Paragon’s Banks Give It Some Wiggle Room

Paragon Shipping reported its 4th quarter and year-end 2008 results last week and the results were relatively strong given the overriding weak economy and depressed shipping markets. Looking forward the company has strong earnings visibility, with 98% of the fleet fixed through 2009, and cash well in excess of its current portion of long-term debt. Nevertheless the company was not immune to the travails suffered by the rest of its peers.

The company announced that it had to amend its six credit facilities for covenant breaches. The facilities are detailed in figure 1.

In its presentation, the company also disclosed the current status of the loan covenants as portrayed in figure 2.

Dribbling Dilution

In a short commentary on DryShips, Scott Burk of Oppenheimer noted that the near-term upside, derived from the cash flow benefits of the newly announced Petrobras contract on the drilling rig Leiv Eriksson, would likely be dampened. He surmises that management would likely “…sell stock into strength from this announcement under its ATM offering.” What we found more sobering was Mr. Burk’s estimate that while this $500 million offering could be completed by mid-April, DryShips would likely need additional equity to comply with LTV covenants by August 2009. The analogy that comes to mind is the Chinese water torture.

Much More Than a Report

This week the Charles Weber Report landed on our desk with a “thunk”. Not only is it heavy; it is heavy reading. In his inimitable style, Johnny K has created something different. Rather than two separate reports, the Weber Report combines an integrated overview of developments in the tanker market as well as the oil industry, which it serves. And, for us, the best part is that it isn’t delivered in PowerPoint. Although all the standard graphs and data are there and well analyzed, it is the commentary and chronology, which we, suffering from short-term memory loss largely attributable to our inability to keep up with our reading, find useful. We particularly found of interest his review of the state of the economy, despite the concluding picture of a house of cards, and his perspectives on China and India. There is much more than can be covered in this short review. Suffice it to say, get your hands on a copy.

Our only quibble is that the period covered has not ended, but, given Johnny’s intuition, that suggests that nothing will likely happen in the next couple of weeks. Trade accordingly.

Going, Going, Gone

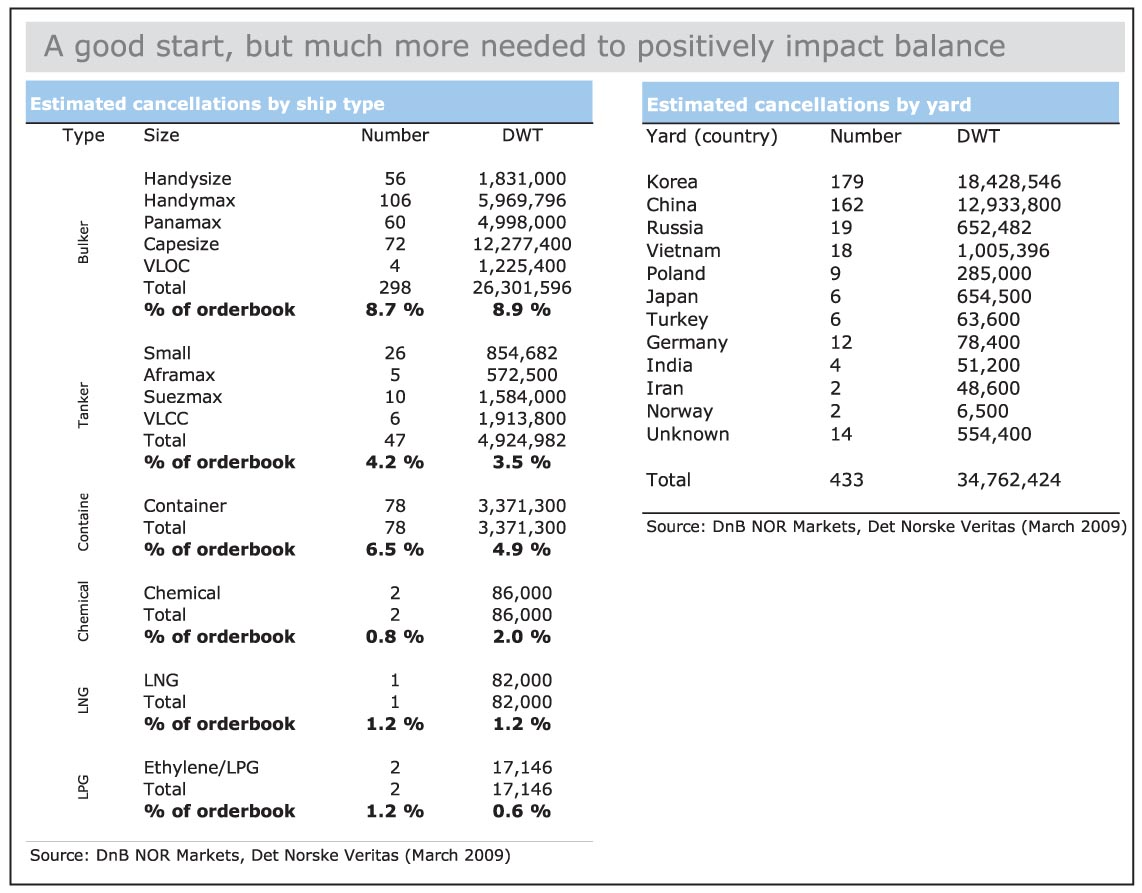

Thanks to Henrik With of DnB Nor Markets who compiled the data provided by Det Norske Veritas, we have a clearer picture, albeit estimated, of how much of the order book has been cancelled thus far (see chart below).

As Mr. With suggests, it is a good start however much more is needed to achieve the much talked about 30% to 50% reduction in the dry bulk sector, no less to begin the process of restoring a balance between supply and demand.

Pooling Talents

First International, Blank Rome, ICAP Shipping and Morpheus Capital Advisors have joined together and formed The Maritime Restructuring Alliance, a maritime financial crisis management and financial restructuring group created to provide hands-on, experienced, executive management of distressed companies and assets through a global network of financial and operating affiliates. With its wide range of affiliates the alliance will be positioned to provide seamless financial, investment banking and legal advice to the industry in order to help it deal with today’s issues as well as to take advantage of the opportunities presented.

Based upon our recent reporting, there would seem to be worlds of opportunity. On the other hand, we wonder how welcome a third party would be at the banker/owner table unless of course the negotiations become adversarial.

Waiver Obtained; Price Paid

Eitzen Chemical today announced that its banks have agreed to amend the loan agreements to allow a higher net debt to EBITDA ratio through 2010 thereby rectifying the breach of the covenant. Accordingly, the company’s loan margin has been increased to 275 bps.

Delay Or Not to Delay

This week Excel Maritime joined TBS International in choosing to delay its earnings release and conference call for the 4th quarter and year-end 2008 results pending receipt of the necessary waivers. Although it raises some uncertainty, particularly with respect to the status of negotiations, shareholders should take comfort that this conservative approach is appropriate as it avoids the formality of the bank debt being treated as current, resulting in the borrower being unable to meet its obligations and, ultimately, the auditors giving a “going concern” opinion. This domino effect gives the banks a great deal of leverage.

According to a report by Omar Nokta of Dahlman Rose the situation is at best difficult. “Excel’s $1.4 billion credit facility, led by Nordea, has several financial covenants that are either in violation or could be in violation in the coming months. These covenants include fair market value-to-loan, interest coverage, net debt-to-EBITDA and minimum net worth, among others.” The breach of the balance sheet covenants is no surprise given today’s valuations although Mr. Nokta foresees a substantial breech of the net worth covenant as Excel marks to market the Quintana fleet it acquired last year. It does not seem so long ago that the fleet’s value was depressed as a consequence of its below market charters and hence very few showed interest in acquiring the company.

Perhaps of greater concern are the possible breaches of its cash flow covenants. Mr. Nokta suggests that the couunterparty defaults have led breaches of its interest coverage and net debt to EBITDA covenants. Cash balances as of the 3Q 2008 were $225 million and if that level of cash remains the company will have some breathing room although the banks’ assistance, in terms of restructuring the debt, will be required.

Pursuing Niches

Speaking of niche markets, Marenave Schiffahrts AG (“Marenave”), the Tobias Konig’s publicly traded vehicle, took advantage of a weakened car carrier market to diversify its fleet. Last week, the company announced that it had entered into a sale-leaseback transaction with Hoegh Autoliners Shipping AS (“Hoegh”). The company purchased the M/V Hoegh Berlin for $95 million and bareboat chartered it back to Hoegh for 10 years at a daily rate of $32,150 per day with an option for an additional 3 years at $35,700 per day. The vessel was built in 2005 and was lengthened in 2008 by 29 meters increasing its capacity to 7,900 CEUs.

The company carefully managed its risk by entering into a pure financial transaction and by choosing a sector that could be viewed as a near oligopoly. Dominated by six key players, who control 80% of the market, Marenave chose one of the top players in Hoegh, which has secured income into 2019. It also chose a high capacity modern vessel that should play a key role in Hoegh’s fleet plans. Consequently this transaction will provide a level of stability to the company’s earnings, which are currently dependent on the container and product tanker markets.

The Rich Get Richer

In these times, it is good to be a shipping company that is not a shipping company, at least as we know it. James Fisher has used “…its core expertise of marine operational and engineering skills based on its Marine Oil division, to invest in and then generate organic growth from niche service businesses in the marine sector.” As a service business, within specialized niches, the company is far less exposed to the swings in asset values which shipping companies in general have experienced. In contrast it earns it’s living by providing specialist services to shipping rather than ship trading and from the oil that its customers continue to produce.

As the company says, “(i)n a credit crunch it is appropriate to start with cash and liquidity.” With its consistent earnings and strong balance sheet, the Company, which enjoys good, long-term relationships with a wide range of British banks, recently entered into a new facility with Barclays Bank PLC for £25 million for purposes of expansion.

Obtaining a credit facility for these purposes in these perilous times is a testament to the company and its management.

In the Long Haul, It Is Not Just About Waivers

At times a more strategic proactive approach is required. Thus, Hellenic Carriers positioned itself to get through the next two years by renegotiating its loan agreement with its lenders.

“In February 2009, Hellenic and its subsidiaries restructured the repayment instalments due in 2009 and 2010 under the existing loan facilities with National Bank of Greece and Piraeus Bank in order to preserve liquidity. As a result, the anticipated breakeven levels during those years (defined as operating expenses plus general & administrative expenses plus management fees plus anticipated dry-docking expenses plus principal and interest repayments divided by the number of available days) have been reduced, enabling the Company and its subsidiaries to weather adverse developments in the dry bulk market and take advantage of possible acquisition opportunities.”