By Binali Yildirim, Minister of Transport and Communications, Turkey

Dear Chairman, Distinguished Delegates and Guests,

It is a great pleasure for me to participate in this important event and to address such a distinguished audience. Thank you to Marine Money International for arranging this occasion. I wish a successful meeting.

I would like to recall that Turkey, with its exceptional geo-political location, is a bridge between the developed west and rapidly growing markets of the east. It is surrounded by sea on three sides, and the length of the Turkish coastline is over eight thousand kilometers.

Given these facts, the maritime sector has an increasingly important role in the Turkish economy. Turkey’s approach to maritime transport is consistent with the broad European principles of fostering free circulation of shipping in fair competition. In other words, the maritime sector is one of the most liberalized sectors in Turkey. Continue Reading

Categories:

Marine Money | May 1st, 2005 |

Add a Comment

Oil demand continues to grow yet tanker rates in the spot market have shown continuing lethargy throughout the month of April. The best approach to understanding how market forces conspire to produce the results observed in the marketplace is to systematically evaluate the data available. One tool for this activity is a trade matrix.

A trade matrix gives actual oil quantities transported between different load and discharge regions on different size tankers over a specific time period. From this one can calculate an approximate rate of oil delivery over a route for a particular tanker size. The matrix has many useful applications in the marine transportation industry.

Once the rate of oil delivery for a specific route and tanker size has been determined, we can calculate the number of vessels required to deliver it by using an average round trip mileage for a particular trade with assumptions for vessel speed, cargo size and port/weather time.

Demand for tankers is determined by how much cargo is being transported and on what routes it is moving. Longer routes will create demand for more tankers than shorter routes for the same cargo volume transported.

For example, the 2004 crude oil trade matrix shows that 22 million tons was transported between the Middle East and the US Atlantic/Pacific and Canada by VLCCs. McQuilling has calculated that 15 of these vessels would have been required to deliver this quantity over the year. Between the Mediterranean and North Europe, approximately the same quantity of crude oil was carried by VLCCs throughout the year, but to deliver at the same rate of around 430,000 barrels / day McQuilling calculate that this much shorter trade route would only require 5 VLCCs.

The global trade matrix changes with new production sources, growing requirements of emerging regions and changes in existing trade routes. By transposing changes in oil volumes through the trade matrix, one is then able to assess the impact on tanker demand.

McQuilling has applied the 2004 crude oil trade matrix for VLCC, suezmax and aframax tonnage to various scenarios.

Baku-Tblisi-Ceyhan Pipeline

Much attention has been focused over the last few years on the construction of the BP operated Baku-Tblisi-Ceyhan (BTC) pipeline due to be completed this summer. The pipeline will have a one million barrels / day oil capacity and will be the first direct pipeline link between the landlocked Caspian Sea and the Mediterranean. Oil will be pumped 1,100 miles from Baku, Azerbaijan through Georgia to Ceyhan, Turkey, which will have the capability of loading VLCCs, unlike Black Sea ports.

Although oil is due to start flowing through the pipeline in June, full capacity is not expected to be reached until the end of the year. Oil transiting the BTC pipeline is expected to be made up of existing Azeri production currently being loaded onto suezmax and aframax tankers in the Black Sea, new Azeri production and Kazakh oil. BTC oil made up of both new oil production and existing production previously loaded out of the Black Sea will create new demand for VLCCs in Ceyhan. The one million barrels / day incremental oil when factored across the trade matrix represents approximately 14 VLCCs.

OPEC Production Increase

There is a possibility that OPEC may increase production by 500,000 barrels / day in May in order to soften oil prices.

With the exception of the UAE, which has a nominal 100,000 barrels additional oil capacity, Saudi Arabia is the only OPEC member which has excess capacity. McQuilling has transposed half a million barrels / day incremental Saudi production through the trade matrix and can show that this would create an additional demand for 9 VLCCs.

Fleet Growth and the Trade Matrix

Another application of the trade matrix is to reverse the above process by transposing a specific number of vessels back through the matrix in order to calculate the oil volume that could be carried.

We expect a net 31 additions to the VLCC fleet in 2005. Reducing this number by 20% to take into account certain availability and utilization factors, which include dislocation factors, maintenance/repair, weather, awaiting laydays/ullage and capacity excess, and transposing the resulting 26 vessels back through the 2004 trade matrix equates to 1.2 million barrels / day in oil production.

Although the EIA has reduced projected oil demand growth by 50,000 barrels / day, growth is still forecast at 1.75 million barrels / day in 2005, over half a million barrels more than the additional VLCC capacity which will become available throughout the year. Based on this application of the trade matrix, McQuilling therefore continue to expect the VLCC fleet to be in a supply deficit situation in 2005.

For more analysis of tanker trade matrices, utilization / availability factors or any other area in marine transportation, please contact McQuilling Services, LLC or go to www.mcqservices.com.

The dynamic duo energy/tanker analyst duo Dan Barcelo and Phillipe Lanier have resurfaced recently in a new post at Bank of America Securities. The addition of these two affable experts is welcome news to an industry that continues to need broader research coverage. The two are also an important addition to the B of A — formerly Fleet — ship finance team, which is headed up by Victor Garcia in Boston.

As to substance, the new Bank of America analysts are bullish, expecting increasing ton-mile demand to support a multiyear growth period. For ton-mile demand itself, the forecast growth of more than 5% for 2005 when considering both 2% oil demand growth and the growing prevalence of long-haul tonnage. Mr. Barcelo and Mr. Lanier look for OPEC production to reach 30 million barrels per day in the fourth quarter, leading to VLCC rates as high as $140,000 per day. Additionally, the analysts call for imbalances in global refinery capacity to lead to a dynamic product market, from which product-leveraged companies including OMI and OSG are expected to benefit.

Their report also evinces a break from thought patterns of many other established shipping research firms with the recommendation of OMI and Ship Finance as the two premiere shipping stock picks, with respective target prices of $24 and $21.55. The analysts cite OMI’s leverage to suezmax and product rates and Ship Finance’s stable yield combined with growth and profit potential as the grounds for their recommendation.

Jefferies analysts Magnus Fyhr and Douglas Mavrinac continued to expand their comprehensive shipping sector coverage with the initiation of coverage on Diana Shipping with a Buy rating and a $21 price target. The analysts note that Diana operates a modern dry bulk fleet while dry bulk fundamentals remain attractive. The company has a strong balance sheet that is readily available to support future growth, and it has announced a policy to pay out all free cash as dividends, a policy which is supported by Diana’s timecharter strategy.

The analysts also reiterated this week their Buy rating for Arlington Tankers, with a target price of $25.00, though the report also reduces EPS estimates based on lowered charter rate expectations. One thing that both these Buy ratings have in common is a notable dividend yield. Calculating the value of near-term returns, dividend yields mean a lot to analysts, but how much do they mean to equity investors?

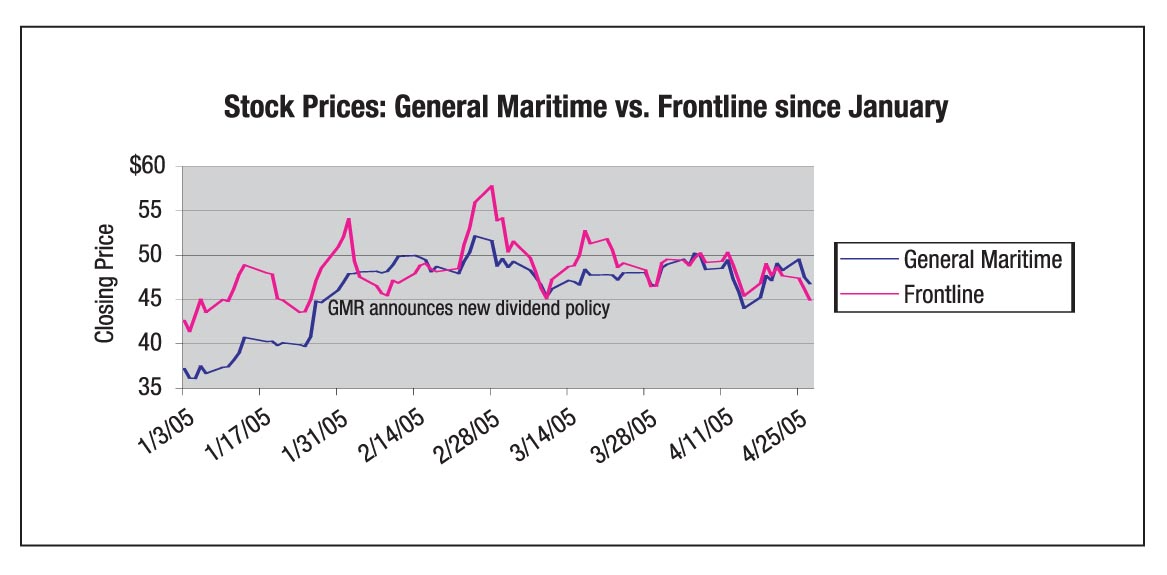

General Maritime’s recent inauguration of a considerable dividend policy gives us a rare venue to test the hypothesis that higher dividends translate into higher share prices. The accompanying graph comparing General Maritime’s share price evolution, starting in the beginning of January and going through the period when the company announced its new dividend policy, to that of Frontline.

Citigroup Smith Barney analyst Charles de Trenck, referred to by some as ringleader of the container bears, has unleashed another attempt to burst what he calls “a perfect bubble.” This time he keeps up the frontal assault on capacity increases, and in the latest Container Trades report, he is attacking on the cost flank. In addition, he insists that good economic indications from the U.S. economy are not bright enough to fend off the storm clouds of a capacity overhang. The dollar is simply too weak.

Mr. de Trenck believes the real question now is the structure and level of the imminent decline, which “will end in tears, but the decline could be slow in the absence of demand slowdown catalysts,” particularly if the U.S. economy remains stable.

While there has been some downward guidance recently from major containers lines, Mr. de Trenck suggests that port congestion won’t help the lines as much as the container execs say it will. He also suggests that the 2005 rate moves will be influenced by whether the U.S. dollar is able to stage a mild recovery or not.

For dry (and container) rates there were periods (such as internet boom years) where both rates and dollar moved up together. But taking weekly moves over the entire April 1986 to February 2005 period, the analyst found a mildly negative correlation of –0.37.

There is rising rhetoric from the lines in advance of May contract season in Transpacific. There is indeed a potential average hike of US$75/FEU, with some hikes around US$150/FEU, against US$285 proposed. Great news but nearly every investor Mr. de Trenck met on a recent roadshow agreed that capacity on order is a key concern. The major surprise for them was that US$ costs/TEU are likely to rise more than US$ rev/TEU. Whatever rates are doing right know, however, Mr. de Trenck believes the increases will be wiped out by costs, then the industry will be pummeled by the capacity tidal wave.

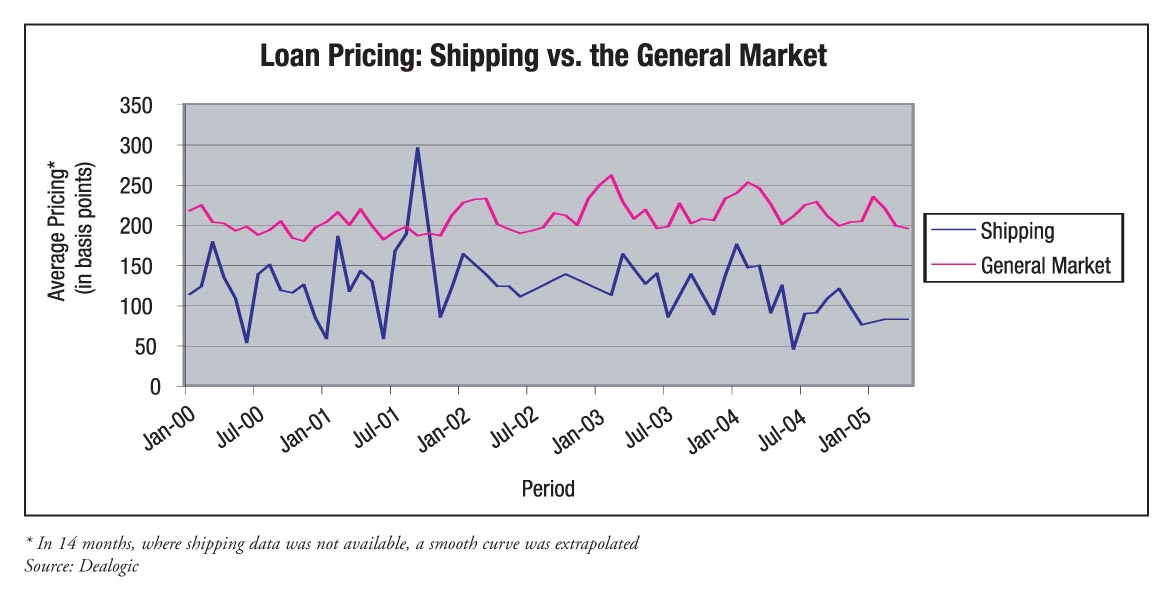

We acquired this week enough data to compare averages shipping loan spreads to average general market spreads from 2000 up to the present. There are two key points to notice, which may or may not surprise you. The first is that, with the exception of one period of a few months in late 2002, shipping loans overwhelmingly price lower than generic loans, typically by 50 basis points or more. This spread has only gotten larger in the current market, with the difference having widened to over 100 basis points. The second thing to notice is the comparative volatility. Shipowners may pay less on their borrowed money the vast majority of the time, but the price they pay is far more sensitive to timing than the market as a whole, though the meaning of this comparison is limited as the nature of an average taken across sectors is to smooth itself out over time.

From its relatively modest roots as an aptly named marine advisory firm, AMA has constantly been growing, and now it has moved up – to the 67th floor of the Chrysler Building, that is. American Marine Advisors has also renamed itself AMA Capital Partners to mark its expansion into the broader transport markets.

The European Commission addressed to the French government this month an official notice that it will be investigating the compatibility of the French tax lease law with regard to EU state aid rules. The EC is concerned that the structure is a disguised form of state aid to the sector. In particular, the requirement to obtain a tax ruling prior to doing the transaction indicates for the EU a degree of discretionary judgment incompatible with state aid rules.

French Secretary of State for Transport and the Sea François Goulard told French shipowners at the annual Armateurs de France dinner “the commission’s questions about the scheme were legitimate.” However, the shipowners association and a group of tax investors are banding together to defend the measures. Meanwhile, Mr. Goulard has also promised to replace the existing tax lease scheme, if necessary, with a new investment aid mechanism, while sources close to the leasing industry in question report that measures have already been taken to implement French tax leases in a different manner, so as to avoid the offending provisions. Additionally, Mr. Goulard has been advocating a greater European approach to shipping policy.

The first round of 2005 earnings has come in, and the results are solid overall. While tanker companies General Maritime and Teekay did not see revenues quite as strong as 1Q04, the results were certainly nothing at which to balk. OMI, International Shipholding and Kirby all posted increases across the board, with OMI’s results particularly strong, and consistent in the revenue, net income and EBITDA categories, as shown in the accompanying table. The real over-performers so far, not surprisingly, were the companies who have gone public and expanded their fleets substantially in the past year. DryShips saw revenue, net income and EBITDA all increase by more than 70% based on 1Q04, while Top Tankers saw returns more than quintuple in each of these three categories.

The highly acquisitive, and therefore capital-hungry, Top Tankers announced last night that it intends to privately place up to $300 million aggregate principal amount of Series A Cumulative Convertible Preferred Stock, convertible into shares of the company’s common stock. Top also plans to grant to the initial purchaser of the convertible preferred stock an option to purchase up to an additional $45 million aggregate principal amount of preferred shares. Top’s “house” investment bank Cantor Fitzgerald has been mandated on the deal.

Use of Proceeds – Ships and Delta Hedge

The company intends to use $250 million of the proceeds to fund vessel acquisitions, including the $475 million acquisition of the Nomikos fleet and another $95 million to acquire two double-hulled tankers.

Top will also use $50 million of the proceeds to buy common stock while Kingdom Holdings, which owns about 15% of the company’s shares and is controlled by members of the Pistiolis family, has agreed to purchase another $20 million of the common stock.

This total of $70 million will likely be acquired by the purchaser of the convertible preferred securities, who would then short the stock to create a “Delta Hedge.” This is not unlike what OMI did when it used a corporate share repurchase program to facilitate its recent convertible bond issued through Jefferies.

Although shares held by Evangelos Pistiolis, through an entity called Sovereign Holdings, are locked up until July 18, 2005, the lock-up for shares held by Kingdom Holdings expired on January 19, 2005.

DVB Joins Royal Bank of Scotland

In addition to the proceeds of this deal, in March 2005 Top entered into a credit facility with DVB Bank, for a total of $56.5 million, to finance the purchase of two suezmax tankers, the M/T Stopless and the M/T Stainless. The loan is payable in 28 varying quarterly installments, beginning on July 29, 2005, and a balloon payment of $10.2 million, payable together with the last installment. The interest rate on the DVB credit facility is 125 basis points over LIBOR. Beginning on the date of the credit facility and ending on the final drawdown date, Top will pay the lender a quarterly fee of 0.25% of the average undrawn amount of the loan for the quarter.

Why They Did It

So why did Top Tankers move into the world of financial exotica rather than simply issuing another round of common stock? There are several reasons. For one thing, the continued issuance of equity used for dilutive acquisitions ultimately erodes shareholder value and therefore is not popular among holders, though we do not intend to suggest that this is the case here. Although investors can understand that sometimes a premium must be paid for certain transformational transactions, they don’t like to see it done over and over. That’s why we thought Top would turn to the highly attractive high yield bond market to finance the Nomikos acquisition.

Pricing

The dividend rate and conversion rate are to be determined by negotiations between Top and the initial purchaser of the convertible preferred stock. These deals are generally executed very quickly, often on an overnight basis, so look for pricing details shortly. Although these have not yet been announced, the table showing last year’s convertible issuance that accompanies this article should give you an idea of what to expect. In an industry like shipping, it is typical to see a deal priced with a 7% dividend convertible at a premium of around 25% – known in Wall Street parlance as a “7 Up 25”. Another rule of thumb is that the conversion premium should be about 3.5x the coupon.

The Valuation – 110% NAV and 4.3x EBITDA

As for the valuation of the Top acquisitions, they appear to be very attractive. Nomikos has agreed to sell its fleet of vessels for $475 million and then lease them back for 24 months at an aggregate charter rate of $357,000 per day – $24,000 per ship per day. Using an average operating cost of $4,000, Top will generate about $110 million of cash flow per annum on the vessels, creating a purchase price of 4.3x EBITDA. Nomikos has also agreed to provide credit support for the charter hire. Based on our valuation of the fleet, Top is paying just 3.5x 24 months of contracted cash flows and only a slight premium over current NAV for the vessels on a charterfree basis.