The World’s Greatest Salesman

We will let the analysts’ dissect Dryships first quarter report and give you their insights and recommendations. We were however intrigued by a number of points that Mr. Economou makes in his presentation. Proclaiming Dryships as poised “…to go after distressed assets and drive the long awaited consolidation of the industry,” Mr. Economou describes Dryships as having a healthy liquidity position of approximately $1.7 billion consisting of $722 million in cash and $948 million in undrawn debt capacity.

Diana Also Taps the Equity Markets. But Why?

In a single day, Diana Shipping withdrew an old registration statement, filed a shelf registration and announced today a public offering of 6 million new common shares. The shares were priced of $16.85, a 9% discount to yesterday’s closing price of $18.52. Gross proceeds are in the order of $111 million. UBS Investment Bank will act as the sole underwriter. The transaction is expected to close on May 12th.

De-leveraging

In its 1Q earnings release last week, Navios Maritime Partners (“Navios Partners”) announced that it had amended the terms of its existing $235 million credit facility with Commerzbank in January. The company prepaid $40 million during the first quarter resulting in an approximate $1.5 million in interest expense savings for 2009 and a commensurate reduction in leverage. Throughout 2009, the partnership will additionally have to fund into a pledged account a further $37.5 million. The interest rate on the remaining facility of $195 million now bears a spread of 2.25%, giving an estimated interest rate of 3.98% for 2009 including the margin (versus 4.17% the effective rate in 2008), and no further installments are due until the 1Q 2010.

A Sponsor’s Proper Role

In its first quarter earnings release, Capital Product Partners L.P. (“CPLP”) announced that it had entered into a vessel swap with its sponsor, Capital Maritime, which effectively improved the fleet’s charter coverage and reduced the average age of an already young fleet.

Specifically, CPLP swapped two of its “…MR product tankers with early charter expiries with two younger, high specification, sister chemical/product tankers both under a 3-year time charter to BP Shipping. As a result, our charter coverage for 2009 is now close to 100% and is approximately 67% for 2010, thus increasing our revenue predictability and strengthening our cash flows. It is also important to note that the base charter revenues of the new vessels are fixed at a higher rate than those that they replace and at rates considerably higher than the current market rate for similar periods and also include profit sharing agreements. Overall, and given the lack of potential accretive acquisitions, we believe that this transaction brings considerable value to the Partnership and demonstrates our sponsor’s ability to conclude attractive repeat business with our charterers, as well as its long term commitment to the Partnership.”

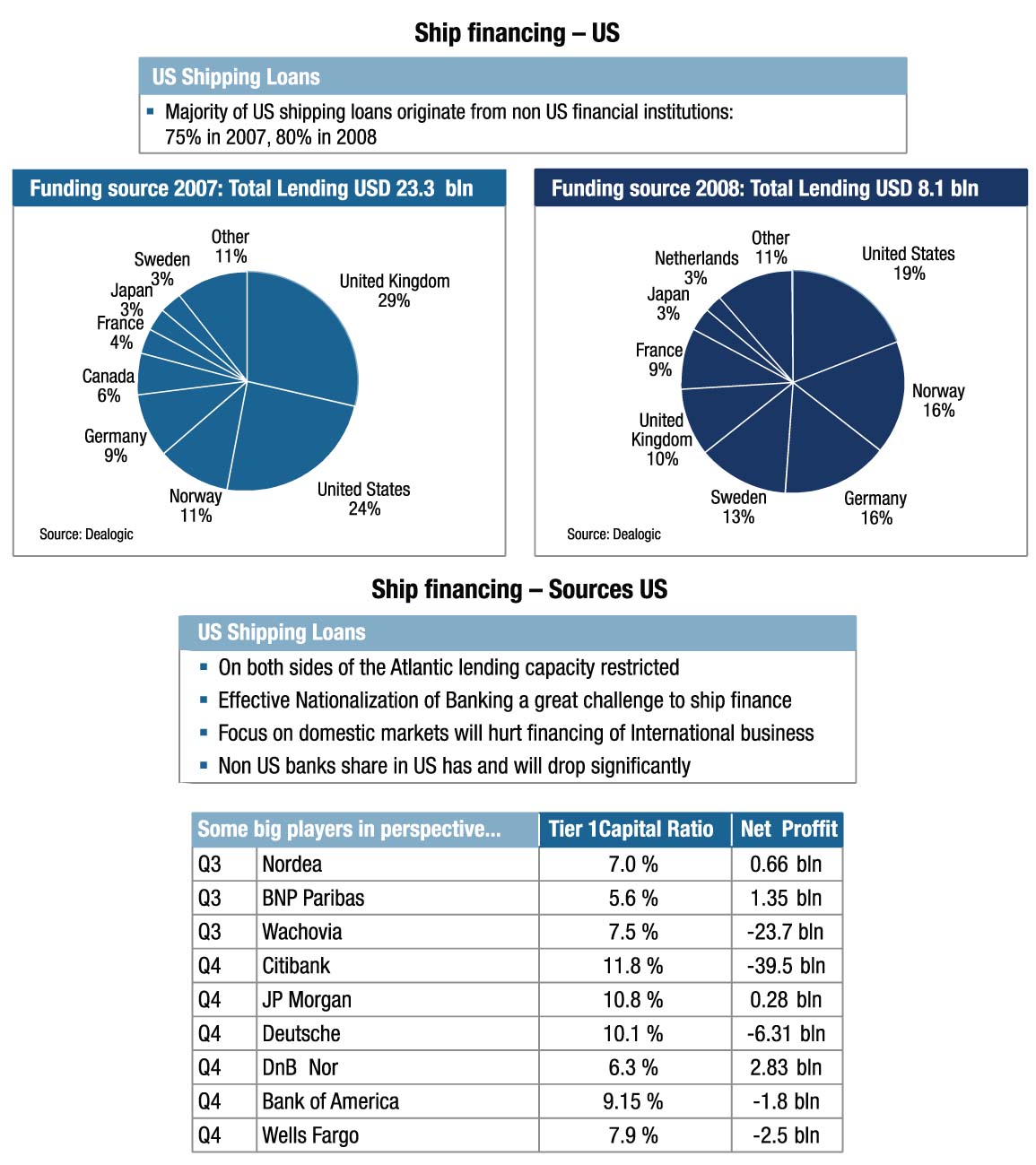

Rapidly Deteriorating Shipping Markets Put Pressure On European Bank Ratings

By Harm Semder and Andreas Kindahl, Standard & Poor’s

Rapidly deteriorating conditions in the shipping sector are squeezing the ratings on European banks exposed to the shipping industry. Many shipping companies are struggling following a sharp downturn in global trade and challenging funding conditions. We expect these difficulties to result in a material increase in banks’ loan loss provisions. We see pressure on banks coming from an increasing number of loan defaults, rapidly deteriorating shipping company credit quality, and weaker recovery expectations due to falling asset values. In addition, we believe banks’ capital ratios may decline as deteriorating creditworthiness feeds through internal rating models and increases the relative risk-weighting under Basel II.

Go East

The global financial crisis has accelerated a dramatic shift eastward in the centre of ship finance as the traditional European banks continue to struggle to put themselves together. In China where shipbuilding has been identified as one of its ten “pillar” industries, banks are stepping up their lending activities to support the sector currently in doldrums. New loans extended by Chinese banks across all industries including shipping and shipbuilding grew to RMB 4.58 trillion (USD 670 billion) in the first quarter of this year, according to the latest figures released by the People’s Bank of China. This is the third straight month new yuan-denominated loans exceeded RMB 1 trillion.

The Past is Harbinger of the Future Confidence is Worth more than Gold

It will surprise no one that the industry’s fall from euphoria has occurred but the enormity of the shift in sentiment and fact is starkly reflected again and again in a review of Marine Money ship finance surveys taken over the past 5 years. Gone are the uniform expressions of confidence.

Our survey from 2005 was full of hope, confidence, bonuses and budget targets made. Sure there were the usual responses that lenders were not being adequately compensated for the risks they were taking, but that was explained by the majority to be simply a function of supply and demand, an age old thorn, but not one to stop the believing. In 2005, 92% of our respondents reported achieving their target returns, returns mind you that for 80% topped 12% and for 38% was greater than 17%. The fact that spreads that year fell 10% or more for 67% was a fact of doing business. There was no gloom to be found.

Shipping’s $64,000 Question – Where Will the Money Come From? A Look at Run-Off

Like, the game show of the 1950s, the shipping industry is facing a multitude of questions, the answers to which add up to a lot more than $64,000. A great deal of discussion has been given to the issue of ships on order. How much tonnage is on order? How much is in various sectors? In the current market environment just how much will actually be delivered? What accommodations may be possible between yards and owners? And most importantly how will the delivered tonnage be financed and paid for? And, sadly, the answers can’t be rigged.

In collecting data for the Banking issue, pieces of the puzzle are added to the equation and while it is far more art than science, the developing picture delivered by the data highlights a troubled and challenging seascape.

The Portfolios

The Portfolios

Perhaps one of the most difficult, but at the same time most enjoyable challenges, we undertake annually is to try to pin down the various heads of the shipping departments to open their kimonos and impart data on the size of their portfolios, along with other related statistical data. Although we are certain a number is readily available, the hesitancy to share comes most likely from our simplistic approach. We ask simply for the size of the loan portfolio. Are we asking for the right number and, if so, how is it correctly measured? Without definition and commonality, the question of whether each portfolio will be fairly portrayed on a comparative basis is a concern to respondents, as the end product is a competitive “league table” of sorts.