STX Pan Ocean launched first shipping bond issue for the year

STX Pan Ocean will be selling KRW 250 billion (USD 223.5 million) worth of three-year bonds at a fixed rate of 3% for general corporate and facility investment purposes. Unlike most of its past domestic bond issues, the latest bond offering will be sold with warrants. Based on our records, this is the first time that STX Pan Ocean will be offering bundles of bonds with equity warrants for sale.

Each warrant gives the bondholder or his designee the right but not the obligation to buy one new STX share (listed on the Korea Exchange) at an exercise price of KRW 6,980. The warrants are priced at a discount to enhance the yield of the bonds and make them more attractive to potential buyers. By offering potential investors warrants that are “in the money”, STX Pan Ocean is able to offer its unsecured plain vanilla bonds at a much lower coupon than would have otherwise cost in excess of 5% for a three year tenor. The exercise price may be subjected to changes depending on prevailing market conditions, but will not be more than a 10% discount to the prevailing market price of the shares prior to the signing of the subscription agreement. Shares of STX Pan Ocean closed at KRW 8,120 last Friday. Continue Reading

Conflicts between Mortgagees and Charterers

By Jim James

Norton Rose, Hong Kong

On occasion, the mortgagees and the charterers of a vessel will be found to have differing commercial interests. Usually, a conflict will arise in circumstances where the mortgagee wishes to take prompt action to enforce its rights (e.g. by arresting the vessel and having it sold free of charter), and the charterer wishes such action to be deferred until the end of the charter period. If the charterer and the mortgagee are not parties to a priorities agreement, general legal principles govern their respective rights. English law in this area is not entirely clear. Each case depends upon its own facts and circumstances, and specific legal advice should be sought in individual cases.

There are two main reasons why the law in this area may seem somewhat unclear. The first reason is that these cases arise rarely in

practice, because either the rights of the parties are governed by a priorities agreement, or it becomes evident that the shipowner is insolvent, which means that the charterparty cannot be performed in any event. Continue Reading

Berlian Laju Tanker Seeks Debt Standstill

Berlian Laju Tanker (“BLT”), one of the largest chemical tanker owners in the world, is asking creditors for a standstill on its debt repayments and has appointed FTI Consulting to restructure its business. The request underlines the parlous financial position of BLT in the wake of a soft chemical tanker market that continues to slide sideways.

Last Wednesday, Fitch Ratings downgraded BLT’s long term and local currency issuer default ratings to Rating Watch Negative, reflecting heightened liquidity risks that the company has yet to secure refinancing for the IDR 1,153 billion (USD 127.4 million) domestic bonds due in May and July 2012. Indonesian credit agency Pemeringkat Efek Indonesia (“Pefindo”) also lowered the ratings of BLT’s domestic bonds to idBBB- and placed the company under its negative watch list for on-going concerns over the company’s ability to fulfill its maturing obligations. Pefindo added that BLT has insufficient liquidity to meet its short term liabilities. Cash and cash equivalent and short term investments at the third quarter of 2011 could not cover its short term debts of USD 421.3 million (including the domestic bonds due in May and July 2012). Fitch noted in a grimmer statement that even if BLT is able to refinance the

2012 notes, it faces looming debt maturities of USD 297.2 million in 2013 and 2014. Continue Reading

KCC sells USD 601 million stake in Hyundai Heavy

Korean construction materials manufacturer KCC Corp has reduced its stake in Hyundai Heavy Industries (“HHI”) from 6% to 3%, in a

block sale arranged by sole bookrunner J.P. Morgan. KCC eventually sold 2.49 million shares in the world’s largest shipbuilder at KRW 280,000 (USD 242) a piece, priced at the top of this indicative price range between KRW 271,500 and KRW 280,000. The final price represented a 3.9% discount to HHI’s closing price on 12 January 2012.

Shares of Hyundai Merchant Marine (“HMM”) soared 4.35% last Monday on market rumours that KCC Corp could use proceeds from its HHI block sale to pick up a stake in the shipping company as the family feud of Hyundai Group shows no signs of receding. For many years, HHI and the Hyundai Group have been fighting each other for control of HMM, the flagship entity of the Hyundai Group. KCC is widely seen as a major ally of HHI.

NOL in Sale and Leaseback with Diana Containerships

Neptune Orient Lines (“NOL”) has concluded a sale and leaseback transaction of two 4,750 TEU panama boxships with New York listed Diana Containerships, a spinoff from New York listed Diana Shipping. Diana Containerships will be acquiring the boxships APL Sardonyx and the APL Spinel, built in 1995 and 1996 respectively for USD 30 million each. The ships will then be chartered back to NOL unit APL Bermuda for a period of minimum 24 months plus or minus 45 days at USD 24,750 daily.

The charterer has the option to employ each vessel for a further 12 month period plus or minus 45 days, at a daily rate of USD 24,750

starting 24 months after delivery of the vessel to the charterer. After that period the charterer has the option to employ each vessel for a further 12 month period plus or minus 45 days, at a daily rate of USD 28,000 starting 36 months after delivery of the vessel to the charterer. Options must be declared by the charterer not later than 20 months for the first option and 32 months for the second option after the delivery date to the charterer. The vessels are expected to be delivered in the first quarter of this year.

Welcome to London

Marine Money Asia was in London this week to attend the Marine Money London conference. The weather was overcast and cool; a bit like the shipping market really. The theme of the conference was “How to save an industry in trouble?” A bit dramatic perhaps, and we are not suggesting for a moment that we, or the world, could exist without shipping, but it is clear to all that major issues in the industry and in the financing of the industry need careful thought and a plan of action. The discussion at the London conference was

focused on three main issues: how shipping companies and shipping banks handle the existing fleet and debt to that fleet; whether the shipping banks and other finance sources can “fill the gap” required over the next year or two to deliver all the already contracted newbuildings; and where does the industry go hence bearing in mind that the common model used for the last decades seems not to have worked and not to be re-usable going forward.

The general conclusion was, yes, we will muddle through. The vessels will be delivered and the banks, together with a small amount of private equity and a large amount of private equity (meaning shipowners own reserves) will fill the gap. Where do we go hence. On that one there are two schools. One believes that when the European debt crisis sorts itself out, whenever that might be, and European banks will again be able to borrow and lend US dollars, we will be “back to normal.” The other school believes that we are in for a structural change. We will have, and should have, huge consolidation within the industry, and financing to the shipping industry will be structured and corporate.

Crisis Management for Mortgagees-Part III

This is the third and final article in a three-part series examining loan enforcement and judicial sale of vessels. In the first two articles, Norton Rose (Asia) LLP partners, Ben Rose and Robert Driver looked at preparations and options for enforcement and vessel arrest and judicial sale. The third and final article is contributed by Manish Singh from ship managers V.Ships and focuses on certain practical matters which a mortgagee needs to consider when arresting a vessel. V.Ships is a highly experienced asset manager, having successfully supported mortgagees during the various recent crises experienced by the shipping industry.

Difficult operating environment, sustained drop in the freight markets, continued pressure by way of cost inflation and increased regulations all make shipping a particularly challenging business at this time. Add to that concerns around counterparty risks and failing contractual relationships and the instances of defaults, restructurings and recovery of assets from non-performing loan relationships is on the rise.

Lenders are concerned not only about non-performance in certain relationships but also cost pressures which may impact the committed standards of operations that are necessary for safety, asset preservation, trading continuity and environment protection. It is for this reason that V.Ships are working extensively with its principals not only to deliver turn-key asset management but also advisory and strategic support to optimize costs and enhance operational efficiencies.

As highlighted in the previous articles, there is no such thing as a normal set of circumstances surrounding a workout situation. The magnitude and dynamics can and do vary enormously. The scale and intensity of the problems faced can and are often adversely impacted by delay in decision making, disputes between stakeholders, poor information and a host of other reasons. Irrespective of the factors specific to the case, every recovery project requires meticulous planning and co-ordination between various stakeholders. Often such takeovers need to be implemented within a short period of time. Due to the multiple stakeholders involved, this is particularly challenging as there are various liens that need to be recognized and managed effectively.

Any mismanagement of liens will surely lead to delays and disputes which may invite additional costs and liabilities or may even lead to subsequent arrest of the vessel.

Circumstances will also vary according to the type of asset owner and type of asset(s) involved. For example, further to the creditor risks, on cargo vessels that are in a laden condition, the recovery project must also anticipate the risks of cargo going off specification and what care is required during the transition to prevent this. Similarly on passenger carrying vessels there is an extensive stakeholder group and further commercial and reputational issues to consider.

Planning for recovery scenarios:

While circumstances vary and must be assessed and acted about on their own merits, there is no substitute for good process to manage a series of actions from the initial diagnosis of the problems faced, through scenario planning until successful completion of the desired outcome.

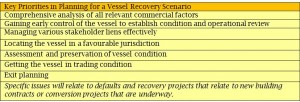

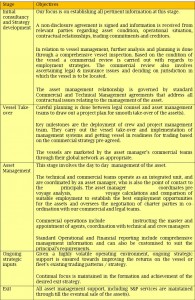

Considering these priorities, the table below depicts a simple five-stage process that we as asset manager adopt with parties engaged in a work out situation to develop a roadmap to be combined with disciplined project management.

Practical considerations:

In terms of various considerations, the earlier articles in this series have already touched upon the commercial review process. This will typically involve the latest valuation of the assets against the exposure of the enforcing parties and claims pending in relation to the asset. Other than the mortgages themselves, typical liens include outstanding crew wages, insurance payments, creditors including bunkers and Lube oil suppliers, fees due to class and disbursements pending to ship agents. Sums may also be due in terms of ship manager’s fee and other 3rd party suppliers.

Careful consideration will be given to the review of charter parties in place and of the commercial outlook for the vessel to be traded.

In terms of the operational and technical considerations, at this stage, it is nessesary to carry out a physical inspection of the vessel and assesment of crew on board and how the vessel is being managed and cared for.

From an asset manager’s perspective, once a vessel has been located in a favourable jurisdiction the takeover can be implemented. This involves co-ordination with the crew and various other liens involved. It will, in most instances, be nessesary to replace the existing crew with incoming crew.

Managing the situtaion on board involves gaining early access and deploying a project team on the vessel. This project team will not only gain the confidence of Master and crew but carry out a comprehensive inspection of vessel to establish actual condition and the scope of works involved to maintain or bring the vessel back into trading condition.

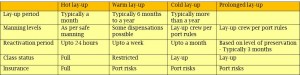

Lay-up scenarios:

It is possible that due to the depressed market conditions, in certain instances the laying up of the vessel may be the most effective strategy short or mid term. Different scenarios tend to play out depending on the type of asset, location, degree of the readiness desired for safety or commercial reasons and other relevant factors.

Risk Management:

It is important for the asset manager to use comprehensive risk assessment tools in order to anticipate all operational, commercial and reputational risks and have a robust management plan to respond to all associated issues. At V.Ships, we have an established and tested management system which anticipates and address all routine matters and contingencies. This provides us with the tools to employ measures to mitigate or manage all material risks.

Communications:

Given the wide range of stakeholders involved, a clearly defined and coordinated communications plan is imperative in instances where vessel recovery is involved. Such instances meet with close attention from trade press as well as the regional media in the location where vessel recovery is affected. Misinterpretation of information or uncoordinated communications could again result in adverse publicity.

Early engagement with an asset manager:

It is desirable to establish an early engagement with competent asset managers in order to carry out the assesment of the asset, development of a strategy and ensuring smooth implementation.

Such engagements could be by way of engaging a competent manager to carry our asset inspections. This can readily be done by exercising the right to carry out periodic inspection available to lender within mortgage

contract. Managers are also often tasked to carry out an audit and report on key operational and financial parameters as well as optimisation of costs and management as a lender’s representative.

V.Ships is the leading independent ship-manager and marine services provider globally and we focus on the marine, offshore and leisure markets. V.Ships group companies service a fleet of over 1,000 vessels and manage an international pool of about 25,000 seafarers drawn through the global V.Ships network that includes over 70 offices across the world in over 26 different countries.

www.vships.com

Dongfang Shipbuilding Hit by Cancellations

The lack of financing has hit the orderbook of London AIM listed Dongfang Shipbuilding, casting doubts on the future of the Chinese shipbuilder. Two of its largest contracts, worth USD 52.6 million,

were cancelled after the shipyard failed to secure the required banking finance and performance bonds. In a statement to the stock exchange, Dongfang says it faces increasing difficulty in securing the relevant banking finance for the execution of the contracts. Existing contracts to construct eight 6,700 dwt bulk carriers are also in jeopardy, after the buyer failed to make the required prepayment for work to commence. Dongfang now sits on an orderbook of USD 5.7 million, substantially down from USD 64.7 million in November 2011.

Wintermar Offshore Taps IFC Loan

On Tuesday, Indonesian offshore company Wintermar Offshore Marine signed a USD 45 million with IFC for the expansion of infrastructure services in the country’s oil and gas industry. IFC, a member of the World Bank Group, is the largest global development institution focused exclusively on the private sector.

IFC’s loan to PT Wintermar Offshore Marine Tbk, the largest Indonesian provider of support vessels to the domestic oil and gas industry, will assist in funding the company’s plan to add 15 supply vessels to its fleet over the next two years. The expanded fleet will support the exploration and development of new offshore oil and gas fields, particularly in eastern Indonesia, to help the country meet growing energy needs. The gradual implementation of cabotage regulations and rising activity level in the Indonesian offshore energy industry have led to higher demand for Indonesian-flagged offshore support vessels. Continue Reading

Wallenius Wilhelmsen JV Builds and Finances in Japan

Norwegian operator Wilh. Wilhelmsen ASA has recently signed a new USD 55 million buyer’s credit agreement with Japan Bank of International Cooperation (“JBIC”). The Norwegian operator will use the proceeds to finance the construction of a pure car/truck carrier (“PCTC”) ordered at Mitsubishi Heavy Industries (“MHI”) in 2010. JBIC will commit USD 27 million to the facility, with the remaining amount to be co-financed by Bank of Tokyo-Mitsubishi UFJ and Sumitomo Mitsui Banking Corp. Nippon Export and Investment Insurance (“NEXI”) will provide the commercial lenders buyer’s credit insurance of USD 27.4 million that covers 97.5% political risks and 95% commercial risks.

The vessel is one of the two PCTCs that Wilh. Wilhelmsen and partner Wallenius Lines ordered in 2010. Wallenius Lines’ Singapore subsidiary secured similar funding agreement with JBIC and NEXI for its PCTC back in September 2011. BTMU was the sole arranger in that particular transaction. Each vessel has a capacity to transport 6500 car equivalent units and will be sister vessels of ten PCTCs delivered from MHI in the period 2004-2009. Continue Reading