Earnings Season Continues

We continue to admire our analyst friends, who four times a year have to pore through the company financial reports, analyze them and update their models to fine tune their calls. With the greater disclosure there is much work to be done during these periods and we are happy to leave it to them. We, on the other hand, prefer to give the earnings releases a quick review in search of items of interest to us, which we think provide broader general insights both to the companies themselves as well as the industry. What follows is a selection of these items.

Eagle Amends

Within its 2nd quarter earnings release, Eagle Bulk Shipping (“Eagle”) disclosed that it had amended its revolving credit facility and entered into a management agreement with its former main shareholder.

In its third Amendatory Agreement to its credit facility, Eagle and Royal Bank of Scotland (“RBS”) have agreed to reduce for the second time the amount of availability under the facility. Originally the facility was for $1.6 billion which amount was reduced in December 2008 to $1.35 billion. With the current amendment, it has been further reduced to $1.2 billion. The facility, which matures in July 2014 continues to be interest only until July 2012, when availability begins to decline with the commencement of four semi-annual reductions of $56.25 million with the balance due at maturity. The facility currently accrues interest at LIBOR + 2.50%, with undrawn portions bearing a commitment fee of 0.7%. The cost of interest has become expensive, having nearly doubled from prior periods. It now represents ~22% of EBITDA up from 13%.

The First Deal is the Hardest

Last week, Northern Shipping Funds (“NSF”) closed what we believe to be its first transaction, assisting in the sale and leaseback of the Sichem Pace, a 19,900 DWT stainless steel chemical tanker built in 2006. The vessel was purchased from Eitzen Chemical for $34 million by a Pareto organized K/S. Senior debt was provided by Nordea, with NSF providing a $4 million mezzanine loan. The vessel was chartered back by Eitzen for five years under a bareboat charter, which the sellers characterize as an operating lease suggesting the seller may not have a purchase option or if it does it is at fair market value.

Although it is playing at a risky level in the capitalization, NSF has carefully mitigated the risks by financing a modern vessel with sub-employment for a short tenor. Moreover it benefits from the peculiarities of the K/S structure, which not only has paid in capital but also contingent uncalled capital to provide a cushion, if needed.

The deal was sourced by John Hartigan, with the rest of the team assisting in closing the transaction.

On the Road?

Last Thursday, Danaos Corporation filed an F-1 registration statement for a follow-on offering. Unlike prior equity deals, there was no press release or announcement of any kind and the statement itself lacked detail. Subsequent to the filing, there has been no further public disclosure.

What we do know is that Deutsche Bank, Citi and Credit Suisse are the joint bookrunning managers for the offering. Proceeds are expected to be used to fund a portion of the newbuilding program and for general corporate purposes.

We suspect that despite the lack of public disclosure, there is a whirlwind of activity behind the scenes as the company and its bankers take to the road. Clearly, if there was a company that needs capital, this is it. Unfortunately, Danaos faces two problems from a marketing perspective. The container market is in the worst state it has ever been in. Also, insiders hold 80% of the shares with little float suggesting the company is neither well-known nor widely held by institutions who would likely be the main buyers of the shares.

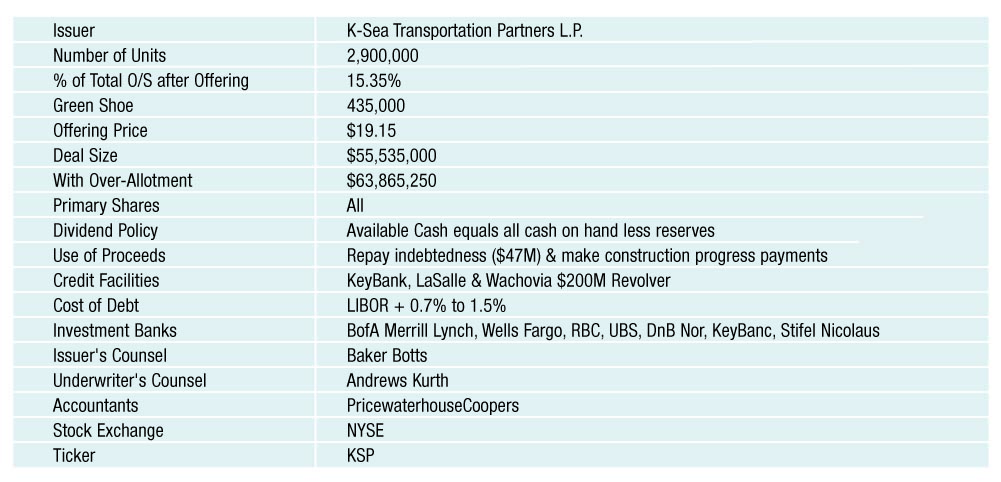

K-Sea Too

What is a week without another follow-on offering? As last week ended, K-Sea Transportation Partners (“K-Sea”) announced a public follow-on offering of 2.9 million of its common units and a green shoe of 435 thousand shares utilizing its existing shelf registration.

The shares were priced at $19.15, a 6.6% discount to the prior day’s close at $20.51.

Of the net proceeds of $52.9 million, exclusive of the green shoe, approximately $47 million will be used to repay indebtedness under the company’s revolver, which currently has $139.9 million outstanding and the remainder will be used to make construction progress payments under shipbuilding contracts. LaSalle Bank, Wachovia Bank and KeyBank are lenders under the facility as well as affiliates of the underwriters and will receive more than 10% of the net proceeds of the offering.

The joint book running managers for this offering are BofA Merrill Lynch and Wells Fargo. RBC Capital Markets and UBS are co-lead managers, with DnB NOR, KeyBanc and Stifel Nicolaus serving as co-managers.

We provide further details in the Guts of the Deal below.

Let’s Together Shipping Fund

Korea Development Bank has established a KRW 2 trillion won (USD 1.6 billion) distressed asset fund to support the domestic shipping industry. We will be providing more details as well as a highlight on the differences between KDB’s fund and state-run debt-clearing agency Korea Asset Management Corp (Kamco)’s fund in the next issue of Marine Money Asia. Stay tuned.

NYK ACQUIRES TAIHEIYO KAIUN

In addition to its double bond issue, NYK has appointed Mitsubishi UFJ Securities to carry out its share swap with financially troubled Taiheiyo Kaiun. On May 28, NYK announced that it will bail out Tokyo listed Taiheiyo through the issuance of new shares and equity-swap arrangements. Taiheiyo is currently an affiliate of NYK and takes pride in managing NYK’s tanker fleet. It was in 2001 when the mega carrier transferred all of its tanker management business to Taiheiyo and took up a nearly 23% stake in the company.

Trouble started when Taiheiyo diversified into the dry bulk sector during the boom. In order to profit from the sky-rocketing charter rates during that time, Taiheiyo chartered in a number of dry bulk vessels and chartered them out at higher rates. This high risk, high return model churned out profits for the company but losses started to accumulate very quickly when the dry bulk market crashed. In October 2008, an unnamed foreign sub-charterer informed Taiheiyo that it was no longer able to fulfill its contractual obligations for four Panamax/Handymax bulk carriers. To make matter worse, less than 5 months later, South Korea’s Samsung Logix filed for receivership in Korea and made clear that likewise unable to honour its charter contracts concerning two Handymax bulkers. Taiheiyo managed to return one of the six vessels to the owner, but it had to continue paying its charter hires for the remaining five vessels and in an effort to stem the losses, Taiheiyo bit the bullet and paid JPT 7.5 billion (USD 78 million) to the owners as cancellation fees. An unfortunate victim caught in between the charter market breakdown, Taiheiyo sold all its five VLCCs to NYK, but even that could not stop the company from bleeding financially. Taiheiyo has projected a net loss of JPY 5,140 million (USD 53 million) for FY2010. As at March 2009, Taiheiyo owned 6 tankers, 1 capesize and 2 wood chip carriers and manages another 20 vessels, mainly tankers from NYK. Continue Reading

Mercator Offshore Finds Success in Syndication

KOGAS is not the only company to have found success in the syndication market. Mercator Offshore, the wholly owned subsidiary of India’s second largest private sector shipping company Mercator Lines, has raised USD 155 million in a syndication deal led by sole bookrunner ICICI Bank. What is perhaps most interesting is the fact that all participants in this transaction are domestic banks. ICICI Bank contributed USD 80 million while State Bank of India and Indian Overseas Bank committed USD 25 million and USD 20 million respectively. Other participants that include Bank of Baroda and Indian Bank held USD 15 million a piece. The six year loan is priced at 500 bps above LIBOR and the proceeds will be used to partly finance a jack-up rig. In addition, ICICI Bank will be providing Mercator with an additional USD 35 million eight year revolving and term loan facility. Continue Reading

Expanded Distribution via Strategic Alliance

Last week, Deutsche Bank (“DB”) announced an agreement with Fidelity Investments allowing Fidelity’s retail and institutional brokerage clients the opportunity to participate in initial public offerings and follow-on equity offerings underwritten by Deutsche Bank. This exclusive relationship represents a significant development for DB’s US equity platform by expanding its retail investor footprint while complementing the existing distribution capabilities of DB’s highly effective Private Wealth Management division which targets high net worth clients.

The alliance with Fidelity, substantially expands DB’s access to an investor base comprising Fidelity’s retail brokerage customers, customer accounts managed by Fidelity’s registered investment advisors, correspondent broker/dealer and other institutional clients.

This venture will integrate into DB’s equities platform enabling it to receive retail indications of interest immediately after a deal is launched.

The company views this new relationship with Fidelity as a great franchise building opportunity.

Capital Products Partners Feels Some Pain

The recent decision by OSG to buy back the remaining shares of its MLP spin-off, OSG America, highlighted the weak domestic tanker market as well the inability of the partnership to pay the distributions going forward as a result. U.S. Shipping L.P. was also unable to survive the current market as its vessels came off charter and it leveraged itself to meet its fleet replacement needs. And without an interested party, it filed for bankruptcy. These problems raised the question in our mind as to whether the MLP structure is best applied to shipping. Of course, there is no easy answer as the range of MLPs is across the board. What is certain however is that Teekay LNG, with its 25 year contracts most closely resembles the typical MLP, a gas pipeline. The majority of the others are based upon medium term contracts that have rollover risk.

While Capital Product Partners is operating in a poor tanker market, its fleet is fully contracted and it reported good but slightly lower earnings for the quarter as a consequence of a lack of profit sharing revenues and increased interest expense. It’s key measure Operating Surplus, which is net income adjusted for non-cash items less replacement capex, was also down.

A Better Deal?

There is no doubt that Rand Logistic’s (“Rand”) non-binding offer to acquire most of the assets of U.S. Shipping Partner L.P (“USSLP”). is superior to the Debtor’s reorganization plan and the most viable exit for the lenders which control the equity. Prior to the filing the company had been pursuing all possible alternatives including the sale of assets with no success. Moreover, with the filing and the agreement to accept equity, the lenders have fully written down their loans positioning themselves for a recovery and a way out of this morass. The question is whether Mr. Levy is offering fair value for the assets and that will be the negotiation.

Speaking of negotiation, it was interesting to note that this proposal had previously been in the hands of USSLP’s advisor, Greenhill & Co. and has been made public given the importance of this proposal to shareholders and creditors.