Condition Met

Eitzen Chemical announced on Tuesday that the book building for the private placement to raise a minimum of $100 million in new equity was successfully concluded with ABG Sundal Collier Norge and Carnegie ASA, as joint lead managers, receiving orders in excess of the amount required. As you may recall this equity offering was a pre-condition for the waiver agreements with the banks.

Continue Reading

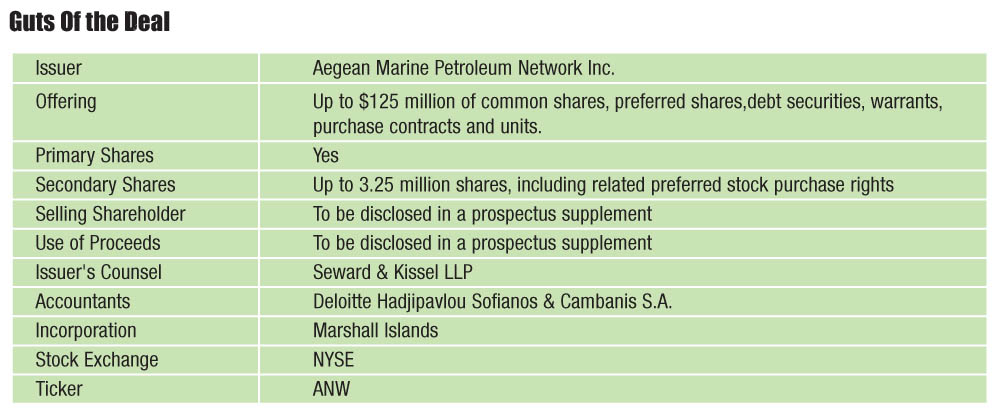

ANW Files Shelf

Also on Friday, Aegean Marine Petroleum Network filed a shelf registration to issue $125 million of common shares, preferred shares, debt securities, warrants, purchase contracts and units. Incorporated in the registration, was a secondary offering of up to 3.25 million shares by selling shareholders. The prices and other terms of the securities that Aegean or any selling shareholder will offer will be determined at the time of the offering and will be described in a prospectus supplement.

Below please find the Guts of the Deal below.

It always pays to be prepared.

Can’t See the Forest for the Trees

Late Friday, the news came out that General Maritime had successfully priced its 144a private placement of $300 million of senior unsecured notes due in 2017. Like the NCL deal that was competing with it, the Genmar bonds were priced in a soft and volatile stock market. Rated B3/B, the notes, with a 12% coupon, were priced at 97.512% to yield 12.5%, a spread of 922 bps over like term Treasuries.

Market noise suggested it was a hard sell, that buyers had issues with the dividend and covenants and, finally that it was expensive. But was it really? While it does look expensive when compared to the NCL and Navios’ offerings, one must not forget that this was done on an unsecured basis. And, although the premium for unsecured was perhaps higher than they anticipated, the company got what it wanted – quasi-equity. The bond provides the cushion that the banks were looking for. And while the $36 million in interest cost is expensive, the impact of that amount, if it had instead been income, appears less costly on an EPS basis based upon a new hypothetical share count (currently 57.9 million shares) which would have included an incremental +/- 33 million shares at $7, that would have had to been issued to meet the minimum requirement of its banks.

Acquisition Alert

Singapore listed offshore support company Swissco could be acquired by C2O Holdings. C20 Holdings has agreed to acquire 54.75% of the total issued shares of Swissco from its controlling shareholder, Yeo Holdings Private Limited as part of its plans to take full control of the company. The offer price of SGD 0.89 is a 22% premium over the company’s net tangible asset value of SGD 0.73. Based in Singapore, Swissco provides marine services to the shipping and offshore oil and gas industries. The group owns, operates and charter offshore support vessels, out-port-limit boats, tugs and barges in support of its customers’ marine logistic needs.

Dynamic Busan: City Of Tomorrow

For the very first time in Marine Money’s history, the 3rd Annual Korea Ship Finance Forum was held at the city of Busan, the heart of the world’s shipbuilding industry and the region home to seven of the world’s top ten shipbuilders. Prior to the event, delegates had an exclusive opportunity to visit the impressive Hyundai Heavy Industries (“HHI”) – the world’s largest shipbuilder. 240 delegates active in the Korean market gathered together and discussed on the today’s challenges and future opportunities.

The keynote presenter Dr. Keo Don Oh, President from the Korea Maritime University started the day by stressing the importance for China, Japan and Korea to work closely together. Dr. Oh noted that there have been discussions on the possibility of setting up a North East Asia Development Bank recently and he believes this could likewise be extended to the creation of a ship finance body to foster closer ties between shipping and shipbuilding industries in Northeast Asia. Continue Reading

Mermaids Buys Ship From Norwegian KS Fund

Mermaid Maritime, Thoresen Thai’s offshore arm, has completed its acquisition of a newbuilt DP2 dive support vessel from Nemo Subsea IS (“Nemo Subsea”). Nemo Subsea is a Norwegian partnership holding beneficial ownership and interest in the M.V. “Mermaid Asiana”, a dive support vessel that is near its completion at ASL Shipyard in Singapore.

The vessel was initially planned to commence a time charter with Mermaid Maritime through, firstly, a bareboat charter from Nemo Subsea AS (a Norwegian private limited company whose sole purpose is to act as a legal owner of the vessel for the benefit of Nemo Subsea) to Great Cormorant Maritime, a subsidiary of Robert Knutzen Shipholding, and subsequently a three year time charter of the vessel from Cormorant Maritime to Mermaid Maritime. Under this contract structure, Mermaid Maritime had signed a time charter agreement with an embedded purchase option after the third year at a pre-determined price. Continue Reading

Bits And Bobs On China

China remains abuzz with activity and anecdotal evidence suggests that Chinese buyers are once again increasingly active in the S&P market. One reason could be that opportunities to pick up distressed assets from shipyards, owners and banks have been surprisingly few, which have prompted people to pay closer attention to the deals available in the market. Continue Reading

A Noble Breed

Last week, our sister publication Freshly Minted reported on Maersk’s successful EUR 750 million (USD 1.3 billion) five-year bond. This was the shipping conglomerate’s first bond issuance, following a recent equity offering of USD 1.7 billion. In Asia, commodity trading house Noble Group has likewise found tremendous success in raising funds, suggesting that investors and bankers are getting warmed up to investing cash again. Continue Reading

Lunch with OSG

Last week’s guest speaker at the CMA lunch was Mats Berglund of OSG and despite the sad state of the tanker market, he was a pretty happy guy. But then again, he noted that the good news about this year is that 10 months are gone.

Mr. Berglund began with a brief overview of OSG. OSG’s predecessor company was founded in 1948 and currently operates a fleet of 103vessels. OSG is focused on four operating segments: crude oil, refined products, LNG and U.S. flag. With crude being the largest business and his responsibility, he drilled down into that business.

OSG is the market leader in this business through its participation in specialized commercial pools that operate VLCCs, Aframaxes and Panamaxes. These form the core of the crude business but the company has diversified into Suezmax, lightering and FSOs.

In operating its crude fleet, OSG’s strategy has been to operate its vessels in the spot market through pools while achieving scale through chartering-in. In terms of numbers the owned fleet was fairly constant during the period from 2004 to 2008, but the chartered-in fleet grew nine times. The combined effect achieved an aggregate EBITDA of $2.5 billion during this period.

KfW Special Program – A Lifeline for Shipowners

Outside of Germany, there has been a certain lack of clarity with respect to the German government’s response to the financial crisis in general and shipping in particular. We were, therefore, very fortunate this week to get insights on the KfW-Sonderprogramm from Iris Heese and Sascha Röber both of whom are involved in the program.

In this instance, government assistance involves specific loan programs for businesses and is managed by KfW Bankengruppe, which as a promotional bank is owned by the Federal Government and the federal states and is headquartered in Frankfurt. Under this program, KfW, acting on behalf of the Federal Government, provides indirect loans to businesses that are having difficulties in accessing liquidity as a result of the financial and economic crisis.

As a means of dealing with the financial crisis, the German Government initiated specific loan packages to give impetus to the German economy. Among the first measures taken, the government provided specific loan programs as shown in the slide below:

Specifically, the main objectives of this program include the following:

Continue Reading