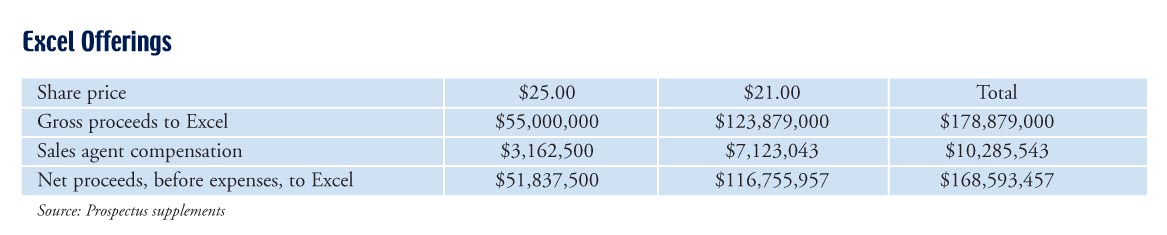

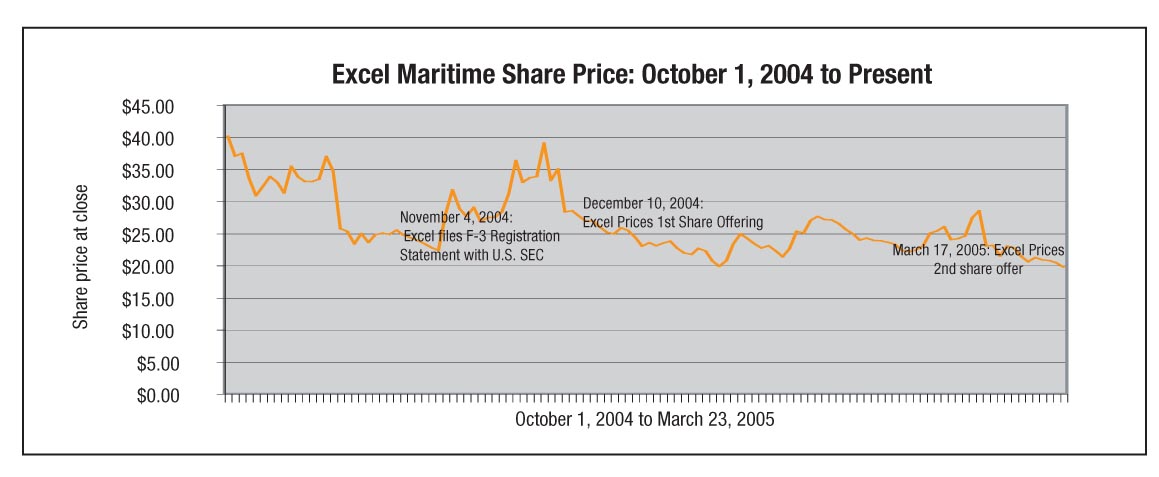

Excel Maritime priced its latest offering of 5,899,000 shares at $21.00 per share last week, raising gross proceeds of $123.9 million. After accounting for compensation of sales agents Cantor Fitzgerald and Hibernia Southcoast Capital of $7.1 million, net proceeds to Excel were $116.8 million. Combined with the company’s December share offering that raised $51.8 million, Excel has now realized $178.9 million of the $200 million the company’s November 2004 shelf registration authorized. The proceeds are earmarked for the acquisition of more dry bulk vessels, which the company had begun to do even before the shares had priced. To a lesser extent proceeds may be used for general corporate purposes.

The company has succeeded in raising an incredible amount of money for expansion and vastly increasing it’s market capitalization. However, while the shipping markets, and correspondingly shipping stocks, are still holding strong, the result of all this fundraising is a real dip in share price for Excel, as can be seen from the share price graph.

Diana Shipping Prices at 1.37X Net Asset Value; 8X Cashflow

As we reported last week, Diana Shipping became the newest member of the public shipping company family last Friday when the company priced its 12.3 million share issue last week at $17 each to raise approximately $210 million. As always, we thought it would be interesting to take a look at how the valuation compares to other public companies. As you can see from the calculation, Diana priced at about 1.37x net asset value and 8x 2005 estimated cash flow. The most recent comparable deal is DryShips, which priced at 1.84x net asset value and 4.1x 2005 cash flow. The reason for the difference in valuation has less to do with market conditions, which remain very good for issuers, and more to do with the fact that Diana has a fleet of vessels with an average age of three years versus DryShips fleet, which has an average age of 13 years. The reason DryShips has the better valuation on assets and not cashflow is that 13-year-old vessels cost a lot less than 3-year-old vessels but have similar earning power. However, what this also means, of course, is that the quality of the Diana cash flows is higher in that the vessels have more years to earn back their cost than the DryShips vessels do.

GE Capital May Buy NIB Capital

There have reports in the financial press this week that acquisition-hungry GE Capital may soon offer to buy NIB Capital, which has a strong presence in the marine financing business. NIB Capital has engaged Goldman Sachs to run the sale of the company either through an IPO or to a strategic buyer, and GE Capital, which in recent years has used major portfolio acquisitions as a method of achieving meaningful growth, has emerged as a likely buyer. The transaction comes at a time of great success at NIB, which had $228 million in net income in 2004, up from just $96.8 million in 2003. As demonstrated by its purchase of the structured finance unit of ABB for $2.3 billion, GE has clearly sets its sites on the $3 trillion European financing market as an opportunity for growth.

Seacor Buys Seabulk: A Perfect Match

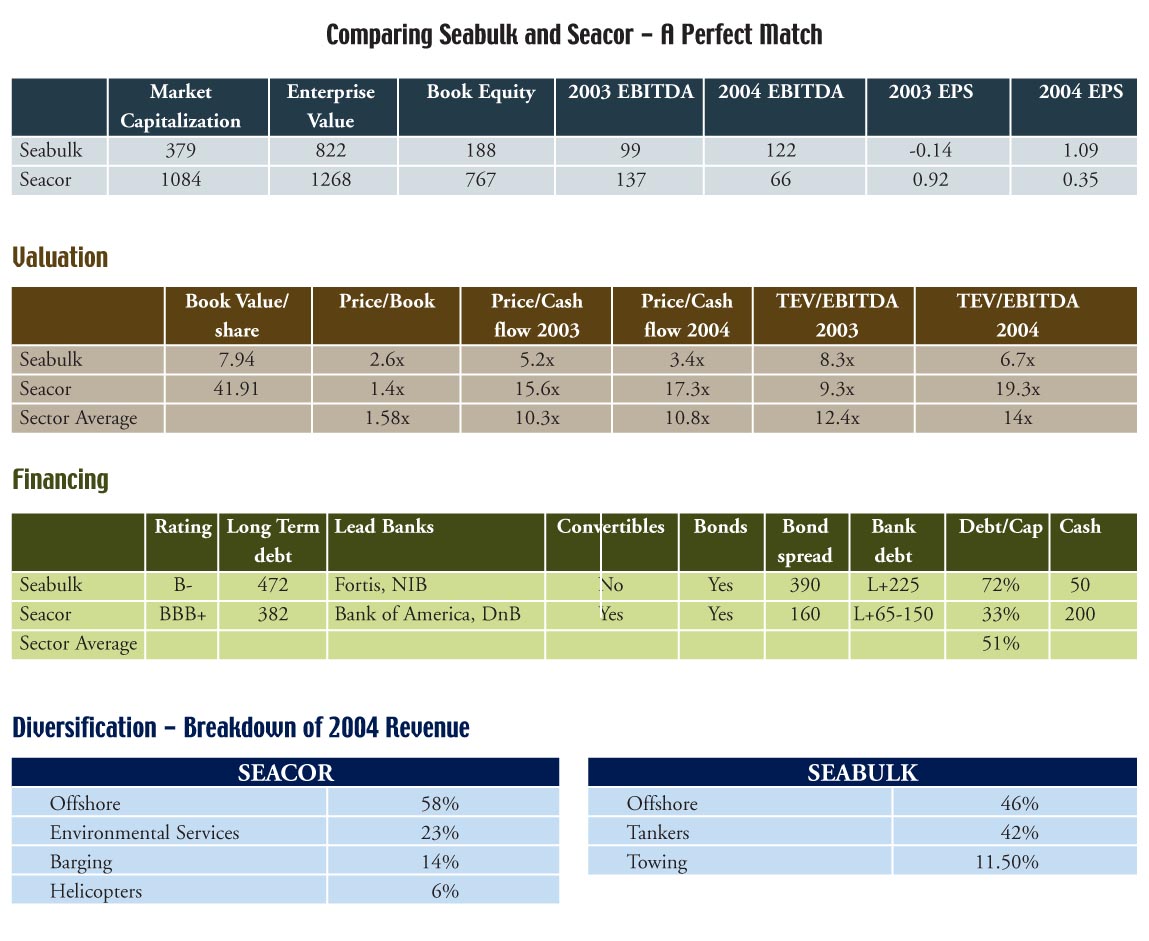

Since the transaction was announced last Friday, and particularly at the CMA show held in Stamford this week, quite a few people asked us what we think of Seacor’s acquisition of Seabulk. Our conclusions up front: we think it’s a perfect fit.

From a market standpoint, the timing of this business combination couldn’t be better. After several years of depressed rates in the U.S. Gulf, it appears that the market is coming back, as OPV day rates come up in the North Sea and West Africa. The driver of this increased demand appears to be strength in the jackup rig and floating rig markets, particularly in deep water. The North Sea has seen rates not witnessed since 1998. As a result, the deal gives Seacor increased financial and operating leverage at a time when the key offshore markets are strengthening and look to remain strong through 2006. Moreover, the acquisition diversifies sources of the company’s EBITDA by even further broadening Seacor’s portfolio of businesses across different cyclical drivers and behavior.

But more compelling than the market fundamentals is the fact that Seacor and Seabulk have very complementary businesses and capital structures – critical components in a successful corporate combination. From a financial standpoint, it is very clear from the valuation data shown in the accompanying charts that Seacor is the stronger company. The company is larger, has more cash, more market cap and a lower debt to cap ratio. Moreover, Seabulk pays hundreds of basis points more for its bank debt than Seacor does, excluding the Title XI bonds on Seabulk’s U.S. flag tankers.

Seacor’s acquisition of Seabulk will also raise the gearing from 33%, bringing it closer to the industry average of 51%. At the same time, Seacor will be able to sharply reduce the cost of much of that financing. What is interesting to note is that although Seabulk is much smaller and more highly leveraged, the company actually produced more EBITDA and earnings per share in 2004 than Seacor did thanks to the strong tanker market.

From a valuation standpoint, the transaction will be dilutive to Seacor on a price to book ratio with the company using stock valued at 1.4x book value to buy a company at 2.6x book value, but it is important to remember that the Seabulk U.S. flag tankers are likely carried at book values that are substantially below their market value. Although we generally provide a Price/NAV metric for M&A transactions, the vast and diverse amount of equipment owned by both of these companies makes the exercise less meaningful than for more traditional shipowning companies.

2005 Marine Money Banker Survey

The results were so interesting last year, we just couldn’t pass up the chance to do it again! Following this are a few of the highlights; look for a full discussion and analysis in the April issue of Marine Money, including information regarding the geographical dispersion of our respondents and the breakdown of their portfolio sizes.

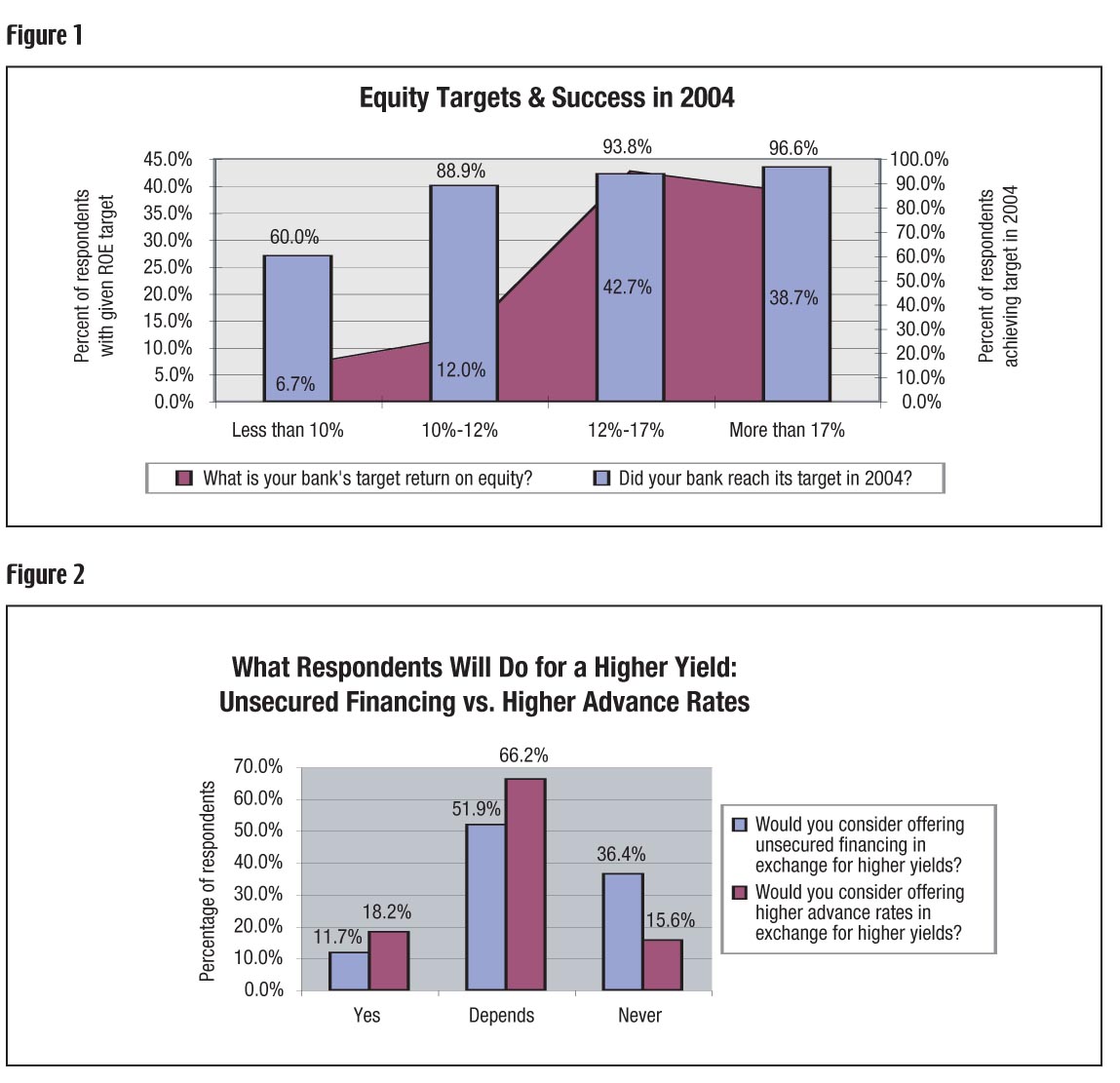

Equity Targets and Success in 2004

To give you a taste of what is to come, Figure 1 shows the breakdown of return on equity targets for our respondents and the corresponding success rates. Not too surprisingly, success rates were very high in 2004, with 92.3% of those responding meeting or exceeding their targets. What is a little more interesting is the correlation we witness among respondents between target ROEs and achievement rates. While it might be expected that banks who set their sights higher achieve higher ROEs, it is certainly worth taking note that, at least in 2004, banks who set higher goals also had a better chance of obtaining those goals.

Unsecured Financing vs. Higher Advance Rates

Figure 2 demonstrates that our respondents are significantly more comfortable offering higher advance rates than in offering unsecured financing in exchange for higher yields. In fact, a full 84.4% of respondents would consider offering higher advance rates under some circumstances while only 63.3% would even consider doing this with unsecured financing.

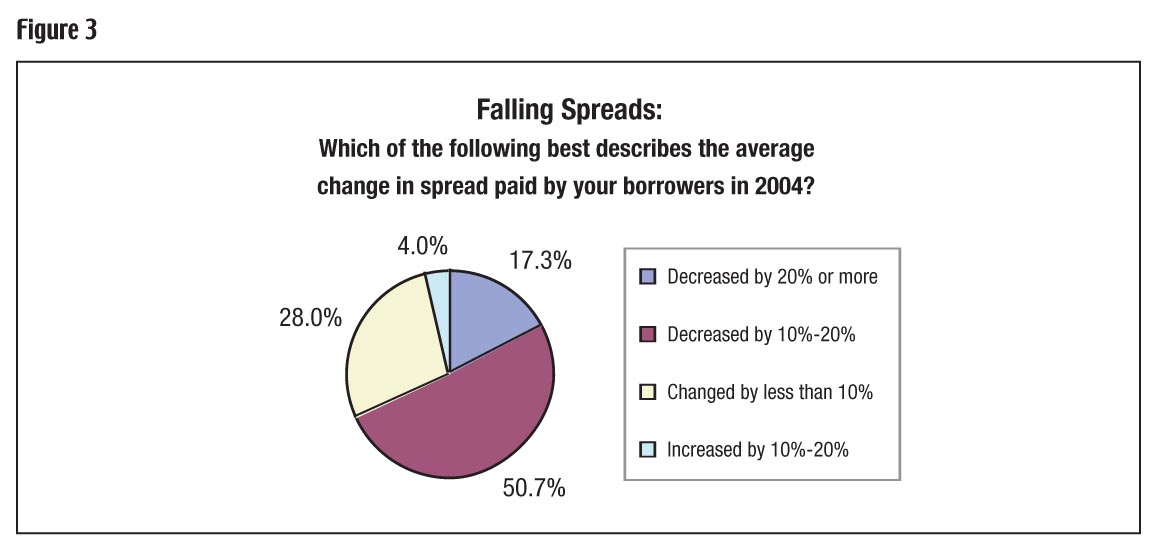

Falling Spreads

Figure 3 shows us something we might expect to see: borrower spreads have been falling almost across the board, keeping pace with falling interest rates to make debt in many cases ridiculously inexpensive. Over two thirds of respondents saw spreads fall by 10% or more, and only a modest 4.0% actually saw spreads increase. Transportation specialist DVB Bank did announce with its earnings release that it partook in the industry-wide trend towards falling spreads, but shipping loans made by that bank were on average just four basis points cheaper to borrowers than those made in 2003.

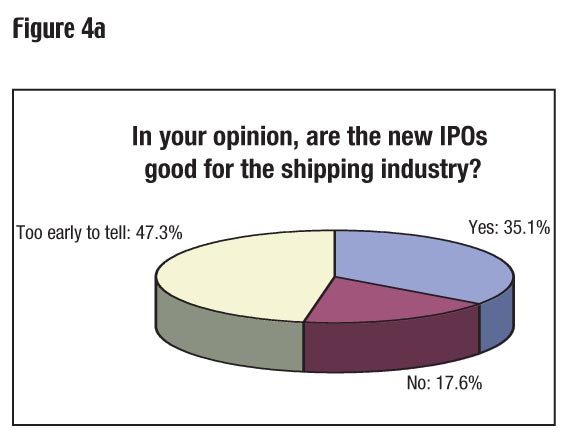

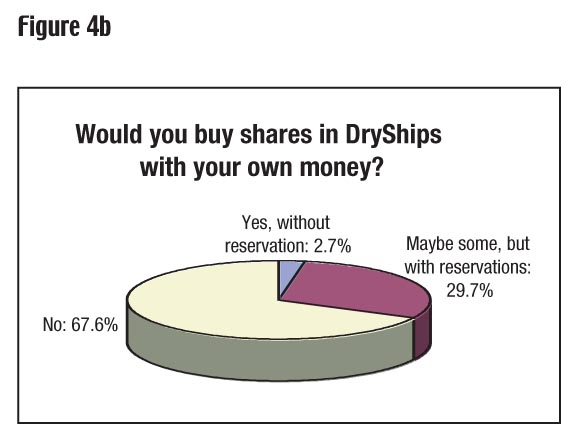

The Impact of IPOs and the Prospects for DryShips

Figures 4a and 4b give an important indication of how shipping bankers are responding to the industry’s turn to the equity markets. Over a third of respondents think that the plethora of shipping IPOs that have been coming to market are good for the industry; they do, after all, increase exposure and spread risk while increasing the variety of sources of capital available to shippers. Almost a fifth of respondents, however, felt that the IPOs are definitively bad for the industry. One valid complaint we have heard is the extent to which the purchase price of ships with public money inflates values, to some extent driving other sources of capital out of the industry. Whatever they think about the IPOs in general, the bankers who responded had an almost universally dismal view on the DryShips IPO, with only 2.7% responding that they would be completely comfortable buying shares in the company with their own money. A whopping two thirds would absolutely not purchase shares. To be fair most, however, results were gathered prior to a number of Economou’s most recent acquisitions and a Jefferies report that rated the company a BUY.

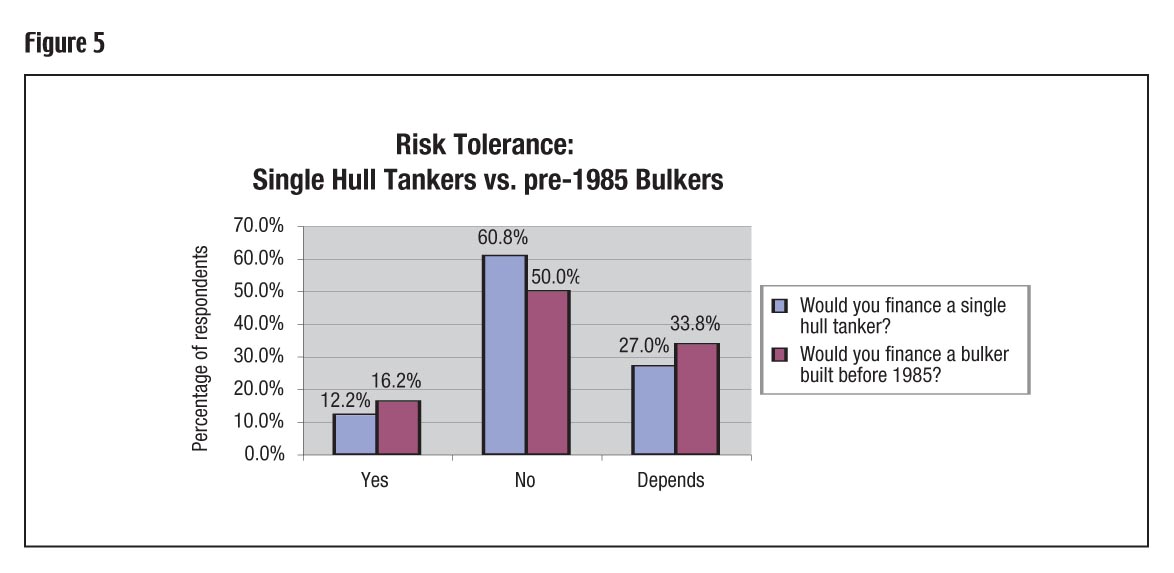

Risk Tolerance: Single Hull Tankers and “Elderly” Bulkers

Finally, Figure 5 shows the breakdown of respondents’ risk tolerance for single hull tankers as compared to bulkers built before 1985. While the bankers do not seem particularly keen on either type of asset, with only half of respondents willing to consider financing an elderly bulker while less than 40% would even consider financing a single hull tanker. This is reasonable considering the different types of risk the vessels face. An older bulker may require more maintenance, and there is always the risk that it will not last as long as expected. Single hull tankers, however, widely vilified as the willful culprit behind oil spills in North America and Europe, face not only an IMO phase-out, but legislation from the E.U., the U.S., and other governing bodies that could have the effect of wiping them out of service permanently sooner than planned. Of course, this results in the upside that single hull tankers are for the most part profitable in the current market while affordable compared to most tanker assets, which is no doubt the reasoning of the 40% of respondents who would still finance such a vessel under the right circumstances.

Untouched here are such topics covered by the survey as portfolio change, credit limits, average spreads, future expectations, and banker salaries, among a variety of others. Additionally not included is a breakdown of responses based on target ROE and success in achieving targets. All this and more will be covered in the April issue of Marine Money, so we hope to have caught your interest.

Merril Lynch Capital Names Dandapani Market Manager

Merrill Lynch Capital Equipment Finance National Sales Manager Randy House announced today that Ravi Dandapani has joined Merrill Lynch Capital as Vice President, Marine Market Manager. Most recently, Mr. Dandapani served as Managing Director for Global Origination of Maritime Structured Products at Citigroup, and he has also worked as Vice President for maritime financing and business development at the CIT Group. All told, he has over 33 years of experience throughout both the operating and financing sides of the marine industry. This marks a second important move by Merrill Lynch to beef up its shipping personnel as it begins to make inroads into the industry. Congratulations to Mr. Dandapani and to Merrill Lynch!

Blue Star in Market with Citigroup for Euro 200 Million Facility

Athens-listed ferry company Blue Star Maritime SA is currently in the market for a Euro 200 million refinancing of an existed syndicated loan as well as other smaller facilities. Citigroup is serving as sole bookrunner and arranger on the deal. The Panagopoulos family-affiliated company also recently reported 2004 consolidated net profit of Euro 10.9 million, 130% higher than the Euro 4.7 million reported in 2003.

Fearnley Finans and Lorentzen & Stemoco Launch $176 Million K/S Deal with Bergesen

Fueled by loads of liquidity and a desire among many investors to use strong Kroners to make deals in cheap dollars, Norwegian K/S arranger Fearnley Finans together with Lorentzen & Stemoco launched this week with Bergesen the largest deal to come to the market. The deal is for the acquisition of four medium-sized LPG tankers currently trading in the Exmar Midsize pool. The new company, Edda Gas K/S, will acquire two of the ships from Bibby Line and the other two from Bergesen. The project price is $176.2 with $50.2 million in paid in capital and $30 million in uncalled capital. Bergesen has already committed 45-49% of the capital, while commercial banks will provide mortgage financing of $126 million. It is estimated he deal will achieve an IRR on 15 years of 15%. The deal is an excellent opportunity for Bergesen to reduce its risk in this market and benefit from premium asset prices while it also represents an growing interest from the larger shipping companies to use the K/S market for sale-lease back deals.

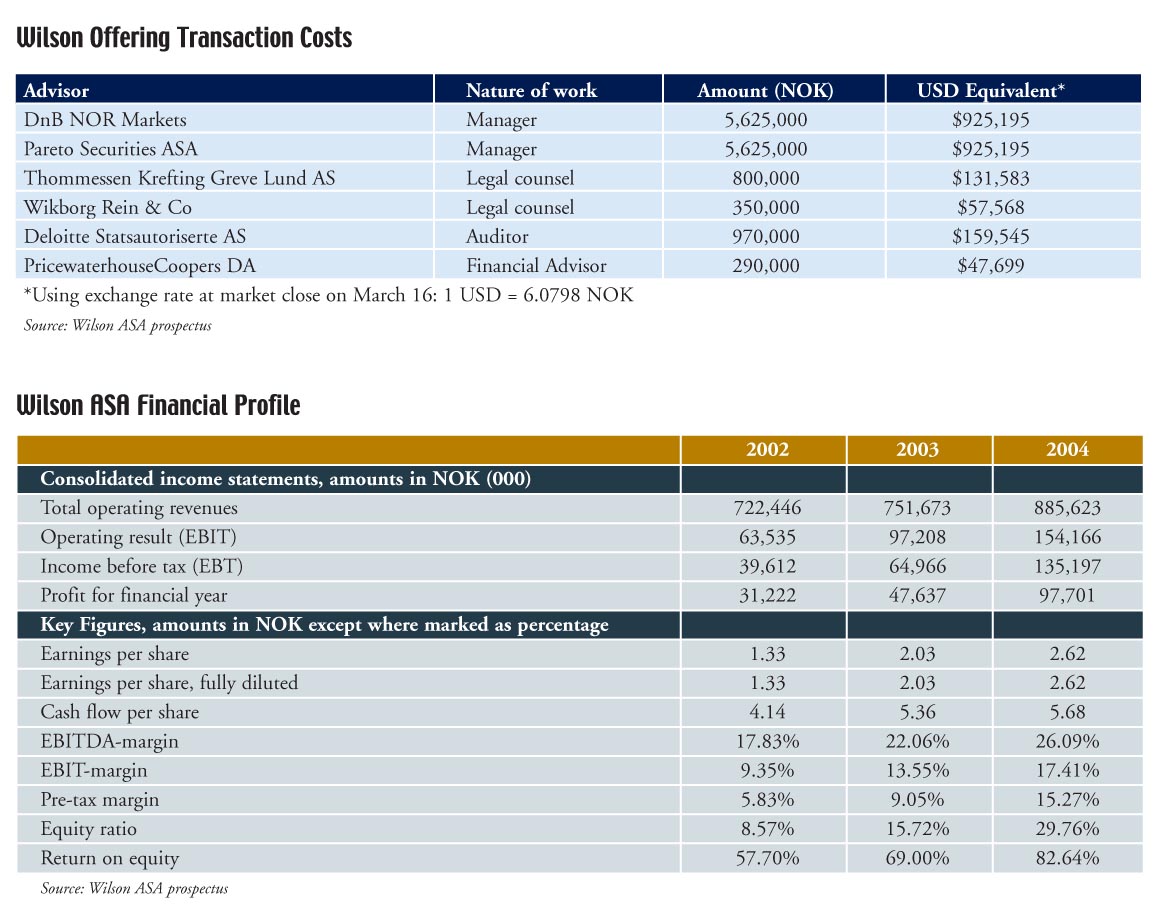

Wilson Completes Successful Roadshow and Starts Trading on OSE Today

Bergen-based Wilson Carriers is the latest dry bulk company to list on the OSE and has started trading today under the ticker code WILS. In Ship (owned by Mr. Kristian Eidesvik) sold 35% or 14.8 million shares at NOK 19.50 to selected Norwegian and UK investors raising NOK 288 million. Arrangers DnB NOR Markets and Pareto Securities reported a huge interest in the company, demonstrating investor attraction to their planned dividend stock. The offering was oversubscribed by 3.3 times and sold 20% to retail and 80% to institutional investors. Among other things, the success of the deal is a testament to its perfect timing in that asset prices on dry bulk ships are widely considered to be at the top.

Seeing the rush of capital towards dry bulk deals like DryShips and International Shipping Enterprises and watching the line for this capital begin to form among operators in the United States, Eidesvik-controlled European-focused minibulker Wilson ASA opted to take a different spin on what so far appears to be a successful model.

Testing New Waters

With only indirect exposure to China, the company had a slightly different story to sell, and the current degree of dry bulk liquidity and demand in Oslo has been largely untested. Like its foreign comparables, however, Wilson ASA met with great success this week when it priced its 14.8 million secondary shares at NOK 19.5, above the anticipated range of NOK 16.5-19.

Both upside and downside risk in this deal were narrower than some of its U.S. comparables, as the company maintains a focus on long-term contracts. While part of the purpose of the offering, which raised approximately $47 million in USD terms, is to facilitate the paying down the debt of selling shareholder In Ship, other reasons cited in the prospectus include providing a regulated marketplace for share trading, making the company more transparent and facilitating satisfactory liquidity in the company’s shares by increasing the free float and broadening the shareholder structure.

Wilson owns or operates a fleet of approximately 90 vessels and 15 million tons, making the company the second largest player in the European short sea market. Core tenets of the company’s business strategy include long-term contract portfolios and extensive knowledge of its customers’ needs. The company believes that this structure allows it to ensure high productivity and stable long-term earnings, which makes it quite a different animal than many of the more spot-focused dry bulk deals we have seen.

A Complicated Past

The ownership history of the company is somewhat convoluted but worth reviewing. Wilson Group, consisting of Wilson EuroCarriers AS and Wilson Ship Management AS, was sold by Actinor ASA in 2000; half went to In Ship AS and half went to Caiano. These companies then established Wilson Holding AS, which has since become Wilson ASA. Caiano was already controlled at the time by Kristian Eidesvik, while In Ship AS was owned by Holter-Sørensen Invest (18%) and Ole Henrik Nesheim (82%). Since that time, Caiano acquired all of the voting share in In Ship AS, the selling shareholder in the offering.