An Elegant Solution

Last week Camillo Eitzen provided an update on the status of the voluntary exchange offer by PT Berlian Laju Tanker to acquire its shares. While CECO indicated the transaction remains on track and is still considered attractive, the Board has decided not to “…extend the exclusivity granted to BLT to ensure the necessary flexibility for CECO in the process of concluding a long-term agreement with its secured and unsecured creditors…”

Far more interesting was the news that BLT proposed a new structure for completing the offer. Previously, the initial transaction structure, which involved the issuance of mandatory exchangeable bonds, was rejected by the Indonesian market regulator. Instead, BLT is proposing an offer based upon a rights issue structure, which is a proven concept in Indonesia, and, for BLT, reduces the execution risk.

Continue Reading

Pareto Places $60 Million of Fresh Equity for B+H

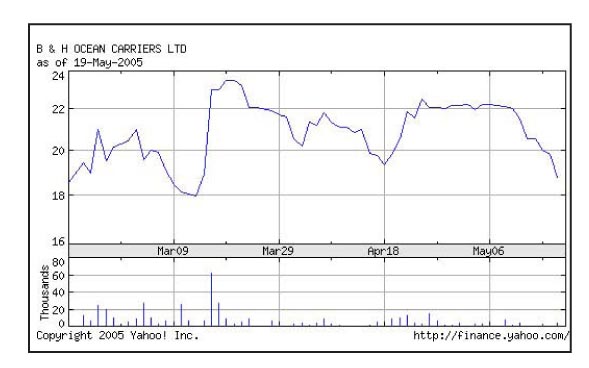

Pareto Places $60 Million of Fresh Equity for B+HUsing the issuer-friendly Form Reg F, which allows a foreign issuer to sell securities to foreign investors through a very simple process, Pareto Securities raised $60 million of cash for tanker company B+H this week. As we understand it, the deal was scaled back from an initial size of about $120 million and pricing was $18.50, about 5% below the trading price at the time. Although we have not done the math, the valuation is somewhere in the vicinity of net asset value. As we understand it, the newly issued shares will trade over the counter in Norway (until BHO lists there officially), and the U.S. lock-up period is only 40 days for investors. As you can see from the accompanying stock price graph, the shares have experienced notable selling pressure since the deal was announced.

Despite the reduced size and valuation that resulted from recent weakness in both the equity and shipping markets, this is an important deal for B+H for a few reasons. First off, the company now has a meaningful amount of buying power and we would be very surprised if they don’t have some specific ideas about how to use it. We would speculate that if B+H has, or will identify, a deal with some charter coverage (as they recently did with the OBO on charter to Sempra), bank financing could add another $200 million in dry powder. B+H management has proven themselves to be very experienced dealmakers with the patience required to do sensible deals in today’s market. Moreover, the new issue will reduce Michael Hudner’s stake to about 50% of the outstanding shares and thereby increase the free float by about five times.

A Courageous Move – Editor’s Choice

Leave it to Mark Friedman and Mark Whatley to be countercyclical. During a year when most employees of financial institutions clung to their jobs with the grip of a shipwrecked sailor clinging to a piece of flotsam, Friedman and Whatley left the Merrill Lynch Mothership and decided to try their hand at something a bit more entrepreneurial when they joined their former colleague George Ackert at Evercore Partners. For those of you who don’t know Evercore, it is best known for its leading Merger Advisory and Restructuring Practice involving high profile deals such as the sale of Burlington Northern to Berkshire Hathaway and the restructurings of General Motors, CIT, and MGM Mirage.

So in year characterized more by damage control and risk management than developing fresh business and taking on new risks, the Marks (and Evercore management) bucked the trend. Either each of these guys already have whopping net worth or, more likely, they placed an all-in wager on their ability to perform in a down market – and perform they did.

Continue Reading

How a Trade Single-Handedly Saved (sort of) the Tanker Market – Editor’s Choice Award

While a transaction of this kind is not within our usual purview when considering our annual awards, it was impossible, given the import and impact of the contango oil trade and tanker storage in 2009, to ignore it. At the outset, we would be remiss if we did not acknowledge Credit Suisse’s Gregory Lewis’ thoughtful analysis and explanation of this trade, which made it more practical than theoretical and therefore more easily understood. We must also provide the caveat that the core data and analysis are reflective of the time of the writing of the report, which was January 2009.

The numbers, as usual, provide the headline. Peak storage estimates in 2009 were over 150 million barrels of oil or roughly 5% of the tanker fleet. In fact, for the first time both crude and products were stored afloat. Newbuilding crude tankers went from the shipyard to the refineries to be loaded with petroleum products before carrying a crude cargo and today many remain in storage. The overall effect was to mitigate the estimated supply growth of 7%, in a period of declining demand.

Continue Reading

Funding a Vision – Editors Choice Award

George Orwell wrote 1984 to describe his vision of the future. Mr. Palios of Diana Shipping and Mr. Hansson of Nordic American Tankers also have a vision that is incorporated in their respective shipping models, and, which may turn out to be the shipping model of the future or at least an ideal to strive for. Both gentlemen have seen the future and debt is not a big part of it. Both companies adhere to a belief that leverage or at least excessive leverage is an anathema and no net debt is something to strive for. To survive in shipping, there is nothing more important, in their view, than a strong balance sheet.

Nordic American Tankers exists for its full dividend payout model and debt avoidance maximizes cash flows and makes acquisitions more accretive provided the fleet grows faster than the share count. A lack of debt makes the company attractive to investors and somewhat immune from the present instability in the financial markets and the weaker freight markets. The company has an undrawn credit facility of $500 million, which can be drawn down as a bridge for financing acquisitions until it can issue equity.

Continue Reading

How I Learned to Stop Worrying and Love the Capital Markets – Editor’s Choice Award

Last Fall was a busy time for A.P. Moller – Maersk A/S’s (“APM”) treasury department, as the company, which is renown for being one of the strongest shipping credits, began to be concerned, as the economic crisis continued, about the future of its traditional main source of capital, bank debt. In particular, would bank lending not only resume but also return to pre-crisis levels. From crisis comes opportunity and the company began to explore alternative funding sources, in particular the capital markets.

APM has traditionally maintained a conservative capital structure for over 100 years. Leverage to say the least has always been moderate, with Net Debt/EBITDA in the range of 0.5x to 1.5x over the last 10 years and historic cash flows have been strong. In addition, the company has a significant liquidity buffer through cash balances, securities and uncommitted undrawn bank facilities. And, most importantly, APM has no significant refinancings due before 2012. Even its outstanding capital expenditure commitments, which total approximately $9 billion, for the purchase of non-current assets, has financing for the $6 billion related to the newbuilding program of ships and rigs, substantially in place. As they say, it is always easy to borrow when you do not need the money.

Continue Reading

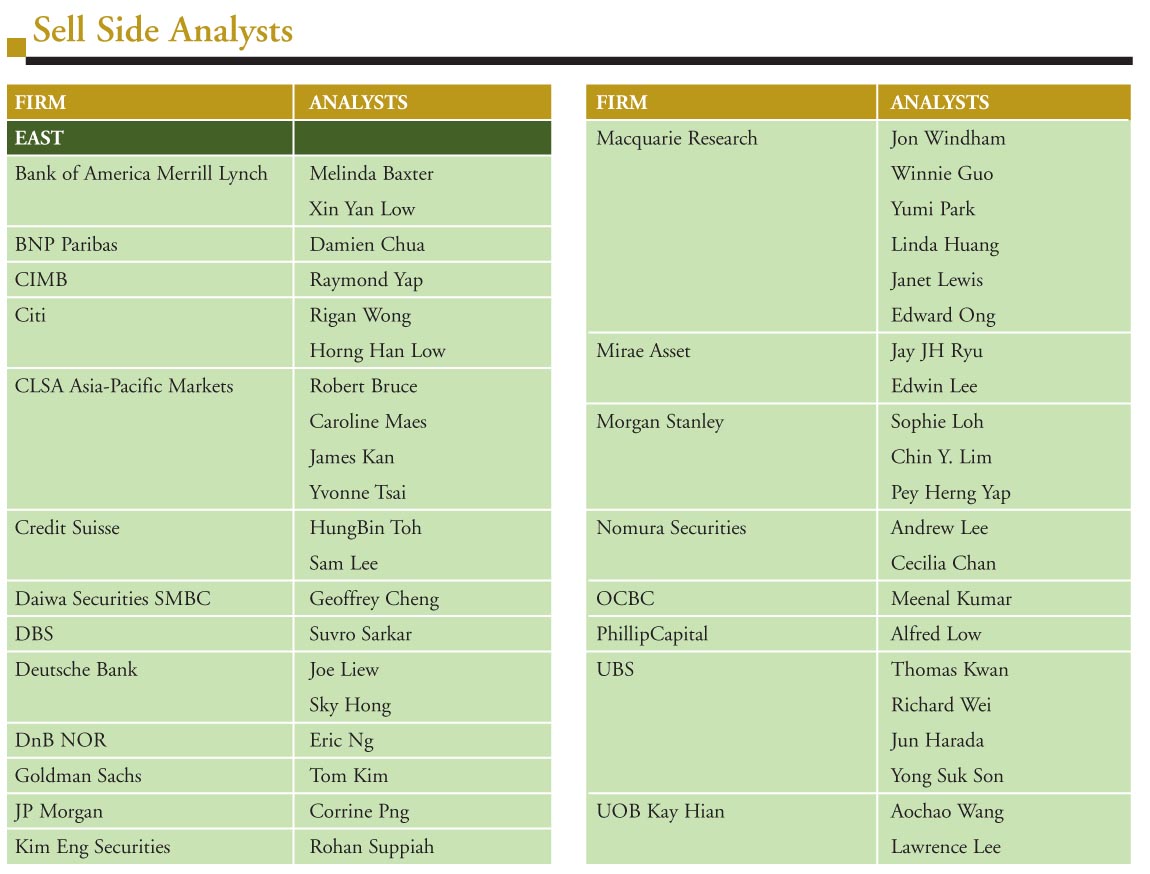

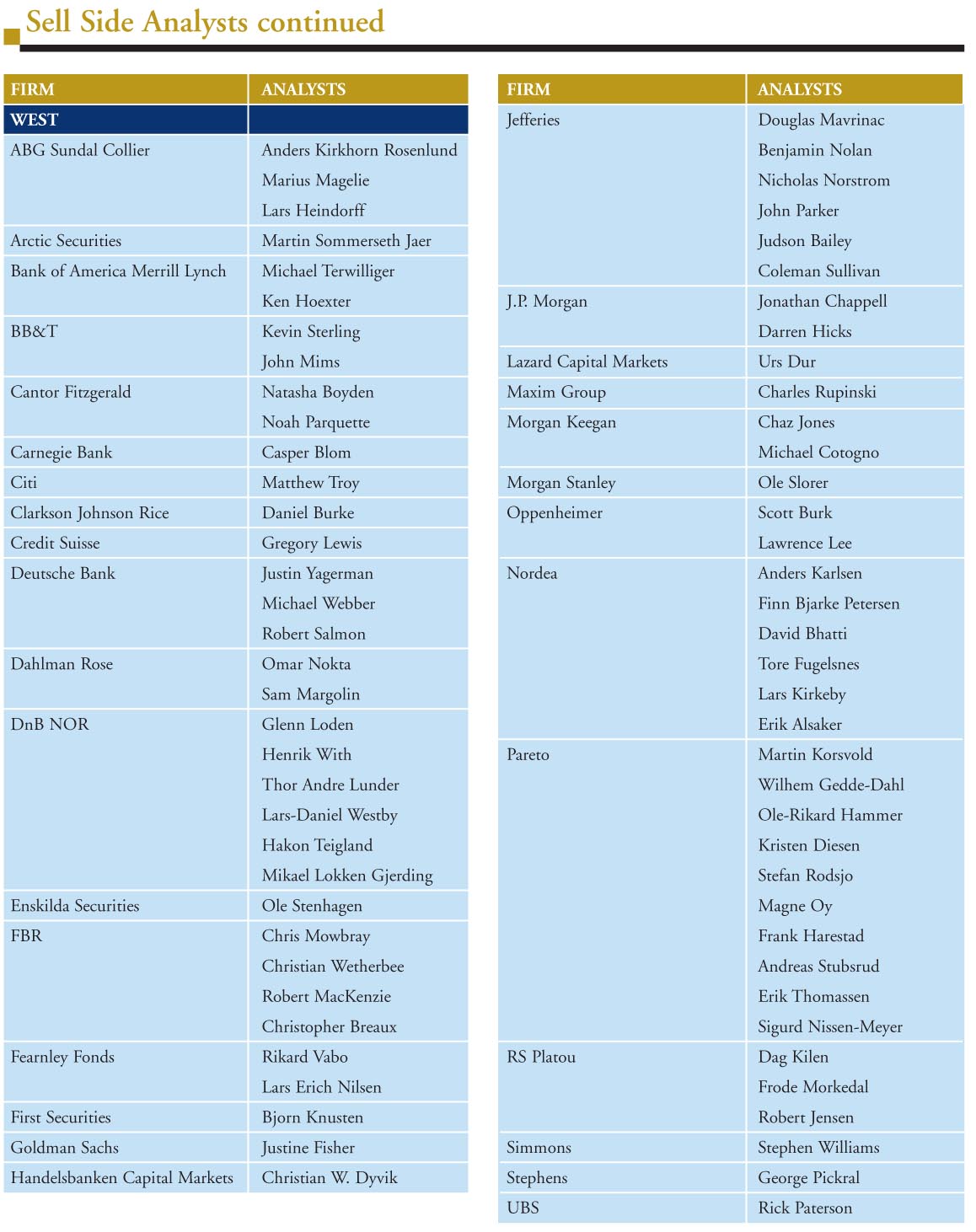

Educating Our Most Important Consumer – Contribution to Ship Finance

In our discussions of the capital markets, we mainly talk about issuers and their advisors, the investment banks. Rarely, if at all, does the subject of the investors come up. And, yet there would be no transaction without them. They are presumed to be out there with open wallets ready to invest, but it does take some education and convincing to make that happen. That role falls to the sell-side analysts and in this year when the capital markets were irreplaceable, we take this opportunity to acknowledge the analysis, the insights and the hard work of this group, which is made that much more difficult by the need to careful balance salesmanship, integrity and SEC regulations. Their ability to accomplish this is more than noteworthy and so this year we present the Contribution to Ship Finance Award to the sell-side analysts whose individual names are worthy of mention. We deeply regret any omissions, which are purely accidental.

The ATM Takes Off – The Innovation Award

2009 was a year when credit evaporated, and cash starved shipping companies were adrift on an illiquid sea.

As Ethan Ram with DVB Capital Markets LLC wrote in Marine Money back in September 2009, “The collapse of freight rates and asset values across most shipping sectors has put a premium on liquidity and access to capital. Today many publicly listed shipping companies are faced with depleted cash reserves, limited or no availability under debt lines, and, worse, debt covenant defaults, which threaten their viability as a going concern. Meantime, given the scarcity of debt, the better-capitalized companies that hope to take advantage of the market downturn are faced with having to fund a significant portion of their acquisitions with equity. For those companies that are able, tapping the public markets for equity regardless of whether to raise “survival capital” or dry powder has been made more challenging by the increase in volatility and the sharp decrease in company valuations.”

Continue Reading

Getting Excited by Leasing – Lease Finance Award

By Matt McCleery and Jim Lawrence

I actually think vessel leasing is exciting, and this makes me nervous. Is it because I recently turned 40 and this is just the kind of thing that interests men in their early middle age? Do I need to pick up a new hobby like kite boarding? Or is it because we are truly in the midst of a market that is evolving on an almost daily basis. I am hoping it is the later, but you can be the judge.

One of the many privileges we enjoy at Marine Money is following and documenting the evolution of how ships are financed. To an outsider, ship financing could appear to have been the same for centuries: a simple combination of equity and debt that comes together to form the value of a ship. In the 18th century, it was mostly equity usual comprised of 16 shareholders who were stakeholders ranging from chandlers to masters to the merchants whose cargo filled the hull with timber and tallow. The 19th century saw the formation of “joint stock” companies where most the equity came from private investors from outside of the industry and the only debt that was deemed appropriate was that which was needed to finance the voyage, which was repaid in full when the cargo was safely delivered. In the 20th century, the availability of debt allowed ship owners to concentrate their equity ownership and spread their risk by having more vessels. The end of the 20th century and beginning of the 21st century has witnessed another major evolution in the business of ship financing which looks a bit like what we saw historically, a reversion to lower levels of leverage and an increase in the roll of outside equity investors. It seems that ship finance, like shipping, moves in cycles.

Continue Reading

Leveraging Petrobras’ Credit – Project Finance Award

In one of the most competitive categories, where enormous skill, structure, and execution are deftly married with underlying credit strength, our Project Finance award this year followed a recent pattern of going to those finance savants who recognize the importance and strength of Brazil and its resident oil major Petrobras.

The two deals are similar. The both finance Drillships, which are on charter to Petrobras. Etesco VIII is a Samsung Heavy Industries $702 million Drillship that will be chartered to Petrobras for 10 years. While, the Odebrecht project consists of the construction of a pair of dynamically positioned DSME 10,000 Drillships being built at Daewoo. The Odebrecht pair cost a whopping $840 million each.