Banc of America Upgrades OSG

Daniel Barcelo, Philippe Lanier and Pierre Sargeant of Banc of America Securities issued a different opinion on OSG late last week, raising the company’s rating to Buy on the assertion that there are no grounds for OSG to be trading at a discount to peers on both EV/EBIDA and Price/NAV. We are inclined to agree.

Bear Stearns Breaks into Shipping Analysis

Concurrent with its Global Transportation Conference held today in New York, Bear Stearns has made a much-awaited break into the world of shipping analysis through the work of Justin Yagerman. Bear Stearns’ coverage initiation includes Diana Shipping, on whose IPO the firm served as underwriter, OMI, Nordic American, OSG and Teekay. Mr. Yagerman uses clever slogans to sum up the capabilities of each of the companies, citing Nordic American as “yielding results through a simple plan,” Teekay as having “a diversified growth portfolio,” and OSG as “sailing on many seas,” and he initiates all three of these companies with a relatively neutral “Peer Perform” rating. OMI, described as “putting the tanker market into focus,” wins the only “Outperform” rating of the tanker group for virtues including growth and favorable charter rates across its asset classes, strong company-specific chartering performance, and a modern, double hull fleet.

Diana Shipping, the only dry bulk company included, was also awarded an “Outperform” rating with the slogan “a great time to buy dry.” Mr. Yagerman cites Diana as having undervalued shares and thin research coverage in an industry with solid fundamentals. Additionally, the fleet’s age averages only 13 years and the revenue outlook is steady, with all currently owned vessels fixed on time charters. The $20 year-end price target Bear Stearns has for Diana represents a 34% upside from current levels based on 10x 2006E EPS estimate of $1.99. Unfortunately for Diana, neither this nor a positive report issued last month by Jefferies have had much of a strengthening effect on the company’s stock price to date, which at press time sits notably below the $17 offering price at $14.40. Investors looking for value in a seasonally week period may do well to take note.

Cantor Initiates Excel with Strong Buy

It’s not just the bankers that are keeping busy these days. The analysts have been turning out an incredible amount of research to monitor and analyze changes in the shipping equity markets. Excel Maritime has moved further into the mainstream of shipping stocks with a report issued by Natasha Boyden of Cantor Fitzgerald rating the company a “Strong Buy” with a target price of $20. We can only imagine what Ms. Boyden or any other analysts would have said had they tried to initiate coverage on the company last year, which not only possess a substantially smaller fleet but also saw shares trading upwards of $60.

Holman, Fenwick and Willan Adds Five New Partners

Holman, Fenwick and Willan announced this week the addition of five new partners, three of whom are members of the firm’s Shipping & Transport Group. The new partners, Jim Cashman, Julian Clark, Craig Neame, Samantha Roberts and Nigel Wicks, are all based in London.

Lepper Leaves Shipping

It seems the time has passed for the shipping industry to wave farewell to veteran analyst David Lepper. Mr. Lepper has maintained a post at UBS, but has moved on from the shipping markets into small cap.

Categories: Bankers & Banking, Freshly Minted, People & Places, The Week in Review | May 12th, 2005 | Add a Comment

Success for CMA CGM

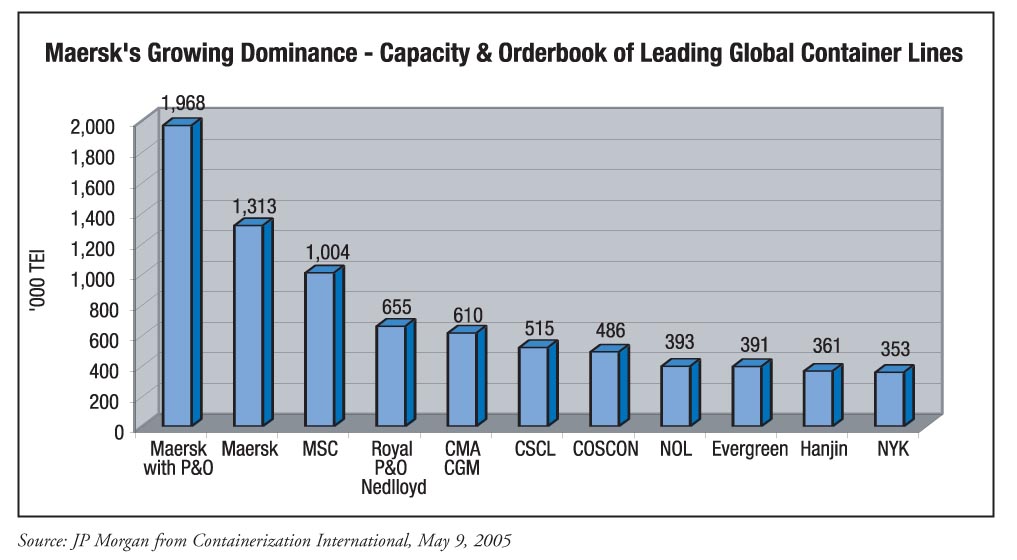

French carrier CMA CGM told the industry press last week that it aimed to be the world’s third-largest container carrier by 2008. Well congratulations! As the container capacity graph on the first page of this issue shows, with the merger of AP Moller-Maersk and Royal P&O Nedlloyd, CMA CGM is set to become the world’s third-largest container line by as early as this summer. And the company still has 55 boxships set to be delivered over the next three years.

Star Cruises Embarks on IPO Plan for NCL

Star Cruises is embarking on a New York Stock Exchange IPO plan for its wholly owned NCL Corp. The targeted amount appears to be a minimum of $250 million, and more is likely considering the company’s cash needs for its aggressive fleet build up.

“No decision has been made” the company said, but Star has been called the most debt-laden of the three major cruise companies, with net gearing of 163%. First and second ranked Carnival Corp and Royal Caribbean Cruises have gearing levels of 46.3% and 106%, according to Reuters data. Even so, Star is buying five new ships for NCL, with the most recent two costing $500 million.

Star Cruises would probably get a somewhat higher price for its NCL stock if it sold shares in the United States rather than Asia, since the industry is more closely followed by investors there.

Peter G.’s Genco Files for Nasdaq IPO

Genco Shipping & Trading Ltd filed for its Nasdaq IPO with the U.S. SEC on Monday. The company is looking to raise up to $350 million with the offering. It is 100% owned by Fleet Acquisition LLC, a limited liability company organized in September of 2004 that is 66.53% owned by Oaktree Capital Management, 26.63% owned by Peter Georgiopoulos and 6.84% owned by others. Jefferies & Company and Morgan Stanley are serving as the underwriters; notably Jefferies, certainly the smaller of the two firms, is listed first in the prospectus. As Genco is a U.S.-issuer whole filing indicates only the early stages of the company’s comment period with the SEC, we consider it safe to wait until a later date to take a more detailed look into the prospectus. But stay tuned!

A.P. Moller Bids for P&O Nedlloyd

In early 2004, it became clear to us that 2005 would be the most active year of consolidation among shipping companies in history. Our belief was underpinned by the fact that shipping companies were generating loads of cash from both operations and the capital markets, the fundamentals for the shipping industry looked set to remain strong and shipyards were operating at or near full capacity. So, armed with loads of cash and good prospects, it is natural to expect that companies would look to reap operational and financial synergies and leverage through growth, and that that growth would come in the form of corporate deals rather than single vessel purchases. And that is exactly what has happened in virtually every sector of the international shipping industry.

The Biggest Gets Bigger

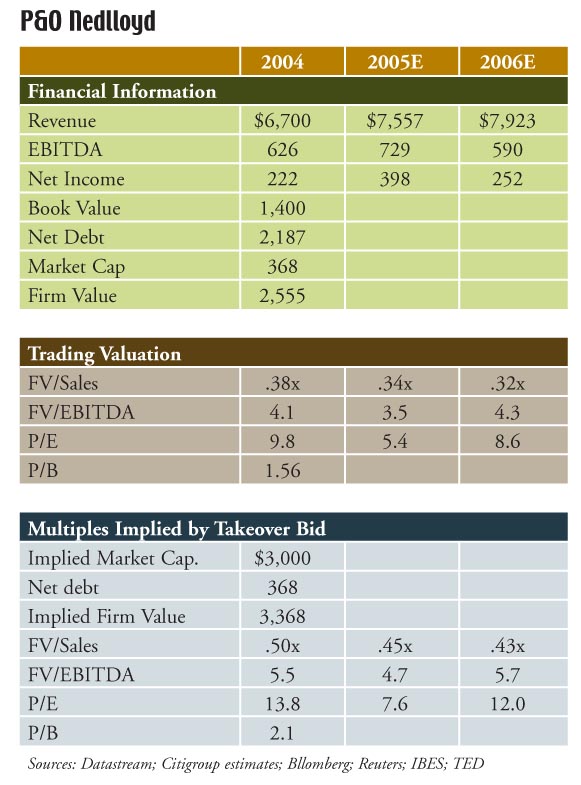

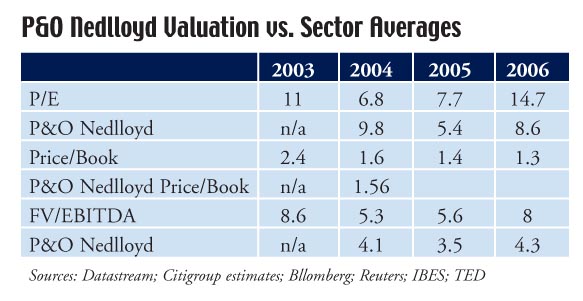

In the latest and most dramatic example of this phenomenon, A.P. Moller-Maersk launched a takeover bid this week for 100% of the shares in Royal P&O Nedlloyd in the largest container shipping M&A deal ever. The takeover bid values P&O at Euro 57 per share, which represents a 41% premium to the then-current price and a 45% premium to the price over the last six months. The bid is also a whopping 130% over the rights issue price on the deal that received Marine Money’s Deal of the Year Award this year and values the company at 1.6x FY05E. Although we expect Royal P&O Nedlloyd shareholders and P&O shareholders, who own 25% of Royal P&O Nedlloyd, to vote in favor the deal, the European Commission may require Maersk to sell off certain routes in order to consummate the deal legally, which could in turn spark a series of smaller M&A deals.

Randy Sesson at Goldman Sachs is representing A.P. Moller on the transaction, JP Morgan is representing Royal P&O Nedlloyd and Citigroup is representing P&O.

Valuation Metrics – AP Moller Set to Get P&O for Free

The transaction is an important one for both AP Moller and the container market in general. As you can see from the graph on the first page, the deal solidifies AP Moller’s position as the world’s largest carrier by taking out the number 3 player and propelling itself to a size that is set to be more than double that of its next largest competitor. On the industry level, the good news is that it shows APM’s bullishness about the outlook for the market, even despite the enormous post-panamax containership order book and some gloomy forecasts by analysts. The loss of P&O from the Grand Alliance will have a negative impact on fellow members NYK, OOCL and Hapag-Lloyd, as Grand Alliance has historically been an effective competitor to Maersk although we can hope that the rationalization of tonnage might ultimately help lessen the blows of looming overcapacity. In a research note, Citigroup container shipping analyst Charles de Trenck said he thinks the deal might raise the ante for other container lines, perhaps suprring NOL to acquire Wan Hai Lines, which has loads of ships on order. De Trenck also surmises that Evergreen could potentially be hurt, so we would expect this transaction to cause a spate of mergers and acquisitions.

Like any truly good M&A deal, this one is beneficial to everyone involved. Shareholders in Royal P&O Nedlloyd get a great valuation for their shares at a time when many think the market might start to weaken. If they want to remain exposed to the industry, they can use their tender proceeds to buy shares in AP Moller. And for AP Moller, the deal is fantastic. With synergies of around $350 million and AP Moller’s P/E valuation of 10x, the company’s share price should increase by the entire purchase price of the new company. Adding in the $400 million of earnings that Royal P&O Nedlloyd is expected to generate in 2005 will bring the number to $4 billion. Put another way, one could make the argument that AP Moller is getting Royal P&O Nedlloyd company for free!

LA Sees Strong Trade Growth, Worries About Pollution, Congestion

Moving away from Wall Street, the Los Angeles County Economic Development Corporation published an in-depth report on world trade that also had some positive implications for the shipping industry. For example the county, which engaged in trade worth $85.6 billion with China, $43.8 billion with Japan and $16.8 billion with South Korea, expects two-way trade in their district to increase by 14.3% to a total of $302.1 billion in 2005. The report also calls for 9.9% growth in the number of containers handled, amounting to 14.4 million TEUs. One of the biggest problems cited in this report was not what to do if the import/export market drops, but rather how to cope with the rapid and massive expansion in international trade that has been occurring in a cost and time efficient manner in a way that also minimizes harm to the environment. The report also takes a look at how transportation of goods breaks down by land, air and sea and types of products, but we will spare those details until a later date.