ShipsPark – A German Response

Without a doubt, the shipping markets have experienced the most tumultuous times in recent history. From unimaginable heights to near collapse, owners are now struggling to meet their financial obligations, as freight rates hit new lows and liquidity, built up in the good times, dissipates.

Due to the peculiarities of its main financing vehicle, the KG system, the German market is showing even greater strains. In good economic times, there is an abundance of equity looking for straightforward cash on cash returns, which shipping and real estate can provide through the employment of assets. Shipowner sponsors and Emissionhauses packaged these deals, which the banks historically financed with liberal terms, including 100% financing in anticipation of the sale of the equity. Together all now find themselves in deals, where the equity has disappeared as ship values collapsed from record highs, and employment is uncertain.

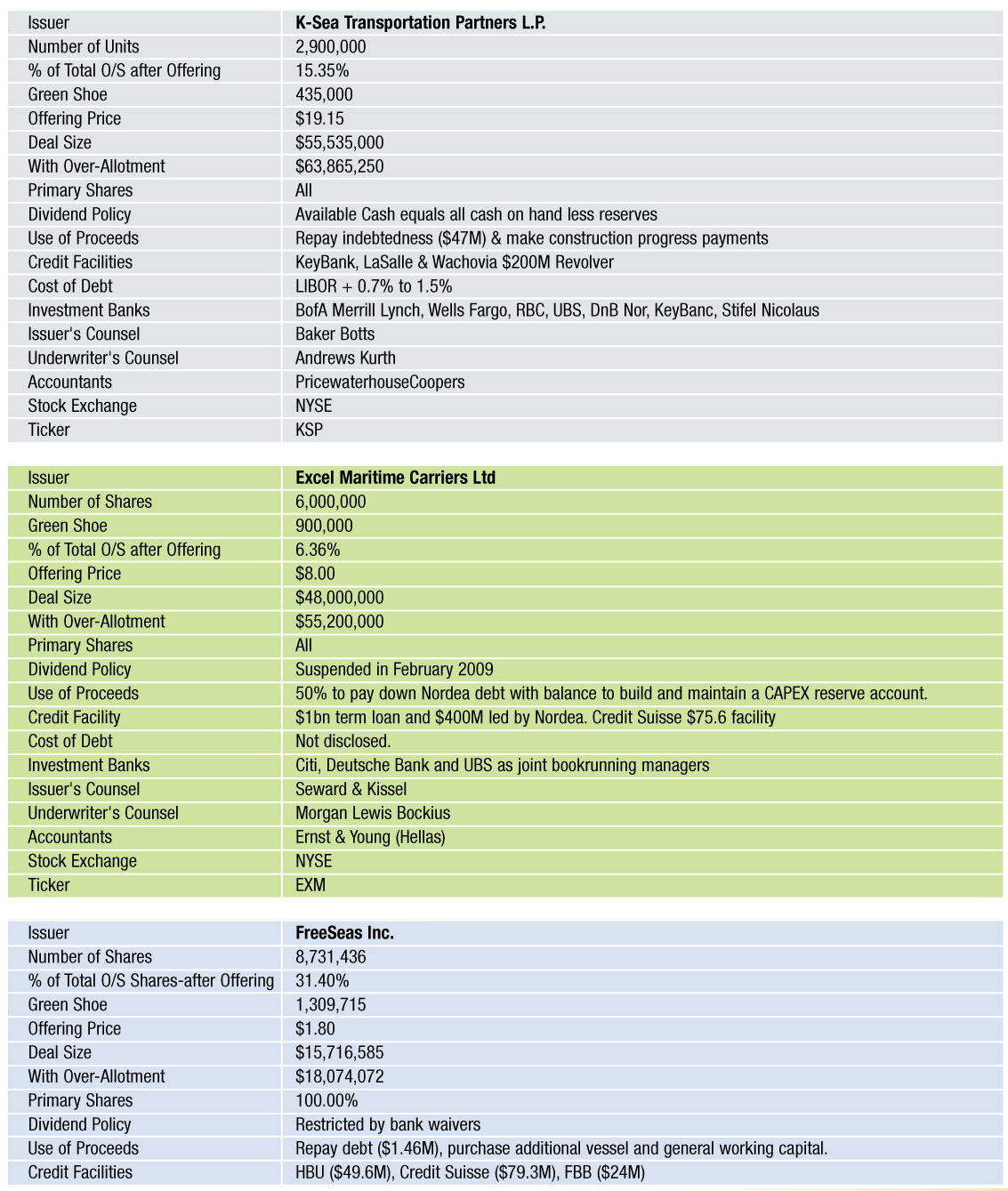

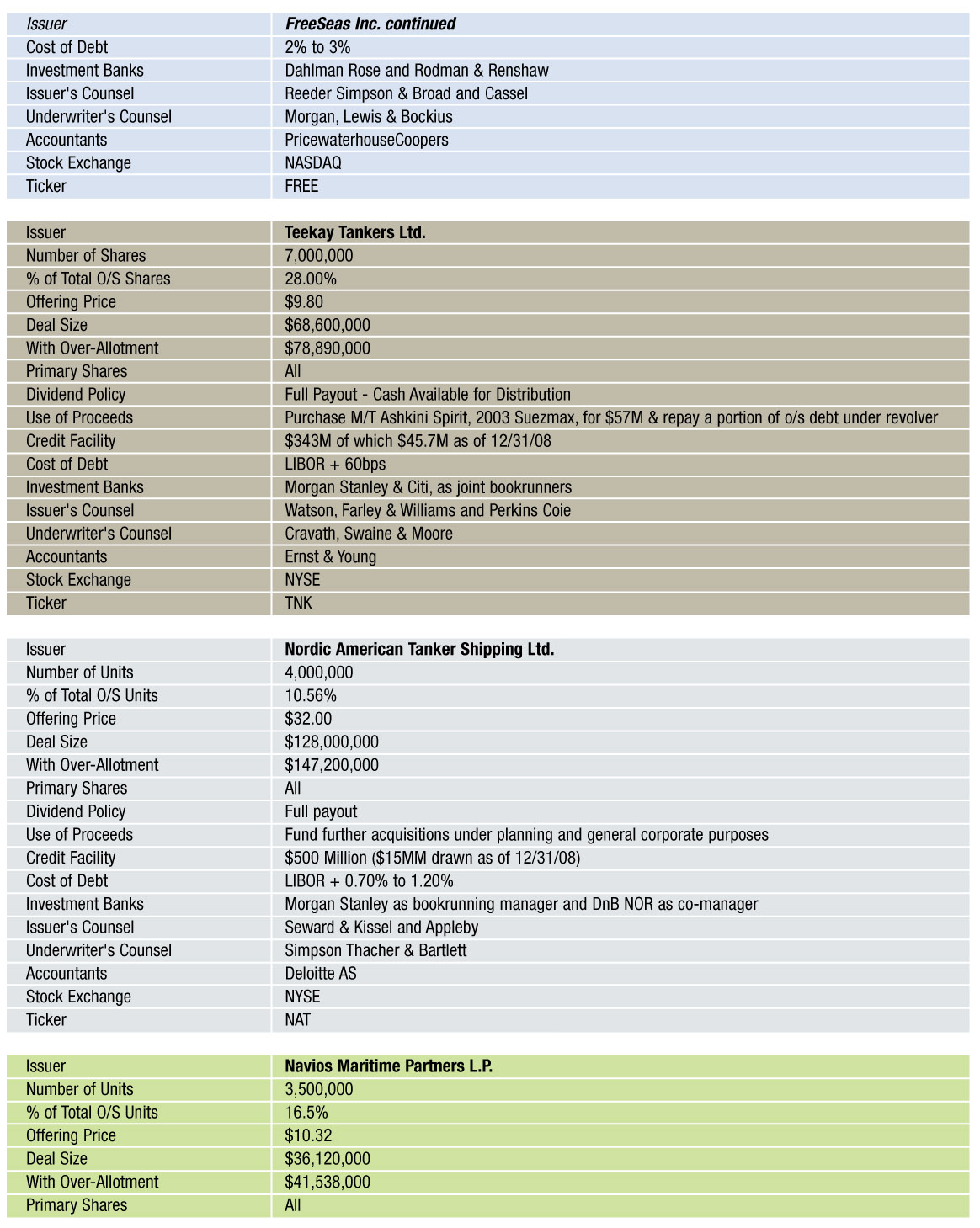

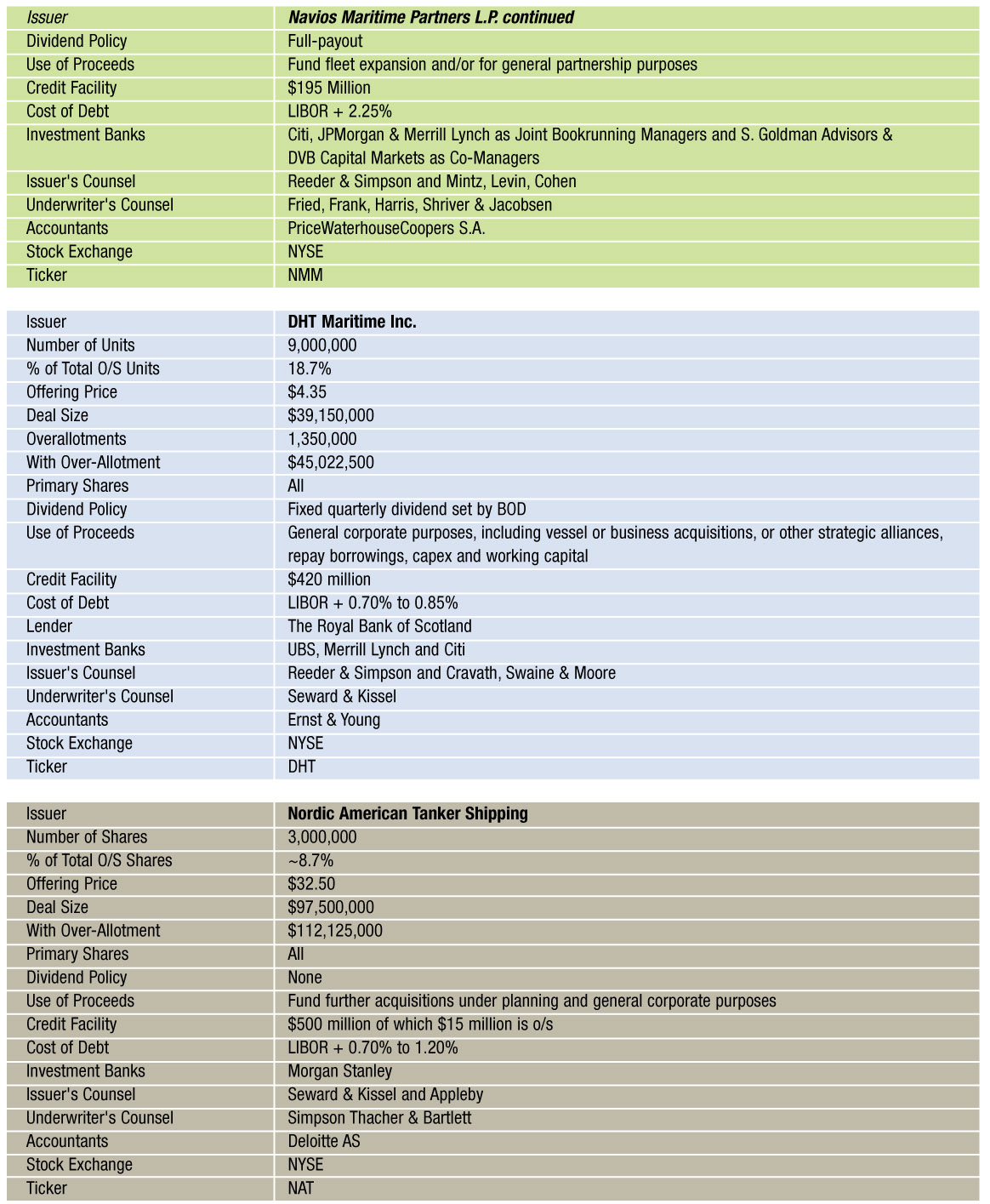

Selected Follow-on Offerings – 2009

While bank lending is on hiatus, capital markets fill the void.

Capex And Market Cap, An Odd Couple

By Jim Lawrence, Matt McCleery, George Weltman and Glenn Muller

One of the favorite pastimes here at Marine Money is the art of comparison – an exercise that has become considerably more interesting now that the universe of public companies has swollen to an unprecedented size. There is almost no end to what one can compare these days. Here are some of the favorites among our readers: G+A expense per vessel, technical management fees per day, underwriting commissions, executive and board compensation.

In our most recent foray into the world of comparison, we thought it would be fascinating to look empirically into an issue that is often talked about anecdotally, but rarely analyzed scientifically – capital expenditure. The issue of capex, which really translates into the more unsavory sounding unfunded newbuilding commitments, is particularly interesting today because of the drop in asset prices and tightness of credit available. These two factors translate into a need for greater amount of equity which, in turn, affects dilution.

To shed light on this issue, we commissioned our friend Glen Muller to collect year-end 2008 and 1st half 2009 unfunded future capital expenditures and create the table that accompanies this article. Then, because everything in life is relative, we compared the capex commitments to the overall equity market capitalization of each of the companies to provide the context.

Continue Reading

Watch The Greeks!!

By Megan McCurdy, Poten & Partners, Inc.

Greeks and shipping have been inextricably entwined since the beginning. The nature of Greek-controlled assets has evolved over time but has remained highly influential. The camaraderie and infighting that characterized the Greek shipping community shaped the entire industry. Information sharing on the streets of Piraeus has demonstrated an ability to wield influence in other parts of the world. When the markets move, all eyes turn to the Greeks.

In 1995, Greece was the third largest flag state for tankers with over 200 vessels over 30,000 DWT registered. Today, that number has increased to 335 tankers, but accounts for roughly the same percentage of the total fleet. While the flag state represents mostly the commitment of the Greek shipowner to supporting domestic employment, a better metric of the Greek communities reach is a ship-by-ship analysis of control.

Continue Reading

Shipbuilding Markets & the Financial Crisis

By Ahmedali Lokhandwala

Overview

The economic recession, going hand-in-hand with the severely imbalanced supply-demand characteristics in the shipping industry has severely hampered the new building sector in its ability to meet contractual agreements between the shipyards and owners. The time lag in ship production led to an inflated order book, and the problems have been compounded by a sharp downturn in the finance sector, leading to an instantaneous dip in demand. This is one of the major reasons behind the dire conditions of the new building market. Under these circumstances, owners are rushing to cancel their vessels presently on order, or at least postpone delivery until market conditions improve. Also, yards are finding it difficult to deliver the promised vessels under the agreed time frame and within the allocated budget. The fate of the order book scheduled to be delivered between now and the end of 2012 is critical to the yards that are building them, the owners that ordered them, as well as the banks that are providing the financing.

This article attempts to provide a generalized framework and a quantitative analysis regarding orderbook cancellations, instead of relying on pure guesswork and gut feelings. Using historical data and probabilistic calculations, the framework forecasts that about 170 to 205 Capesize vessels currently on order are likely to be cancelled. Also, the model suggests that out of the total number of vessels to be delivered in 2010, about 47 are likely candidates for cancellation.

Continue Reading

RULE B AND THE ALTER EGO – HAVE THE COURTS PIERCED THE CORPORATE VEIL?

By Lawrence Rutkowski and Bruce Paulsen

Introduction

Rule B attachment – the pre-judgment seizure of assets in maritime cases — has been a hot topic for several years now. Rule B cases have, in some areas, substantially altered the traditional application of otherwise well-settled principles of law. For instance, though ostensibly two sides of the same coin, alter ego analysis under Rule B appears to have become divergent from, and more lax than, the established standards of “piercing the corporate veil” in corporate law. In many ways, it is now easier for a maritime claimant to pierce the corporate veil – and attach the assets of alleged “alter egos” – than it is under general jurisprudence. This development has wide-ranging practical ramifications. (As discussed in this article and as used in court decisions, an “alter ego” is an affiliated company whose identity is virtually indistinguishable from the defendant who allegedly committed the tort or breached the contract at issue; courts often refer to the principal defendant as a “mere instrumentality” of the alter ego.)

A Short Primer on Rule B

Historically, Rule B owes its existence to the transitory nature of assets within the maritime industry. Vessels travel from port to port and may vanish from the view and reach of their owner’s or charterer’s creditors; other assets may be reachable only in distant and inaccessible jurisdictions or hidden behind dense corporate structures, perhaps leaving creditors without security on unpaid maritime contracts. Rule B provides for an extraordinary remedy to maritime creditors. It permits pre-trial, ex parte attachment of assets; the significance of this being that the debtor need not be aware of the complaint before its assets are seized. In addition, a plaintiff is not required to post security to initiate a Rule B action, which limits the transaction costs and risks associated with bringing a legal claim against a defendant. In order to permit the attachment and/or garnishment of property of a debtor the court must determine, (i) whether the plaintiff has a valid prima facie admiralty claim; (ii) whether the defendant cannot be found within the district; (iii) Whether the defendant’s property can be found within the district and (iv) that there are no maritime or statutory bars to attachment.1

Continue Reading

RAISING THE BAR IN AT-THE-MARKET (ATMs) OFFERINGS: THE CERTAINTY OFFERED BY PRINCIPAL-TYPE ATM TRANSACTIONS

By George Kanakis and Troy Rillo, Yorkville Advisors LLC

At-the-market (ATMs) offerings have become a popular financing tool in today’s volatile market. Earlier this year, Bank of America completed its own ATM of $13.5 billion in perhaps the largest ATM conducted to date. In an ATM, a public issuer sells, through an intermediary, new equity into the market at prevailing market prices – hence the name “at-the-market” offering. In a rising market, ATMs often result in equity being sold at increasing prices. This results in less dilution than in traditional equity raises conducted at a single time and single price.

Traditional equity raises are commonly referred to as “follow-on” offerings or placings. Such offerings are marketed by means of a road show in which senior management conducts weeks of marketing the stock to potential buyers. Stock prices often decline as a result of such road shows because of the uncertainty as to whether the required amount will be raised, and at what price, which can increase the cost of capital. Some advantages of ATMs compared to follow-on placings are:

Continue Reading

Storm Approaching? Keeping a beady eye on the BDI in these turbulent waters

By Claudio Chiste, Shipping Finance,

Banca IMI SpA London Branch (part of Intesa Sanpaolo banking group)

Although demand fundamentals are always important, these should be viewed with a healthy respect for the supply side as well. Supply capacity is largely inelastic (since newbuildings can take more than two years to build) but since it can be forecast reasonably accurately, its influence is often overlooked in the analysis and interpretation of Baltic Dry Index (BDI) behaviour. One of the most important Greek philosophers, Plato, said, “A good decision is based on knowledge and not numbers.”

There has been considerable focus – particularly in the current economic climate – on the BDI by the mainstream media which frequently reports on movements of the index. The BDI is regarded as one of the purest leading indicators of economic activity: former chairman of the US Federal Reserve, Alan Greenspan, is also reportedly a fan. Currently the BDI is not a tradeable exchange: it is not open to manipulation from speculators and shortsellers. Economic indicators, such as consumer spending which accounts for 70% of US economic activity are retrospective in nature, meaning they are derived from historical data. The BDI differs in that it is regarded as offering a real time glimpse of global raw material demand, by measuring the seaborne movement of raw materials such as iron ore, coal and grains. Accordingly, it is generally regarded as the global benchmark for shipping commodities. It has been increasingly used as an indicator for ‘global health’, which is based on the reasoning that the index looks at raw materials, so it captures activity at the very beginning of the production process, and is therefore a precursor to production. It also embraces ocean shipping, so it reveals details of international trade – a critical driver of global economic growth.

Continue Reading

The ‘crisis’ is behind us

By Kit Juckes, The ECU Group plc

The world is not back to ‘normal’ but it is in a lot better shape than it was at the start of 2009. The worst financial crisis and subsequent recession since the 1930s has not turned into a repeat of the Great Depression, and for that we can thank the exceptionally aggressive response from the world’s central banks, led by the US Federal reserve. Mind you, the Fed must accept a huge slice of responsibility for getting us into this mess, with ludicrously accommodative monetary policy early in this decade. Let’s also not forget that the ‘cure’, which helped to avoid economic Armageddon, has involved pumping vast amounts of liquidity into the global economy and saddling governments with huge debts.

‘Reflation’ is the name of the game and with fiscal and monetary policy as helpful as possible, inventory levels far too low for any kind of revival in demand and falling prices giving some support to household incomes, the economic data can continue to flatter. Longer term, there are multiple threats to this recovery and that is why policy-makers and economists are so quick to warn that ‘it will be different this time’ and that the rebound will be very gradual. Governments need to raise taxes and cut spending in order to reduce gargantuan deficits, households need to continue to reduce debt levels and the corporate sector is still fighting loan-shy banks.

All of that is for the long term however. Right now, one striking feature of this economic recovery is just how synchronised it is. There was talk of ‘de-coupling’ between the major economies before the 2008 crisis and there has been more talk since about who would recover first, who would lead and who would lag. But in reality, the economic impact of a sudden and dramatic freezing-up of bank lending and capital flows that followed the collapse of Lehman, as well as the destruction of US demand that was triggered by the collapse of the US housing market, hit everyone at the same time. As US housing has stabilised and as central banks work to restore order to the banking system, everyone benefits together. So all indicators of orders, and of business and consumer confidence, as well as any other leading indicators of future economic activity, are pointing towards a significant improvement.

Continue Reading

Pipavav Shipyard

This week, we are impressed to see another shipyard finding success in the IPO market. This makes India’s Pipavav Shipyard the third successful shipbuilder to raise equity following Taiwan’s China Shipbuilding Corporation and Malaysia’s TAS Offshore since the beginning of this year.

Pipavav Shipyard will soon be listed on the Bombay Stock Exchange and National Stock Exchange upon the completion of its book building. The private shipyard has offered its shares at a price band of Rs 55 – 60 a piece and plans to raise between Rs 4.7 billion (USD 98 million) and Rs 510 billion (USD 106 million). This amount is significantly lesser than the USD 200 million it had previously planned when the shipyard registered its IPO during the first quarter of 2008. Out of the 85.45 million shares on offer, 2.6 million shares have been set aside for the employees. We have provided a summary of the transaction in the Guts of the Deal table that follows. JM Financial Consultants, Citigroup Global Markets India, Enam Securities and SBI Capital Markets are the appointed bookrunners for this IPO. Continue Reading