As rumors circulate about Top Tanker’s intentions to purchase Nomikos’ dry bulk fleet, the company announced that its tanker fleet is now officially 100% double hull with the sale of its final single hull tanker, the 29,998 dwt 1989-built M/T Yapi. Speculation has arisen that the company may also consider a third equity issuance to raise cash for its Nomikos acquisition, but no announcements have been made.

Meanwhile, Torm announced the sale of two tankers to an “international buyer” for a total consideration of $61 million. The sale will bring a gain to Torm of $30 million. Tradewinds reports that the tankers have been sold to Polys Haji-Ioannou, who already owns a total of 31 tankers, suggesting that Stelios’ move out of the merchant marine was by no means indicative of the intentions of the rest of the Haji-Ioannou family.

After announcing last week that it had agreed to acquire three panamax bulkers for a sum of $118 million last week, Excel Maritime announced this week that it has agreed to acquire another three panamax bulkers for a sum of $113 million. Proceeds from Excel’s recent $124 million follow-on offering are to go towards both purchases.

Finally, Saudi Arabian-affiliated Lebanese owner Ghassan Ghandour is reported to have placed an order for three additional VLCCs from Daewoo Shipbuilding for as much as $130 million each. This comes after Ghandour had acquired two VLCCs for $270 million from Metrostar at the same time that Euronav had purchased a fleet of five from the same company. Prior to this, Ghandour had already been aggressively building his VLCC fleet through newbuilding orders and promises to be an important player in the global VLCC market for some time to come.

Watson, Farley & Williams announced this week the hiring of Laurence Martinez Bellet as a partner in the firm’s Paris office. Ms. Bellet has substantial expertise in maritime finance with both WFW and Orrick and will help strengthen the firm’s Paris office in this regard, reaffirming WFW’s commitment to the shipping field.

Last Friday, Holman Fenwick & Willan announced an even bigger increase in its ship finance law capabilities. The firm has hired three specialists in the field from Stephenson Harwood. John Forrester has joined HFW as a partner, while Ruth Allcoat and Adam Shire have joined as senior assistants. HFW now has eight partners in its London office who specialize in ship finance, and Senior Partner Roderic O’Sullivan reaffirmed his firm’s commitment to the field, saying, “As one of the world’s premier shipping firms, our aim is to develop the transactional side of our business so that we become recognised as a true leader in ship finance and other transactional maritime work.”

First Jefferies, then Cantor Fitzgerald, and now Dahlman Rose has become the third institution to issue analytical reports on DryShips recommending that investors buy the company’s stock. It is particularly interesting that all the analysts agree the shares should be bought considering that two thirds of respondents to our 2005 Marine Money Banker Survey, given the option to buy shares in DryShips with their own money, would buy none at all. The company’s share price has also fallen notably off its high of $23.90, but at $18.88 at press time, is still up from the issue price of $18.00.

This suggests that long-time shipping bankers are concerned about George Economou’s history and probably suspicious of the incredible market reception the deal was given. At the same time, analysts running numbers on what are currently high asset values and reasonably high charter rates are coming to the conclusion that the company, which has bought a slew of ships since its offering, will bring in a lot of cash. Investors expect George to wow Wall Street with 1Q05 numbers to quiet some of the criticism, and most likely in the long-term the truth, as always, will be somewhere in between.

Reports indicate that Teekay Shipping’s bank meeting in Las Vegas this week was wildly successful. Teekay updated bankers on the company’s prospects and entertained them with such events as a golf outing and an Elton John concert. The company succeeded in reinforcing its solid, quality reputation relative to other tanker companies, even if its stock valuation does not currently reflect this.

Looking to expand and diversify from its 10-vessel tanker fleet base, India’s Mercator Lines has turned to the foreign currency bond market. The company aims to raise $60 million, which it will put towards the purchase of six modern vessels, three of which are to be bulk carriers. The total cost of the identified vessels is estimated at $270 million. The bonds are to carry an interest rate of 1.5% with a yield to maturity of approximately 5.95% and are convertible at INR 149.53. Barclays Capital is acting as lead manager while UTI is serving in the capacity of financial advisor in India.

A strong credit bundled with steady earner port and container-leasing businesses, the Cosco Group is preparing for what it hopes will be a very successful mid-year IPO in Hong Kong. The twist on the deal is that Cosco Holdings, if and when established, will contain both Cosco Container Line and the Cosco Group assets of Cosco Pacific, which is already listed in Hong Kong. Cosco Holdings is expected to raise between HK$15.6 billion and HK$23.4 billion (approximately US$2-3 billion), which would give it a leg up on the China Shipping Container Line IPO that raised a disappointing HK$7.7 billion last year.

Investors will get an estimated 40% share of Cosco Holdings, which will hold 53% of Cosco Pacific, translating into a 21% share of a $4.7 billion market cap company. That explains US$1.1 billion of the fundraising target, which means that the company thinks it can raise $1 to $2 billion on the Cosco Container Line assets and newbuilding orderbook.

It’s all about the arbitrage these days.

What we mean by this, of course, is the fact that ships have a higher value on Wall Street than they do in the shipping markets – and not surprisingly there is a steady stream of people looking to capture the difference.

For proof of this, one need only to look at our Cash Flow Multiples by Vessel Type valuation table and compare it to the “Fair Value” table showing the valuation of shipping companies that trade on the stock exchange. It depends on the age of the vessels, of course, but on average a shipowner can buy a middle-aged vessel at about 4x cash flow and sell it to Wall Street investors at about 6x cash flow – much more if the company is valued based on its dividend yield.

Here’s where the rubber meets the road: by valuing shipping companies using a multiple of their cash flow generation, issuers of equity can effectively sell their vessels for 1.5-2.0x their value in the sale and purchase market. It is a truly remarkable moment in the evolution of shipping and the capital markets – and not surprisingly the Delta flight between Athens and New York is once again being seen as a direct journey to wealth and early retirement for shipping dealmakers.

A Growing Party – Private Equity Funds Enter

In the early stages of this “multiple expansion” (or “bubble” for cynics) process on Wall Street, issuers of equity were largely financially savvy shipping companies that realized that by selling ships, and leasing them back as Stena did with Arlington Tankers, they could extract the premium value of their ships while at the same time maintain commercial control and chartering “upside.”

However, as we move into year three of the shipping bull market, we are beginning to see private equity funds hire some shipping professionals and form new companies for the purpose of buying ships at 4x cash flow and selling them to Wall Street for 6x cash flow – capturing the arbitrage along the way.

Not surprisingly, most of these private equity investors are focusing on the dry bulk sector where the fundamentals are rosy, and more importantly, the valuations are higher, even in situations with external management companies with older vessels.

There are several deals presently preparing or considering coming to market in which the issuer is a private equity fund, or “sponsor” as they are called, looking to capture the value arbitrage, but the first has finally reached the starting line – a newly-formed entity called Eagle Bulk Shipping owned by a private equity fund in New York called Kelso and comprised of former Credit Suisse investment bankers.

We’d like to take a moment to discuss why this deal has filed. For those readers less familiar with the S.E.C, there are two kinds of registration forms used for equity – the F-1 and the S-1 – the former of which is used by foreign-based filers and the latter by U.S.-based filers. The documents are virtually the same except for one critical difference: foreign filers using form F-1 are permitted to submit their initial prospectus filing confidentially while U.S. filers are not. That is why companies such as TBS Shipping, Horizon Lines and now Eagle Bulk Shipping have documents accessible to the public while foreign filers such as DryShips and Diana do not have their registration statements made public until they have finished with the SEC comment period and are ready to print red herrings and go out on the road. But we digress…

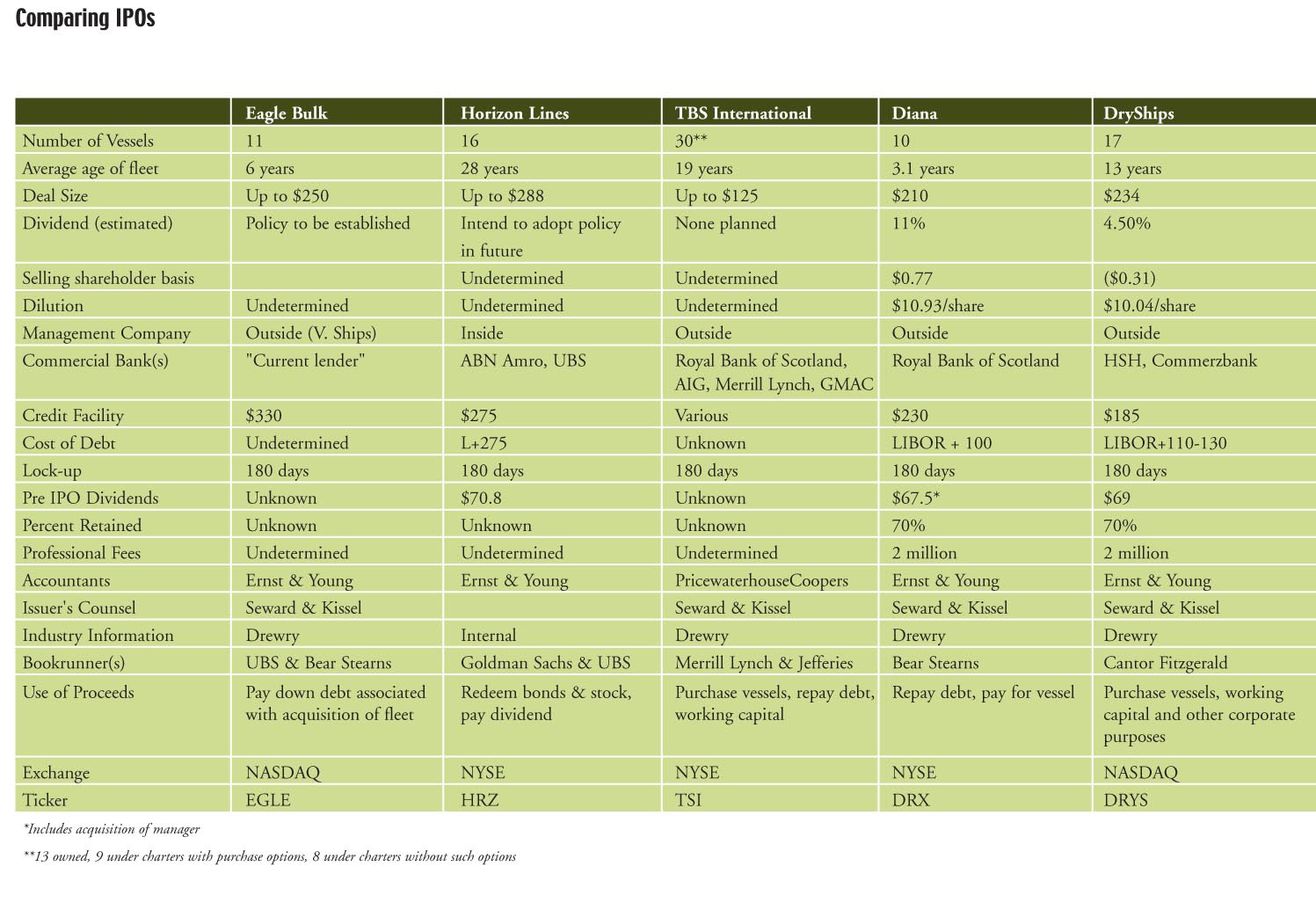

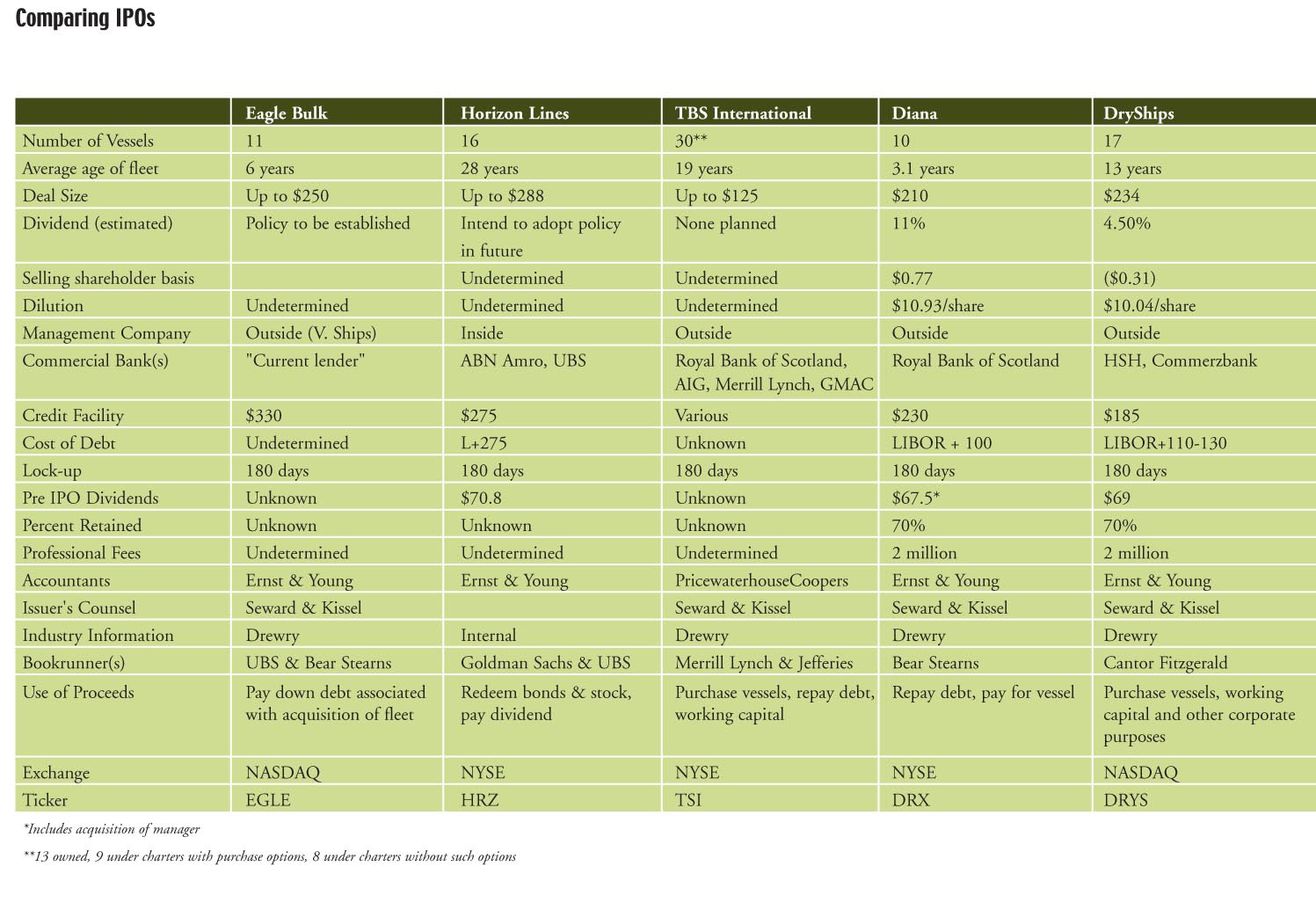

The first financial sponsor deal, Eagle Bulk, is hoping to raise up to $250 million through a listing on the Nasdaq under the ticker symbol EGLE. Start-up companies use the NASDAQ because it does not have the same requirements for previous years of existence and profitability that the NYSE imposes. Joint bookrunners on the deal are UBS Investment Bank and Bear, Stearns & Co. – a pair of that seems to have either officially or unofficially teamed up to underwrite shipping deals. Legal advice is being provided by Simpson, Thacher & Bartlett for the underwriter and Seward & Kissel for the issuer.

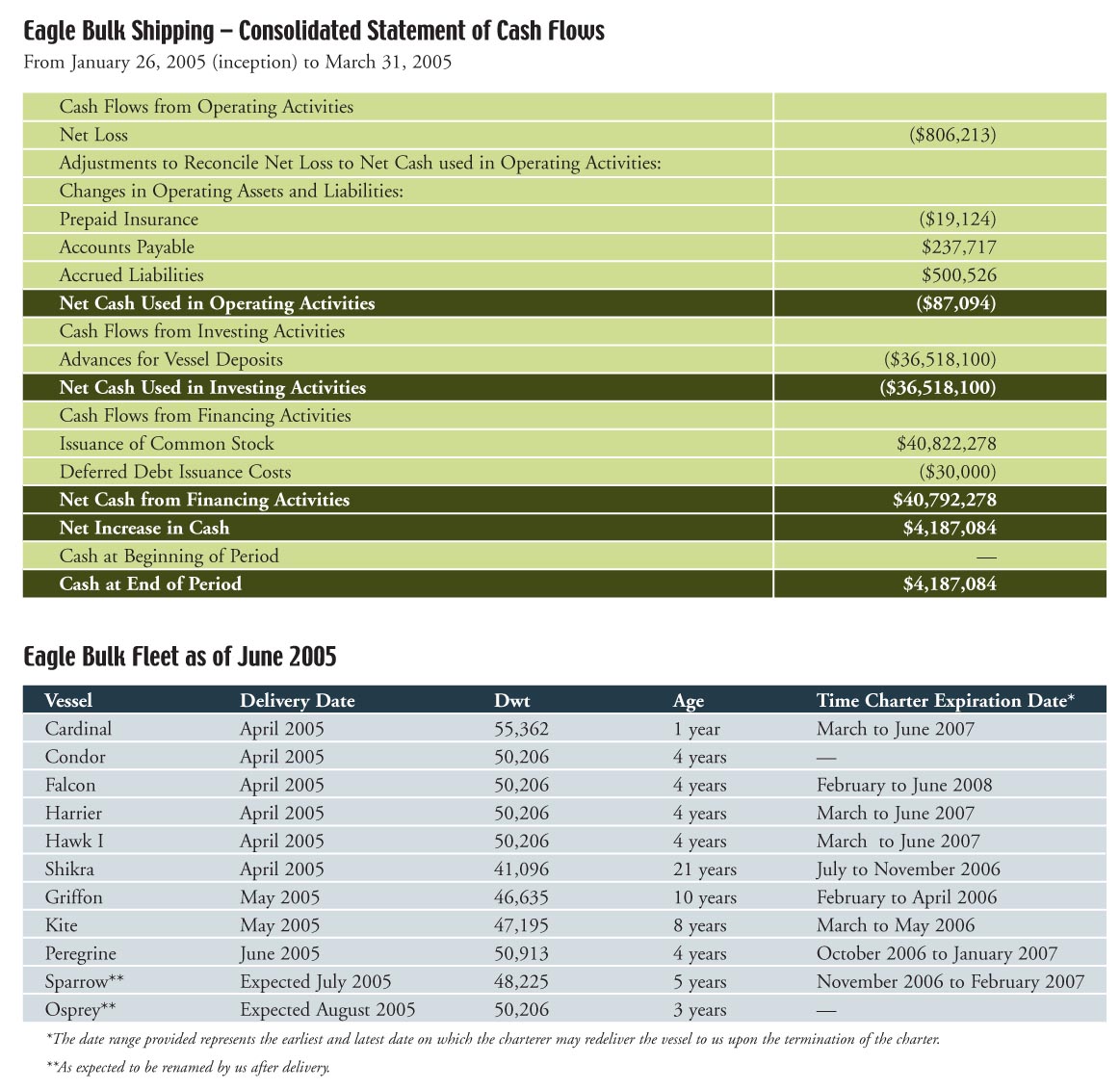

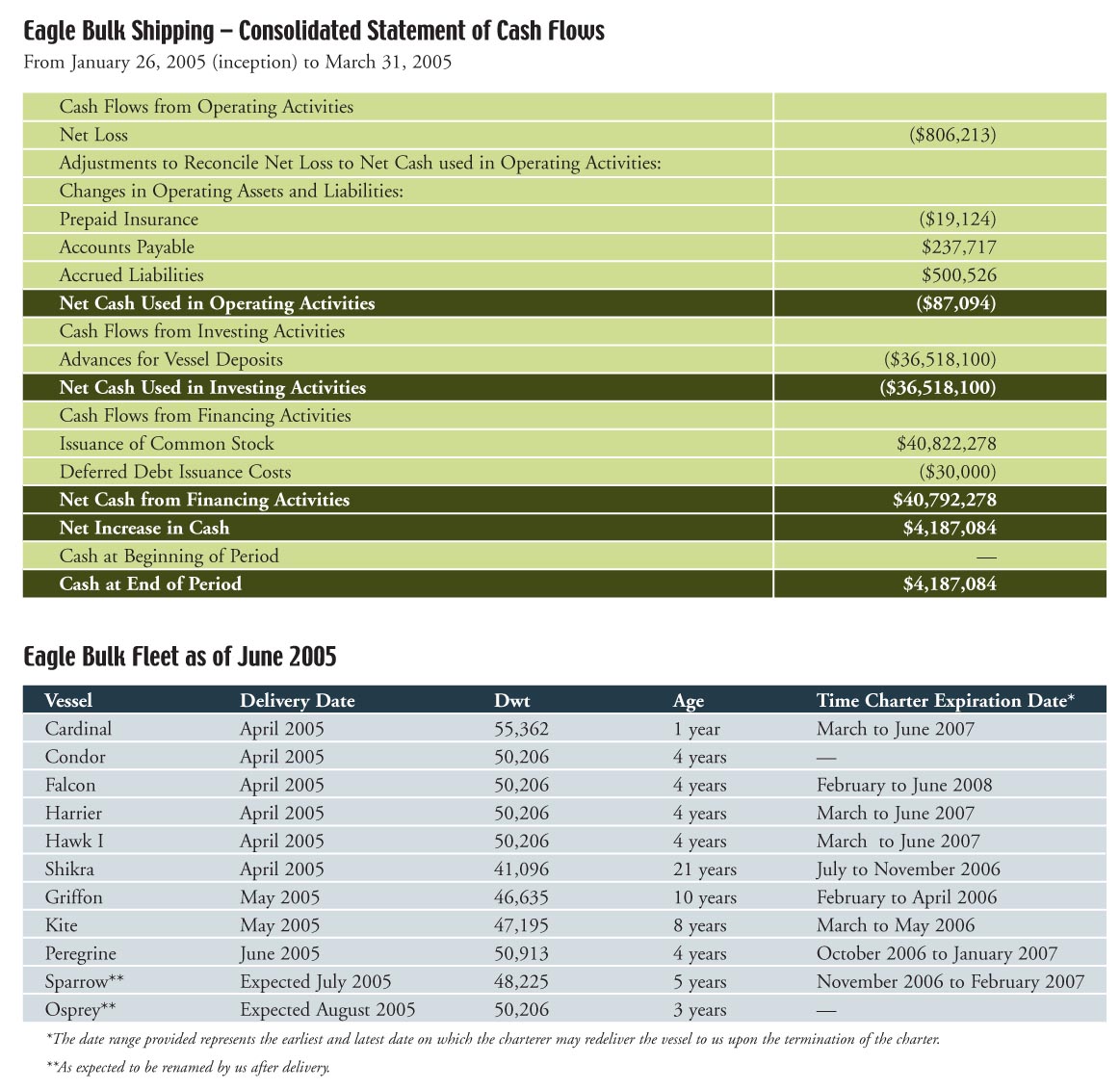

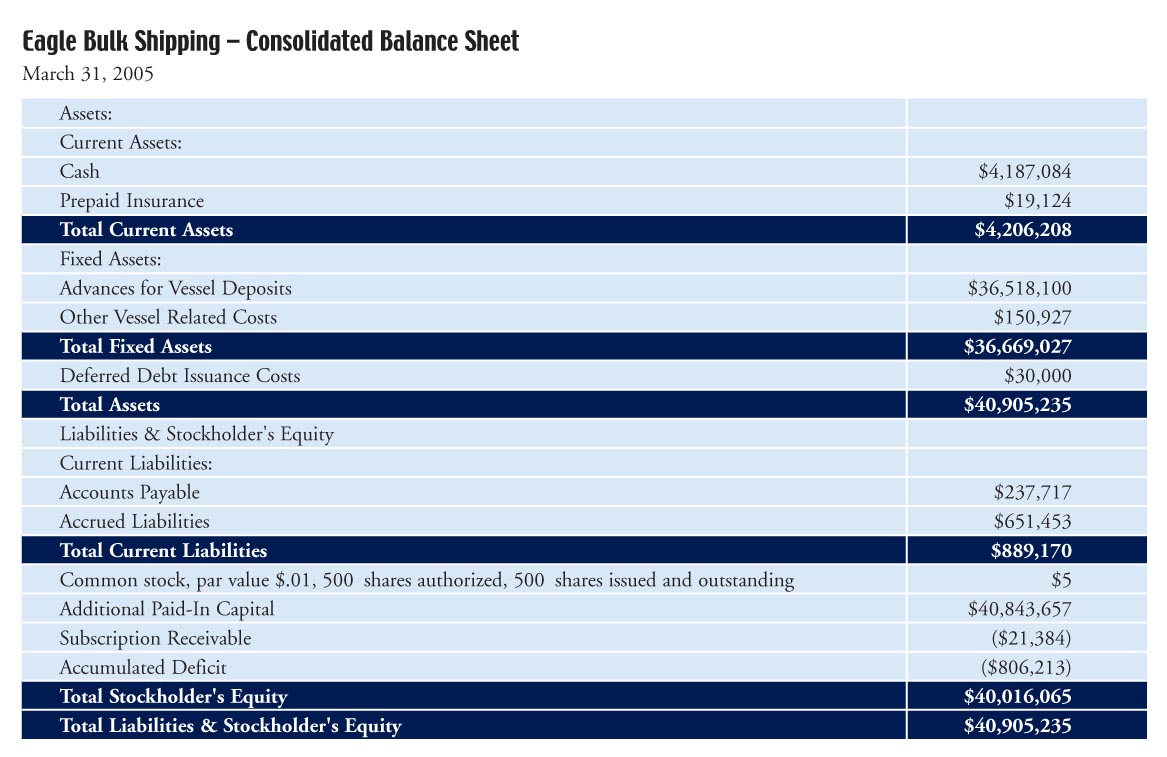

What is unique about this IPO is that the company did not actually own any vessels at the time it filed its S-1 with the SEC. A quick look at the balance sheet shows that virtually all of the company’s net worth is associated with the deposits paid to secure vessels delivering in April to June 2005. We’re sure that some of the vessels have been delivered by now and there is nothing inherently wrong with this, but it is clear that the issuer has been formed for the express purpose of the IPO.

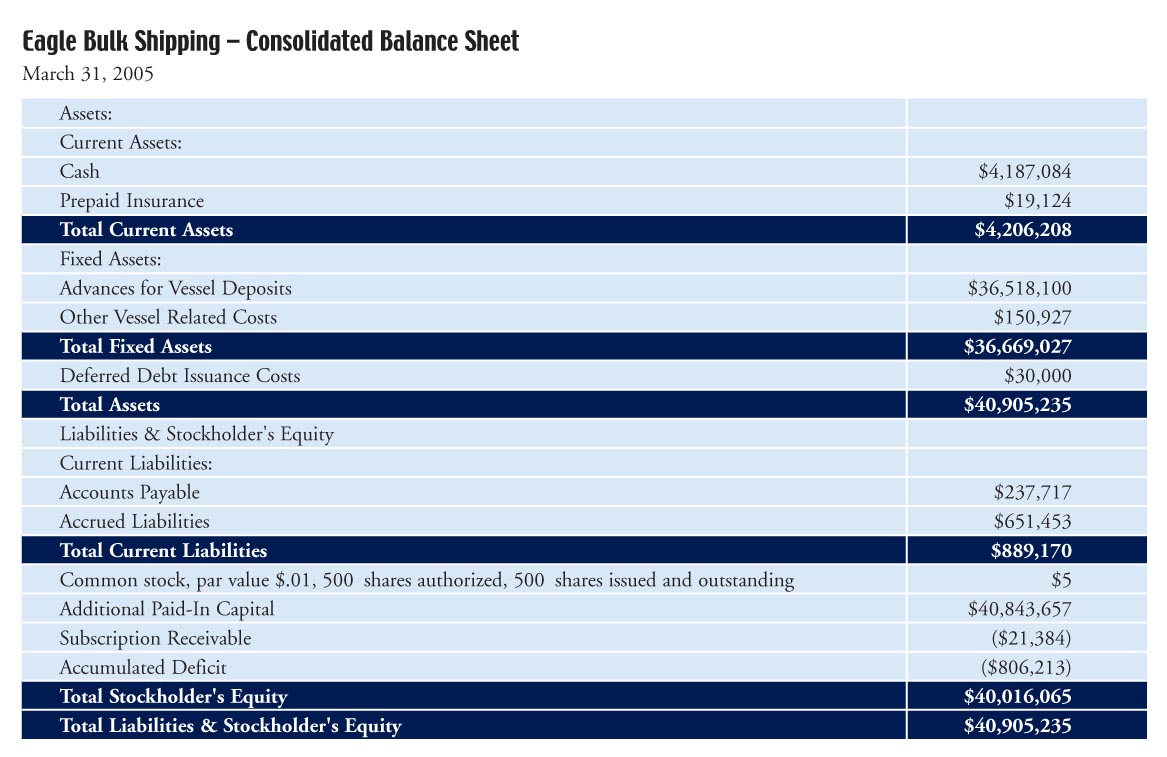

Although we will refrain from getting into valuation issues, Eagle’s fleet will consist of 11 modern handymax dry bulk vessels, nine of which have been acquired and two of which are to be delivered in June 2005, as shown in the accompanying chart. The vessels range in size from 40,000 to 60,000 dwt and have an average age of six years, as compared to the global handymax fleet average age of 15 years. In a small industry where nothing is secret, management did a good job hiding their purchases from the market and industry publications such as Tradewinds. It is still true that if the sellers know you have plans or money, the price goes up.

Management

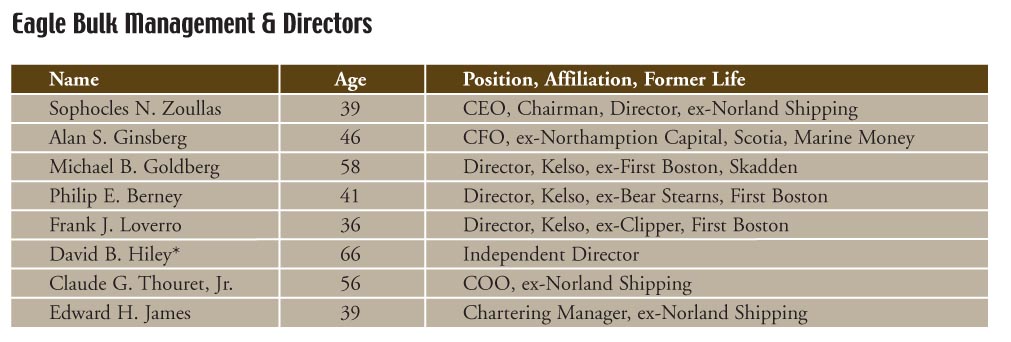

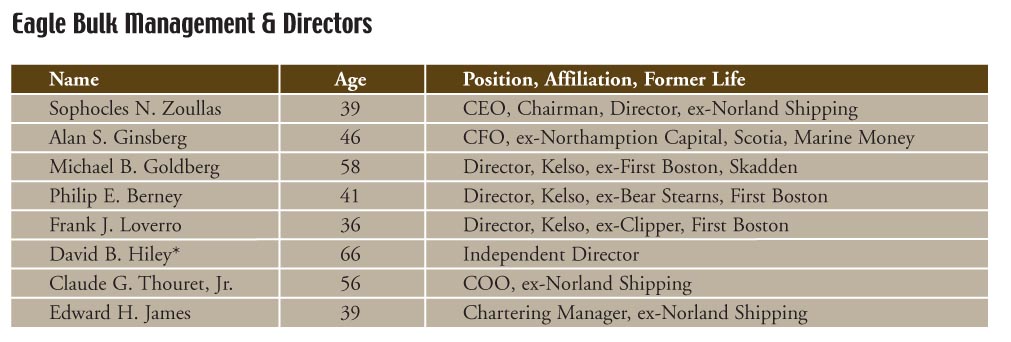

The management team is lead by 39-year old Sophocles Zoullas, and Alan Ginsberg, a former editor of Marine Money, will serve as CFO. The rest of the directors are drawn from private equity fund Kelso, which is sponsoring the deal, and Norlands Shipping. This team will focus on strategic and commercial management, while technical management will be done by V. Ships.

The company’s pitch is that by focusing on handymax dry bulk vessels, they will have advantages that include reduced volatility in charter rates, a smaller newbuilding orderbook, increased operating flexibility, the ability to access more ports, the ability to carry a more diverse range of cargoes, and a broader customer base.

Strategy: Buy With Debt, Backfill with Equity

There’s a whiff of Diana Shipping and Nordic American to the Eagle deal, thanks to the fact that Bear Stearns is involved in all three. The company is planning to use the proceeds of the IPO to paying off existing debt and will enter into a new 10-year $330 million credit facility to refinance other existing debt, acquire additional vessels and fund general corporate purposes. Eagle plans to keep lower than industry average levels of debt. The company has not committed to a specific dividend and will leave the decision to the discretion of the company’s board of directors.

Categories:

Equity,

Freshly Minted | April 7th, 2005 |

Add a Comment

A few weeks ago, we wrote an article in these pages called “Eagle Bulk – All About the Arbitrage.” The article outlined the recently filed S-1 for an IPO of handymax bulk carriers being offered by New York private equity fund Kelso. In this article, we discussed the concept of private equity funds buying ships just prior to, or even concurrent with, IPOs so that they could capture the arbitrage that exists between the value of ships in the private and public markets.

Although much of this premium has been drained away during the last six weeks due to choppiness in both the equity markets and the shipping markets, we believe it is likely to return in the very near future and look for shares back in the range of 1.5x net asset value. The transaction concept is one with which private equity funds are comfortable: buy a company cheap, then sell enough of it to the public to get their money out with a return through a dividend, and then keep a slug of shares in the company that has the potential to result in a real home run.

With the economics of the shipping markets fitting this bill, the concept is spreading, and we are seeing more and more non-shipping company issuers in the shipping markets. The way to think of this is that Wall Street wants products and is willing to pay a certain price for them, and in response a variety of experienced financiers are creating these products and attempting to bring them to market. There is nothing necessarily wrong with this; in fact companies created for the sole purpose of equity offering might offer cleaner management structures and fewer conflicts of interest than old-line companies.

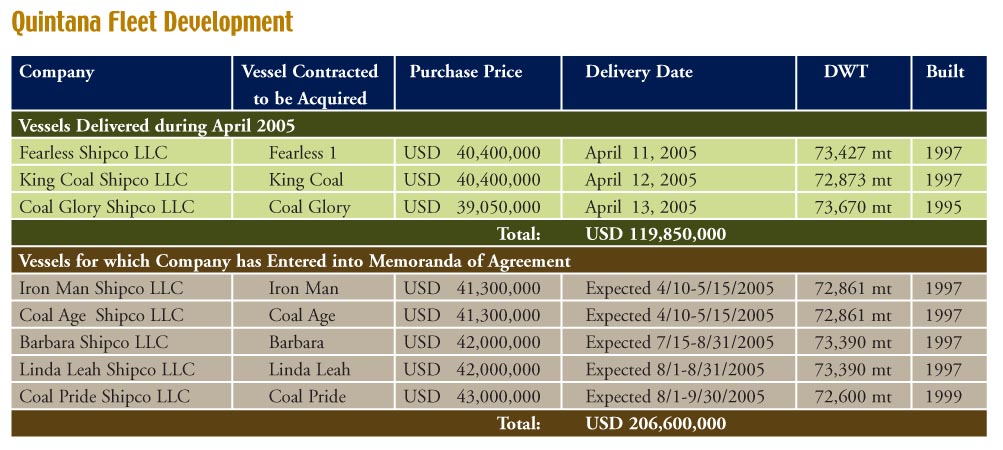

This week, we saw the filing of an IPO called Quintana Maritime, which is backed by Corby Robertson, whose family sold the Quintana oil field in Texas to Exxon many years ago, and who has since made investments in commodities such as coal mining. Robertson has teamed up with First Reserve of Greenwich (who have been plotting an entry into shipping ever since their agreement to purchase OMI shares at about $1.50 each a few years ago failed amidst bad feelings) and American Metals & Coal International, also of Greenwich. Stamatis Molaris, former CFO of Stelmar, is serving as CEO and President of Quintana. Citigroup and Morgan Stanley, who lent the company the money it needed to acquire its fleet, are acting as joint bookrunning managers.

A Short History

Quintana does not have the storied history that many recent and future issuers have. They cannot point to hundreds of years of experience or their origins from an island – except perhaps Long Island. In fact, they were formed on January 13th, 2005, and began operations in the following April, in other words last month. As of March 31, 2005, Quintana had not taken delivery of any of the identified panamax vessels, though the company did take delivery of three such vessels in April, and expects to take two more in May and the remaining three in July, August and September.

Distinguishing Deals

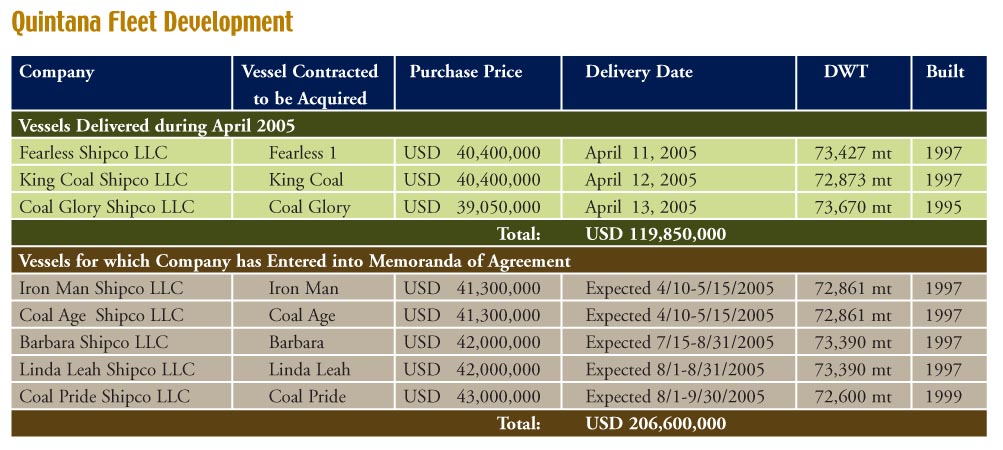

One of the challenges borne of the incredible torrent of deals heading to market is differentiation. What we mean is that there is nothing particularly compelling about this deal compared to others currently or soon to be trading in terms of asset type, employment, age, deal size, management or structure. Like Eagle Bulk, Quintana has signed MOAs and placed deposits on the eight modern panamax bulkers outlined in Figure 1.

Although we expect valuations to improve, the company shows strong asset and structural similarity to Diana Shipping, which suffered from bad timing in both the shipping and equity markets that may have been exacerbated by the fact that it was fully priced and sold into the wrong types of accounts. This must be a little unnerving for the sponsors, and we fail to understand how this deal will ever be judged on anything other than how much of discount it is offered at relative to Diana. Although Quintana does not indicate that it will use the model of a dry cargo version of Nordic American Tankers as Diana did, the company does plan to repay its debt in full upon consummation of the offering.

Perhaps there will be enough buyers to go around. There is nothing inherently wrong with the Quintana deal, but the sponsors will need to see valuations improve and have one heck of a good roadshow. That said, with the firepower of Citigroup and Morgan Stanley behind them, who likely do lots of other business with the sponsors of this deal, it is unlikely that it will be sold into the accounts of hedge fund “flippers” as the Diana deal seems to have been.

Of Bridge Loans and Mezzanine

As we also wrote in our article about Eagle Bulk, these kinds of deals are not without risk to the sponsors as we cruise along a high point in the cycle. In fact, they involve a lot of risk. Unlike the Top Tankers IPO, in which the purchase of the Sovcomflot fleet was contingent upon a successful equity offering, both Eagle and Quintana involve the sponsors buying ships first and hoping they can get a premium in the future. In this case, the joint bookrunners have provided both secured debt and mezzanine facilities to result in 85% financing. This structure is not dissimilar in concept to the highly leveraged facility that Citigroup and Nordea provided to soon-to-be-public Genco, sponsored by yet another private equity firm, Oak Tree Capital.

Quintana entered into a $150 million bridge loan facility, dated as of May 3, 2005, with Morgan Stanley Senior Funding, Inc., not a regular player in the world of ship finance. In addition, the company entered into a new six-year three-month $262 million secured delayed-draw term loan facility, dated as of April 29, 2005, with Citigroup. The term loan facility consists of Tranche A, in an aggregate amount equal to the lesser of $213 million and an amount equal to 65% of the fair market value of the vessels, and a Tranche B, in an aggregate amount equal to the lesser of $49,210,500 and 15% of the fair market value of the vessels. The aggregate principal amount applied in respect of any vessel acquisition must not exceed 80% of the fair market value of the vessel. According to the filing, interest on amounts drawn will be payable at a rate of 1.625% per annum over LIBOR in respect of Tranche A and 2.50% over LIBOR in respect of Tranche B, for interest periods of 1, 2, 3 or 6 months or, if agreed by all lenders with commitments, 9 or 12 months. In the event the Tranche B term loans are not syndicated within 45 days, Tranches A and B will collapse into a single tranche and interest will be payable at a rate of 1.75% per annum over LIBOR.

Categories:

Equity,

Freshly Minted | April 5th, 2005 |

Add a Comment

By Kevin Oates

To get an idea of what Dubai is like right now, consider the following statistics:

• UAE growth was measured at 7% in 2003, estimated at 3.6% in 2004 and forecast for 4.5% in 2005.

• Jebel Ali was the first Free Zone in the 1980s; there are now more than 30 such zones in the Middle East.

• Estimates put planned aggregate Middle East regional investment in the energy sector, to meet demand growth, at $150 billion.

• Estimated capital required for oil projects by 2006 is $41 billion, for gas projects $19 billion and for petrochemical projects $13 billion.

• The container throughput in Dubai has grown from 1.16 million boxes in 2001 to 2.61 million boxes in 2004. Continue Reading

Categories:

Marine Money | April 1st, 2005 |

Add a Comment

By Matt McCleery

For the past couple of years, there has been a breakthrough literally every few months in the relationship between the U.S. capital markets and the shipping industry. The result of this series of watershed events is that even the most experienced players have come to the conclusion that almost anything is possible these days – and that the conventional wisdom about what can or cannot be done should be tossed out the window.

For example, in December 2003, the separation of vessel ownership and management created through Frontline’s Ship Finance International changed the way public companies can be valued, marketed and structured. A few months later came the oft discussed but never before used Master Limited Partnership. This equity structure, pioneered by K-Sea Shipping, replicated by U.S. Shipping and soon by Teekay LNG Partners, combined shipping’s strong cash flow with favorable tax treatment to value shipping companies without any regard for net asset value.

But the fun didn’t stop there. A few months later the next watershed moment came when Top Tankers exceeded all expectations and proved that you didn’t have to start out big to access the public markets, so long as you had a compelling business plan and identified acquisitions to buy with the fresh money. Continue Reading

Categories:

Marine Money | April 1st, 2005 |

Add a Comment