More Mega Bonds

Following Mitsui O.S.K. Lines’ JPY 50 billion double bond issue in June, Nippon Yusen Kaisha (“NYK Line”) is the next Japanese mega carrier that will be tapping the local domestic market for financing. NYK Line will issue two sets of bonds worth a total of JPY 60 billion (USD 625 million). The first bond issue has a maturity of 5 years and pays a stunning annual coupon of just 0.968%. The second offering has a longer tenure of 10 years but carries a higher coupon rate of 1.782%. Both offerings are managed by Mitsubishi UFJ Securities, Mizuho Securities and Nomura Securities.

Rating & Investment Information (“R&I”) and Japan Credit Rating Agency have assigned ratings of AA- and AA to the bonds, but both rating agencies maintain a negative outlook on the industry. R&I said in its report that even though the dry bulk market has been recovering since May, NYK’s losses in regular liner services have grown while the earnings from the car carrier and tanker services have deteriorated sharply. The credit agency noted that NYK’s ambition in becoming an integrated logistic provider will allow the mega carrier to develop an earnings structure that is less susceptible to the fluctuations in the marine transport industry. But until that materializes, the air cargo business will continue to drag down NYK’s earnings in the short run. Nonetheless, a high credit rating has been assigned to the bonds and the issuer, taking into account NYK’s solid client base, strong operating expertise and its proactive cost reduction measures in streamlining its liner and air cargo businesses. Continue Reading

Oil & Natural Gas Money

In another transaction that exemplifies commercial banks’ appetite to finance offshore oil and gas assets, S V Oil & Natural Gas has raised USD 51 million via a four year loan. Sole mandated lead arranger and bookrunner Standard Chartered Bank managed to rope in Chang Hwa Commercial Bank, First Bank of Nigeria, State Bank of India and State Bank of Mauritius as participants at the lower tiers. Fully underwritten by Standard Chartered Bank, the loan is reportedly priced at 400 bps above LIBOR and is secured by oil rigs. S V Oil & Natural Gas has a fleet of 5 rigs and the proceeds will be used to charter oil rigs. Continue Reading

Bumi Armada Completes USD 190 Million Fundraising

Armada Oyo has secured a five-year USD 190 million limited recourse loan facility with a club of seven mandated lead arrangers for an FPSO currently undergoing conversion and owned by its parent Bumi Armada Berhad. The loan will finance around 75% of the project cost, and remarkably was oversubscribed by more than the total project amount. Final commitments came through in springtime, with closure just in August.

SMBC acted as structuring bank, documentation bank and SACE coordinator on behalf of the team of mandated lead arrangers, which in addition to SMBC comprised Banca UBAE S.P.a., Australian and New Zealand Banking Group Limited (ANZ), ABN AMRO Bank N.V., WestLB A.G., Malayan Banking Berhad (Maybank), and Standard Chartered Bank. Watson, Farley & Williams advised Bumi Armada on the legal aspects of the transaction. Continue Reading

Less Buzz, but…………More Business

On the outside, this year’s Jefferies Conference was subdued with less buzz than previously. However, it was a marked improvement to last year’s event, which coincided with the collapse of Lehman Brothers. Then the shipping markets were still good but all eyes were focused on the Bloomberg screens awaiting developments, while discussions revolved around whether or not to buy gold. Today was different. The economy seems to be improving while the shipping markets struggle. Shipping’s main source of capital, bank debt, is rationed while the equity markets are offering hope. Today was the day for public shipping companies to plead their case to investors. It was all about business.

We know that the presentations are the interlude and that the real action takes place behind the scenes during the one on one meetings as investors and companies engage in speed dating. Yet even in the public venue, we saw a clear dichotomy between the haves and have not’s. The rooms were packed for those companies with large market caps, liquidity and share volatility. For investors these days, slow and steady does not win the race. Nevertheless, the good news was that all the companies had meetings, although some had more than others. But all agreed the meetings were of high quality and now included a new class of investor – the opportunity fund.

As usual, our coverage will focus on points of interest to us. But as it was impossible to cover three tracks, our emphasis, for the most part, was on those unappreciated companies where interest may have waned, whether for lack of coverage or as a consequence of the market sector in which they participate.

Charles in Charge

When Seacor challenged the unions and two Jones Act competitors, it certainly helped that Mr. Fabrikant has a strong legal mind and the fortitude to carry on the battle. The lawsuit dates back to 2005, when Seacor received a determination from the U.S. Coast Guard that the work to be done in China to retrofit two vessels to a double hull configuration would not constitute a “rebuilding” within the meaning of the regulations and would therefore not disqualify the vessels from the Jones Act trade.

The Elephant in the Room

A.P. Moller – Maersk A/S (“Maersk”) also announced last week that they have no intention of missing future opportunities. The company sold 250,340 treasury “B” shares at a price of DKK 33,000, down from the prior day’s closing price of DKK 36,900 per share, through an international private placement to institutional investors. Gross proceeds of DKK 8.26 billion were achieved through an accelerated book-building process.

A key rationale for the offering was the company’s concerns with respect to the global financial markets, which continue to be affected by the economic crisis. There remains limited access to bank debt which has traditionally been Maersk’s main source of capital. The proceeds will not only lower the company’s loan requirements but will at the same time increase the company’s attractiveness as a potential bond issuer.

The proceeds will preserve financial flexibility in line with Maersk’s conservative capital structure while allowing the company to pursue strategic opportunities that may result as the economic crisis continues. The sale has the added benefit of increasing the free float which should also improve the liquidity of the “B” shares.

Even the big guys are worried about the availability of capital and are in search of alternatives to bank debt, bonds being one of them.

A Vulture’s First Strike

In the first acquisition in 2009 by a German opportunity fund, Maritim Equity purchased two 1,700 TEU containerships built in 2008 from Asian owners. The vessels were purchased for $21.5 million each, which represents a reduction in price of over 50% from early 2008 when similar ships sold for $45 million. Both ships, the Ocean Emerald and Ocean Mermaid are time chartered to STX Pan Ocean at a rate of $16,400 per day, versus current market rates of $4,500 to $5,000 per day, until the summer of 2011.

The fund is premised on buying bargain vessels with reliable income from stable charter contracts.

Leverage, Dividends and Values

It’s difficult keeping everyone happy these days, particularly when you are a shipowner. The banks are nervous Nellies, the shareholders want more and then there is the market. Like everyone else, DHT Maritime, Inc. (“DHT”) is being squeezed. Revenues, although fixed, are down on reduced profit sharing. Operating expenses are up reflecting new management agreements that are more market orientated. From an accounting perspective, results were impacted by the decision not to use hedge accounting for interest rate swaps going forward and the decision to terminate a interest rate swap in the amount of $42 million. All things considered, it was not a bad quarter. The cash flow from contracted revenue keeps coming in and the banks are being paid.

Euronav Goes with Bonds

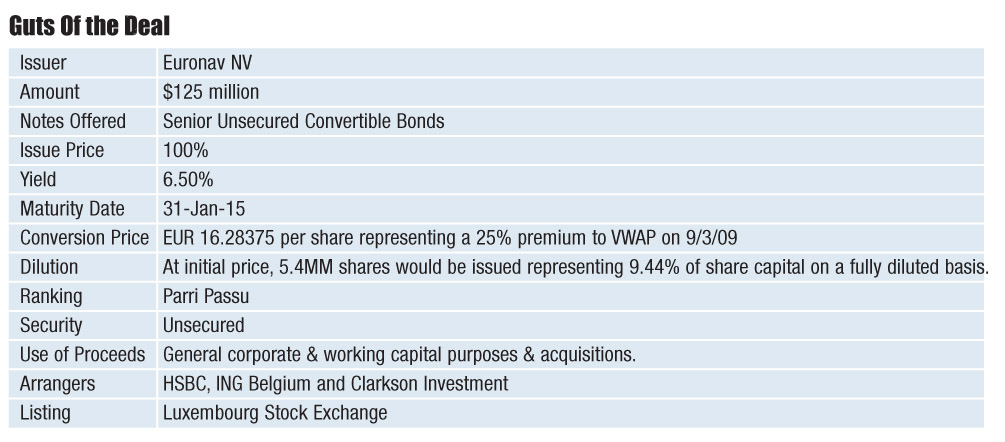

Last Friday, Euronav NV announced an offering of $200 million fixed rate senior unsecured convertible bonds due in 2015. By the end of the day, bonds with a value of $125 million were placed with institutional investors outside the United States by HSBC, acting as lead, ING Belgium, as co-manager, and Clarkson Investment Services, as placing agent.

The bonds were priced at 100% to yield 6.5%. The initial conversion price is EUR 16.28375 per share and is set at a premium of 25% to the VWAP of Euronav’s shares on September 3rd. If all the bonds were to be converted at that initial price, 5,395,256 new ordinary shares would be issued, representing 9.44% of Euronav’s share capital on a fully diluted basis. The bonds are convertible between November 4, 2009 and January 24, 2015 into ordinary shares at the conversion price applicable at such date. Unless previously redeemed, converted or purchased and cancelled, the bonds will be redeemed in cash on January 31, 2015 at 100%.

Further details are provided in our Guts of the Deal.

Clarification

Last week, we had the privilege to discuss with KAMCO about its shipping funds and here is an update for our readers.

To recap quickly, the KAMCO fund structure resembles the Korean Ship Investment Company scheme that is incidentally modeled after Germany’s KG fund and Norway’s KS fund. Firstly, a ship investment company (“SIC”) is established with equity financing from KAMCO funds, pension funds, insurance companies, investment companies and individuals looking for tax benefits. Depending on each shipping fund, KAMCO’s own restructuring fund along with other investors (if any) will provide 40% junior loans to the SIC set up to own the vessel. Financial investors including Hana Bank and Korea Exchange Bank will provide senior loans of up to 20% of the ship’s market value to the SPC.

With the funds from the SIC and financial investors, the SPC will next execute a sale and bareboat charterback with the shipping company, in most cases BBCHP (Bareboat Charter Hire Purchase) for a minimum of 5 years. The BBCHP model allows rates to be set so that owners can continue to operate ships reasonably in the current environment. Typically, only interest payments are to be made over the life of the loans with a balloon payment at the end. The investors will be exposed to minimal residual and equity risks under the BBCHP structure as the shipping company will be obligated to purchase the vessel at the end of the charter. KAMCO can accommodate bareboat charters in the structure as well, depending on the preference of the shipping company. Continue Reading