STX Panocean Finds Success with Multiple Bonds – Public Debt Deal of the Year

By Rodricks Wong

Much to everyone’s surprise, the bond market in Asia has suddenly sprung back to life over the past few months. Shipping companies, which have demonstrated their wizardry in the public capital markets are now finding themselves tempted by this window of opportunity. Among those have found success include Nippon Yusen Kaisha, China Chanjiang National Shipping Group, Hyundai Merchant Marine, Mitsui O.S.K. Lines and Berlian Laju Tanker.

Over in Japan, Mitsui O.S.K. Lines (“MOL”) issued two series of secured straight bonds in June this year and raised over JPY 50 billion (USD 528 million). The first tranche of five year JPY 30 billion bonds carried an annual coupon of 1.278% while the second ten-year JPY 20 billion tranche pays investors 1.999% annually. The funds were used to repay existing borrowings and for the redemption of commercial paper. Both Rating & Investment Information and Japan Credit Rating Agency have assigned AA- to the bonds, acknowledging that the company’s well-diversified earnings have a strong capacity to recover in a market turnaround. The bonds, although unsecured, came with a negative pledge.

Compatriot Nippon Yusen Kaisha (“NYK Line”) followed suit two months later with the issuance of two sets of bonds worth a total of JPY 60 billion (USD 625 million). The first bond issue had a maturity of 5 years and pays a stunning annual coupon of just 0.968%. The second offering had a longer tenure of 10 years but carried a higher coupon rate of 1.782%. Both offerings were managed by Mitsubishi UFJ Securities, Mizuho Securities and Nomura Securities. Rating & Investment Information (“R&I”) and Japan Credit Rating Agency assigned ratings of AA- and AA to the bonds, but both rating agencies maintained a negative outlook on the industry. We must say that we continue to be fascinated by the Japanese mega carriers’ ability to raise extremely low cost capital from the public debt market, at incredible levels that may even be comparable to the Japanese banks’ actual cost of funding.

A Showcase of Value Maximising – Public Equity Deal of the Year

By Rodricks Wong

Riding on improved sentiments in the global equity markets, we have witnessed a number of public equity placements since the beginning of this year, mainly in the form of new shares placements or rights issues (see accompanying table). Companies are seizing the window of opportunity to re-capitalise and strengthen their balance sheets in order to better prepare themselves for the uncertainties lurking ahead.

A number of transactions stood out and among these, by far the largest ever rights issue in the shipping sector globally, was Neptune Orient Lines (“NOL”)’s SGD 1.44 billion (USD 996 million) 3-for-4 rights issue. Managed by DBS Bank, HSBC, JP Morgan and Morgan Stanley, the rights issue was favourably priced at a 15.0% discount to the closing price of SGD 1.53 per share on 29 May 2009, the last trading day prior the announcement. Singapore’s investment fund Temasek, which owns at least 66% of NOL, agreed to subscribe for its pro-rata entitlements and sub-underwrite the entire rights issue in consideration for a commitment fee of 1.75% on the pro-rata subscription and 2.25% fee on the sub-underwriting portion.

Against the Odds – IPO of the Year

By Rodricks Wong

It is hard to believe anyone would be able to pull off a public share offering over the past twelve months amidst all the restructurings and loan renegotiations. As one would expect, there were very few successful listings in Asia since the collapse of Lehman Brothers last September, and those who braved the markets and found success were all winners in their own right.

It was rather unexpected to see Singapore-based bunkering company Yujin International announced admission to the London AIM in a deal organized by nominated advisor and broker Seymour Pierce this February. The size is small, but to have a Singapore company listing on the small alternative market in London is a big step. Prior shipping companies to have listed on the AIM include Global Oceanic Carriers, Globus Maritime and Hellenic Carriers, all of which were sponsored by Greek interests. The trip to London was not only convenient in these circumstances, but an extension of a long tradition of Greek shipping companies doing business in London. Yujin listed with 30,000 shares priced at GBP 0.33 each, making its total market capitalization after expenses just shy of GBP 10 million.

Over in Taiwan, the Taiwanese government raised NT$6.66 billion (USD 143 million) and sold 54% of state-owned China Shipbuilding Corporation (“CSBC Corp”), reducing its shareholding from 99.4% to 45.4% last December. The IPO was not easy to pull through, considering that the global shipbuilding industry had lost its shine as concerns over cash flows, potential cancellations, changes to payment structures or delivery dates that could cloud earnings visibility.

Spice It Up With Sharia – The Leasing Awards

By Rodricks Wong

The benefits of leasing are widely known. For the shipowner or operator, leasing lightens the balance sheet, provides an opportunity to increase working capital and unlocks cash. In return, the lessor/owner is rewarded with a long-term asset that generates interest income and has the potential for capital gains, depending on structure. But in reality, leasing transactions are tough to put together. The challenge lies in finding the right assets that investors are comfortable with against the backdrop of turbulent shipping markets. The arrangers will also have to look out for creditworthy investors who have the money or the ability to raise funds for the assets in today’s environment of tight liquidity. That all said, Marine Money is very pleased to have observed a number of leasing transactions concluded in Asia over the past twelve months. This demonstrates that with the proper structure and the right partners, deals can still be done against all odds. We have two additional transactions worthy of respectful mention.

In the last quarter in 2008, ICBC Leasing acquired eight 53,000 dwt Supramax bulkers from Chengxi Shipyard under state-owned China State Shipbuilding Corporation (“CSSC”). The ships which are scheduled to be delivered from the end of 2009 through third quarter of 2011 are said to cost in the range of USD 53 million and USD 55 million a piece. This sums up easily to an investment amount of over USD 420 million. These newbuildings were previously ordered by the nation’s biggest electricity producer China Huaneng Group (“Huaneng”). Huaneng had sold the ships at contract prices to ICBC Leasing and will be chartering the vessels back for 10 years. This transaction comes with purchase options. At the end of 2008, ICBC Leasing has a leasing portfolio of over USD 760 million, one of the largest in China.

Tufton Oceanic Bags Allocean Ships – Mergers & Acquisitions Awards

By Rodricks Wong

As the global financial crisis continues to take its toll across all major shipping sectors, there have been surprisingly few mergers and acquisitions in the market, contrary to what one might expect. The lack of liquidity and funding from the banks could be an obvious reason. Or could it also be that many market participants are still holding on to their belief that asset prices have room to fall further and the worst has yet to come? There has been a lot of talk these days on whether private equity firms will be able to provide the much needed funding support for the shipping industry. As we understand, a number of private equity firms are in the process of raising money while those who have the cash are still largely sitting on the sidelines.

Our winner, Tufton Oceanic, demonstrated that with the right ingredients in place, exciting deals can still come into fruition. This July, fund management firm Tufton Oceanic completed the full acquisition of Allocean Charters (Singapore) Pte. Ltd. (“ACS”), together with SIF Limited, a private investment vehicle specialising in asset-backed investments. Although the cost was not revealed, the acquisition immediately gave Tufton and SIF Limited a fleet valued at approximately USD 250 million, comprising nine anchor handling tug supply vessels, two Aframax tankers, two 1700-TEU containerships and a Supramax bulk carrier. Twelve of the fourteen vessels came with long-term charters attached.

Asian Awards 2009 Achievements

MARINE MONEY AWARDS THE BEST IN ASIAN SHIP FINANCE

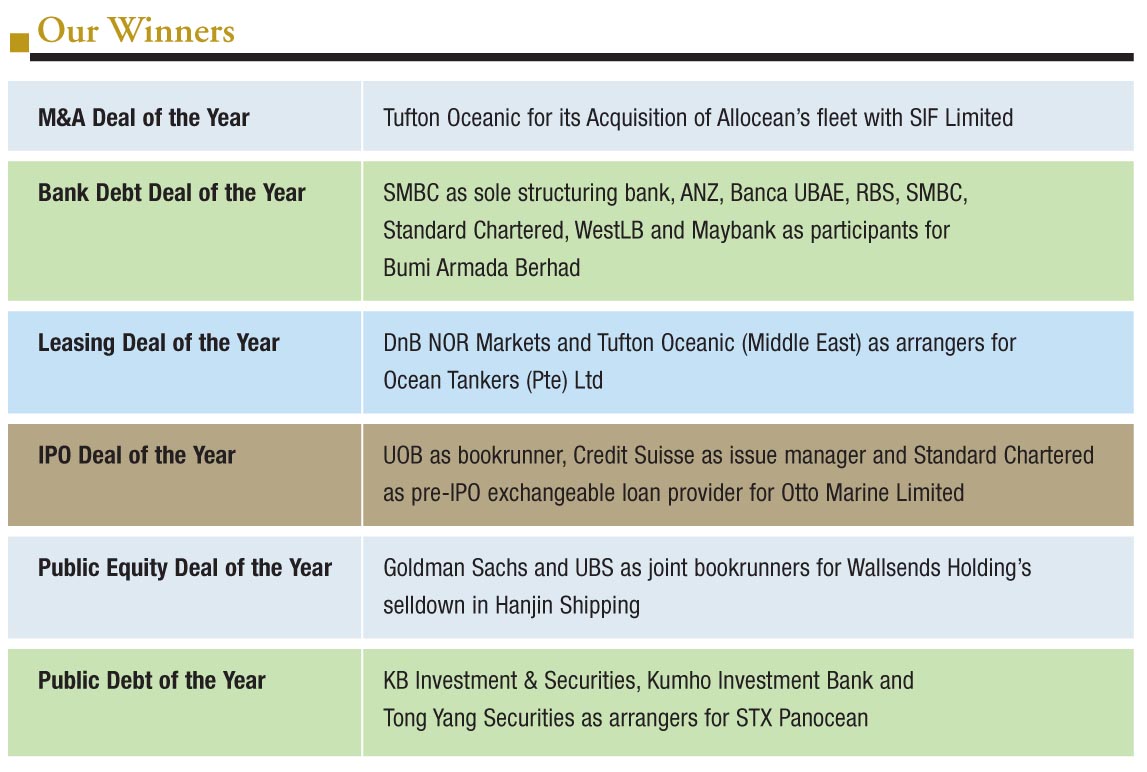

Not many will disagree that 2008 will go down in history as one of the most theatrical years the entire shipping industry has ever experienced. But despite a worldwide shutdown in the credit markets, shipping deals were still being done amid the shipping market doldrums and there are still financial institutions out there that continue to deliver superior value propositions and assist their clients in value preservation. In this context, Marine Money is proud to announce the winners of our 2nd Annual Asia Deal of the Year Awards. Our objective is simple which is to recognize the efforts undertaken to meet a client’s particular needs, or success in the face of a daunting challenge and this year we are extremely delighted to be able to showcase an enormous breadth of ship finance creativity, happening right here in Asia.

Without further ado, it is with great pleasure that we present you this year’s winners.

Jesse Crews to Join Willis Lease Finance

Jesse Crews has joined commercial jet engine leasing leader Willis Lease Finance, as its new chief operating officer. He joins Willis from Fortress Investment Group, where he spent the past five years as a managing director. Before Fortress, Crews spent 26 years with GATX Corporation, where he served as president and CEO of GATX Capital Corporation. Willis has a solid balance sheet and assets above the $1 billion level, so it is a great platform for Crews, and an important one for shipping to know.

Asian Strength: Heard on the Street

A wildly successful hedge fund principal told a gathering of investors in NY this week that in 5 years looking back, it will be almost impossible to recall the exact year of the credit crisis in Asia. The reason being, that unlike the Asian financial crisis of 1997, the recession of 2008/9, which rocked the West, has been only a small bump to the Asian financial markets, company performances and stock exchanges in Asia, so small that in five years it will barely be specifically identifiable.

Equity Stars Aligning

The stars are beginning to align now for a return of the IPO. The New York Times wrote on Monday that backed up companies are waiting. Investors are warming up to risk. Bankers are back out marketing and private equity is looking to exit investments.

The US, Brazil and Asia are leading the way. In Brazil US$6 billion in IPO equity was raised in the first half of 2009.

The Euro market for IPO’s in the first half of 2009 was virtually closed with just 465 mil Euros raised. Europe is focused still on secondaries. In the US, there has been well over a billion dollars raised by shipping companies in “at the market” offerings, all since the Lehman collapse.

The good news from the Times was that the supply side pipeline is slowly filling. Regulated and less cyclical businesses will have the jump.

All Quiet On the Banking Front, or So It Appears

Like an iceberg, which is mostly hidden under water, the banking world, too, is certainly less visible these days. It is summer, so it is not unexpected, but yet it feels different. In the past, at this halfway point, everyone was off in a celebratory mood knowing volume budgets were achievable with bonuses surely to follow. Today, some of the banking community may be on vacation but, in the main, the bankers are mainly hunkered down in their offices/bunkers working not on the next deal but how to carefully manage and protect their portfolios to mitigate losses. For the moment, the tide of losses has been stemmed from existing, albeit lower, cash flow, cash on hand and, in the case of public companies, an ability to tap the equity markets. The fact that many deals were done without amortization has also helped defer the problem. Nevertheless, vessel values remain depressed; loans are under water and waiver periods are soon to expire. The day of reckoning will soon be upon us. The accounting rules demand marking assets to market and the banks are responding by assessing loans for risk and taking general and/or specific credit reserves. But perhaps more importantly, bankers have to face the reality of today’s market and decide whether they will be passive, and hope for a rising tide to lift all boats, or proactive and do what is necessary to protect the interests of their employer. It may well be that the latter approach, although drastic, will also be in the long run interests of the borrower.