Quintana – Wall Street Mining Wall Street

A few weeks ago, we wrote an article in these pages called “Eagle Bulk – All About the Arbitrage.” The article outlined the recently filed S-1 for an IPO of handymax bulk carriers being offered by New York private equity fund Kelso. In this article, we discussed the concept of private equity funds buying ships just prior to, or even concurrent with, IPOs so that they could capture the arbitrage that exists between the value of ships in the private and public markets.

Although much of this premium has been drained away during the last six weeks due to choppiness in both the equity markets and the shipping markets, we believe it is likely to return in the very near future and look for shares back in the range of 1.5x net asset value. The transaction concept is one with which private equity funds are comfortable: buy a company cheap, then sell enough of it to the public to get their money out with a return through a dividend, and then keep a slug of shares in the company that has the potential to result in a real home run.

With the economics of the shipping markets fitting this bill, the concept is spreading, and we are seeing more and more non-shipping company issuers in the shipping markets. The way to think of this is that Wall Street wants products and is willing to pay a certain price for them, and in response a variety of experienced financiers are creating these products and attempting to bring them to market. There is nothing necessarily wrong with this; in fact companies created for the sole purpose of equity offering might offer cleaner management structures and fewer conflicts of interest than old-line companies.

This week, we saw the filing of an IPO called Quintana Maritime, which is backed by Corby Robertson, whose family sold the Quintana oil field in Texas to Exxon many years ago, and who has since made investments in commodities such as coal mining. Robertson has teamed up with First Reserve of Greenwich (who have been plotting an entry into shipping ever since their agreement to purchase OMI shares at about $1.50 each a few years ago failed amidst bad feelings) and American Metals & Coal International, also of Greenwich. Stamatis Molaris, former CFO of Stelmar, is serving as CEO and President of Quintana. Citigroup and Morgan Stanley, who lent the company the money it needed to acquire its fleet, are acting as joint bookrunning managers.

A Short History

Quintana does not have the storied history that many recent and future issuers have. They cannot point to hundreds of years of experience or their origins from an island – except perhaps Long Island. In fact, they were formed on January 13th, 2005, and began operations in the following April, in other words last month. As of March 31, 2005, Quintana had not taken delivery of any of the identified panamax vessels, though the company did take delivery of three such vessels in April, and expects to take two more in May and the remaining three in July, August and September.

Distinguishing Deals

One of the challenges borne of the incredible torrent of deals heading to market is differentiation. What we mean is that there is nothing particularly compelling about this deal compared to others currently or soon to be trading in terms of asset type, employment, age, deal size, management or structure. Like Eagle Bulk, Quintana has signed MOAs and placed deposits on the eight modern panamax bulkers outlined in Figure 1.

Although we expect valuations to improve, the company shows strong asset and structural similarity to Diana Shipping, which suffered from bad timing in both the shipping and equity markets that may have been exacerbated by the fact that it was fully priced and sold into the wrong types of accounts. This must be a little unnerving for the sponsors, and we fail to understand how this deal will ever be judged on anything other than how much of discount it is offered at relative to Diana. Although Quintana does not indicate that it will use the model of a dry cargo version of Nordic American Tankers as Diana did, the company does plan to repay its debt in full upon consummation of the offering.

Perhaps there will be enough buyers to go around. There is nothing inherently wrong with the Quintana deal, but the sponsors will need to see valuations improve and have one heck of a good roadshow. That said, with the firepower of Citigroup and Morgan Stanley behind them, who likely do lots of other business with the sponsors of this deal, it is unlikely that it will be sold into the accounts of hedge fund “flippers” as the Diana deal seems to have been.

Of Bridge Loans and Mezzanine

As we also wrote in our article about Eagle Bulk, these kinds of deals are not without risk to the sponsors as we cruise along a high point in the cycle. In fact, they involve a lot of risk. Unlike the Top Tankers IPO, in which the purchase of the Sovcomflot fleet was contingent upon a successful equity offering, both Eagle and Quintana involve the sponsors buying ships first and hoping they can get a premium in the future. In this case, the joint bookrunners have provided both secured debt and mezzanine facilities to result in 85% financing. This structure is not dissimilar in concept to the highly leveraged facility that Citigroup and Nordea provided to soon-to-be-public Genco, sponsored by yet another private equity firm, Oak Tree Capital.

Quintana entered into a $150 million bridge loan facility, dated as of May 3, 2005, with Morgan Stanley Senior Funding, Inc., not a regular player in the world of ship finance. In addition, the company entered into a new six-year three-month $262 million secured delayed-draw term loan facility, dated as of April 29, 2005, with Citigroup. The term loan facility consists of Tranche A, in an aggregate amount equal to the lesser of $213 million and an amount equal to 65% of the fair market value of the vessels, and a Tranche B, in an aggregate amount equal to the lesser of $49,210,500 and 15% of the fair market value of the vessels. The aggregate principal amount applied in respect of any vessel acquisition must not exceed 80% of the fair market value of the vessel. According to the filing, interest on amounts drawn will be payable at a rate of 1.625% per annum over LIBOR in respect of Tranche A and 2.50% over LIBOR in respect of Tranche B, for interest periods of 1, 2, 3 or 6 months or, if agreed by all lenders with commitments, 9 or 12 months. In the event the Tranche B term loans are not syndicated within 45 days, Tranches A and B will collapse into a single tranche and interest will be payable at a rate of 1.75% per annum over LIBOR.

Categories: Uncategorized | May 5th, 2005 | Add a Comment

Frangou on Eve of Triumphant Navios Acquisition

Understanding the Valuation

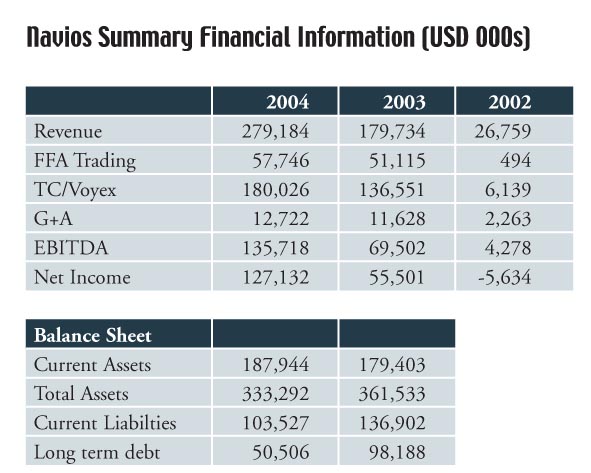

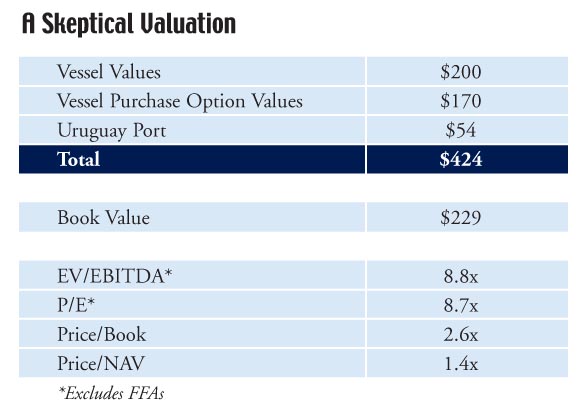

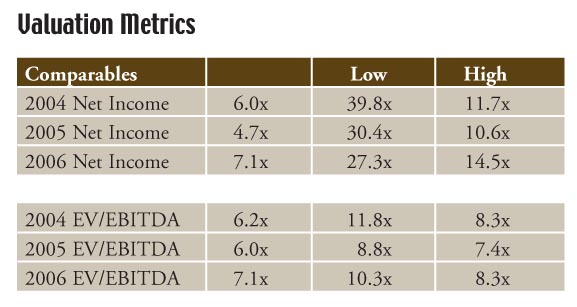

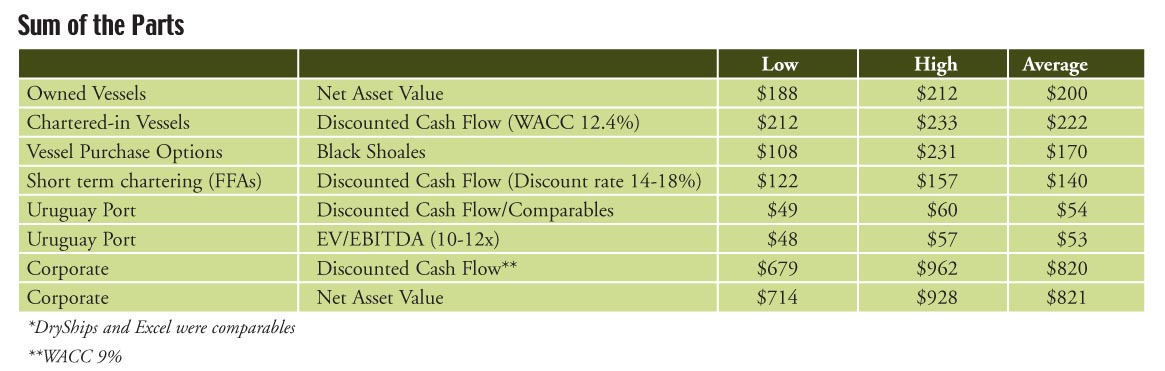

Defying skeptics who speculated that she would use the $180 million of blind pool money she raised from investors in late 2004 to buy her family company at an inflated price, Greek shipowner Angeliki Frangou is poised to take over one of the most powerful and important franchises in the dry cargo business. Like all shipping deals made at this point in the cycle, it is yet to be determined whether this will prove a good investment over time, but one thing is for sure: irrespective of shipping market performance, International Shipping Enterprises is buying into a real business that is capable of enduring through the cycles.

By acquiring Navios, ISE will take ownership of a fully integrated business with a truly unique strategy that blends opportunistic vessel acquisitions with sophisticated risk management to produce extraordinary returns without the assumption of extraordinary risk. If the transaction is consummated in the coming months, as we think it will be, the “blank check” structure will have worked absolutely perfectly, a fact that not only bodes well for Greek shipping and Ms. Frangou personally, but also for the future use of this source of capital for shipping.

Unlike other public offerings in which selling shareholders retain a majority interest through “secondary shares,” Navios shareholders are cashing out 100% of their interest in the new company while many members of key management have entered into employment agreements and non-compete agreements.

Weekend Reading

With a document longer (and, to us, more interesting) than War & Peace, blank check company International Shipping Enterprises (ISHP.OB) filed a proxy statement yesterday outlining the details behind why it wants to buy dry cargo company Navios. And the details are juicy.

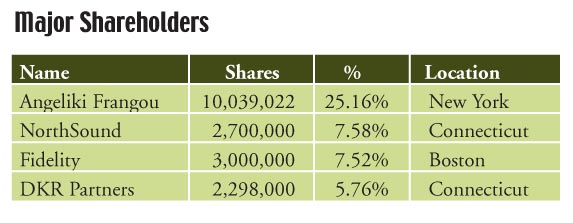

Although the document references a closing date of May 20th, the proxy statement was just filed with the SEC on April 20th, after which is required 4-8 weeks for initial and follow-up comments by the SEC, so it is still unknown when the shareholder meeting will take place and when the deal may actually close. ISE needs a majority of those who vote, either in person or by proxy, to vote in favor of the transaction for it to be consummated, but this should not be a major issue. Though Ms. Frangou and her 5%+ shareholders comprised about 45% of the votes and we suspect they are all comfortable with the transaction, the deal does have to be approved by a majority of the public shareholders, with private and founding shareholders required to vote alongside the public majority. Still, we can’t imagine a scenario in which Ms. Frangou could possibly find a better deal and a more cooperative and patient target. And that fact remains that it is an exciting deal with excellent potential that is supported by the major shareholders.

ISE will finance the acquisition using a portion of the $180 million from its offering and a $520.0 million credit facility from HSH. The loan is comprised of a $140.0 million facility that matures eight years from the closing of the acquisition and a $380.0 million facility that matures six years from the closing of the acquisition.

Categories: Uncategorized | April 21st, 2005 | Add a Comment