Electronic commerce in maritime shipping: Beneath the hype, a transition is underway

By H.L. Kite-Powell

Electronic commerce is on the brink of making a serious impact on maritime shipping — an industry that traditionally has been slow to adopt new technologies. Among the main drivers are transaction costs (for shippers) and yield management (for carriers and ship owners).

A lot of hype still surrounds most shipping e-commerce ventures, but it is possible to discern some significant trends. E-com in maritime shipping is concentrated on two aspects of the business: cargo booking and tracking, and procurement in support of ship operations.

Continue Reading

How the Shipping Industry Can Create Real Value

By Jim Dolphin

The great freight recovery of 2000 has been welcome news to shipowners, bankers and investors. While nearly all freight markets have strengthened, the post-Erika tanker market has seen the greatest increases, with spot rates doubling to tripling since the beginning of the year.

Additionally, owners are bullish that this run will continue for the next 18 to 24 months for a variety of reasons: the world economy keeps chugging along, OPEC is promising incremental production, the orderbook is largely set, and there remain a large number of older vessels which look likely to retire should freight rates drop, which hopeful owners see as a self correcting mechanism to keep supply tight and rates firm.

With all of this good news, what could be wrong? Simply stated, shipping destroys capital – and these “good times” may postpone necessary industry restructuring.

Continue Reading

Selling Short Tanker Stocks

By Matt McCleery

With the tanker market reaching dizzying heights and speculators chasing stocks up to unsustainable levels (See Figure Three), contrarian investors hoping to catch the volatility on the way down are gearing up to do some short selling.

We don’t mean to be grim. It’s just that during the later half of the 20th century, 7 years in every 10 have been either flat or down for tankers. That means that even for those who believe this tanker market will run into 2002, short selling shipping shares is not a question of “if”, but “when.” Since many of our readers are not familiar with selling equities short, this article will provide a basic introduction to what is involved.

Continue Reading

Greek Banks in Greece

By Kevin Oates

A few years ago the Greek shipping community had to look almost exclusively to foreign banks to find conventional ship financing. There were plenty of them, European and American, up and down Akti Miaouli and they enjoyed a near monopoly on term lending and operational services. The only Greek player in the game was the National Bank of Greece but it’s participation was not significant. The other Greek state banks were not involved and at that time there were no private Greek banks to talk about.

Now in 2000 there are a number of Greek banks involved in ship financing. According to a Marine Money survey about $ 2.75 billion of the total $ 16 billion advanced to the Greek shipping industry is provided by Greek banks. That’s about 17% and we estimate that this is probably more than three times the percentage of the total advanced by Greek banks a decade ago.

Continue Reading

Determining the cost of equity

By Geoff Uttmark

Exxon Valdez and Erika may bracket the decade it took for even the semblance of a two-tier tanker market to evolve. At this speed, shipping, along with manufacturing, construction, retail and virtually everything else pre-dating Yahoo, Netscape and the like is unquestionably “Old Economy”, as opposed to “New Economy” companies concentrated in telecommunications, information management and globalization of business. Adjective opposites like old and new imply two distinct economies with little in common. False. There is but one economy and no where is this more evident than in the quest for capital. As a well-aired TV advertisement proclaims, “Money is indifferent.” That pits ship owners’ needs for capital against abundant and formidable competition on a global basis. To make matters worse, along with expected returns, the rules for raising money also seem to have changed. A shipping banker recently left this writer gulping for air with her pronouncement on capital formation. “We call it the elevator pitch,” she said. “How so?” asked I. “Because it should take no more than eleven seconds.” “Eleven seconds to sell the story, and get an indication on funding?” “Right,” she said. So much for the dignified, two-pound business plan placed neatly around a conference table surrounded by somber, blue-suited males. “Given just eleven seconds, I might use them differently,” I retorted. Add the new breed (and gender) of banker to changed rules and expected returns in the unceasing battle for capital.

Continue Reading

Into Thin Air with Peter G.

By Matt McCleery

The key to success for recreational climbers interested in ascending the peaks of the world’s loftiest mountains is finding an experienced guide. Since the most spectacular peaks are generally the least accessible, there is no substitute for enlisting a professional with superior local knowledge to blaze the trail.

Some believe that the same logic holds true for financial players hoping to reach the top of the treacherous tanker market. In an industry characterized by having more valleys that peaks and lots of foggy corporate structures, some outside investors looking to reach the summit of a shipping cycle engage a local guide in whose hands they place their financial well-being.

One guide who is leading a pack of recreational participants to the top of this tanker market is New York-based shipowner Peter Georgiopoulos, or Peter G as he is ubiquitously known. Peter G’s General Maritime, the largest private shipowner in the US, has assembled a party of adventure-seeking backers that includes both hedge funds and private investors. With today’s rising tide of the tanker market having reversed General Maritime’s ill-timed acquisition of four aframax tankers from Euronav, market sources indicate that General Maritime is shopping for an underwriter to lead the company’s IPO this autumn.

Continue Reading

Anatomy of a successful financial restructure: PSL – a case study

By Khalid Hashim

WHO could have imagined that the Asian Tigers would collapse in the middle of their sprint? Who in their right minds would have predicted Singapore, Korea, Taiwan, Malaysia & Thailand, which all had been growing at an astounding rate year on year during the nineties, would suddenly contract? Who possibly could have imagined that the once rock-steady exchange rates of the Far Eastern Tiger economies would implode? But the fact is that all of this happened in 1997, and when it did, no one knew what hit them.

What started as an isolated case in Thailand in July 1997 quickly spread like wild fire, engulfing in its wake such giants like South Korea and Singapore which had only recently been admitted into the elite OECD Club! Not a single country in the entire Far East was spared, with the possible exception of China which managed to hold out on its own with minimal damages. All others suffered badly and a number of corporates could not survive, leading to widespread job losses. The West was not spared either, though the impact on their economies was not as severe.

In this traumatic period one word which caught the fancy of everybody was “re-structuring” or more specifically, “financial re-structuring”. This became the magic mantra for every company attempting to recover from the dumps; Ofcourse, not all succeeded. What set apart the successful ones was their ability to identify the problems early on, and their willingness to take onboard all concerned parties through transparent and effective communications.

Continue Reading

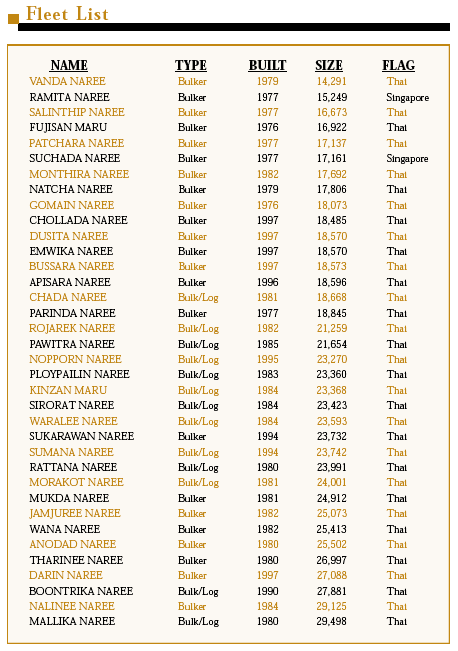

PRECIOUS SHIPPING

On July 17th, Thailand based dry bulk shipping company Precious Shipping and advisors Bank Boston (Singapore) concluded a year-long restructuring of various flavors of the company’s $184 million in debt. With four classes of creditors from America, Europe and Asia this restructuring looked like it would be a struggle.

Since the deal closed, Precious has emerged proudly touting its new look. The efforts have not gone unnoticed as the company’s shares were the highest traded stock on the Stock Exchange of Thailand, accounting for almost 6% of the entire market volume. In the last 5 trading sessions nearly 10 million shares or roughly 20% of the company’s registered stocks have changed hands.

There are a number of reasons for the increased interest in the company. Firstly Mr. Kashim’s tireless efforts to promote the company in lieu of a $22 million secondary offering has been very successful. Two recent positive analyst reports and a decision to allow the company to report their earnings in US$ have attracted foreign investors. In addition the company now has a much lower cost of capital on its handysize bulkers.

When we decided the do an analysis of the restructuring the first thing that we did was contact Mr. Hashim in Thailand for his views on the restructuring. We were pleased to find that he had put pen to paper the candid description of the process that follows. We hope that you find it as insightful as we did.

NORDIC AMERICAN TANKERS

By Nicolai Heidenreich

The first of Hamish Norton of Lazard Freres and Peter Swift of Seascope’s structured tanker companies, Nordic American Tankers (NASDAQ: NAT) is basking in the glory of the record earnings achieved by their triplet of suezmax tankers. Things are so good, in fact, that as we go to press NAT CEO Herbjorn Hansson is on a roadshow throughout the United States meeting his investors. There’s a lot for NAT to be happy about. The stock currently has a dividend yield of about 15% and the share price has rocketed from a 52 week low of $9 7/8 to above $22.50. Driving the move in the share price is the fact that suexmax rates have surged from $25,000 to $45,000 per day following the developments in the tanker market as a whole.

So the future looks bright for NAT investors, right? Maybe not. In this article we will give you a quick introduction to the company’s structure, explain the translation between market rates and dividends and, using a handy discounted cash flow valuation model and explain why at current levels we feel the share has reached its peak and will fall faster than most shipping shares when the markets turn the other way

Continue Reading

The heart of the matter’ Chairman’s Statement

In ‘Why nations go to war’ Stoessinger’s first of seven case studies is World War I. Contrary to the commonly held belief, that the event, one of history’s saddest, was inevitable and predictable, the author puts forward a differing view. He argues, that the same system of dividing alliances, which now caused the outbreak of the conflict, would under an alternative scenario, precisely have prevented it, ‘if’. How different history would have unfolded without ’1914-1918′, leaves imagination working overtime.

This annual report, the 10th, marks the end of Benor as a public company. Scheduled to be delisted soon, our history as a quoted tanker company is over.

Continue Reading