By Matt McCleery

Of all the thousands, probably hundreds of thousands, of ship finance charts and graphs we’ve made over the years, we’ve never had as many comments as we have gotten about the one that appears alongside this article – vessel value to EBITDA.

We came up with this valuation metric because many of our investor friends on Wall Street were valuing public companies by enterprise value, or “EV,” to EBITDA, so we simply applied the same concept to the values, or “enterprise value” in Wall Street parlance, of every major class of bulk vessel.

Enterprise value, for those who don’t make their living uttering such words, is defined as the value of the debt and equity in a business – in this case, the value of a mortgage free ship. So what this table really shows is how many years, at prevailing charter rates, it will take an investor to get back his original investment in a ship, plus repay in full any debt that was assigned to the vessel if the investor were to buy the ship, collect the freights, pay the expenses and use the rest of the free cash, or EBITDA, to repay the capital employed in the project. While there is nothing particularly novel about this valuation metric in the world of, say, private equity, the use of this tool for individual ships has never been a standard valuation metric, largely because of rate volatility. Continue Reading

Categories:

Marine Money | May 20th, 2005 |

Add a Comment

According to public filings, it appears that seven of the nine upcoming shipping issues will be listed on the Nasdaq, joining the recent IPOs of Top Tankers and DryShips. It seems like Times Square is the place to be these days.

Categories:

Equity,

Freshly Minted | May 19th, 2005 |

Add a Comment

1. There is a negative correlation between the dollar and the BDI of -0.37 since 1986.

2. The dollar to U.S. Rev/TEU correlation is -0.7 since 1987.

3. Freight is a commodity and commodities fall in dollar rebounds.

4. Since Breton Woods collapsed there have probably been three major periods of massive dollar declines; looks like we just had the third.

5. Wal Mart tells us consumers could very well be about to be maxed-out from the cumulative effect of buying binges in the 1990s.

6. Wal Mart accounts for 25+% of China outbound container shipping volumes Wages in China for Wal Mart low-end goods are rising faster than any potential RMB revaluation.

7. Ship capacity on order — almost any type of ship you care to choose; tankers, bulkers, containers — is currently equal to about seven years of normalized demand.

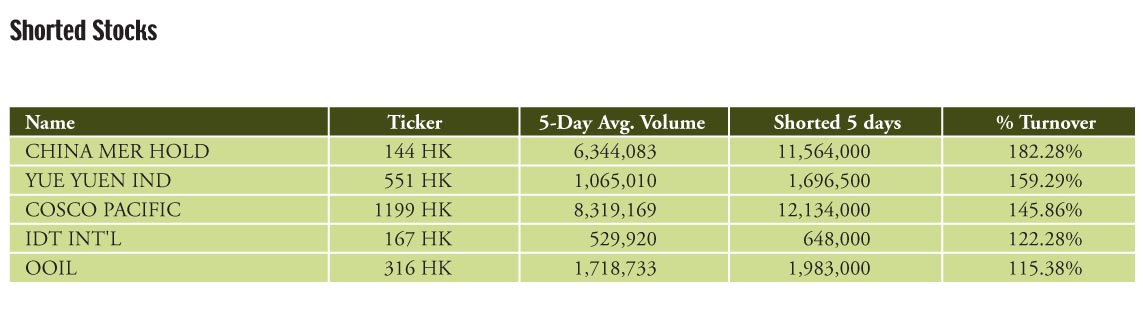

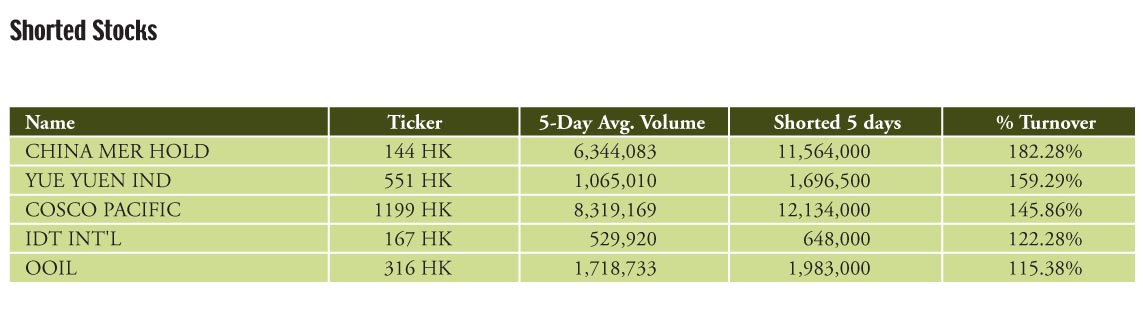

Since Mr. de Trenck’s advice was issued, transport stocks have been getting shorted in Hong Kong all week, and three of the top five are shipping names.

“COSCO Pacific and China Merchants have taken a reasonable licking, in line with traditional volatility. We still think COSCO Pacific is over-priced (our official long-term view on valuation), but would expect a rebound or a breather in correction,” said Charles. He simply doesn’t care for currently listed companies nor Coscon’s upcoming IPO. “Pricing and IPO of parent’s container shipping arm at top of cycle remains an issue which will contribute added volatility to sector.

Charles also pointed out that Taiwan shipping was in a distressed state on 16 May, with reports that rates from Taiwan to the U.S. fell 12%. “For now, we maintain our view of a low-end of 3-5% revenue/TEU growth in 2005E against a market view that was as high as 7%,” he said. Also news such as the more than 7% per TEU cost hike cited by NOL mean that costs are outracing the weaker revenue gains.

Fresh on the heels of last week’s announcement that AP Moller would tender to acquire Royal P&O Nedlloyd, there were this week reports in the Daily Telegraph this week that the Singapore government investment vehicle, Temasek, which owns a 70% stake in rival Neptune Orient Lines, is speculated to be building a stake in P&O (which owns 25% of Royal P&O Nedlloyd). Although such reports have not been confirmed, analysts at Citigroup think it might make sense from a timing and strategic point of view, but not because Temasek is interested in outbidding the mighty Moller. Here’s their reasoning:

* Temasek owns the second largest port company in the world, Ports of Singapore

* Citi believes P&O Ports would be an attractive addition to the PSA, as it would further dilute the dominance of the transhipment port in Singapore, which currently accounts for over 60% of volumes

* It would also make PSA a more attractive company if Temasek looked to IPO it in the future

* NOL has long been mooted in the press as an attractive merger partner for P&O Nedlloyd (PONL) due to complementary route networks

* The recent announcement by AP Moller that it intends to make a cash offer at EUR 57 for PONL may have forced Temasek’s hand

* Given the strong financial backing of AP Moller, entering into a bidding war for PONL would not appear to be an attractive option; however, acquiring P&O would give Temasek a 25% stake in PONL, which could be enough to defend or discourage a bid from AP Moller

* This would give Temasek the option in the future to initiate a merger between PONL and NOL

* Recent bid premiums have been in the range of 20-40%, which would imply an offer of 340-390p would be needed to secure P&O

* There is no tangible evidence at the present time, but Citi believe this is a plausible scenario

* Citi maintains their Buy/ Medium risk (1M) recommendation for P&O and 315p share price target, rates P&O Nedlloyd Hold/ High Risk, price target EUR 57, and rates AP Moller Sell/ High Risk, target price Dkr40,000

Our ambitious friends at Berlian Laju Tankers in Jakarta plan to issue $53 million of three-, five- and seven-year bonds in June. Berlian said 75% would go to fleet expansion while the remainder would be used as working capital. The company has appointed PT Danatama Makmur and PT DBS Vickers Securities Indonesia as underwriters for the issue. The bonds will be offered between May 17th and May 21st and listed on the country’s main bond exchange on June 27th. Berlian shares have risen nearly 36 percent this year, compared to a seven percent rise in the overall market after the company increased the buyback price of its shares from IDR1000 to IDR2000 per unit. Finance Director of Berlian Kevin Wong said, “In the past, when we mention about the buyback plan, we referred to the projection of $32m profit. Today we need to make some adjustment as the profit could reach more than $80m.” Berlian Laju is expanding to buy seven tankers at an estimated cost of $350 million. “The $350 million is the amount of pre-approved investment, which approval we obtained today (Wednesday). It is not necessarily only seven ships, but can and will probably be far more,” Mr Wong told FM. Mr. Wong is a regular at Marine Money Week and will be on hand to answer any questions you may have.

Categories:

Bonds,

Freshly Minted | May 19th, 2005 |

Add a Comment

On the eve of our 1st annual, and well oversubscribed, ship finance event in Moscow tomorrow, Freshly Minted has learned that Far-Eastern Shipping Company (FESCO) is working with Citibank NA for a $30.5 credit facility to fund a declared option for a containership order at Stoczia Szczecinska Nowa Yard, Poland. By FESCO’s proposal, the yard requested export financing for all three ships with fixed CIRR (Commercial Interest Reference Rate) by Credit Export Agency of Poland (KUKE). The request was accepted and the interest rate was fixed for eight and a half years at 4.36% p.a. on the condition that the commercial bank-agent will be provided with project-financing authority.

Flush with cash and bullish on the future, AP Moller has stepped up and signed an MOA to acquire six Lake Maracaibo barge drilling rigs and related assets for cash consideration of $59 million from ENSCO International Incorporated (NYSE: ESV). According to ENSCO, the sale does not include the ENSCO I barge drilling rig, which is currently under long-term contract in Indonesia. There were no financial advisors on the deal.

ENSCO anticipates closing the transaction by the end of the second quarter, and expects to recognize a minimal after-tax gain at that time. Carl F. Thorne, Chairman and Chief Executive Officer of ENSCO, commented: “The sale of the Venezuela barge rig fleet is in keeping with our stated intent to de-emphasize specialized assets. While Venezuela operations contributed meaningfully to our success during our formative years, we believe that this transaction will allow a redeployment of capital to investments which have more attractive return potential.”

Categories:

Equity,

Freshly Minted | May 19th, 2005 |

Add a Comment

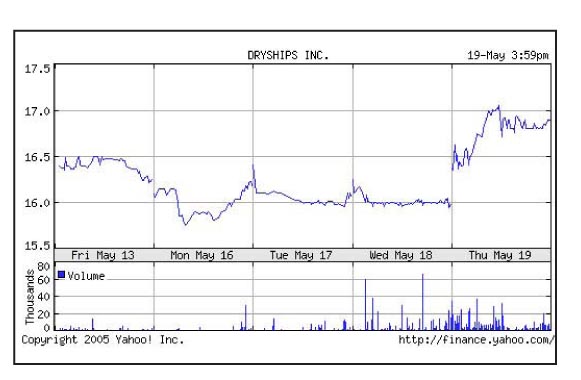

George Economou has been running around various New York City financial media outlets this week talking about the shipping markets and his stock – with great success. Economou gave a bullish interview on CNBC this morning and plans to be on Bloomberg this afternoon and CBS MarketWatch early next week. As you can see from the stock graph, both in terms of volume and price appreciation, active investor relations can yield spectacular results – something that all public companies should remember.

Categories:

Equity,

Freshly Minted | May 19th, 2005 |

Add a Comment

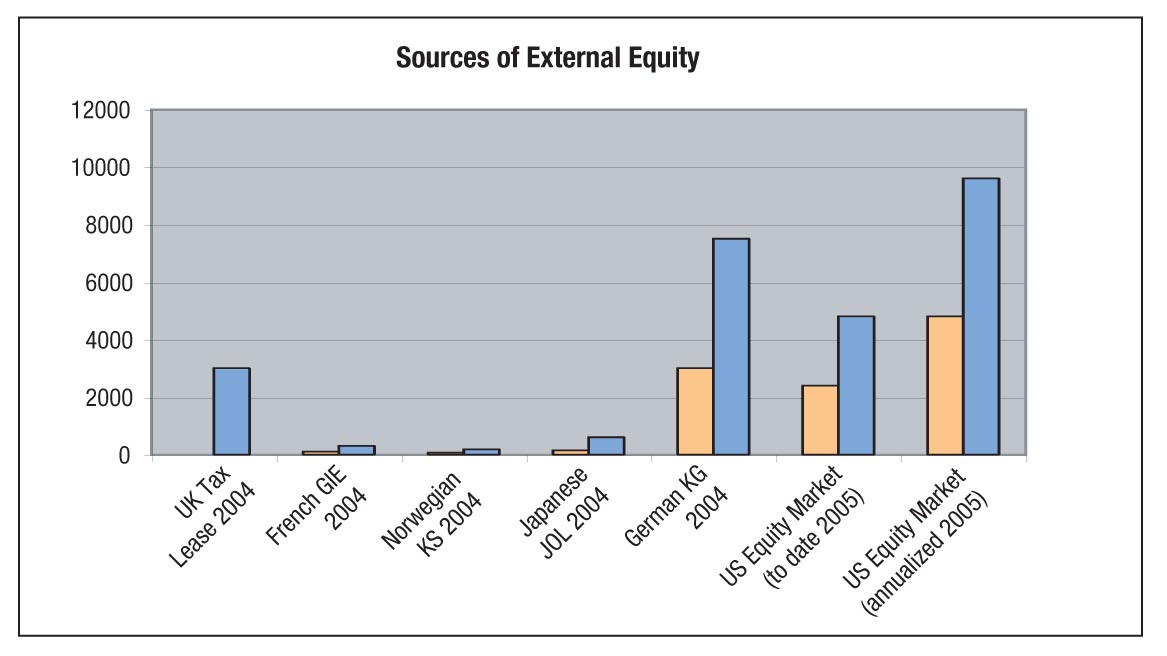

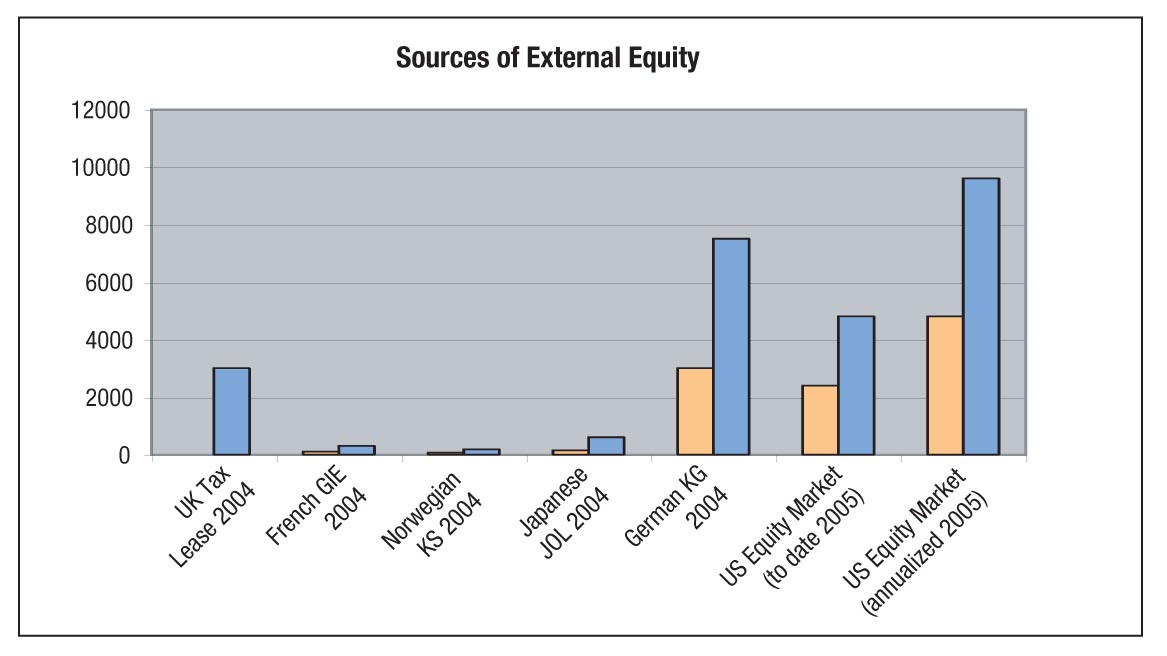

As ridiculous as the concept would have sounded a year ago, according to our data it looks as though shipowners might raise more outside equity in the United States than in Germany this year. As you can see from the Sources of External Equity table, the German tax lease market contributed $3 billion of equity to shipping projects in 2004, which formed the basis for another $4 billion in debt. 2004 was a very good year for KG deal volume, and we would expect a similar result this year. U.S. equity markets, on the other hand, have gone from providing a negligible amount of equity in 2003-2004 to a potentially providing a massive amount in 2005. According to our figures, there are about $2.4 billion in deals that have been done or filed so far in 2005, which accounted for another $2.4 billion in fresh debt – and this is only May. Assuming that all these deals get done and the pace continues throughout 2005, the U.S. equity markets will contribute close to $5 billion in equity and attract another $5 billion in debt. So what does this mean to the investment banking community – quite a lot. Assuming issuers all pay the full gross underwriting spread of 7%, shipping deal volume could produce fees of $350 million.

Categories:

Equity,

Freshly Minted | May 19th, 2005 |

Add a Comment

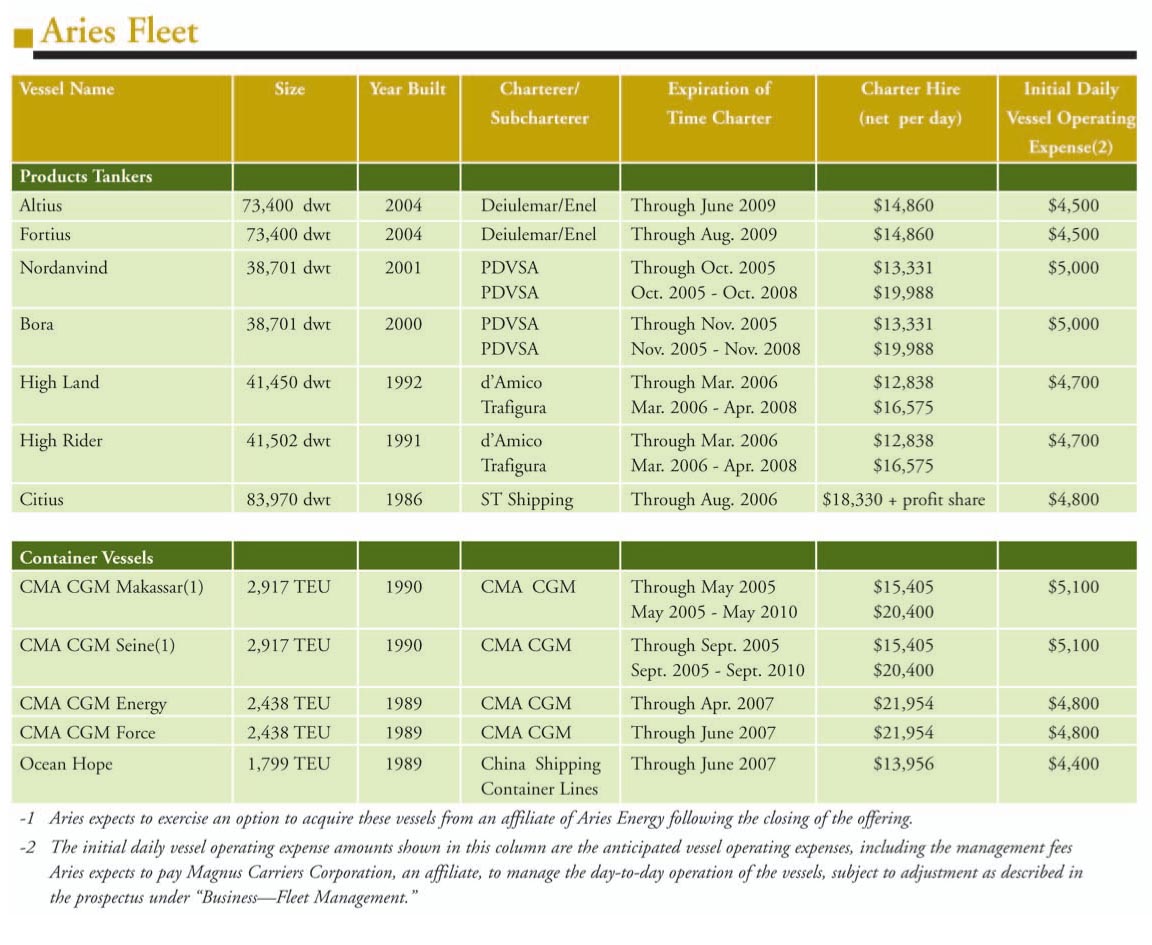

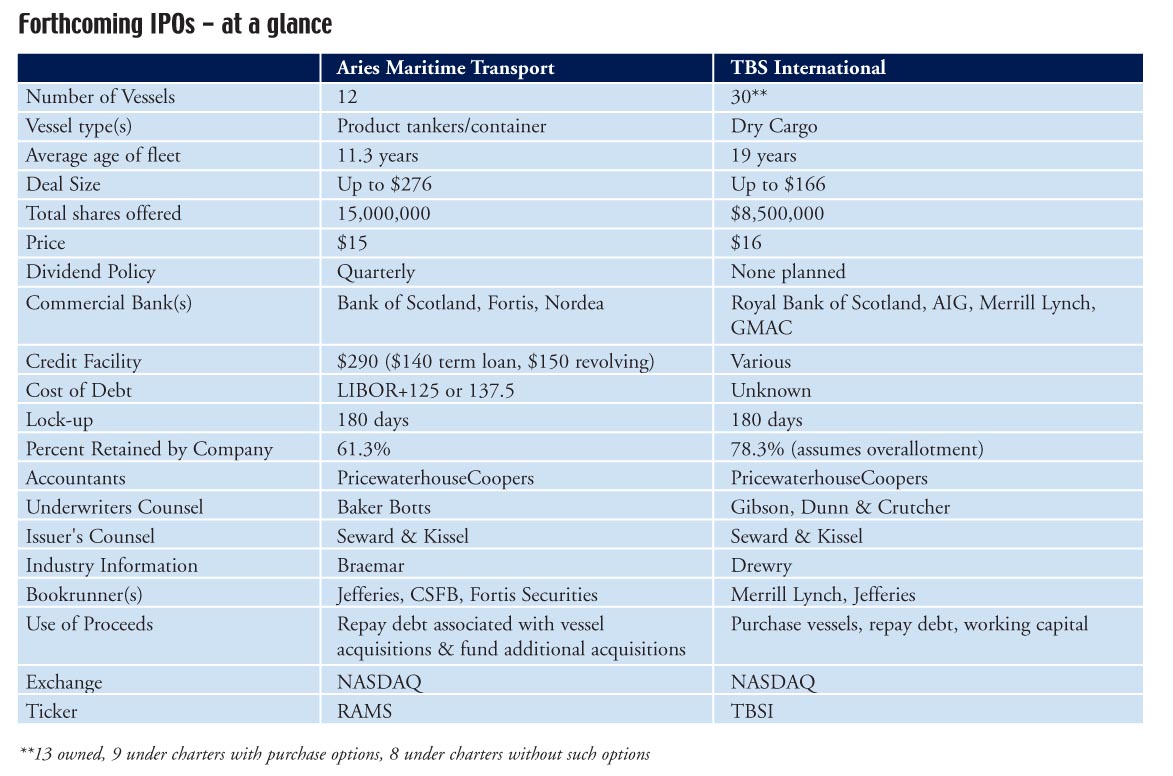

Aries Maritime Transport and TBS have emerged this week as the next shipping companies likely to head off on IPO roadshows to raise fresh capital. These two deals follow on the heels of the wildly successful IPO of Teekay LNG, and before that Diana’s less-than-spectacular post-offering performance.

We have been watching TBS since it made its initial S-1 filing with the SEC in March, but noticed that the company filed a revised document with the SEC this week that includes much more detailed figures, as highlighted in the Forthcoming IPOs table. Although public transactions are not generally deemed “effective” until shortly before pricing time, we imagine TBS is getting very close to launching. As for Aries, the deal was initially filed using the confidential Form F-1 and was therefore previously unknown to the marketplace.

This is a very good combination of deals to launch so close together in that they are very different and will likely appeal to different categories of investors. As you can see from the accompanying fleet list, Aries’ fleet is comprised of product tankers and container ships, 100% of which are on term charters. In contrast, TBS operates a long-established liner service using a fleet of owned and chartered-in bulk carriers to serve its industrial customers. There are plenty of other differences as well. For example, Aries plans to pay a substantial dividend that appears similar to Arlington Tankers in concept while TBS does not anticipate paying a dividend. As always, we will refrain from engaging in a valuation analysis until the deals conclude, but below are some facts and figures that appear in the public document.

Categories:

Equity,

Freshly Minted | May 19th, 2005 |

Add a Comment