General Maritime’s Dividends Approved by Nordea

Nordea has amended its L+100 $825 million credit facility with General Maritime to allow for dividends for the first time in the General Maritime’s history as a public company. General Maritime’s management team has done a masterful job using free cash, embedded equity and additional borrowing to grow and improve its franchise. Like a plane that burns a lot of fuel to reach cruising altitude, General Maritime’s dividends are a sign that the company may not see accretive acquisitions on the radar. Some also think it’s a method of increasing the company’s share price to make it a less attractive target to Frontline.

Dividends, like everything else these days, will be based on EBITDA after interest expense and necessary reserves for fleet renewal.

K-Sea in New $80 million Facility with KeyBank

One-year-old Master Limited Partnership K-Sea Transportation Partners refinanced its $61 million of debt with a five-year $80 million revolving credit agreement with a syndicate of banks led by KeyBank National Association. We suspect relationship lender CIT is also in the deal. The new deal is cheaper, has looser covenants and can be topped up to $100 million for increased buying power.

Diana Trades Down, Tanker Stocks Stage Comeback

Shares of Diana Shipping were trading below its offering price of $17 this week. The fact that lead underwriter Bear Stearns does not publish shipping equity research probably has not helped investors see the value in the stock at current prices.

The Street.com featured an article on oil tanker stocks this week stating that; “One of the lessons of recent market action is that you generally want to own companies in industries where supply is tight and sell companies in industries where supply is plentiful. The framework would lead you to be long natural resources and trucking stocks, to be sure, and short the makers of dime-a-dozen stuff like commodity semiconductors. But the idea also takes longs into the fabulous and mysterious world of oil tankers.”

Incidentally, many of the traditional tanker stocks staged a comeback today, trading up by a dollar or more.

Argyropoulos Appears on Bloomberg

Shipping investment banker Anthony Argyropoulos of Cantor Fitzgerald appeared on a relatively lengthy interview on Bloomberg television on Wednesday. When asked if markets had topped and a flood of lower quality IPOs are coming to market, Argyropoulos replied with a confident “no.”

Eastwind & Marine Capital Pick Up Georgia’s OSCo Fleet

The Eastwind Group of New York and Marine Capital of London announced today that they have reached agreement with the Ministry of Economic Development of Georgia for their acquisition of Ocean Shipping Company, following a recently-concluded competitive bidding process. OSCo, the Georgian state shipping company, owns a fleet of 15 product tankers ranging in size from 16,000 to 35,000 DWT and in year of build from 1981 to 2004. The ships have been trading primarily in the Atlantic Ocean and the Baltic and Mediterranean Seas.

Eastwind is an owner and operator of 70 vessels, including product tankers, dry bulk carriers and refrigerated ships. Marine Capital is a well-known shipping investment company and was the originator of the transaction.

“We have been working on this transaction for a few months and are very pleased to have secured the deal despite keen competition,” said Tony Foster, managing director of Marine Capital. “We are delighted to be in partnership with the Eastwind Group. I believe we were successful because of the strength of our investor group and the imaginative financing provided by Bank of Scotland. I want to emphasize that the Georgian government has dealt with us constructively and professionally throughout the process.”

“The OSCo fleet will greatly strengthen us in an attractive sector of the shipping market, where we expect continued growth and development for our company,” said Don Simmons, managing director of Eastwind. “Although the transaction represents an outright privatization by the Georgian government, we will retain strong links to the country through our acquisition of OSCo’s crewing operations. In addition to their continued manning of the OSCo fleet, we also expect to introduce Georgian seafarers on a number of our other vessels.”

It is understood that the new owners plan to retain Columbia Shipmanagement to operate the OSCo vessels.

Top Acquires Nomikos – A Watershed Event

For many years, Marine Money conferences have featured presentations asserting the theory that when public markets begin to value shipping companies at a premium to net asset value, the entire ownership structure of the industry will change. The change, it was said, would be inevitable because public companies would have a lower cost of capital and could therefore be more competitive on the single largest daily expense item – money.

After years of theorizing, this fundamental change appears to be underway. Although the larger and more established public companies such as Teekay and OSG have seen this situation for some time, we believe the emergence and aggressiveness of Top Tankers has really been the catalyst for a change of psychology in Greece – the change in psychology is that there are only three options: to be public, to sell to a public company, or to slowly liquidate assets. Although figures vary since foreign companies are able to make confidential filings for IPOs, we understand there are about 15 deals in registration, comments and drafting currently.

One of the most startling examples of the change that is taking place is the ”broker talk” this week that Top Tankers has reached a deal to acquire AM Nomikos. Top has been an aggressive buyer since going public last July, but to date has picked up unwanted vessels such as the older ships owned by Sovkomflot and suezmaxes that Essar had been marketing for some time.

But the acquisition of Nomikos, if it is true, is something else entirely; the idea that a company like Top, which at this time last year was a private company with very few ships, can acquire the entire fleet of a company like Nomikos, a multi-generational blue chip shipping company with a premier fleet and reputation that was never even for sale, has been a real eye opener. We imagine that Top presented Nomikos with an offer the company simply couldn’t refuse, about $50 million over already high asset prices from our rough and dirty calculations.

If, as we mentioned above, sensible private shipping companies have three options, going public, selling to a public company or slowly liquidating, Nomikos chose option number two. In an effort to understand why this deal appears to have been consummated, we thought we’d do some math.

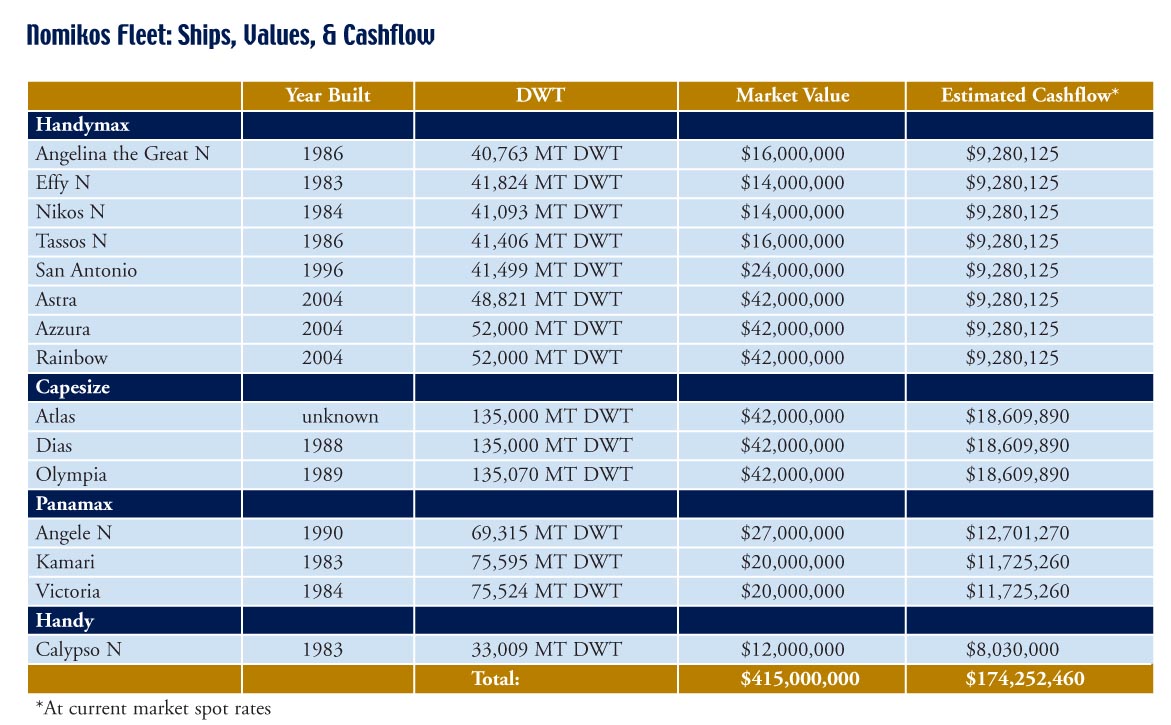

As you can see from the fleet list and valuation, the Nomikos ships are worth about $415 million. Using full employment, current spot rate estimates, the company would generate $174 million in cashflow in the current 12-month period. Using public comparables, if Nomikos had decided to go public, their fleet could have been valued at about 4x cash flow, or almost $700 million. The major difference, of course, is that when a company goes public, the selling shareholders generally extract a healthy valuation and keep control of the company and management of the vessels, which generally employs family members.

However, if the deal ever comes to fruition, judging from the valuation of Nomikos, it offers them a chance to get a full valuation from their fleet without taking the risk of doing a public offering. The IPO is a consuming process that can take as few as four months but much longer if there are accounting issues. Pre-funding expenses can be about $1.5 million, so if the equity market and/or the shipping markets do not cooperate, the entire effort can be made in vain.

CMA Hosts Connecticut Shipping 2005

The Connecticut Maritime Association this week hosted in Stamford, CT its most successful tradeshow yet. Over 1,200 shipping professionals from around the country and around the world signed up for the event; we can only imagine that even more attended. From exhibitor booths to panel discussions led by experts in a myriad of shipping fields to business meetings, luncheons and cocktail receptions, there was certainly something for everybody.

The Westin Hotel in Stamford was definitely the place to be this week. Faithful exhibitors set up booths where one could learn about everything from ship registries to environmental consulting to high-speed, affordable offshore internet access. It certainly would have taken more than the three days’ time available to get to each one.

But you wouldn’t want to spend your whole time just wandering around and taking it all in – aside from developing new business contacts and meeting up with old friends, there were presentations and panel discussions running almost continuously that featured distinguished leaders of the global shipping industry and dealt with a variety of the important issues that are facing shippers today.

Not surprisingly, there was a great deal of speculation about the future in regards to how long the current market can last, if and how far it will have to come down off its highs, and how China, and eventually India, will impact the market as they continue to evolve. Some time was also spent taking in the current shipping environment. Dr. Arlie Sterling of Marsoft observed happily “This market has exploded, and it’s done so with great style,” while Gary Vogel of VOC Shipholding noted more cautiously “the more things change, the more they stay the same.” Frederick Chavalit Tsao of IMC Holdings and INTERCARGO had a different take on the changing world, telling his audience that one must be proactive in managing change in order to achieve sustainability.

And the owners who spoke sounded up to the challenge. Rather than speculate on the future, a number of speakers, including Giuseppe M. Rizzo of Bottiglieri di Navigazione SpA and Robert Bugbee of OMI, discussed strategies to sustain their companies, come what may in the markets. For three days, often in multiple sessions at once, shipping and other professionals discussed issues ranging from safety to crewing to currency and FFAs.

At night time, there were dinners, parties, and of course the Greenwich Marine Club. Three exhilarating days were capped off with CMA’s annual Gala dinner, where Fort Schuyler cadets entertained with their songs and Ole Skaarup regaled the audience with tales of life, death and past commodores. Peter Georgiopoulos handed his commodore hat to Sean Day, and then Peter Drakos presented a donation on behalf of the CMA to the Seamen’s Church, who returned graciously that the CMA would be presented with the Seamen’s Church’s own Silver Bell award in June.

Cantor Fitzgerald Initiates Maritrans, Hornbeck with STRONG BUY

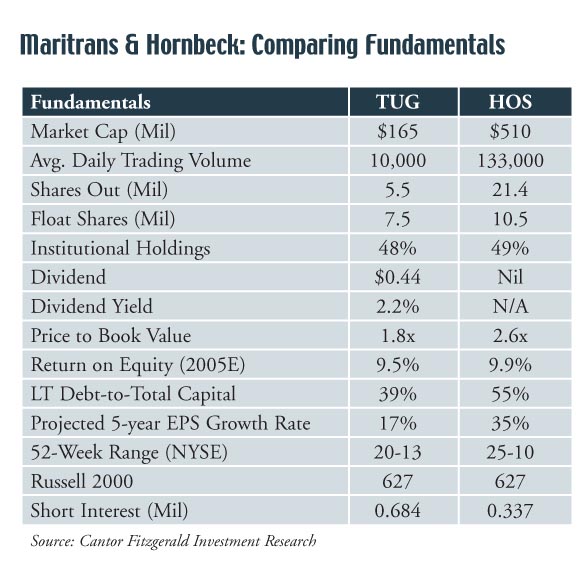

Cantor Fitzgerald initiated coverage this past week on U.S.-flag operating companies Maritrans and Hornbeck Offshore Services with a STRONG BUY. The report follows only a month or so after Fortis initiated coverage on Hornbeck and Seacor with a BUY rating, demonstrating a growing interest among investors and analysts in this segment of the marine market. Seacor, of course, has now been bought. But the coverage in question is another step in Cantor Fitzgerald’s growing involvement with the marine industry. Having helped to bring both tanker and dry bulk companies to the public markets in the past year, it is only fitting that the group should turn some attention to the offshore industry.

Analyst Natasha Boyden notes in both reports that, due to 1990 Oil Pollution Act requirements that eventually require oil-carrying vessels to be double hulled, she expects approximately 33% of the U.S.-flag industry fleet to be retired between 2005 and 2007. Such requirements will be very bad news for companies that operate fleets of older vessels, but for companies that operate relatively young fleets to high standards, this means an opportunity to increase market share and utilization rates.

Considering high barriers to entry, attributable in large part to “rising steel prices, operational and technological barriers to entry, and the high cost of building new vessels under Jones Act requirements,” Ms. Boyden believes that the advantages thus gained by high quality operators will not be short-lived. Add to that the Energy Information Administration’s predicted U.S. petroleum product demand growth of 1.5% annually over the next 20 years, both Maritrans and Hornbeck could be looking at very favorable supply and demand dynamics.

Tug and tank barge company Maritrans (NYSE: TUG), with 15 vessels, boasts the industry’s largest fleet and represents approximately 20% of overall market capacity. With low costs, leverage to the spot market that Cantor expects to be strong and sustainable, and a debt-to-cap ratio of 39% and falling, the company has a lot going for it. As such, Ms. Boyden targets a P/E valuation of 18x, a significant appreciate from the 14.3x at which it has been trading, which leads to a price target of $24 compared to a share price of$18.09 at press time.

Hornbeck (NYSE: HOS), by contrast, operates a fleet of 24 new-generation offshore supply vessels (OSVs), which make up approximately 16% of the domestic new-generation fleet. The fleet is also exceptionally modern, with an average age of only four years compared to the entire U.S.-flagged fleet average age of 24 years. As Fortis analyst Dan Barrett also noted in his report, modern OSV vessels are not just important because they comply with regulations being phased in and have less maintenance needs, but they also have more capabilities than older vessels that typically make them significantly more efficient when they are employed and lead to higher utilization rates.

Nevertheless, Hornbeck has been trading at a significant discount to peers and as such, Ms. Boyden convincingly argues, represents a very good value. To achieve the Cantor’s $29 price target, she uses EV/EBITDA due to the capital intensive and cyclical nature of Hornbeck’s business. The analyst recommends a valuation of 10.5x as opposed to the 8.9x at which the company has recently been trading – the share price now stands at $24.51.

Banc of America Securities Initiates Coverage on Tanker Sector

Banc of America Securities initiated widespread coverage on the tanker sector yesterday. Companies covered include General Maritime, Teekay, Frontline and OSG – all with a Neutral rating – and Ship Finance International and OMI Corp., with a Buy rating.

Hot on Heels of Torch Default, GE Capital Seizes Tour Boats in Hawaii

Just weeks after calling a default and arresting ships of bankrupt borrower Torch Offshore, GE Capital has arrested two tour boats owned by Honolulu-based Dream Cruises, which subsequently filed for bankruptcy. According to press reports, GE had U.S. Marshals seize the two vessels because the company was in default of a $1.4 million mortgage on the vessels. The company operates whale and dolphin tours, snorkel activities and sunset cruises on O’ahu and the Big Island. “This filing is intended to allow us to regain our boats so we can continue normal business operations,” said Mike Watson, president of Aquamarine Inc., which operates Dream Cruises. “Because GE Capital refuses to accept what we believe is a fair and reasonable repayment schedule, we unfortunately have no choice but to ask for the court’s intervention.”