Good Faith Shipping Two years on

By Kevin Oates

Many Greek shipping companies bought what turned out to be expensive dry bulk vessels in 1997 and 1998. The boom market of 1995 and 1996 had long gone and the expectation was the market was stable and about to turn. How wrong they were. Unexpectedly for owners, banks and brokers alike the Far East economies crashed and this had a long and devastating effect on dry bulk shipping. Values reduced by 40% in a year and the freight market tumbled.

At the same time in 1997 and 1998 Wall Street was hot and money plentiful. Where better to get a great return than from Greek shipping companies who were willing to pay above average on their high yield coupon. Transatlantic flights were full and Akti Miaouli was looking like a Manhattan mid-town football pitch (if there are any!!!). Who would be first to get on the bandwagon? What rating would they get? What coupon would they get? The flurry culminated in several bond issues by Greek shipping companies between November 1997 and May 1998. And then the market changed.

Continue Reading

H. Clarkson and Its Approach to Ship Valuation

Forward by the Editors of Marine Money

Text By Richard Fulford-Smith of H. Clarkson & Co. Ltd.

Managing Director and Head of Clarksons Sale and Purchase Division

Forward

H. Clarkson is one of the most widely known “brand names” in shipbroking and recently developed and introduced shipvalue.net online. Marine Money was interested to see what set this product apart from other valuation methods offered by their competitors and the below comes from Mr. Richard Fulford-Smith. It gives his assessment of ship valuation practices and his explanation of why ship valuations need be more transparent and thus the need and value, in his opinion, for shipvalue.net.

In general, Marine Money is bullish on the development of new web products and likes to keep our readers abreast of those developments. We are not specifically endorsing the below as the only, or even as the best, product that can help a shipowner, potential investor or cargo owner determine the value of a vessel. Simply, this is a newer and transparent approach which was given a rather thorough explanation from Mr. Fulford-Smith, which is as printed below.

From Mr. Fulford Smith…

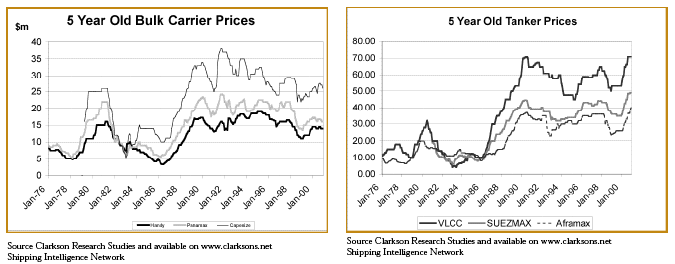

The graphs below show time series price movements for a selection of second hand (5 Year old) tankers and bulk carrier types over the last 25 years. Younger second hand ship prices are affected by replacement cost and therefore may not reflect market earnings to the extent expected.

The last peak in the tanker market was as long ago as 1972/1973 where five year-old VLCC tanker prices exceeded $80,000,000 and would have therefore been off the graph that we are providing. The dry bulk market peaks have been more or less ten yearly, but indeed the peak of the market was during the 1990 – 1992 period, when newbuilding prices (replacement costs) were at their highest since the beginning of the 1970′s.

Replacement costs in 1990 were significantly higher than they are today.

Expectation is for newbuilding prices to continue to climb as they did throughout the year 2000 and following previous patterns, we would expect second hand values for modern second hand tonnage to reflect the increase. We reserve judgement on that last point pending jury’s verdict on whether or not there is still a surplus of shipbuilding capacity!

Owners will place orders rather than pay what they perceive as too high a price for second hand, although they will of course give credit to spot earnings and more importantly, longer timecharter earnings potential when assessing relative second hand values.

Our job as brokers of course has been to monitor values on behalf of Owners and bankers but in order to bring a great degree of order to that process we have now decided to create a transparent on-line service, which is available to all industry users.

Ship Valuation Practices

For a number of years there has been a war of words raging over the inadequacies of the ship valuation process. During the 1990′s a number of failed junk bond issues were blamed on the over zealous selling by investment bankers of ‘junk’ paper to the public (and via private placement) relying on sub-standard evaluation and ridiculously over-optimistic cash flow forecasts and inflated expectations of vessel’s values. As a result of the over enthusiastic selling based or such inflated categories of vessel values and cash flow. In the worst instances company shelf lives were almost down to a six to twelve month period of survival. The amazing fact is that many of these issues succeeded despite the fact that many in the shipping community had voiced criticism at the way the investment banking community had offered these companies to investors the projected forecasts were unrealistic and that indeed in a number of instances Clarksons opined that the evaluation of some of the fleets were significantly exceeding reasonable market expectations. On many occasions Clarksons refused to be involved.

The most public issue on valuations related to the apparent over valuation by so-called experts of the ‘Adriatic’ Tankers tonnage. There was threatened legal action at the time against a number of shipbrokers who had participated in that process. An industry debate questioned how supposedly market-aware brokers could be persuaded to come up with such fantastic over-statements of value. The image of brokers was tarnished. It was indeed this dialogue, which was at the route of a debate, which was well covered by the media during 1998 and 1999.

At that time Clarksons felt that there was a need for a generally greater transparency in the way that evaluations were undertaken. It was even suggested by Clarksons that an independent watchdog could regulate the way in which evaluations were undertaken and at least approve the systems involved.

The creation of ‘Shipvalue.net’ is now allowing people to look at what should become regarded as the equivalent of ‘Glass’s Guide’ in the form of a ‘price guidance’ system for a number of nationally standard ships. Clarksons has also developed a ship portfolio evaluation system within shipvalue.net, which adjusts the valuation of vessels from the Price Guidance given for a number of standard types according to the specific details of the individual ships. The purpose of these two exercises is to produce a system, which has transparency and can be vetted by people who subscribe and which is fully sensitive to market developments. It uses the brokers’ market awareness of what factors within an individual vessel’s description can reasonably (repeat REASONABLY) enhance the value. This does not mean that the owner can claim his ship is ‘better’ although an owner’s reputation for running good ships can have a positive influence on the value.

The team working in the Research and Sale and Purchase departments of Clarkson’s monitors each transaction. Where possible Clarksons has made this information widely available through the publications business of C.R.S. The transparency this provides is of service to owners and financiers alike. Financiers can utilise the charts in the system, to see a negative trend developing, as an early warning system pointing to their increased exposure through declining asset value, where pertinent. Even banks whose lending rationale is based more on a corporate basis, as opposed to asset based finance, will find the service of value, as obviously the market development has an impact on corporate solidity so indeed.

We are pretty convinced at Clarksons that those that object to the creation of the system and do not like the transparency that it brings are those very same people who have tried to manipulate the process in the past. It is the view of Clarksons that every ship has a fair market value within a fairly narrow ‘band’. In common with many competitive brokers in our industry Clarksons has a team in house that is able to monitor very closely the basis upon which speculators or industry users evaluate secondhand or new tonnage. The basis upon which evaluations are made are fairly complex but can be measured through a number of relatively simple analysis including the following main three points:

a) Comparison with recent sales marks the level at which competing buyers evaluate ships. The brokers therefore rely quite heavily on the use of comparable sales.

b) Business-plan assessment and discounted cash flow calculations. Despite the fact that freight markets are volatile shipowners frequently make assumptions about future earnings profile of any ships and to gauge value accordingly, based upon a conservative life expectancy for the vessel in question. Life expectation can change but the majority of shipowners seek to write off any loan on a commercial basis.

c) Business plan fit. The evaluation of any vessel will be determined by how the ship can fit into a large number of client’s portfolios including being attractive for financing. Special dedicated ‘industrial’ use can add value to a vessel that fits.

Without being able to assess these three important commercial elements and being in-house people with such skills it is impossible to qualify as a valuer. Clarksons has these abilities and with the extensive data base that CRS has diligently built up is now able to offer the industry shipvalue.net.

CHANGING NESTS

By Nicolai Heidenreich

We concluded our “What Now for Osprey?” article in July last year with a list of items that we thought would be beneficial for all involved with Osprey. The banks would be paid, shareholders would receive a long awaited dividend, and the principals would be left to focus on what they know best; the ownership and commercial management of LNG vessels. The list, which compromised the following six items, looked like this:

1. Sell the two remaining VLCCs to Tankers International

2. In the same transaction, OMI sells its Suezmaxes to Frontline

3. Osprey sells its share of IPC to OMI, leaving OMI a pure product tanker player.

4. Raise $500+ million in a bond offering with LNG charter revenues providing healthy EBITDA coverage. Continue Reading

Coming to America

By Matt McCleery

Leverage is an important ingredient in the stew of ship finance. In a bubbling cauldron of big-ticket assets, thin operating margins and meager long-term returns, debt financing is the spice that makes the meal tasty for risk seeking equity. While commercial banks have historically been a reliable source of competitively priced secured capital, The Bank for International Settlements’ (BIS) revised rules for the calculation of risk by commercial banks, and the adequacy of capital that must be allocated to fund that risk, appear set to tighten the market.

The BIS regulations aren’t the only factor at work; ship finance liquidity is also being reduced by an inability of Japanese and Korean banks to lend, reduced tax advantages, non-existent export credits, limited longterm employment and erratic newbuilding prices. Oh, and did we forget to mention that over time many shipping assets classes fail to earn their cost of capital? As a result, the question that we are asked more and more frequently is this – where will ship finance leverage come from in the future? We draw our answer from an aphorism uttered by JP Morgan: “money changes direction like a school of fish.”

BULK SOLITAIR

By Kevin Oates

This time last year I was writing an article to be published in Marine Money about how resilient the Greeks are. After going through an incredibly depressed market for two years, after surviving the grilling of ISM and after putting up with the endless press about consolidation and corporatisation and how all of this was going to spell the end of Greek shipping as we know it, the Greeks have come out the other end pretty much intact. It is fair to say that 2000 was a good year for shipping (except perhaps for the reefer sector) and a very good year for Greek conventional shipping. Markets improved, owners were enthusiastic buyers of more modern tonnage and some of the stronger owners continued the newbuilding spree that had begun in 1999. Here, at the beginning of 2001 all looks well.

Continue Reading

The Story of Pandora’s Box

Everytrade – A Liner Primer

By Geoff Uttmark

It is the maritime sector on which the overwhelming majority of the world’s shippers depend, though many never see a ship.

It is an occupation as different in skills and style from bulk tramping as Bangkok is distant from Baltimore (Figure1).

It is a fleet that tallies less than a fourth of the world’s bottoms (Figure 2), yet by some accounts produces almost three fourths of all global oceanborne freight revenue.

It is a technological innovation less than fifty years old that has injected the ubiquitous “box” into any corner of the globe where a cargo can be found to fill it. Continue Reading

The Year of the Not and Dot Coms

By Jim Lawrence

In the December issue, where we covered the best of the year 2000, we did not cover the dot-coms. This is largely because, on our first assessment, we noted that the year 2000 had more dot-comers running for cover than running for coverage. This is not to say that there were not some bright spots. Also, where there were things symptomatic of the great abyss in the arena, even those who did not perform well gave it their best shot. Hey, it is not a race unless someone wins and someone loses and it is always competition that makes the product better.

What a year its been for the dotcom world! It began with a sky’s the limit sort of optimism and is ending with the sobering realization that hard work is critical, but that even hard work may not be enough. Dotcom mania was the sort of funding spree we had not seen since the early days of the “Asian Tigers” market frenzy of the mid nineties. Flows of funds dreaming of 300% returns (at least that is what the papers were touting) helped support an industry filled with eager young revolutionaries set upon changing an industry. Everywhere we turned during that heady first quarter there were new ideas for shipping, primarily borrowed from other business sectors and given a maritime pitch (but never mind), that promised efficiencies, cost savings, new ways of buying or trading.

It was exciting. The ideas and technology really did look new. The economy was strong, investment dollars were making people rich and our industry, big and small, really was exploring the concepts, or at least email. Ours is a very compelling story involving the movement of billions of dollars worth of goods and services around the world, on consumption happy assets requiring a global inventory of products and hardware. The early spring ramp-up included mention of some of the stronger players in such dotcom icons as Industry Standard and consumer trades as Forbes.

Continue Reading

Offshore Contracting: STOLT OFFSHORE’S STRONG POSITION

By Urs M Dür

Stolt Offshore (NASDAQ: SCSWF) the petroleum exploration sub-sea/offshore contracting firm, has experienced a rough year in terms of its share price, likely to lose $0.39/share in 2000, at best. Yet, in the face of losses, on percentage terms, they have performed on a par with the Dow Jones Industrial Average, the S&P 500, and certainly have out-performed their US home exchange index, the NASDAQ. So, if you held this company this year it most certainly could, speaking broadly, have been worse.

That therefore is the primary point. A company that lost money this year has maintained its share-price and is only down marginally in percentage terms. According to their estimates, earnings will break-even in Q4 2000 and SO feels strongly that black numbers can return as early as Q1 2001.

Continue Reading

Finding Religion with Jefferies & Co

Three out, one in. That’s the summary of the ebb and flow of investment bankers into and out of shipping in recent years. Outbound bankers include Hamish Norton of Lazards, Ed Lincoln of Paine Webber and Regg Jones of Goldman Sachs, none of whom have been replaced. The lone inbound IB is Jefferies and Co.

Now we at Marine Money are generally skeptical when new investment banks come into shipping. Perhaps we are too protective, but when we see investment banks like CSFB enter business, we just assume they are doing so to skim the cream off of an irrationally exuberant market before sacking their staff and moving on when the deal flow dries-up.

Continue Reading