BEYOND THE HEYDAYS: THE BANK DEBT AWARD

2009 was the year that all shipping companies were finding ways to plug the balance sheet gap, especially those with a sizeable orderbook committed during the heydays. Banks are still rationing credit, even as there is a gradual improvement in risk appetite for shipping. Data supplied by Dealogic pointed out that the annual volume of shipping syndicated loans was at a record low of USD 32.9 billion in 2009, a sharp contrast to the USD 89 billion posted in 2008. The number of deals likewise dropped sharply from 297 in 2008 to 121 last year.

Lending terms as one would expect have become more stringent. Not only has the advance rate been lowered to 50 – 60%, banks prefer shorter tenors between 3 and 5 years. This is in stark contrast to the 10 to 12 year tenors banks were offering shipowners just a couple of years ago. Many new deals, often bilateral loans (which are not included in Dealogic’s figures) are made to well-established clients with strong balance sheets. Bankers call this a return to basics, but we are picking up anecdotal evidence that price competition for the top names is gradually returning, while the doors remain shut to those lower in the pecking order. Have bankers learnt the lessons from the financial crisis to avoid the mistakes of excessive risk taking?

Continue Reading

THE DEALMAKER OF THE YEAR AWARD – ICBC

In the tradition of Marine Money’s awards, our Dealmaker of the Year has always gone to the biggest individual rainmaker in the industry, a true game-changer, who changed not only the way we looked at things but, also, ultimately the playing field when it came to doing business in the world of ship finance.

In 2009, there was one story that undeniably stood up above all the rest in changing the way the game was played: China. The Dealmaker of the Year Award for 2009 goes to one of China’s most committed ship finance institutions: Industrial and Commercial Bank of China (ICBC)

2009 was a transformative year as traditional ship lending banks found themselves severely constrained by the sub-prime credit crisis and no longer able to fulfill the increasing needs of their clients in Asia and Europe. China, whose vast growth engine was sustaining global markets also became in 2009 a ship financing powerhouse as well.

Industrial and Commercial Bank of China (ICBC) more than any other single institution must be considered the model example for this important success and powerful ship finance capability. While traditional western banks curtailed lending and ran off their portfolios ICBC grew its shipping portfolio to US$ 7.8 billion. Of that a stunning 65% is in US dollars and just 35% in RMB. In 2009 alone ICBC closed 45 new shipping transactions with a total amount of US$2.3 billion.

Continue Reading

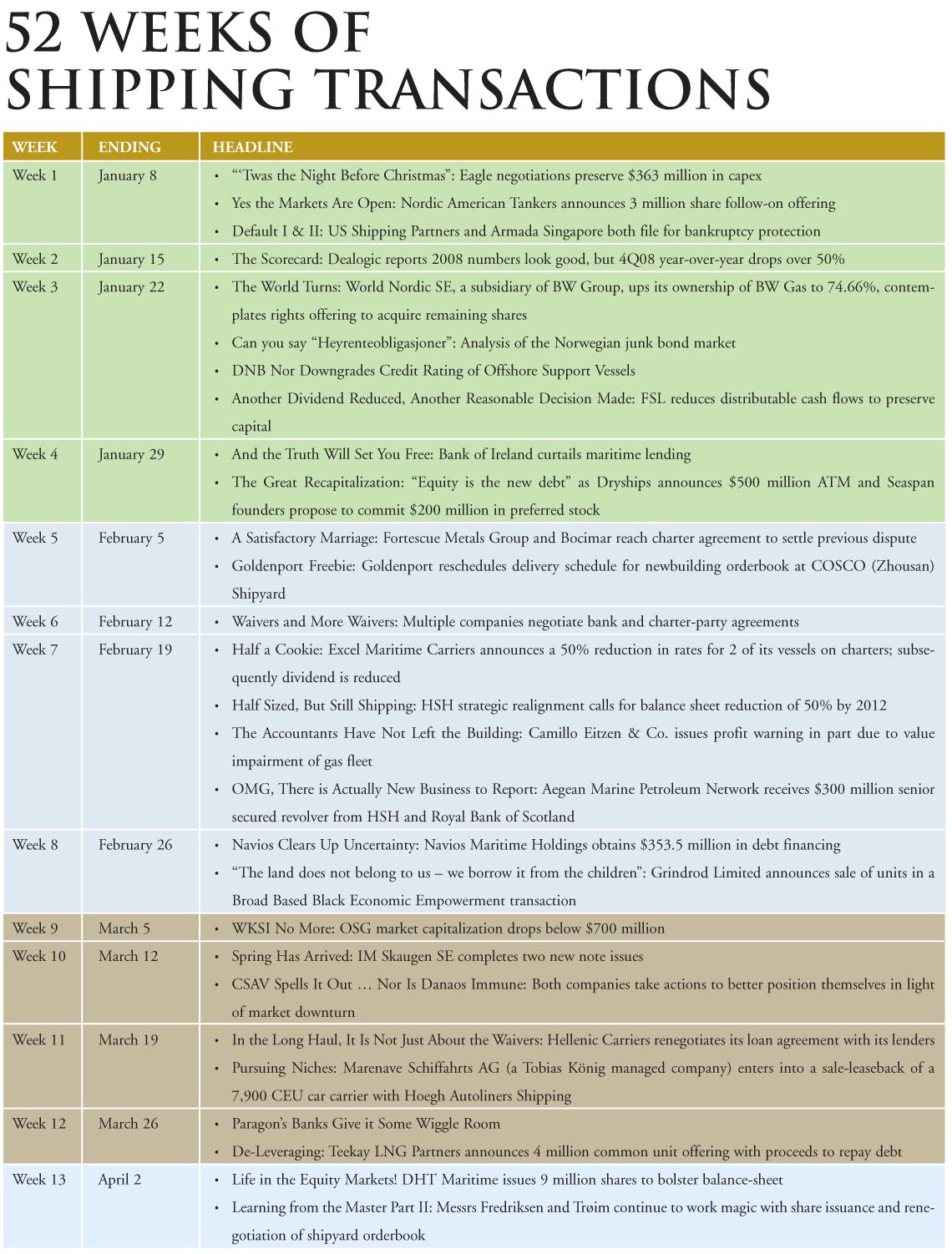

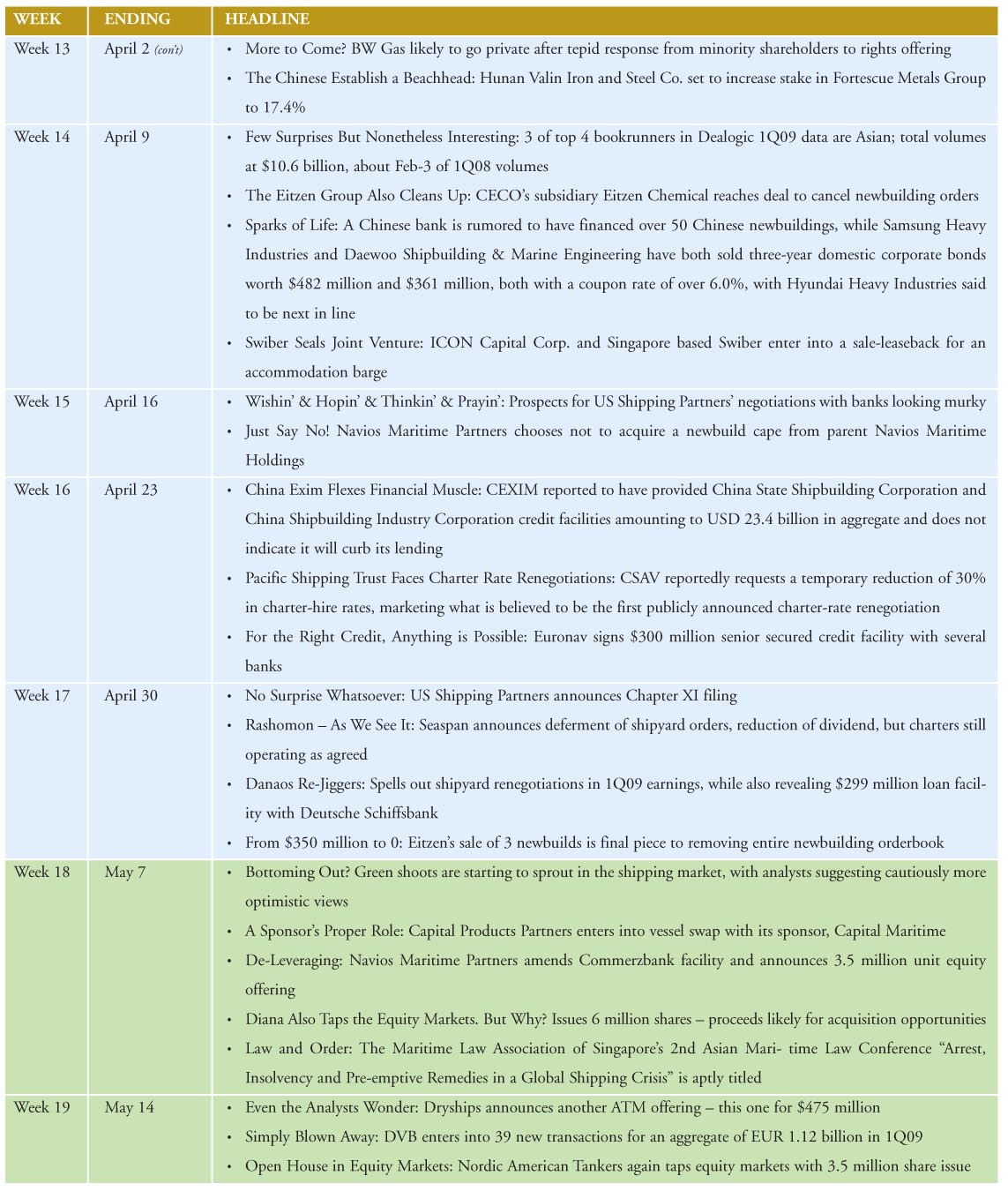

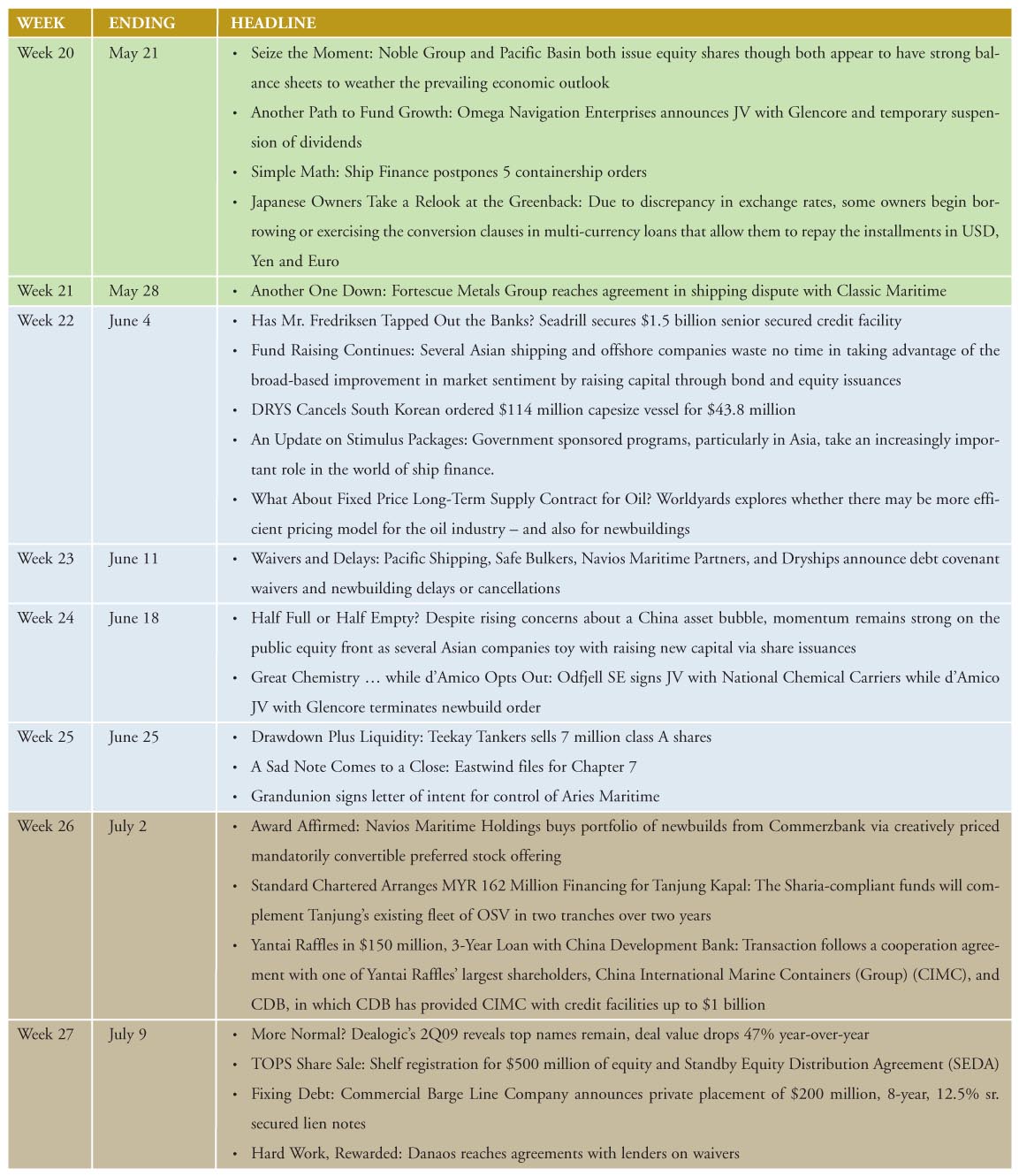

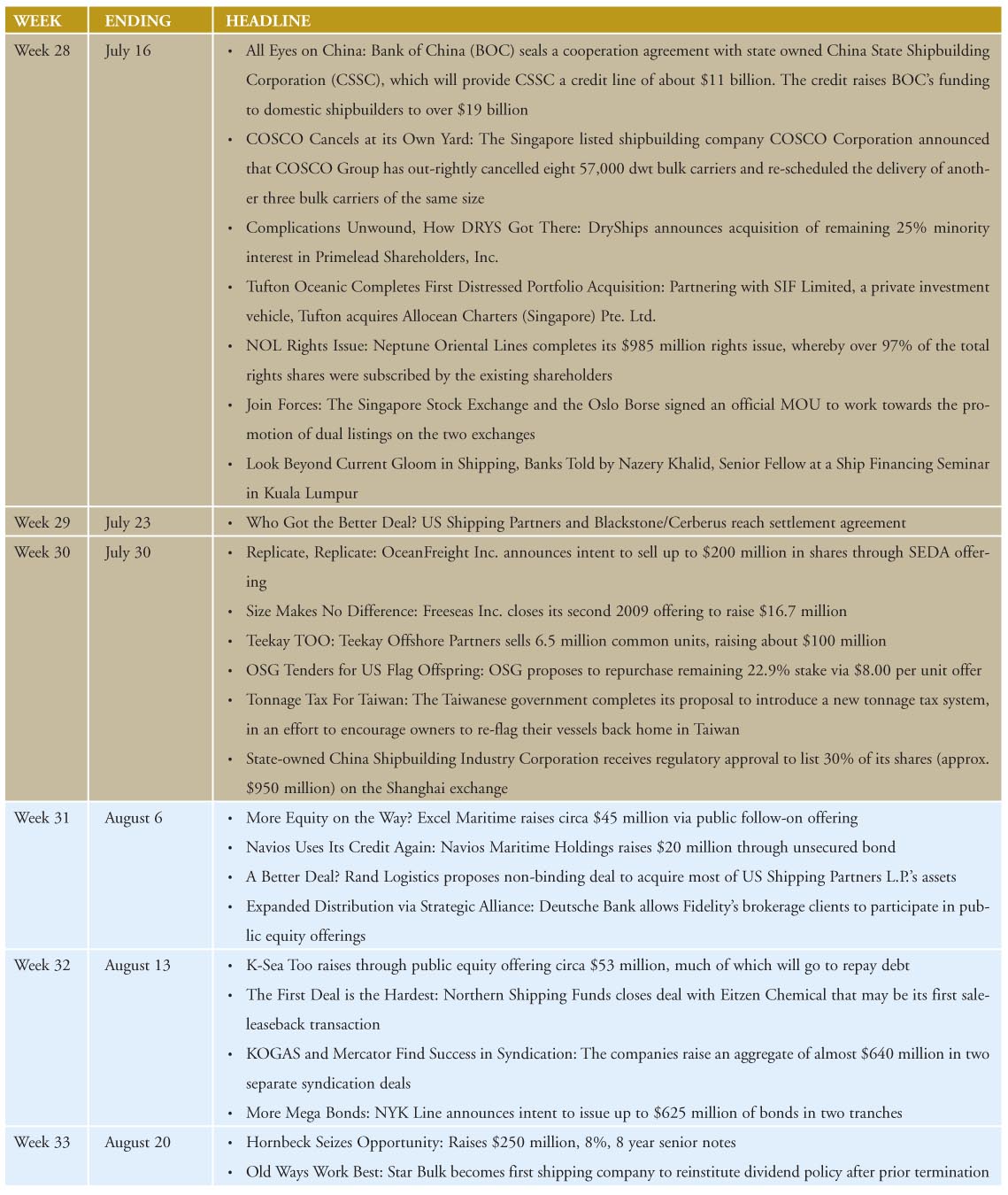

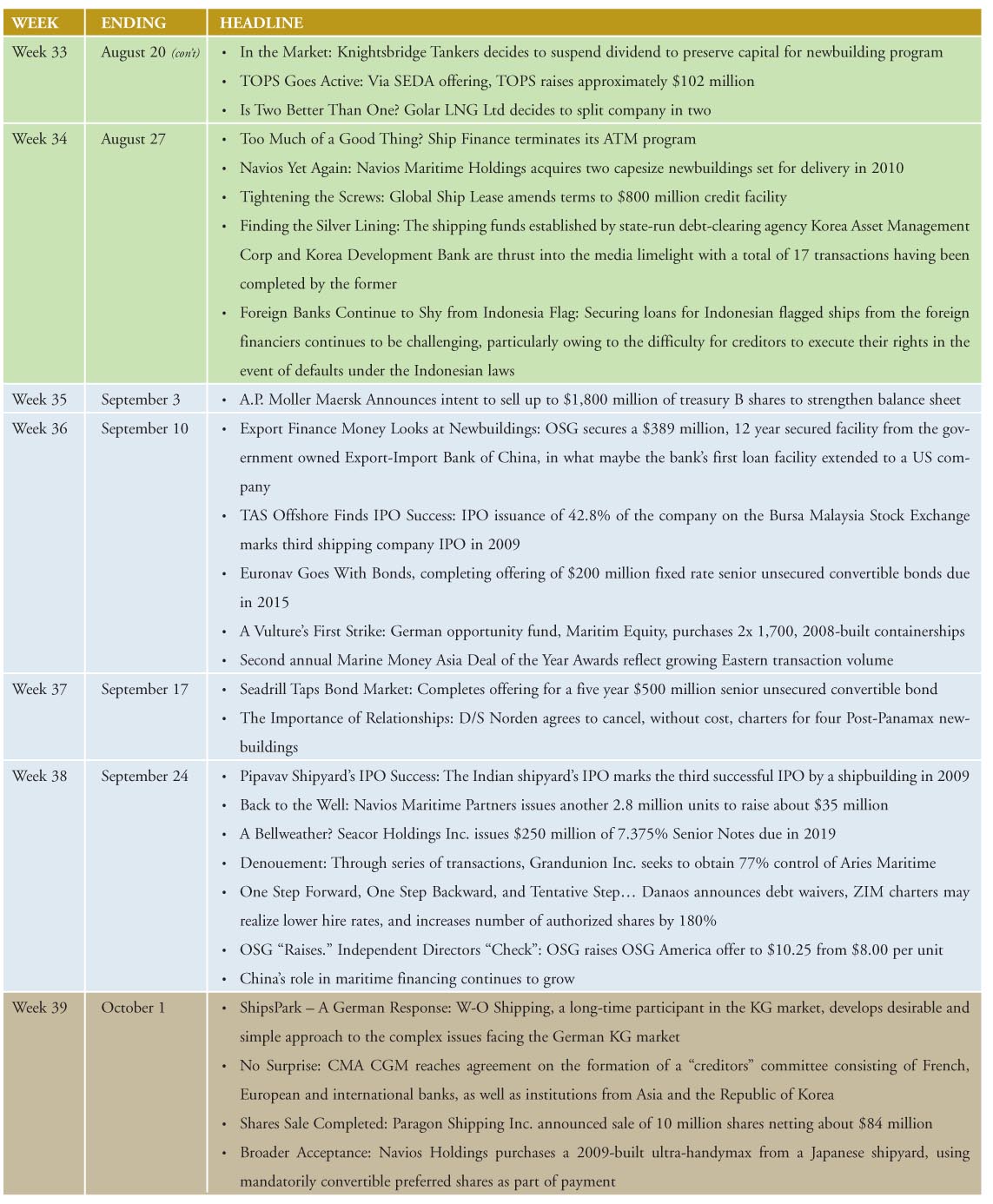

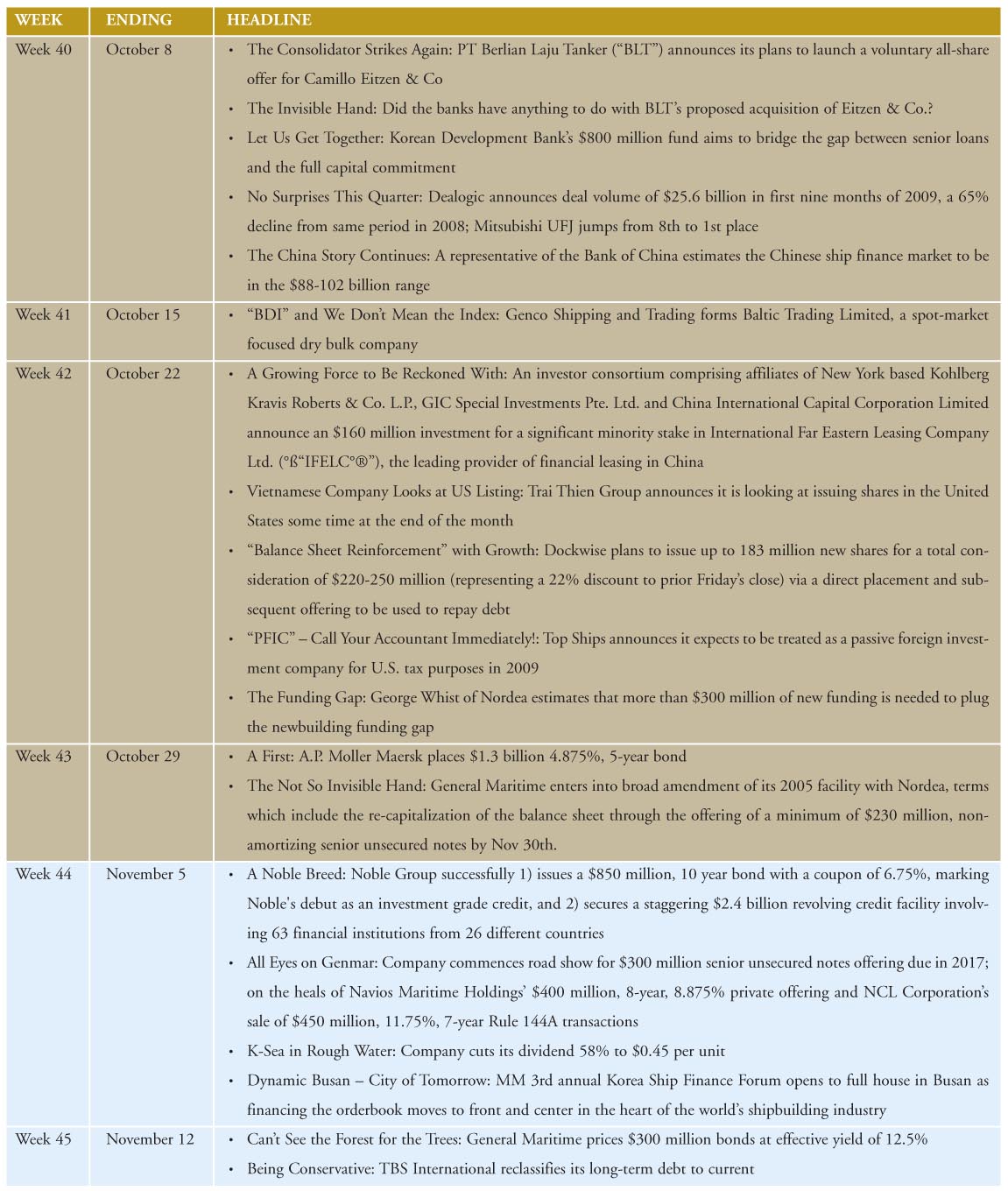

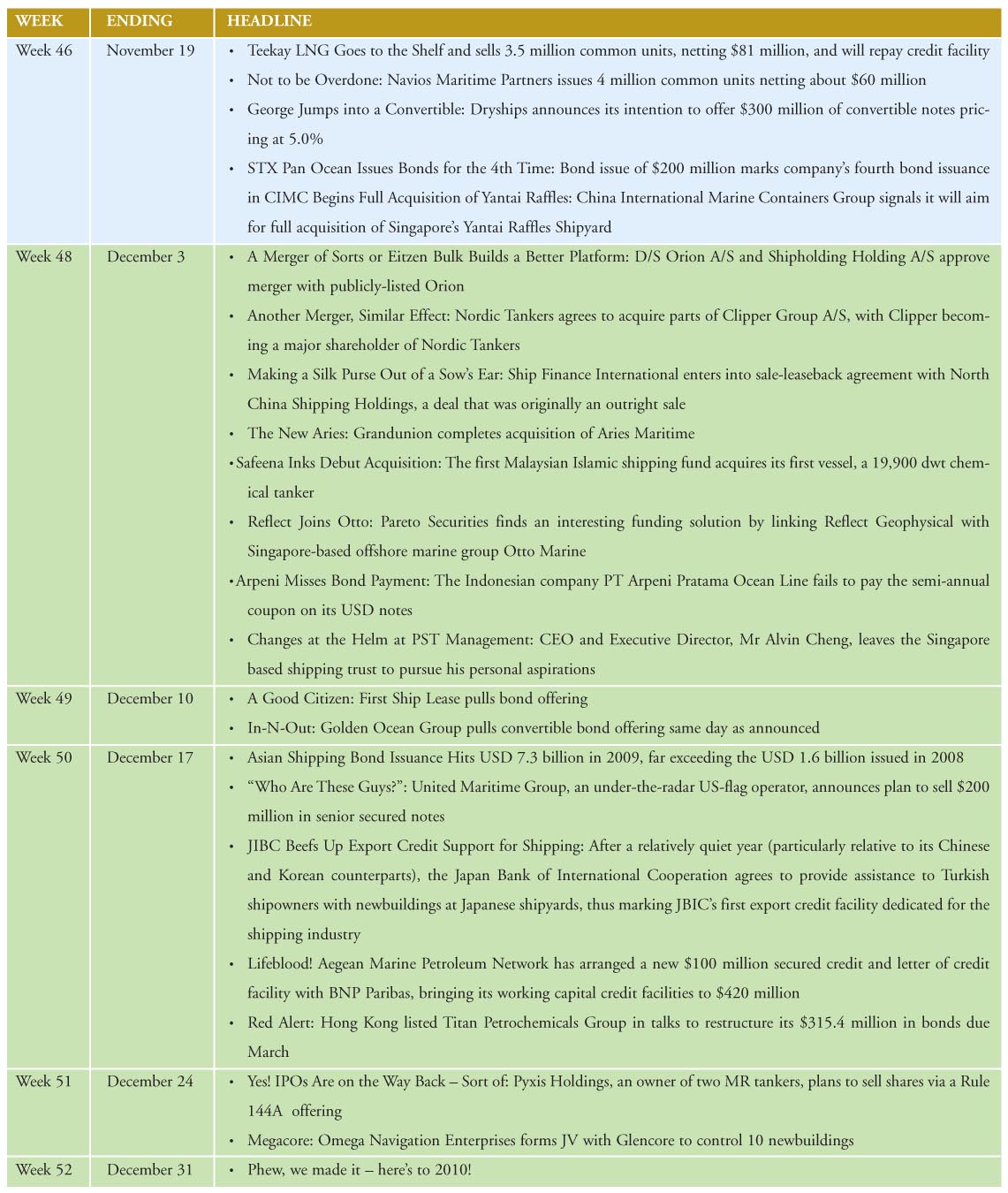

52 Weeks of Shipping Transactions

Look at What Have You Wrought!

Being the publisher of a magazine titled Marine Money, in the midst of a recession and credit crisis, is challenging. We wonder every week whether there will be something to write about. Despite the many travails of the industry, including a virtual shutdown of bank lending, there, in fact, was nothing to worry about. The subject matter changed, but there was certainly sufficient material to fill our pages. Not only did lending virtually disappear but also those financings such as IPOs, private equity, M&A and leasing, which depend on bank funding, became quiescent. The capital markets, both equity and debt, export credit and unfortunately, restructurings helped filled these pages. The lack of cheap bank debt required creativity, the capital markets, and owners’ equity to fill the financial gap. The one burning question was how to get capital. To say it was a very different period from those that preceded it would be an understatement.

And it should come as no surprise that nominations for the deals of the year followed these same trends, with certain categories sparse or non-existent, while others overflowed. IPOs for example remained virtually extinct, despite the obvious benefits of being public. Perhaps 2010 will mark their return. There was one other noticeable and important trend evident in the nominations this year and that was the appearance of an increasing number of Asian nominees, indicating Asia had come into its own. Having escaped the brunt of the credit crisis, Asian banks not only had money to lend, but more importantly were at the center of what has become the shipping universe. As we wrote earlier, the world has tipped eastward. And it is with no small thanks to the efforts of our Singapore office that greater disclosure and transparency surrounds these transactions. We were so encouraged by the turnabout that we have decided to end the bifurcation of Asian and Western awards and have only a single Deal of the Year, with East and West competing on a level playing field.

In Conversation With Nordic Maritime

Nordic Maritime celebrated its 10th anniversary with good company, good food and good cheer recently, having come a long way since its humble beginnings as ship manager. The company began life during the Asian Financial Crisis when CEO Morten Innhaug found himself torn between decisions – return to Norway or find a job in Singapore. And as fate would have it, Innhaug was offered the opportunity to take over the Singapore office he was tasked to set up for a Norwegian owner. The office at that time already had the people and procedures to perform ship management services but the challenge was to find business to cover the overhead costs. As the saying goes, every crisis breeds opportunity and in this one, the lifeline came when DMNG – a Russian geophysical company, awarded Nordic Maritime a ship management contract for one of its vessels. The rest, as they say, is history.

Today, in addition to operating 7 vessels for DMNG and other clients in the offshore market, Nordic Maritime is a shipowner with plans to diversify into the offshore construction and accommodation sector. It acquired its first survey/utility vessel, Emma in 2005 and is in the midst of constructing four accommodation field development vessels (“AFDVs”) at NGV Tech yard in Port Klang, Malaysia, specially designed to meet the increasing need for premium accommodation. Marine Money speaks to Chief Operating Officer Kjell Gauksheim and Chief Financial Officer Wayne Law this week to find out more about the strategies that Nordic Maritime has in place to ride through the next decade. Continue Reading

Different Means, Same End

There are a number of similarities between Marco Polo Marine and Otto Marine. Both are Singapore listed and have their ship chartering and shipbuilding businesses focused on tugboats and barges. Coincidentally, both revealed plans to raise more capital in the past two weeks, but in different ways.

Last Wednesday, Marco Polo Marine announced its disposal of 8 vessels to a related party on a sale-and-leaseback arrangement for SGD 11.9 million (USD 8.48 million). The company explained that this arrangement would serve two purposes. Firstly, this reduces the company’s gearing level and improves cash flow while maintaining the fleet size without the loss of commercial and operational control. Secondly, this circumvents the restriction faced by company in operating Indonesian flagged vessels. The company is not allowed to own Indonesian flagged vessels (since only Indonesians can do so) and the sale-and-leaseback arrangement will enable the company to operate Indonesian flagged vessels freely in Indonesian waters. Continue Reading

Showing Resilience

Last Thursday, Pacific Shipping Trust (“PST”) released its full year results and as expected, there were no surprises. Key figures – revenue, operating profit and distributable income were largely in line with analyst expectations. Gross revenue in 4Q09 grew 8% to USD 15.6 million from the corresponding quarter in 2008, boosted by contributions from a vessel chartered to Compania Sud Americana de Vapores S.A. (“CSAV”). Net profit for the full year of 2009 increased 49% to USD 27.4 million while distributable income grew correspondingly by 46% to USD 27.1 million. With a fleet of 12 containerships all on long term charters, PST has contracted charter income of USD 300 million over the next 7 years.

For shipping trust investors, credit risk remains a top concern. And unlike the other two shipping trusts, PST has only two charterers – its sponsor Pacific International Lines (“PIL”) and CSAV and both have been facing immediate challenges in the container shipping business. PST has chartered 10 vessels (2 Panamaxes and 8 Handymaxes) to PIL for 6 to 8 years and 2 Panamaxes to CSAV for 5 years. Questions at the results briefing were therefore naturally centered on the financial standings of both companies. Continue Reading

Reaching The Light At The End Of The Tunnel

A breakfast meeting with a well respected shipping analyst from an investment bank this week was filled with pleasant surprises. Among which is the growing interest of institutional investors in the container shipping sector. “Last year, I can count with my fingers the number of institutional investors who agreed with my view that there is significant capital appreciation for containers. Now, not many disagree with me,” he relayed. Quick reviews on the market reports available on the sector appear to be supporting his observation.

A headline from the latest Alphaliner Weekly Newsletter reads: “Container freight rates on the main export trades out of China have risen by 24% over the last three months, providing some relief for shipping lines as they seek to return to profitability in 2010. The rate of recovery is much faster than expected, although rates on some of the short-sea sectors are still depressed.” Analysts at DnB NOR sounded optimistic, albeit more cautiously. They recognized the growth in world GDP over the next few years and operators’ ability to control capacity but at the same time, warned that the size of the idle fleet could overshadow demand. CIMB in Malaysia expects the carriers in the Transpacific Stabilization Agreement to attempt another round of increase during the May/June negotiations and believes that Asia-Europe spot rates are now profitable for most carriers. And perhaps, our friend is the most bullish among them all, maintaining his view that containers could surprise by posting incremental profits in the second half of this year. Continue Reading

Solar In Bond Offering

Market rumours indicate that Solar VLCC Corporation, a privately held company belonging to Mr. Nobu Su, is in the market for a three year USD 165 million bond offering. Proceeds from the senior secured bonds will be used to acquire two new VLCCs currently under construction at Daewoo Shipbuilding & Marine Engineering and the vessels will be operated by TMT upon delivery. The figures will represent a LTV of approximately 75% based on an estimated resale value of a VLCC newbuild at USD 110 million.

BLT Loses CECO Exclusivity

Berlian Laju Tanker (“BLT”) and Camillo Eitzen & Co ASA (“CECO”) provided an update on the acquisition progress. BLT is proposing a new transaction structure that involves the issuance of new shares to CECO shareholders, after its initial plans of a mandatory exchangeable bonds issue hit a roadblock with the Indonesian regulator. CECO re-affirmed that BLT’s offer is still attractive but no extension of the exclusivity agreement was granted to BLT. Immediate hurdles for BLT would be to raise USD 200 million in new equity and secure the green lights from all the lending banks of BLT and CECO.